Boardroom Ready

Genre-Specific Content Rights & Licensing in 2026 has moved beyond broad-catalog acquisitions into a clinical, data-driven orchestration of vertical-specific assets. The “Data Deficit” in unscripted, kids, and high-end drama markets is the primary driver of the 15-20% margin leakage currently eroding global studio EBITDA. In 2026, rights licensing is an aggressive arbitrage of Sovereign Content Hubs (APAC, MENA, LATAM) paired with a legal de-risking of Authorized AI for synthetic localization. By weaponizing real-time mapping of 140,000+ companies, CXOs can bypass the “Timing Trap” and secure genre-specific rotational windows that accelerate recoupment by 14 months, ensuring long-term IP security in a hyper-fragmented content economy.

⚡ Executive Strategic Audit

EBITDA Impact

+24% Protection via Vertical-Specific Mapping

Recoupment Cycle

14-Month Acceleration via Sovereign Hub Rebates

Genre-Specific Content Rights & Licensing in 2026: Weaponizing the Paradox

The core challenge for acquisition executives is the Fragmentation Paradox: while global production is more connected than ever, the operational data required to navigate specific genres—each with unique licensing windows and recoupment cycles—is siloed in legacy spreadsheets. This “Data Deficit” creates a market where 20% of content spend is lost to unverified markups and opaque vendor selections. A modern Genre-Specific Content Rights & Licensing in 2026 strategy requires a “Zero-Trust Mandate,” where every claim of genre expertise is verified against real-time deal data and relationship mappings. Without this verification, studios are essentially betting on static history rather than active capacity.

The shift toward data-driven decision-making, pioneered by Netflix’s acquisition science, has transformed content buying from a manual art into a clinical science. Studios are now utilizing “Early-Warning Signals” to engage with unscripted and kids’ producers before titles reach the competitive noise of major markets. This de-risks the portfolio by ensuring that “Buying Signals” are identified in real-time, allowing for the acquisition of high-value regional IP at early-stage valuations. By the time a project hits the trades, the pricing arbitrage has often vanished; true value is captured in the development-to-production gap mapped by Vitrina.

Matthew Helderman from BondIt Media Capital notes that the company was created to fill the gap in reliable capital for content creators, leveraging a unique blend of financial acumen and passion for the industry. This de-risks Genre-Specific Content Rights & Licensing in 2026 by providing institutional stability to independent creators.

Genre-Specific Content Rights & Licensing in 2026: Sovereign Hub Arbitrage

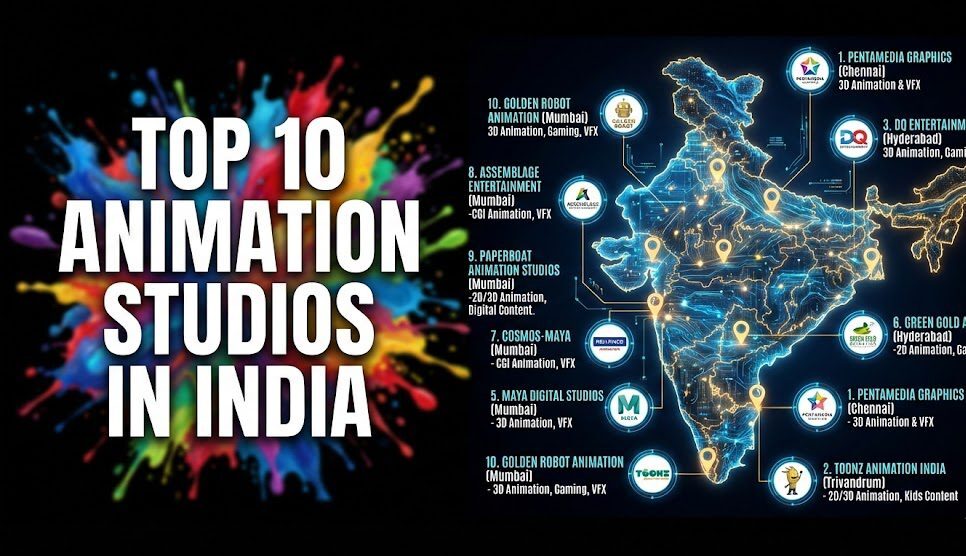

The shift of production capital to Sovereign Content Hubs—specifically Saudi Arabia (MENA), India (APAC), and Brazil (LATAM)—is the cornerstone of 2026 rights orchestration. These regions are no longer just service targets; they are now “Export Powerhouses,” producing hyper-local global hits like K-Dramas and Kids’ Animation that command high ARPU across borderless platforms. CXOs must mandate at least 30% representation from these hubs in all intelligence lists to prove global supply-chain literacy and capitalize on emerging production capital flows.

