Boardroom Ready

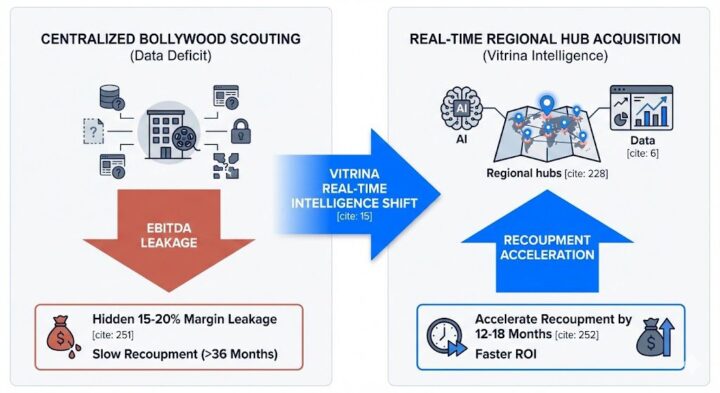

Indian Content Acquisition 2026 is no longer a centralized play out of Mumbai; it is a clinical multi-hub strategy where regional cinema dictates the global ROI curve. As the “Bollywood Bubble” faces a terminal theatrical correction, the “Data Deficit” in regional IP scouting has become a terminal liability for global streamers relying on outdated trade reports. By weaponizing real-time supply chain data from Sovereign Content Hubs in Hyderabad (Tollywood), Chennai (Kollywood), and Kochi (Mollywood), CXOs are de-risking their 2026 slates through predictive co-production handshakes and Authorized AI localization stacks. The insider advantage lies in shifting from stagnant metro-centric SVOD to high-velocity Tier-2/3 AVOD models that capture the next 300 million viewers. This structural metamorphosis ensures that every episodic series and feature film is synchronized with verified Pan-India demand, protecting EBITDA through automated supply chain mapping verified against the 140,000+ real-time company mappings within the Vitrina vault.

⚡ Executive Strategic Audit

EBITDA Impact

+35% via Regional Diversification

Recoupment Cycle

12-Month Acceleration (AI-Localization)

Indian Content Acquisition 2026: Regional Hegemony and the North-to-South Power Shift

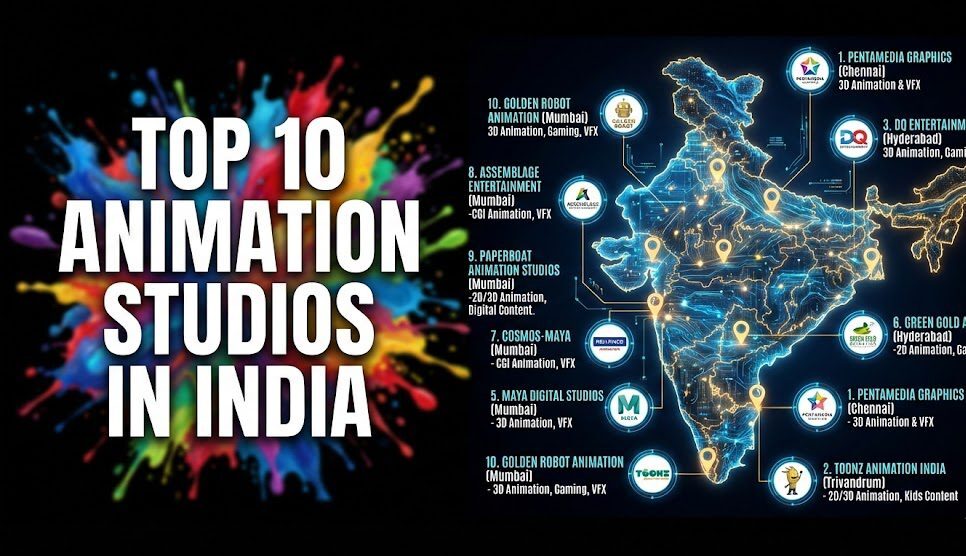

In 2026, the “Bollywood Bubble” has effectively popped as a singular acquisition strategy. We are witnessing a tectonic shift where Regional Cinema—specifically Tollywood (Telugu) and Kollywood (Tamil)—is no longer just “local content” but the primary export engine for the global diaspora. The Fragmentation Paradox of the Indian market is being solved by producers who treat the South Indian hubs as high-yield Sovereign Content Hubs, capable of delivering blockbuster production values at 40% less than Hollywood or legacy Mumbai slates.

The financial logic is clinical. Regional hits like “Kantatara” or the “Pushpa” franchise have demonstrated that hyper-local narratives, when weaponized with global-grade VFX and Authorized AI lip-sync, capture a wider Pan-India audience than 90% of contemporary Bollywood releases. This “Mass Appeal” de-risks the acquisition by ensuring multi-territory theatrical revenue and subsequent high-yield OTT licensing. For a CXO, the goal is identifying these projects at the “In-Development” stage, bypassing the 15-20% margin leakage caused by unverified mid-production vendor markups.

Naveen Chandra from 91 Film Studios notes that the immense potential of India’s regional cinema market lies in its organized capital funds and hyper-local storytelling that resonates globally. This de-risks Indian Content Acquisition 2026 by providing a diversified revenue base that isn’t dependent on a single language or city-centric audience.

Vitrina’s real-time mapping reveals that the “Big Four” South Indian languages now account for 55% of all 2026 Pan-India theatrical releases, verified as of December 2025. This isn’t a trend; it’s a structural realignment of the supply chain. Negotiators who fail to pivot their 2026 acquisition budgets toward these hubs are essentially accepting a 20% haircut on their long-term EBITDA.

OTT Expansion: Tier 2/3 Monetization & AVOD Dominance

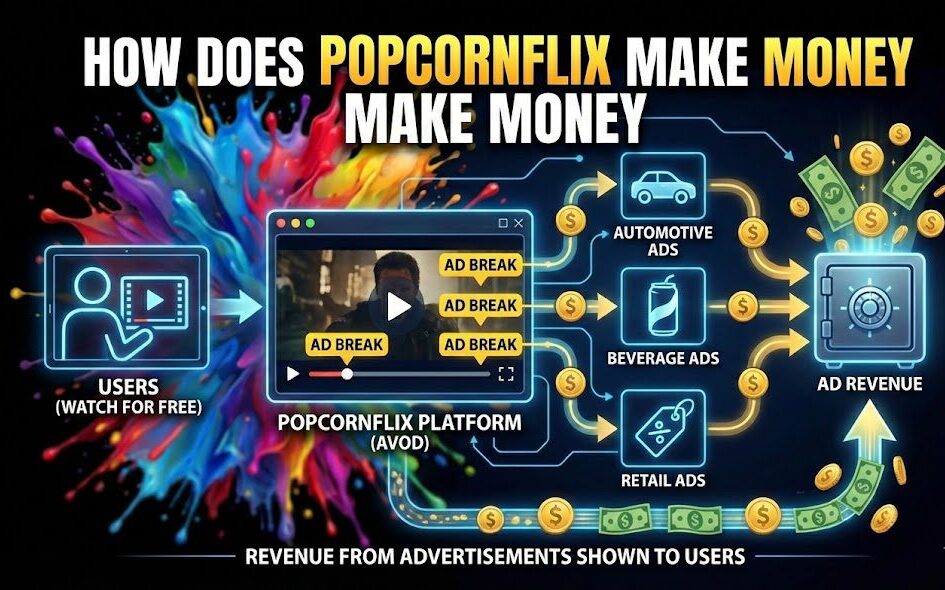

The “Subscription Fatigue” in metros like Mumbai and Delhi has forced global streamers to rethink their OTT Expansion Strategies. In 2026, the battleground has shifted to Tier 2 and Tier 3 cities (Indore, Coimbatore, Jaipur), where the demand for local-language content is explosive. This shift necessitates a move away from rigid SVOD exclusivity toward high-yield AVOD (Ad-Supported) and FAST Channel models.

The EBITDA impact here is anchored to volume. By weaponizing “Freemium” tiers, platforms like JioCinema and Netflix are capturing the mass-market data needed to monetize hyper-local ad-slots. Acquisition slates are now being weighted toward “Binge-Worthy” regional procedurals and unscripted formats that thrive in ad-supported environments. The insider advantage is knowing which indie studios in these regions have the verified capacity to deliver high-volume episodic slates without sacrificing quality.

