| Strategic Pillar | Executive Insight |

|---|---|

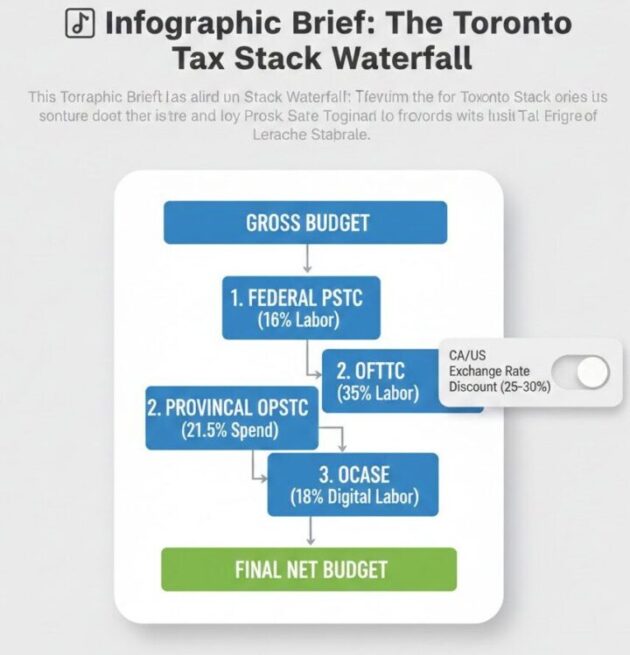

| The Tax Credit Stack | Productions can layer the 25% Federal PSTC with the 21.5% Provincial OPSTC or the 35% OFTTC for qualifying labor. |

| Permit Efficiency | Toronto Film Office maintains a 48-hour turnaround for standard street permits, a global benchmark for major metros. |

| Infrastructure Capacity | Over 1.5 million sq. ft. of soundstage space is now online, including the massive Basin Media Hub and Pinewood expansions. |

| Vitrina Relevance | Identify the verified service producers who specialize in “Ontario Residency” compliance for labor-based tax credits. |

Table of Content

The Fiscal Stack: Mastering OFTTC, OPSTC, and OCASE

In the global incentive arms race, Ontario has signaled its commitment to stability through a multi-layered tax credit system. Unlike jurisdictions that offer simple cash rebates, Toronto-based productions leverage a “Tax Credit Stack” that rewards local labor and high-end technical services. According to data from Ontario Creates, the province administered nearly $1 billion in tax credits in 2023 alone, supporting a record volume of foreign production.

The primary decision for finance executives lies between the Ontario Film and Television Tax Credit (OFTTC) and the Ontario Production Services Tax Credit (OPSTC). The OFTTC is a 35% refundable credit on qualifying Ontario labor for Canadian-controlled corporations. However, for foreign-owned studios (the “Service” side), the OPSTC offers a 21.5% refundable credit on all qualifying production costs—not just labor—provided the minimum spend of $100,000 for a feature film is met.

But there is a catch. To maximize the stack, savvy producers incorporate the Ontario Computer Animation and Special Effects (OCASE) Tax Credit, an additional 18% credit on qualifying Ontario labor for digital assets and VFX. When layered with the federal Film or Video Production Services Tax Credit (PSTC) of 16%, the effective net reduction in production costs can exceed 35-40% of the local spend.

Strategic Permitting: Navigating the Toronto Film Office

Toronto’s permitting landscape is reshaped by the city’s proactive Film Office, which operates as a one-stop-shop for location clearances. For HODs, the agility of the Toronto Film Office is a primary competitive advantage. Standard permits for street closures or parking are typically turned around in 48 to 72 hours, a velocity that rivals smaller, less congested hubs.

However, the city has implemented “Congestion Management” protocols that restrict filming in high-density zones during peak traffic hours. Success in Toronto requires a nuanced understanding of these “Permit Zones.” For instance, the Financial District offers a brutalist and glass aesthetic that frequently doubles for New York or Chicago, but filming here requires advanced coordination with the Toronto Police Service (TPS) and the TTC (Toronto Transit Commission).

According to the City of Toronto’s official film reports, over 1,500 film locations were utilized in the last calendar year. The permitting fee structure is highly transparent, with daily permit fees generally remaining under $500 CAD for large productions, excluding police and parking costs. This transparency de-risks the location scouting phase, allowing line producers to build accurate contingency buffers.