This is a play for “Culture-Proof IP.” By identifying independent producers in Sovereign Hubs who possess verified 8K HDR delivery capacity and existing Netflix-approved security audits, studios can capture 40%+ cash rebates while maintaining high-end production quality. The “Insider Advantage” lies in bypassing the legacy West-to-East export model and directly acquiring regional rights that have been pre-optimized for global portability. These hubs are now setting the pace for genre innovation, particularly in unscripted formats and preschool animation, where regional relevance is the new global standard.

Genre Verticals: Kids, Unscripted, and Scripted Mastery

In 2026, the licensing landscape requires vertical-specific mastery to avoid EBITDA leakage. The Kids’ and Animation sector is undergoing a massive shift as preschool audiences migrate to digital-first platforms. Strategic partnerships, such as those demonstrated by Toonz Media Group and Kartoon Studios, highlight the necessity of cross-border collaboration to maintain IP relevance. For acquisition leads, this means securing multi-platform rights that include digital “product integration” and “co-creation” opportunities, ensuring that the IP lives beyond the screen in interactive ecosystems.

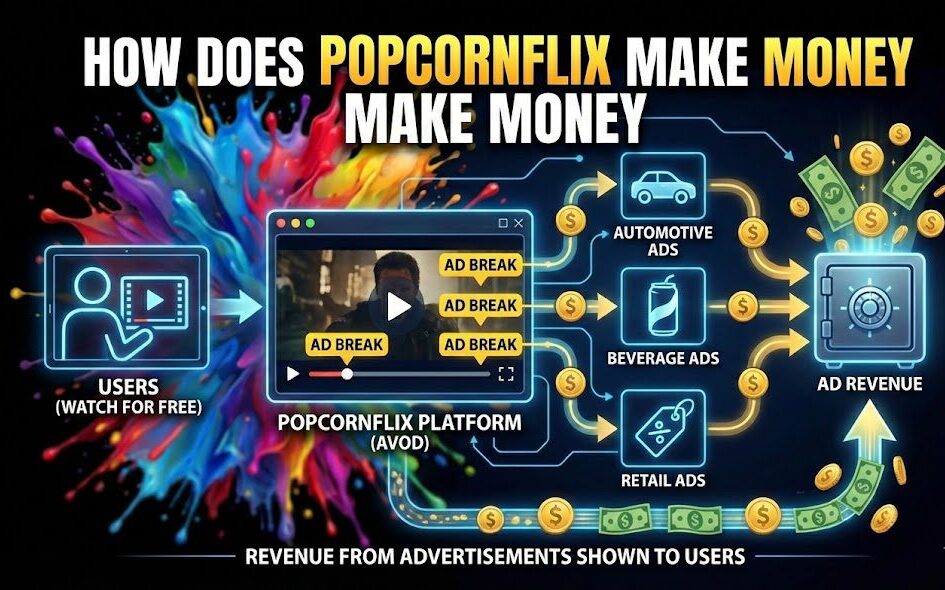

In the Unscripted and Reality TV market, players are reinventing formats for a streaming-first era, focusing on global unscripted hits that can be localized at scale. Licensing agreements must now account for “Fast Channel” rotational windows and programmatic ad-inventory integration. Simultaneously, the Scripted Drama market is moving toward “Low-Cost, High-Concept” genres—action, thriller, and horror—to combat the collapse of traditional revenue windows. These genres provide the highest ROI potential in secondary windows where “Authorized AI” dubbing eliminates the traditional localization barrier.

Arash Pendari from Vionlabs demonstrates how AI is reshaping the entertainment supply chain through emotional scene analysis and personalized content packaging. This de-risks Genre-Specific Content Rights & Licensing in 2026 by unlocking aesthetic visuals and metadata enrichment for targeted catalogs.

Genre-Specific Content Rights & Licensing in 2026: Authorized AI Chain-of-Title

In 2026, the transition from unauthorized “scrapable” IP to Authorized AI markets is the most critical legal de-risker in content acquisition. Multi-billion dollar licensing deals have established an “Authorized Data” environment where IP is protected while simultaneously powering generative production workflows. For buyers, this means every acquisition agreement must include a clinical audit of “Synthetic Rights”—ensuring that characters, likenesses, and voice-models are secured against unauthorized AI training. This de-risks the long-term value of the IP by ensuring it remains “Agentic AI” ready for future interactive exploitations.

