Ott companies are digital distribution entities that deliver video and audio content directly to viewers over the public internet, bypassing traditional gatekeepers like cable or satellite providers.

This ecosystem involves complex revenue structures including Subscription Video On Demand (SVOD), Advertising-based Video On Demand (AVOD), and the rapidly growing Free Ad-supported Streaming Television (FAST) sector.

According to industry data from the Vitrina Intelligence Platform, the global OTT market is projected to reach $227.29 billion in 2025, driven by a structural shift toward data-powered supply chain frameworks.

In this guide, you’ll learn how to identify top-tier partners, leverage “Weaponized Distribution” strategies, and use vertical AI to discover trending regional content 5x faster.

While legacy resources provide surface-level lists of streaming apps, they fail to address the critical “data deficit” facing acquisition leads. Sourcing content in a borderless market requires visibility into over 140,000 companies and 1.6 million titles.

This comprehensive analysis fills those gaps by providing actionable frameworks for platform evaluation, market positioning, and real-time project tracking.

Table of Contents

- 01What defines top Ott Companies in 2025?

- 02Market Positioning: Global Giants vs. Niche Players

- 03Weaponized Distribution: The New Content Strategy

- 04Sourcing Regional Content: A Multi-Territory Framework

- 05How to Choose the Right OTT Platform Provider?

- 06Authorized AI: Reshaping Content Libraries

- 07Key Takeaways

- 08FAQ

Key Takeaways for Acquisition Leads

-

Data-Driven Sourcing: Acquisition teams tracking 140,000+ global companies find trending international titles 5x faster than manual research methods.

-

Weaponized Distribution: Strategic licensing of “sunk assets” to rival platforms after 18-24 months is the primary driver for maximizing ROI on premium IP.

-

Vertical AI Advantage: Using Vertical AI assistants like VIQI compresses months of partner due diligence into hours by mapping 30 million industry relationships.

What Defines Top Ott Companies in 2025?

In 2025, Ott companies have transcended their roles as mere content repositories to become sophisticated data-driven engines. These platforms are defined by their ability to bypass traditional broadcast networks, using the public internet to deliver 4K Ultra-High Definition (UHD) content directly to connected devices. This technological shift has created a two-device market where Connected TV (CTV) and smartphones dominate consumption.

Leading entities are now classified by their revenue models: SVOD (Subscription-based like Netflix), AVOD (Ad-supported like Tubi), and the increasingly popular FAST channels (Free Ad-supported Streaming TV). The core differentiator for a successful OTT firm today is its technical stack—specifically its ability to handle adaptive bitrate streaming and global Content Delivery Networks (CDNs) while maintaining a robust Digital Rights Management (DRM) framework.

Find FAST channels and digital distributors in North America:

Market Positioning: Global Giants vs. Niche Players

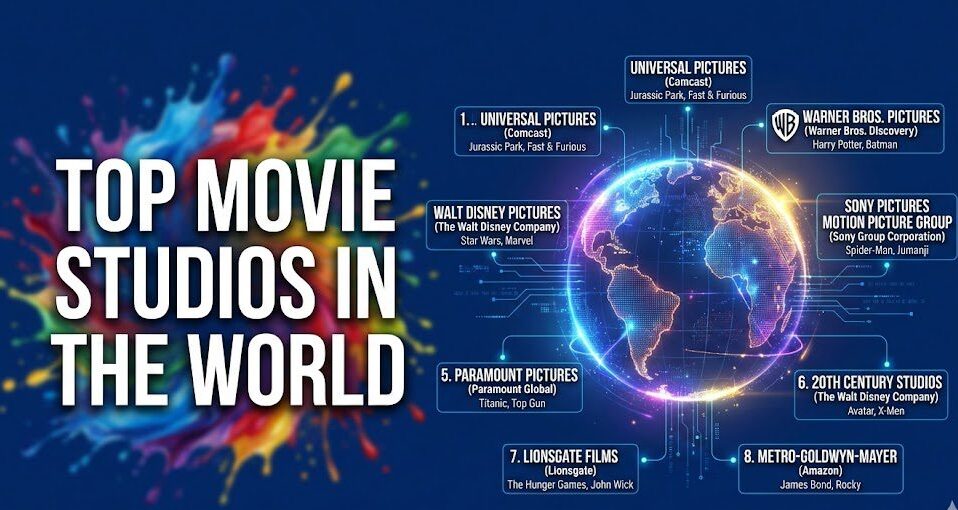

The landscape of Ott companies is currently bifurcated between global incumbents and specialized regional aggregators. Netflix remains the standard-bearer with over 300 million paid subscribers, leveraging a $17 billion annual content budget. However, the real growth is occurring in localized “Skinny Bundles” and regional champions like JioCinema in India or Viaplay in Europe, which cater to specific linguistic and cultural nuances.