Location Architecture: Versatility and “The Double” Strategy

The strategic value of filming in Toronto is often rooted in its ability to “double” for major US metros. The city’s architectural diversity allows it to stand in for London, New York, or a generic “Anywhere, USA” suburb. This versatility is not just an aesthetic choice; it is a budget optimization strategy. By shooting a New York-set project in Toronto, producers capture Ontario’s 21.5% OPSTC while maintaining the visual fidelity of a premium urban setting.

Key location hubs include:

- The Distillery District: Frequently used for Victorian-era London or industrial New York.

- University of Toronto (St. George Campus): A staple for Ivy League collegiate settings.

- The Port Lands: The primary site for massive set builds and exterior action sequences.

Market intelligence from Statistics Canada highlights that the favorable exchange rate between the USD and CAD provides an immediate “automatic discount” of 25-30% on non-incentivized local spend. This exchange rate advantage, when paired with the tax credit stack, surfaces Toronto as one of the most cost-effective premium production hubs in the Western Hemisphere.

Infrastructure Capacity: Post-Production and Stage Dominance

The “Hollywood North” label is finally backed by physical scale. Toronto has accelerated its stage capacity, moving from soundstage scarcity to abundance. With the expansion of Pinewood Toronto Studios and the arrival of the Basin Media Hub, the city now boasts one of the world’s largest clusters of high-ceiling, purpose-built stages.

The shift toward Virtual Production (VP) is particularly pronounced. Toronto is home to several LED volumes and high-end VFX houses that allow productions to maximize the OCASE credit. According to industry analysis by Ampere Analysis, the city’s VFX and post-production sector has seen a 15% CAGR since 2020, driven largely by the stackability of the OCASE and federal tax credits.

Furthermore, the proximity of these stages to Toronto’s downtown core minimizes crew transport costs, which can consume up to 5% of a production budget in sprawling cities like Los Angeles. The “Film-Friendly” infrastructure extends to the labor pool, where over 35,000 highly skilled crew members are represented by world-class unions like IATSE 873 and NABET 700-M UNIFOR.

Vitrina Execution: How to Source Toronto Partners

Greenlighting a project in Toronto requires more than a location scout; it requires a verified supply chain of service producers, tax accountants, and vetted HODs. Vitrina accelerates this discovery by mapping the Toronto ecosystem in real-time. Whether you are seeking a production service company that can handle OCASE compliance or a VFX house that qualifies for the full provincial stack, Vitrina de-risks the partner selection process.

Use these contextual prompts to signal your needs and surface the right collaborators:

Accelerate with VIQI Intelligence

Strategic Conclusion

Toronto has moved beyond its reputation as a “cheap New York.” It is now a self-sustaining production superpower characterized by a sophisticated fiscal stack and world-class infrastructure. For heads of production, the decision to film in Toronto is a play for fiscal stability. By mastering the overlap between federal and provincial tax credits and leveraging a streamlined permitting system, studios can reallocate up to 40% of their labor spend back into on-screen production value.

The path forward requires a shift from manual scouting to data-driven discovery. As the city’s stage capacity continues to expand, the ability to surface verified vendors who understand the intricacies of Ontario residency and digital asset credits is the ultimate competitive advantage. Vitrina provides the intelligence layer needed to connect with the decision-makers who can transform Toronto’s fiscal potential into a tangible production reality.

Strategic FAQ

What is the minimum spend to qualify for the Ontario Production Services Tax Credit (OPSTC)?

To qualify for the 21.5% OPSTC, a feature film must have a minimum Ontario expenditure of $100,000. For television series, the minimum spend is $100,000 per episode if the episode is 30 minutes or longer, or $50,000 for shorter episodes.

Can a foreign production stack the OCASE and OPSTC tax credits?

Yes. Productions can layer the 21.5% OPSTC with the 18% OCASE credit on qualifying computer animation and VFX labor. This combined stack is a primary driver for major studios to relocate high-end post-production work to Toronto-based houses.

What are the “Ontario Residency” requirements for crew labor credits?

To qualify for provincial labor-based tax credits, individuals must have been resident in Ontario at the end of the calendar year preceding the start of principal photography. Managing this residency compliance is a critical task for local production service companies.

How long does it take to get a film permit in Toronto?

The Toronto Film Office typically processes standard film permits in 48 to 72 hours. However, more complex requests involving major street closures, special effects, or significant police presence require at least 5 to 10 business days for inter-departmental clearance.