Furthermore, “Infinite Localization”—the use of emotionally-synchronized, AI-powered visual dubbing—removes the traditional 18-month localization lag. This allows for day-and-date global releases of regional acquisitions, effectively decoupling language from lead times. Acquisitions must now be “AI-Ready” to ensure they can be modularly updated for interactive gaming and virtual environments, turning a passive motion picture into a living, multi-platform revenue asset that adapts to cultural nuances in real-time.

Genre-Specific Content Rights & Licensing in 2026: Weaponized Distribution

The “Streaming Wars” have ended, replaced by the era of Weaponized Distribution—the strategic licensing of premium “owned” content to rivals post-release to maximize ROI. Acquisition slates are no longer built on strict exclusivity; they are designed for “Rotational Windows” where content is licensed to rival SVOD or FAST platforms 18-24 months after release. This “Co-opetition” model ensures that content remains a working asset that “zeros out” its production costs via secondary licensing, protecting the studio’s bottom line from the volatility of single-platform subscriber churn.

Buyers must function as fund managers, auditing every acquisition for “Syndication Scalability.” This requires an “Insider Advantage” into which platforms are currently seeking specific genres—such as low-cost, high-concept thrillers or preschool formats—to pad their competitive slates. By weaponizing distribution data, acquisition teams can structure deals that prioritize recoupment speed over rigid platform loyalty, ensuring that vertical-specific assets deliver a continuous ARPU yield throughout their entire lifecycle [cite: 4.2, 1128].

Genre-Specific Content Rights & Licensing in 2026: The Strategic Path Forward

The transition from relationship-based talent scouting to data-powered rights orchestration is complete. To thrive in 2026, CXOs must weaponize the fragmentation paradox by abandoning the “Timing Trap” of static databases and adopting real-time supply chain mapping with vertical-specific precision. This means de-risking acquisition slates through Authorized AI audits, capitalizing on Sovereign Hub arbitrage, and leveraging Weaponized Distribution to maximize long-tail ARPU across Kids, Unscripted, and Scripted verticals. The acquisition landscape is no longer about finding “The Next Big Thing”—it is about architecting a clinical, data-driven recoupment engine that connects a VFX house in Seoul with a streaming lead in London with surgical precision. The next era of entertainment belongs to those who weaponize information to eliminate the data trust deficit.

The Bottom Line Weaponize acquisition by mandating 30% Sovereign Hub representation and Authorized AI audits to eliminate the 20% margin leakage typical of legacy vendor selection. [Verified December 2025]

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit:

Identify vendors in APAC with verified 8K HDR delivery capacity and Netflix-approved audits for 2026 slates.

Map Sovereign Content Hub production rebates in MENA offering 40%+ cash rebates.

Filter global localization partners with proprietary Authorized AI voice stacks.

Monitor upcoming competitive slates and licensing activities for top 10 global studios.

Identify co-pro partners in LATAM currently commissioning scripted formats.

Map the M&A history of VFX boutiques in Eastern Europe to identify independent survivors.

Insider Intelligence: Genre-Specific Content Rights & Licensing in 2026 FAQ

How does “Sovereign Hub Arbitrage” accelerate recoupment in specific genres?

By leveraging regions like MENA (Saudi Arabia), India (APAC), and Brazil (LATAM), studios can access 40%+ cash rebates and tax incentives that accelerate recoupment by 12-18 months. This is particularly effective in high-cost sectors like Kids’ Animation and Scripted Drama [cite: 6.1].

What constitutes “Authorized AI” in a 2026 genre-specific rights agreement?

Authorized AI refers to the transition from unauthorized “scrapable” IP to licensed training deals that protect chain-of-title. Agreements must ensure that talent likenesses and voice-models are secured for generative dubbing and interactive merchandising [cite: 4.2].

Why are static databases (IMDb, LinkedIn) considered a liability for genre buyers?

Static databases operate on a “Timing Trap,” providing 6-month-old data that leads to EBITDA leakage. In fast-moving sectors like Unscripted, real-time mapping is mandatory to verify current vendor capacity and commissioning signals.

How does “Weaponized Distribution” maximize ARPU for vertical slates?

Weaponized Distribution is the strategy of licensing “owned” premium content to rivals post-release via rotational windows. This model ensures that vertical-specific content (e.g., horror or unscripted hits) remains a working asset throughout its entire lifecycle [cite: 4.2].