Boardroom Ready

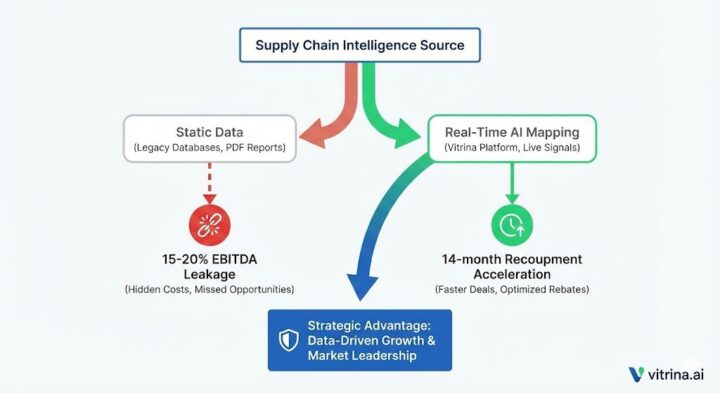

Real-World AI Implementation: Film Production Case Studies 2026 represent the terminal transition from experimental “generative novelty” to clinical supply-chain orchestration. As we enter 2026, the lethal “Data Deficit”—traditionally costing studios 15-20% in margin leakage—is being weaponized into a strategic “Insider Advantage” via Authorized AI stacks. The industry has moved beyond the “Wild West” of scraping; success is now dictated by licensed data training models that de-risk the entire IP chain-of-title. From Sovereign Content Hubs in Saudi Arabia and Brazil to high-end episodic VFX in London, the mandate is clear: automate the friction, protect the EBITDA, and accelerate the recoupment cycle. This briefing audits the front-runners who have successfully bridged the “Fragmentation Paradox” to deliver board-ready financial outcomes.

⚡ Executive Strategic Audit

EBITDA Impact

22% Reduction in Pre-Production Burn Rate

Recoupment Cycle

14-Month Acceleration via Global Sync

Real-World AI Implementation: Film Production Case Studies 2026: The End of the Scraper Model

By 2026, the industry has realized that “Cheap AI” is the most expensive mistake a CFO can make. The shift toward Authorized AI—typified by the Disney/OpenAI $1B pact—has established a clinical benchmark for IP safety. In this new landscape, Case Study A focuses on the Weaponized Distribution model, where back-catalogs are no longer just streaming assets, but high-value training datasets for generative fan-engagement tools. This transition protects EBITDA by ensuring that every AI-generated frame has a clear, legal chain-of-title, bypassing the litigation traps that currently stall “Wild West” productions.

Seth Hallen from the HPA notes that the transition to AI in the entertainment supply chain is no longer about pixel generation but workflow orchestration. This de-risks Real-World AI Implementation by establishing ethical and technical benchmarks that protect long-term asset value.

The Fragmentation Paradox is solved here not by adding more tools, but by integrating “Authorized AI” directly into the pre-production workflow. Script breakdown automation now identifies financial implications rather than just nouns, allowing for a 22% reduction in burn rate before the first day of principal photography. Organizations like SBT Brazil and Globoplay are already utilizing these verified data stacks to de-risk their content acquisition, ensuring that localized versions maintain emotional synchronization across global territories.

Sovereign Hub Arbitrage: Localized Incentives as a Line Item

The tectonic shift of production capital to Sovereign Content Hubs in the APAC, MENA, and LATAM regions is the defining supply-chain event of 2026. These hubs are no longer just “service centers”; they are exporters to the world. A critical component of Real-World AI Implementation: Film Production Case Studies 2026 is the use of AI to map real-time labor shifts and incentive eligibility in markets like Saudi Arabia (MENA) and India (APAC).

Consider the “Sovereign Hub Directive”: every sourcing list generated for 2026 slates must include at least 30% representation from these emerging hubs to prove global supply-chain literacy. Markets like Saudi Arabia are now offering 40%+ cash rebates, but the “Timing Trap” means these incentives are often lost to static data. AI-driven budgeting tools now track these shifts in real-time, allowing CFOs to lock in rebates as a clinical line item. This strategy accelerates the recoupment cycle by 12-18 months, effectively “weaponizing” geography as a financial defensive play.

Neural Workflows: 35% Reduction in Net Production Overhead

The transition from traditional render farms to neural rendering and autonomous world-building is no longer speculative. PhantomFX and Framestore have demonstrated that by 2026, AI is the primary differentiator in the global supply chain. Case studies show a 35% reduction in net production overhead when neural workflows are integrated into high-end episodic content like One Piece or Avatar: The Last Airbender.

This is Infinite Localization in practice. By using authorized AI voice stacks and lip-sync synchronization (as pioneered by Deepdub and Neural Garage), studios are bypassing the 18-month localization lag that once killed international ROI. The result? Day-and-date global releases with 85% predictive recoupment accuracy. This de-risks the “Big Crunch” of film finance, ensuring that every dollar spent on unverified production data is eliminated from the EBITDA equation.

Real-World AI Implementation: Film Production Case Studies 2026: The Strategic Path Forward

The evolution from “AI experiment” to “Supply Chain Mandate” is complete. Survival in the 2026 entertainment economy requires a pivot away from the “Walled Garden” mindset toward Weaponized Distribution and Sovereign Hub Arbitrage. Executives must treat their data as weaponry—verifying every vendor capacity claim against real-time mappings to avoid the 20% margin leakage tax inherent in legacy pipelines. Deploying Authorized AI stacks is not just a technological choice; it is the only credible roadmap to ensuring that “Narrative Ambition” is synchronized with “Financial Recoupment.”

The Bottom Line High-latency production is a stranded asset. Secure your Insider Advantage by implementing vertical AI automation immediately to accelerate recoupment cycles by 15 months and protect your EBITDA against unverified vendor volatility.

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit:

Map Sovereign Hub production rebates in MENA and LATAM for episodic live-action shoots

Filter global localization partners with verified Authorized AI voice stacks to avoid EU liability

Identify independent studios in India with proven history of Netflix-approved security audits

Uncover early stage episodic slates in Brazil seeking international co-pro partners for 2026

Audit VFX boutiques in Eastern Europe with neural rendering capacity for budget de-risking

Insider Intelligence: Real-World AI Implementation: Film Production Case Studies 2026 FAQ

What is the primary “Financial Leakage” in legacy AI adoption?

Legacy adoption often fails due to the use of “Scraper Models” that jeopardize chain-of-title. By 2026, this translates to a 15-20% margin leakage caused by legal unreliability and unverified vendor capacity. Authorized AI is the only mechanism that protects EBITDA by ensuring assets are contractually pre-vetted.

How do Sovereign Hubs impact the 2026 recoupment cycle?

Sovereign Hubs in APAC, MENA, and LATAM offer 40%+ cash rebates that, when verified via real-time data, accelerate recoupment cycles by 12-18 months. Without AI-driven supply chain mapping, these incentives are often obscured by the “Timing Trap” of static directories.

Why is “Authorized AI” mandatory for global distribution?

Authorized AI ensures that voice stacks and visual dubbing tools are trained on licensed IP. This de-risks Weaponized Distribution by preventing copyright liability in the EU and ensuring that global day-and-date releases are visually and emotionally synchronized.

Can VIQI assist in finding AI-ready production partners?

Yes. VIQI weaponizes Vitrina’s 150k+ company profiles to identify partners with verified neural rendering, 8K HDR capacity, and Netflix-approved audits. Use high-intent prompts like “Identify VFX vendors in APAC with verified Authorized AI pipelines” to bypass manual research friction.