Negotiating investor back-end participation has evolved from a simple “points” conversation into a complex battle of supply chain visibility.

In 2026, the success of an independent film is determined by the “recoupment waterfall”—a structured hierarchy that dictates how every dollar is distributed across financiers, talent, and production partners.

As the industry shifts toward a centralized, data-powered framework, producers who lack verified intelligence on distribution windows and regional incentives often find their “net profits” evaporated before they reach the bank.

This guide examines the “data deficit” in back-end negotiations and how to leverage Vertical AI to secure equitable deal terms.

While traditional legal templates provide a baseline, they fail to account for “Weaponized Distribution” or the impact of global creative economies on investor ROI.

This analysis fills that gap by mapping back-end points directly to actionable supply chain data from the Vitrina ecosystem.

Strategic Roadmap

Investor Back-End Checklist

-

Waterfall Prioritization: Ensure senior debt and regional co-production grants are cleared before calculating “equity” back-ends.

-

Net Profit Definitions: Explicitly define “deductible expenses” to prevent studio accounting from zeroing out the back-end pool.

-

Window Licensing: Include provisions for secondary “Weaponized” licensing fees (AVOD, FAST) in the participate revenue pool.

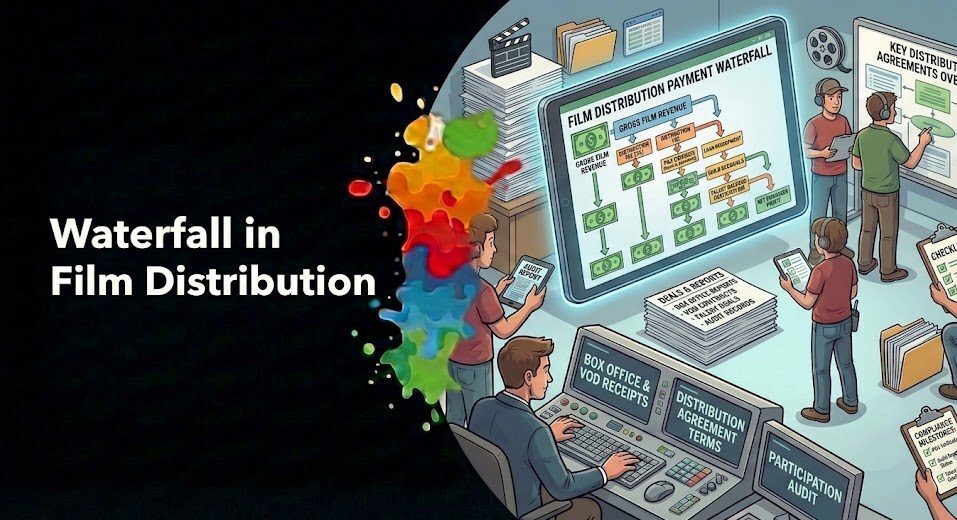

The Waterfall Transparency: Navigating Recoupment Tiers

The “Recoupment Waterfall” is the blueprint of a project’s financial survival. For independent producers, negotiating where an investor sits in this waterfall is more critical than the percentage they own. Traditionally, waterfalls are split into “Hard Money” (senior debt), “Soft Money” (tax credits), and “Equity” (investor capital).

Without transparency into regional production volumes—which Vitrina’s monthly webinars track globally—producers often fail to leverage tax rebates as “investor insulation.” This oversight leads to investors demanding higher points to compensate for perceived risk, even when that risk is already mitigated by government-backed incentives in hubs like the Middle East or Asia.

Model your recoupment waterfall with AI:

Benchmarking Points: Moving Beyond Anecdotal Deal History

Most back-end negotiations rely on “Market Norms” that are often out-of-date or skewed toward studio-led projects. This is the “Data Deficit” in action. Producers need to benchmark their participation offers against real-world deal history for similar 1.6M titles across the global supply chain.

By utilizing Vitrina’s Global Projects Tracker, you can demonstrate to investors that your 25% back-end offer is consistent with current “A-List” indie benchmarks in specific genres. This shifts the negotiation from an emotional plea to a data-validated enterprise proposal, significantly increasing your leverage with high-net-worth capital.

