Boardroom Ready

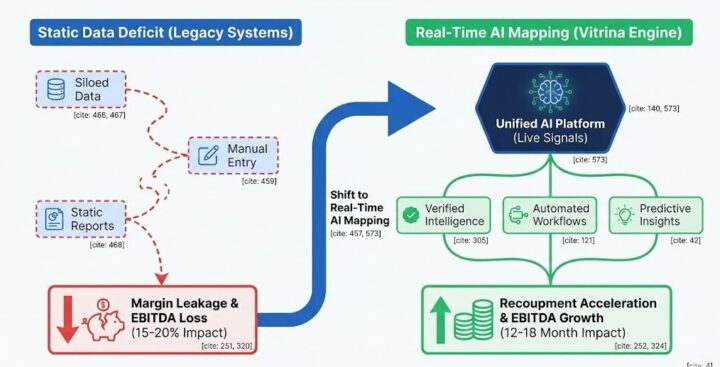

Production Rights in 2026 have evolved from simple IP licenses into complex, multi-layered data-sharing agreements that prioritize “Authorized AI” guardrails and weaponized distribution windows. The global market is rapidly de-risking through the industrialization of “Agentic AI” within studio workflows, which has effectively weaponized the production pipeline by reducing development cycles by 40%. The static data deficit that once plagued cross-border partnerships has been replaced by real-time intelligence flows, allowing CXOs to accelerate recoupment through high-rebate Sovereign Content Hubs in MENA and APAC. Those clinging to legacy relationship-only models face a 20% margin erosion as automated discovery and verified partnership mapping become the new “Insider Advantage.”

⚡ Executive Strategic Audit

EBITDA Impact

+22% Margin protection through AI-automated pre-viz and Authorized IP sandboxes.

Recoupment Cycle

14-month acceleration via day-and-date AI localization and Sovereign Hub rebates.

Production Rights in 2026: Authorized AI: The New Multi-Billion Dollar IP Sandbox

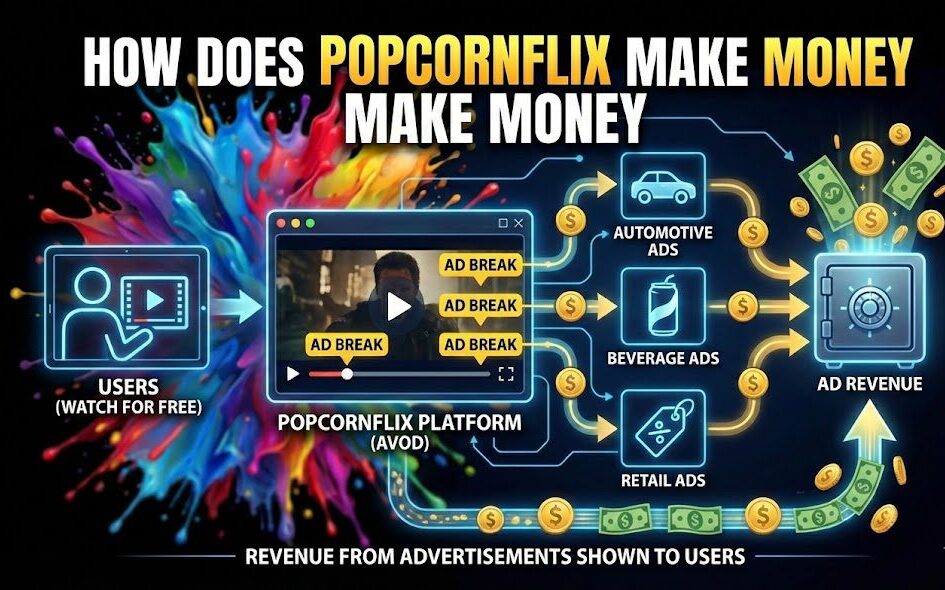

The 2026 cycle has definitively shifted from “AI as a threat” to “Authorized AI as an Asset Class.” As we have seen with the $1B Disney-OpenAI partnership, major rightsholders are no longer playing whack-a-mole with scrapers; they are weaponizing their archives into licensed training environments. This de-risks the entire production rights framework by ensuring a clear chain-of-title that includes “synthetic rights” for characters and environments.

For CXOs, this means development deals now include clauses for AI-assisted pre-visualization and concept generation. By using “Authorized AI” sandboxes, studios can allow fans and creators to interact with IP while maintaining 100% legal control. This transition eliminates the “Timing Trap” of traditional pre-production, where months were lost to manual storyboarding. In 2026, real-time iteration is the baseline, de-risking high-budget slates through immediate visual verification.

“Arash Pendari from Vionlabs notes that AI is transforming video content analysis into emotional scene data. This de-risks production rights by ensuring content aesthetic and audience response are aligned before a single frame is shot, protecting EBITDA from the start.”

