Deal Overview

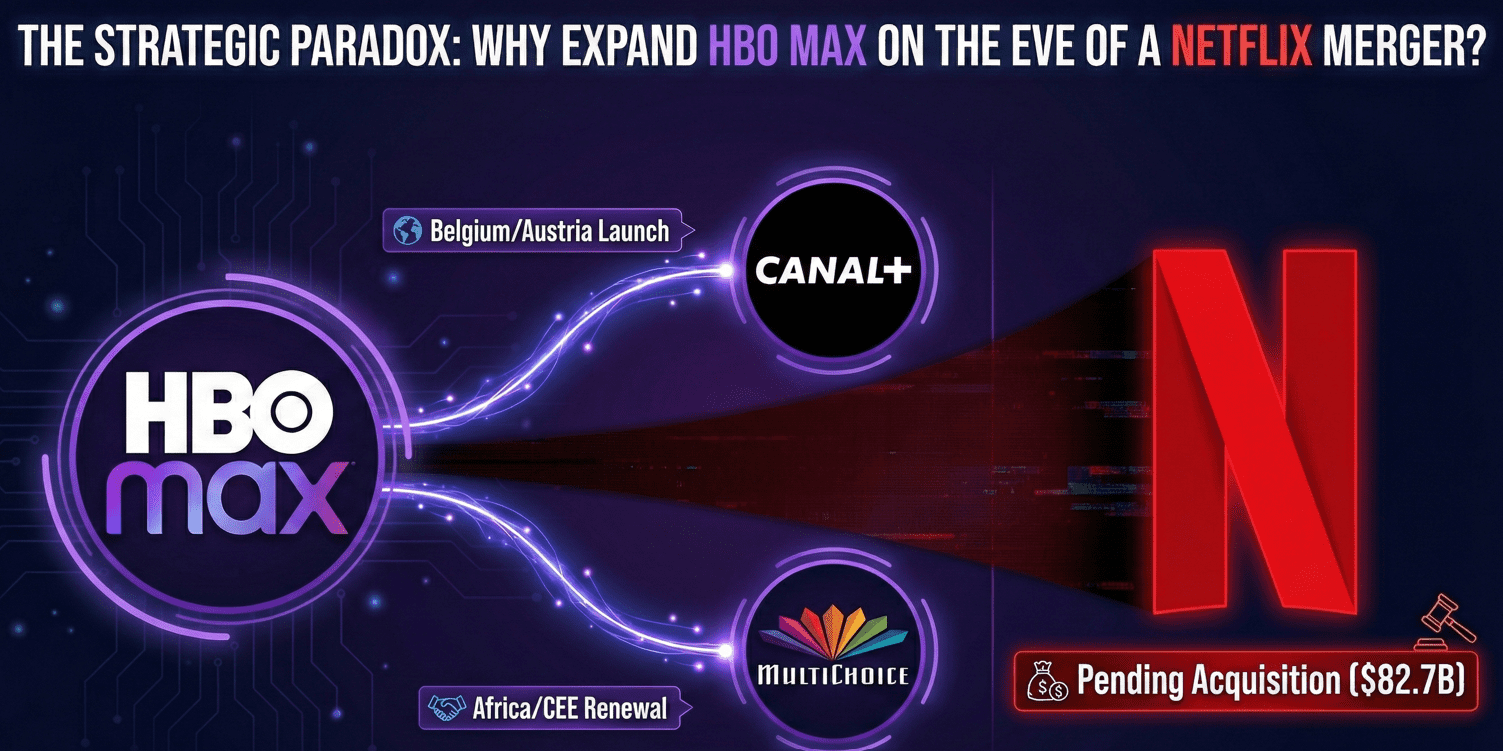

Warner Bros. Discovery (WBD) and Canal+ Group have finalized a multi-year, multi-territory agreement that stabilizes the distribution of WBD’s thematic portfolio while introducing a strategic anomaly in the SVOD space. The deal renews the distribution of 12 thematic channels—including CNN International, Discovery, and Cartoon Network—across MultiChoice’s DStv footprint in Africa and throughout Central and Eastern Europe (CEE). Most notably, the agreement expands the HBO Max service into Belgium and Austria via Canal+ (M7 Group). This move occurs just as WBD prepares for its $82.7 billion acquisition by Netflix and the simultaneous Q3 2026 spin-off of its linear assets into “Discovery Global.”

Parties & Dealmakers

The agreement was executed by leadership at Warner Bros. Discovery and Canal+ Group, with MultiChoice managing the synchronization across sub-Saharan Africa. Ted Sarandos, co-CEO of Netflix, reinforced this partner-led approach at a recent industry showcase in Paris, noting:

“Our intentions when we buy Warner Bros. will be to continue to release Warner Bros. studio movies in theaters with the traditional windows. Then those movies would flow through the Canal+ output deal.”

The Mystery of Sunset Branding

-

Strategic Rationale: The renewal of the 12-channel linear slate is a calculated move to stabilize the Discovery Global entity ahead of its Q3 2026 separation. By securing long-term carriage for CNN, Cartoon Network, and the Discovery suite on platforms like DStv and Canal+, WBD is protecting the valuation of the assets Netflix will not be acquiring. This ensures a consistent cash-flow foundation for the new standalone networks company.

-

The HBO Max Question: While the linear renewals are a standard exercise in asset protection, the launch of HBO Max in Belgium and Austria remains the central puzzle. Why deploy a “sunset” brand in new territories today? Launching a service banner that is technically slated for retirement in other global markets—and just months away from a total structural reset under Netflix—forces a significant question about the internal roadmap. Is this a case of technical path-dependency, where legacy infrastructure in these regions is not yet ready for the newer technical stacks?

Supply-Chain Impact

The agreement prevents a significant “blackout” for African vendors and secures the localization pipeline for CEE languages. For the newly launched territories of Belgium and Austria, the deal creates an immediate spike in demand for localized French, Dutch, and German content. However, technical vendors and metadata teams should prepare for a massive migration project in late 2026 as these new territories eventually shift to whatever unified platform emerges after the Netflix-WBD integration.

Vitrina Perspective

We understand the linear logic; it’s a necessary move to protect the spin-off’s valuation. But why launch HBO Max in new territories now?