Strategic Masterclass: The Big Crunch in Film Finance

Phil Hunt, founder of Head Gear Films and Bankside Films, discusses the structural difficulties in current film financing and why terms are tighter than ever.

Negotiation Insight

Hunt emphasizes that producers must be more disciplined than ever, as the “big crunch” in finance means investors are scrutinizing the back-end details to ensure they are the first to be paid in an increasingly fragmented market.

Weaponized Distribution: Impacting the Back-End ROI

The dawn of “Weaponized Distribution” has fundamentally changed back-end calculations. Producers are now licensing premium content to rival platforms 18-24 months post-release. This “rotational window” strategy creates new revenue streams that must be explicitly included in back-end participation agreements.

If your investor agreement doesn’t account for secondary AVOD or FAST channel licensing—trends monitored by Vitrina’s vertical AI—you are leaving 15-20% of your total ROI on the table. In 2026, the back-end is no longer a one-time event but a multi-year tail of weaponized licensing fees that requires constant supply chain monitoring to audit effectively.

Identify weaponized licensing opportunities:

AI-Powered Validation: Mapping Investor Reputation

Negotiation is as much about the partner as it is the points. The metamorphosis of the media supply chain allows producers to move away from opaque personal networks and toward Verified Reputation Scores. Before agreeing to a complex participation structure, you must qualify your investor’s historical deal behavior.

Using VIQI, Vitrina’s Vertical AI, producers can map 30 million relationships to identify which financiers have historically “clawed back” participations through aggressive accounting or which distributors are reliable in their reporting. This “Digital Lighthouse” approach ensures that the back-end you negotiate is actually collectable, de-risking the creative’s future earnings.

Vet your financing partners with VIQI:

Moving Forward

In the new era of film finance, the “Devil in the Details” is no longer an insurmountable threat; it is an opportunity for those armed with supply chain intelligence. Negotiating back-end participation is now a data-driven science that rewards transparency and precision.

Producers who move beyond the “Data Deficit” and utilize Vertical AI to map their recoupment waterfalls will not only secure more capital but also protect the creative core of their projects.

Outlook: Expect the standard “50/50” back-end split to fragment into more complex, tiered models as rotational distribution windows become the primary driver of content ROI.

Frequently Asked Questions

What is back-end participation in film?

Back-end participation refers to the share of net or gross profits distributed to investors and talent after the film has covered its production and marketing costs.

What is a recoupment waterfall?

A recoupment waterfall is the legal hierarchy that defines the order in which different participants (debt holders, equity investors, talent) receive payment from a project’s revenue.

How do I prevent studio accounting from zeroing out profits?

You must explicitly define “deductible expenses” and cap distribution fees in your agreement to ensure a transparent calculation of the net profit pool.

What is weaponized distribution?

It is a strategy where premium content is licensed to rival platforms post-release to maximize ROI on sunk production costs through secondary windows.

How does tax alpha affect back-end negotiations?

Tax alpha (regional rebates) can serve as “investor insulation,” allowing producers to offer lower points because the investor’s downside risk is already partially covered by the rebate.

What is the “Data Deficit” in film finance?

It refers to the vulnerability caused by relying on fragmented data and personal networks rather than verified, real-time supply chain intelligence during negotiations.

How can I verify an investor’s reputation?

By using Vitrina’s platform to access reputation scores and verified deal history for over 140,000 companies and 3 million professionals.

Why is benchmarking points important?

Benchmarking ensures your participation offers are competitive and realistic, preventing you from over-leveraging your project or losing out to better-informed competitors.

What is Vertical AI in entertainment?

Vertical AI (like VIQI) is trained exclusively on proprietary entertainment datasets to understand industry context and provide strategic answers on funding and executive movements.

How do I get started with data-driven negotiations?

Begin by mapping your recoupment tiers and using VIQI to benchmark your points against current global production and financing trends.

About the Author

Entertainment Finance Architect at Vitrina AI, specializing in supply chain transparency and de-risking independent film investments. Expertise in leveraging Vertical AI for complex back-end negotiations and global partner discovery.