For content acquisition leads, the opportunity lies in identifying “aggregators” who are seeking entry into customers’ homes via ISP and telecom partnerships. These players boost revenue for niche content owners by lowering high customer acquisition costs. Vitrina’s Company Intelligence tracks these 140,000+ entities, providing deep profiles that include their specialized territories, deal histories, and commissioning behaviors.

Industry Expert Perspective: AVOD, FAST, and Beyond: How Whip Media is Shaping Streaming Solutions

Carol Hanley, CEO of Whip Media, explains how their analytics platform solves the reporting and revenue-tracking gaps for FAST channel owners and global OTT companies. This session provides a deep dive into the technical infrastructure needed to monetize content across fragmented digital platforms.

Whip Media provides tailored solutions for streaming platforms, focusing on royalties, revenue tracking, and audience insights. Their tools streamline performance reporting across FAST, SVOD, and AVOD platforms, allowing companies to make better data-driven acquisition decisions.

Weaponized Distribution: The New Content Strategy

The era of rigid platform exclusivity is over. We have entered the phase of “Weaponized Distribution,” where major Ott companies license high-value content to rivals 18-24 months post-release. A landmark example is Netflix’s $72 billion acquisition of Warner Bros. Discovery’s studio assets, signaling a shift where premium content is leveraged across multiple storefronts to maximize Average Revenue Per User (ARPU).

This “rotational window” strategy prioritizes ROI over walled gardens. Acquisition leads can now track these licensing windows using Vitrina’s Global Film+TV Projects Tracker. By monitoring unreleased titles and release renewals, buyers can engage in negotiations precisely when content becomes available for secondary licensing, ensuring a steady pipeline of proven IP without the initial production risk.

Analyze recent content licensing trends:

How to Choose the Right OTT Platform Provider?

Choosing an OTT technology provider is no longer just a feature-checklist exercise; it is a strategic decision that impacts global scalability and revenue retention. For content creators looking to launch their own branded apps, white-label solutions like VPlayed, Brightcove, or Kaltura offer complete customizability and source code access.

Key evaluation criteria in 2025 include:

- Monetization Flexibility: Supports hybrid models combining SVOD, AVOD, and TVOD.

- Security Infrastructure: Multi-DRM solutions and AES encryption to combat $26.6 billion in piracy losses.

- Global CDN Connectivity: Ensuring low-latency delivery across emerging markets in APAC and MENA.

Before committing, acquisition leads should vet partners based on verifiable track records found in Vitrina’s “Reputation Scores,” which aggregate industry feedback and past deal success.

Authorized AI: Reshaping Content Libraries

The integration of generative AI has moved from theoretical to a core business strategy. Disney’s $1 billion deal with OpenAI establishes an “Authorized Data” market where IP is licensed for training in controlled environments. This allows users of tools like Sora to access verified characters and environments while protecting talent likenesses.

For Ott companies, this creates a new revenue stream: licensing archives for AI training. However, it also sparks legal battles, as seen in Disney’s cease-and-desist actions against Google for unauthorized IP usage. Navigating this landscape requires real-time intelligence on who is licensing what, a feature tracked within Vitrina’s Deals Intelligence module.

Moving Forward

The transformation of Ott companies from relationship-driven entities to data-powered supply chain hubs is complete. This evolution has addressed the critical gaps in market visibility, emerging platform coverage, and technical due diligence. By leveraging supply chain intelligence, professionals can now compress months of research into strategic, high-velocity outreach.

Whether you are an acquisition lead looking to discover regional hits, or a production head seeking co-production partners in APAC, the principle remains: actionable intelligence drives deal velocity. Understanding where active buyers are and what they are acquiring transforms distribution from speculation to science.

Outlook: Over the next 12-18 months, platform consolidation will accelerate as niche players merge to survive rising bandwidth and acquisition costs. Those who adopt vertical AI discovery tools now will dominate the next phase of global content distribution.

Frequently Asked Questions

What is an OTT company?

What are the top Ott Companies in 2025?

What is Weaponized Distribution?

How can I find trending regional content?

What is FAST TV?

How much do Ott Companies spend on content?

What is Authorized AI in streaming?

Why is data trust important for OTT partners?

About the Author

Strategy Lead at Vitrina AI, specializing in entertainment supply chain transformation. With over 15 years in content acquisition and media-tech, they help global platforms navigate the “data deficit” using AI-powered intelligence. Connect on Vitrina.