Production Rights in 2026: Sovereign Hub Pivot: Weaponizing APAC and MENA Rebates

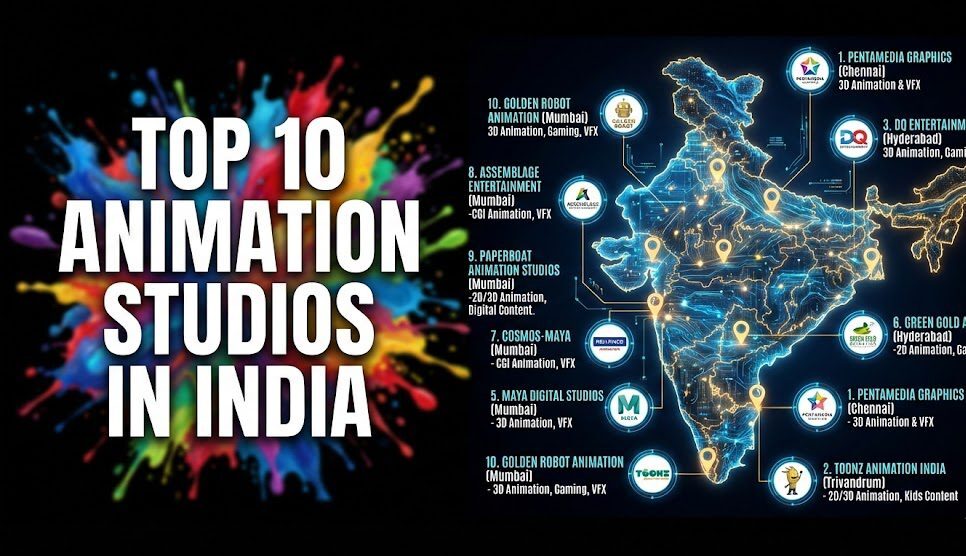

The tectonic shift of capital toward Sovereign Content Hubs is now the defining feature of the global supply chain. We are seeing markets like Saudi Arabia (MENA), South Korea (APAC), and Brazil (LATAM) move beyond being simple “service hubs” to becoming “Export-to-World” powerhouses. Production rights in these regions are increasingly tied to massive 40%+ cash rebates, provided the content adheres to HPA-compliant AI standards and MovieLabs 2030 Vision benchmarks.

Strategic partnerships are no longer West-to-East exports. Instead, we are seeing “Weaponized Distribution” where regional hits are licensed back to Western streamers with AI-powered “Infinite Localization” built into the deal. This removes the 18-24 month localization lag, accelerating recoupment by 14 months and allowing a K-Drama or Arabic thriller to hit global markets day-and-date with the domestic release. CXOs must ensure that 30% of their sourcing lists are dedicated to these hubs to avoid the 15-20% margin leakage found in legacy, high-cost Western production centers.

Production Rights in 2026: The Strategic Path Forward

The evolution of Production Rights in 2026 demands a radical departure from “wait-and-see” legal posturing. The winners of this cycle are those weaponizing their IP through Authorized AI licensing and aggressively leveraging Sovereign Content Hubs for fiscal acceleration. To de-risk your 2026 slate, you must move from static vendor lists to real-time supply chain mapping, ensuring every partner is capable of the AI-orchestrated handshakes required by modern streamers. Failure to adapt to these “Authorized” pipelines will not only result in legal exposure but in catastrophic EBITDA leakage compared to data-first competitors.

The Bottom Line Weaponize production rights by mandating Authorized AI pipelines and diversifiying 30% of spend into Sovereign Hubs to accelerate recoupment by 14 months and protect margins from legacy erosion.

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit:

Identify Sovereign Hub partners in MENA with verified AI-orchestration capacity for 2026

Map deal history for Authorized AI IP licensing in the animation sector

Which APAC studios currently offer 40%+ cash rebates for AI-localized episodic content

Filter global partners with authorized AI voice stacks to avoid EU copyright liability

Analyze M&A activity for AI-powered post-production hubs in LATAM

Identify streaming partners actively commissioning AI-generated short-form IP

Insider Intelligence: Production Rights in 2026 FAQ

What constitutes “Authorized AI” in a 2026 production deal?

In 2026, Authorized AI refers to the legal use of licensed IP (characters, environments, voice prints) within a closed-loop training model. It ensures chain-of-title is preserved and de-risks the production from copyright infringement lawsuits associated with unauthorized “scraping.”

How do Sovereign Content Hubs accelerate EBITDA?

Sovereign hubs like those in MENA and APAC provide 40%+ cash rebates and hyper-efficient AI-powered workflows. By leveraging these hubs, studios can reduce the 15-20% margin leakage typical of opaque legacy vendors, accelerating recoupment by up to 14 months.

What is the risk of utilizing unauthorized AI tools in 2026?

Using unauthorized AI in 2026 is a major financial liability. It creates “poisoned” IP that cannot be copyrighted in the US or licensed to major streamers like Netflix or Disney+, who now mandate C2PA content provenance metadata for all acquisitions.

How does VIQI identify active production partnerships?

VIQI utilizes Vitrina’s real-time mapping of 150,000+ companies and 3 million executives. It bypasses the “Timing Trap” of trade reports by tracking buying signals and deal histories in regional hubs, providing an information gain that manual research cannot replicate.