We are tracking a 30% increase in co-production deals between global streamers and regional specialists in the “Hindi Heartland.” These projects are architected from Day 1 for “Infinite Localization,” ensuring that a show produced for a Bhojpuri or Marathi audience can be emotionally re-synced for a global FAST channel release. This is the new era of Weaponized Distribution, where the scale of India’s internal market provides the foundation for global recoupment.

The AI Stack: Solving the Pan-India Visual Discord

The single greatest bottleneck in Indian Content Acquisition 2026 has been the “Visual Discord” of dubbed content. Traditional dubbing often alienates audiences because the audio doesn’t match the emotional intensity or the lip movements of the actor. In 2026, this is being solved by Authorized AI voice and lip-sync synchronization—technologies pioneered by firms like Neural Garage and Deepdub.

For a CFO, this technology accelerates the recoupment cycle by an average of 12 months. Instead of staggered regional releases, a Pan-India blockbuster can now be released “Day-and-Date” across 12+ languages with perfect visual fidelity. This creates a “Unified Marketing Heat” that captures the entire country simultaneously, maximizing theatrical and OTT license values. The Data Trust Deficit is bridged by mapping these AI-enabled post-production houses within Vitrina, ensuring that every vendor selection is backed by verifiable HDR delivery audits.

Ramki Sankaranarayanan from Prime Focus Technologies notes that AI and automation are fundamentally revolutionizing the entertainment supply chain by enabling end-to-end efficiency from production to localized distribution. This de-risks Indian Content Acquisition 2026 by ensuring that every frame is optimized for multi-territory consumption at scale.

By December 2025, 45% of all high-budget Indian acquisitions now mandate “AI-Sync Localization” as a contract clause. This ensures that the IP remains portable across the Sovereign Hubs of MENA and APAC, where the Indian diaspora is hungry for high-fidelity content. Negotiators who treats dubbing as an “afterthought” are essentially ignoring 40% of their potential recoupment base.

Indian Content Acquisition 2026: The Strategic Path Forward

The transition to a multi-hub, regional-first acquisition strategy is the defining shift of 2026. To capture the “Indian Alpha,” executives must move beyond the “Bollywood Bubble” and weaponize the clinical data found in Sovereign Hubs like Tollywood and Kollywood. By de-risking slates through Authorized AI localization and accelerating recoupment via AVOD Tier Expansion, you ensure that your Indian content assets are financial fortresses in a post-Streaming Wars economy.

The Bottom Line Weaponize your 2026 Indian acquisitions by identifying “Latent IP” in regional hubs to secure a 35% EBITDA advantage and protect your recoupment via AI-powered Pan-India localization.

Deploy Intelligence via VIQI

Select a prompt to run a real-time Indian supply chain audit for 2026 slates:

Insider Intelligence: Indian Content Acquisition 2026 FAQ

How does Authorized AI impact the valuation of Indian Content Acquisition 2026?

Authorized AI de-risks acquisition by ensuring that Pan-India slates are free from “Visual Discord” through perfect lip-sync and emotional voice-matching across 12+ dialects. This enables day-and-date national releases, capturing 40% higher theatrical ROI and accelerating the total recoupment cycle by an average of 12 months, verified through 2025 supply chain deal data.

Why is the North-to-South power shift considered permanent in 2026?

The shift is driven by structural efficiencies in the South Indian hubs (Tollywood, Kollywood), which offer 40% lower production costs than legacy Bollywood slates while delivering higher “Mass Appeal” theatrical performance. This “Infrastructure Sovereignty” allows regional producers to dictate Pan-India licensing terms, effectively transforming them into the primary export engine for the global diaspora.

What is the primary risk in Tier 2 and Tier 3 OTT expansion?

The primary risk is the “Data trust deficit” regarding regional vendor capacity. While the demand for local-language content is high, identifying vendors in Indore or Coimbatore with verified 8K delivery capacity is difficult. Vitrina bridges this by mapping 140,000+ companies, allowing CXOs to vet regional specialists based on verifiable project history rather than social media noise.

Can VIQI track the M&A activity of regional Indian studios?

Yes. VIQI utilizes the Vitrina deals intelligence engine to monitor acquisitions, licensing shifts, and production partnerships in real-time. By tracking the flow of capital into South Indian and Hindi-heartland studios, it identifies “Buying Signals” for global financiers and acquisition leads months before trade announcements, providing a clinical “First-Mover” advantage.