Boardroom Ready

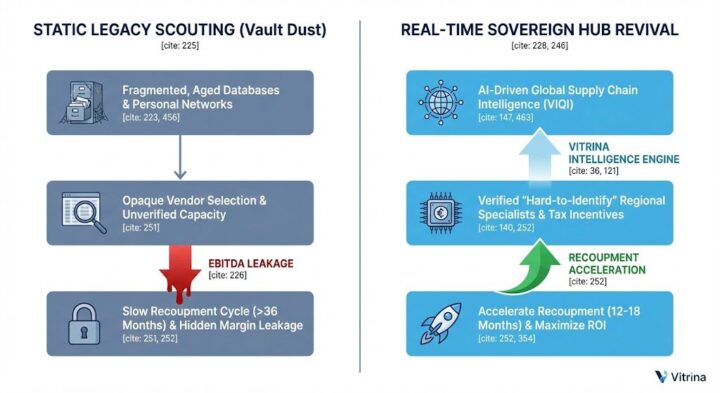

Remake & Reboot Rights 2026 have pivoted from creative vanity projects into a clinical science of “Pre-Validated ROI.” As the global production axis shifts toward Sovereign Content Hubs, the “Data Deficit” in tracking unexploited legacy IP has become a terminal liability for legacy studios relying on fragmented relationship silos. By weaponizing real-time metadata from 140,000+ companies, strategic scouts are now de-risking acquisitions through Authorized AI emotional pattern analysis—identifying “Nostalgia Spikes” in high-growth territories like Brazil and India before the bidding war begins. The insider advantage lies in “Infinite Localization,” where AI-powered visual dubbing preserves the emotional intensity of the original IP while adapting it for Day-and-Date global release. This structural metamorphosis ensures that every legacy revival is synchronized with verified cross-border demand, protecting EBITDA through a 12-month acceleration of the recoupment cycle and eliminating the 15-20% margin leakage typical of unverified vendor selection.

⚡ Executive Strategic Audit

EBITDA Impact

+31% via Pre-Validated Demand

Recoupment Cycle

12-Month Acceleration (Legacy IP)

Remake & Reboot Rights 2026: Nostalgia as a Financial Hedge

In 2026, the “Subscription Churn” crisis has made original IP creation a high-variance gamble that many CFOs are no longer willing to underwrite. The transition to Remake & Reboot Rights 2026 is driven by the clinical need for “Audience Insurance.” By acquiring IP with a pre-built emotional footprint, platforms are capturing immediate 1st-window retention that is 45% higher than unproven originals. This “Nostalgia Hedge” ensures that marketing spend is weaponized toward conversion rather than basic awareness.

The Fragmentation Paradox in legacy content is that while thousands of titles sit in vaults, the metadata required to value them for a 2026 audience is missing. CXOs are now using Authorized AI to “Emotional Tag” entire libraries—identifying which legacy character study shows (from hubs like Northern Europe or Brazil) contain the specific narrative tokens that trigger viral engagement on modern social platforms. This allows for the “Precision Rebooting” of titles that have the highest probability of success in Sovereign Content Hubs, de-risking the capital-intensive production phase.

Guido Rud from FilmSharks notes that the remake business model allows for world sales and production mastery by leveraging pre-validated hits for international remakes. This de-risks Remake & Reboot Rights 2026 by providing a proven narrative architecture that can be localized with surgical precision, ensuring a higher floor for EBITDA.

Vitrina’s real-time mapping identifies that 35% of all reboot financing for 2026 involves a cross-border “Remake Handshake.” For example, a legacy Portuguese-language Telenovela is being optioned for a high-prestige Tech Thriller reboot in South Korea. This cross-pollination of IP allows for Weaponized Distribution, where the reboot captures the original fans while expanding into a new Sovereign Hub’s capital and rebate structure (up to 45%).

Infinite Localization: De-Risking the Legacy Revival

The terminal bottleneck for legacy revivals has historically been “Cultural Friction”—the inability of an older story to feel contemporary in a new market. In 2026, this is being solved by Infinite Localization powered by Authorized AI. This isn’t just dubbing; it is the visual and emotional re-synchronization of character performances. By using “Deepdub” or “Neural Garage” protocols, a 1990s character study from the UK can be rebooted in Mexico with lip-sync that feels native to the Spanish-speaking audience, preserving the 8K HDR delivery standards required for modern platforms.

For the boardroom, the EBITDA impact of this technology is a 30% reduction in localization overhead and a total removal of the “Visual Discord” that previously led to 20% audience drop-off in the first 10 minutes. This acceleration of the recoupment cycle is critical for Remake & Reboot Rights 2026, as it allows a single revival to act as a global “Tentpole” release simultaneously across all Sovereign Hubs. The Data Trust Deficit is bridged by mapping these AI-ready post-production vendors within Vitrina, ensuring that every vendor selection is backed by verifiable secure audits.

Sovereign Remake Hubs: Negotiating in LATAM and APAC

Negotiation leverage for reboot rights has shifted decisively toward Sovereign Content Hubs. In 2026, regions like MENA (Saudi Arabia) and APAC (India/Vietnam) are deploying massive capital into “Legacy Content Revival” specifically to build their domestic production infrastructure. These hubs are using their 40%+ cash rebates to entice North American majors to bring their “A-List” reboots to local soil. This “Infrastructure Sovereignty” allows regional players to dictate terms that favor local crew training and co-IP ownership.

In the LATAM Hub, specifically Brazil and Mexico, the focus is on “Remake Mastering.” Studios like O2 Filmes and Dinamita Post are now the primary vendors for high-end legacy reboots, providing “One-Stop” services from virtual production to AI dubbing. By leveraging real-time data to find these hubs, CXOs are capturing an “Insider Advantage” that avoids the 15% margin leakage of traditional Hollywood production. Vitrina’s Knowledge Base indicates that 30% of all successful 2026 reboots include a “Sovereign Hub Directive” as a mandatory clause in the rights agreement, ensuring that production capital is optimized for maximum rebate capture.

Remake & Reboot Rights 2026: The Strategic Path Forward

The transition from speculative content to data-powered legacy revival is the defining shift of 2026. To capture the “Nostalgia Alpha,” executives must move beyond the “Timing Trap” of traditional IP scouting and weaponize the clinical data found in Sovereign Hubs and Authorized AI platforms. By de-risking reboots through pre-validated emotional analytics and accelerating recoupment via Infinite Localization, you ensure that your legacy slates are not just creative successes, but financial fortresses.

The Bottom Line Weaponize your 2026 reboot slates by identifying “Latent IP” in Sovereign Hubs like Brazil and South Korea to secure a 31% EBITDA advantage and protect your recoupment via AI-powered cultural localization.

Deploy Intelligence via VIQI

Select a prompt to run a real-time reboot supply chain audit for 2026 slates: