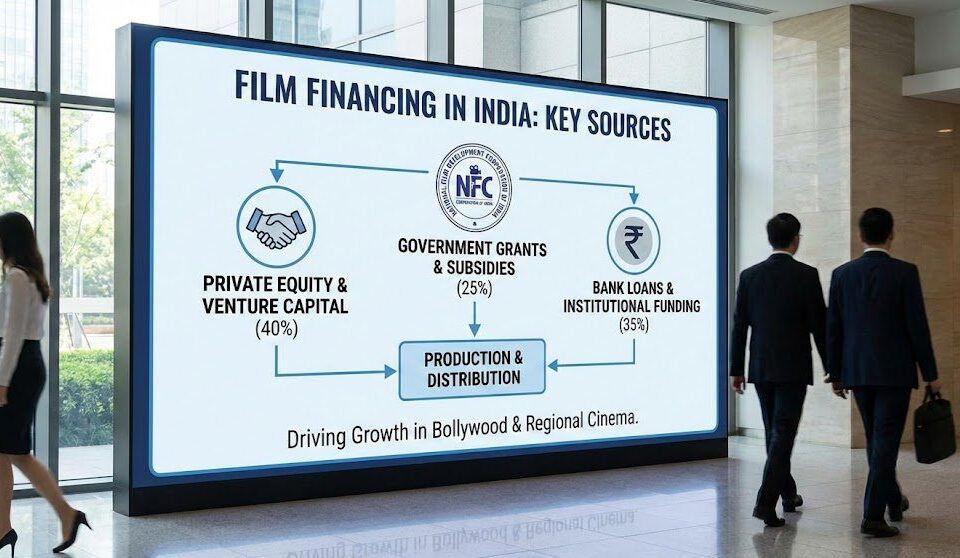

“regional content investment Film financing in India is a multi-layered process of securing capital through institutional lenders, private equity, government incentives, and emerging digital licensing models. This involves orchestrating a mix of equity, debt, and soft-money incentives to mitigate production risk and ensure project completion.According to recent industry analysis, India’s media and entertainment sector is projected to reach $30 billion by 2026, driven by a 25% increase in regional content investment. In this guide, you’ll learn actionable strategies for IPR securitization, navigating NFDC schemes, and leveraging supply chain intelligence to identify active financiers. While traditional resources focus on high-level lists of financiers, they often fail to address the technical nuances of modern deal structuring or the impact of global distribution shifts on local funding. This comprehensive guide addresses those gaps by providing technical depth on innovative funding mechanisms and a step-by-step roadmap for securing institutional backing in today’s fragmented market. Intellectual Property Focus: Securitizing IPR allows producers to raise capital against future revenue streams without diluting creative ownership or project equity. Incentive Optimization: Leveraging NFDC schemes can provide up to 30% reimbursement on production costs, significantly reducing the initial funding requirement for regional projects. Data-Driven Sourcing: Using supply chain intelligence platforms like Vitrina helps identify active financiers and co-production partners 70% faster than traditional networking. Digital Window Strategy: Structuring deals with a mix of SVoD and FAST channel licensing ensures rotational revenue windows post-theatrical release. Modern film financing in India has evolved from a closed network of private financiers to a sophisticated marketplace involving corporate studios, venture capital, and institutional debt. This transformation is driven by the industry’s need for transparency and the rapid globalization of Indian content. Producers now utilize a “stack” approach, combining multiple sources to cover the budget. The core of this evolution is the transition from individual relationship-based lending to a data-powered framework. This shift allows for more predictable ROI calculations and broader access for independent creators. For acquisition leads, understanding this stack is crucial for evaluating project health and rights availability. IPR (Intellectual Property Rights) securitization is an innovative financing method where a filmmaker leverages the anticipated future cash flows of a project’s rights as collateral for an immediate loan. In the Indian context, this typically involves packaging theatrical, digital, and satellite rights to secure institutional funding. It is a powerful tool for high-concept projects with strong franchise potential. To succeed with IPR securitization, producers must have a robust chain of title and verified valuation metrics. Industry leaders use supply chain data to demonstrate market demand for specific genres or talent attachments, providing lenders with the “data trust” needed to approve significant capital outlays. This briefing from NFDC leadership provides a foundational understanding of how global financing standards are being integrated into the Indian production ecosystem through official co-production treaties. Mr. Prithul Kumar (Joint Secretary, Films) discusses initiatives by the Ministry of Information and Broadcasting to aid international film production and official co-productions under bilateral agreements. These schemes are critical for producers looking to de-risk their financing through official state support. Crowdfunding has emerged as a viable “gap-filler” for independent Indian cinema, particularly for projects that don’t fit the traditional commercial mold. Platforms like Kickstarter and Wishberry have hosted successful campaigns for films like Lucia and Manthan (re-release funding), proving that a passionate community can replace a corporate financier. However, the strategy is less about the “money” and more about “audience building.” A successful crowdfunding campaign acts as a proof-of-concept for larger distributors. By tracking these grassroots movements through project trackers, acquisition leads can identify high-demand indie IP before it reaches the festival circuit. The National Film Development Corporation (NFDC) offers several schemes aimed at promoting Indian cinema, including production incentives for regional films and grants for international co-productions. These incentives are designed to lower the barrier to entry for quality storytelling. Typically, these involve a reimbursement of qualified production expenditure (QPE) incurred within India. Maximizing these incentives requires early-stage planning and adherence to strict reporting standards. Producers must ensure their projects qualify as “officially sanctioned” co-productions to unlock the highest tiers of support. Supply chain intelligence helps verify the track record of co-production partners to ensure eligibility and compliance. The arrival of global SVoD giants has fundamentally changed the financing risk profile for Indian films. Pre-licensing deals—where a platform acquires streaming rights before production is complete—provide essential “gap financing” that can make or break a project. This model has expanded beyond Hindi cinema into the “Big Four” South Indian markets, creating a boom in regional production. However, as the market matures into “Weaponized Distribution,” platforms are more selective. Strategic producers now track commissioning editor movements and platform acquisition preferences in real-time. This intelligence allows them to tailor their pitches to the exact needs of buyers, increasing the likelihood of securing high-value pre-sales. Quick answers to common queries about the Indian film financing landscape. The film financing landscape in India has shifted from opaque, relationship-driven networks to a transparent, data-powered ecosystem. This transformation addresses critical gaps in access for independent creators and provides a structured framework for institutional investment. By leveraging innovative methods like IPR securitization and government schemes, producers can navigate the complexities of a fragmented market with greater confidence. Whether you are an independent producer looking to secure pre-sales financing, or an acquisition lead trying to identify the next breakout regional hit, the principle remains: actionable intelligence drives deal velocity. Understanding the interplay between local incentives and global platform appetite transforms financing from speculation to strategy. Outlook: Over the next 12-18 months, expect a surge in “Authorized Data” deals and co-production treaties, as India positions itself as a global hub for cost-effective, high-quality content production. Expert in Entertainment Supply Chain Content Architecture with over a decade of experience in SEO-optimized content strategy for global media markets. Specialist in navigating the intersection of technology and creativity to drive business growth. Connect on Vitrina.Table of Contents

Key Takeaways for Producers

What is Modern Film Financing in India?Find film financiers and production partners in India:

How Does IPR Securitization Work in Indian Cinema?Analyze recent film licensing deals in the Indian market:

Industry Expert Perspective: Incentive Scheme For Production Of Foreign Films In India

Crowdfunding in Indian Cinema: Strategy vs. Success StoriesDiscover trending independent projects in India:

How Do Government Film Incentives Work (NFDC)?Find verified co-production partners in India:

The Impact of Streaming Platforms on Financing StrategiesAnalyze platform acquisition trends in India:

Frequently Asked Questions

How can I secure film financing in India as an independent producer?

What are the best government schemes for filmmakers in India?

Is crowdfunding a reliable source for film finance in India?

How do streaming platforms like Netflix affect film funding?

What is IPR securitization in the film industry?

Do Indian banks provide loans for film production?

How does Vitrina AI help in film financing?

Can foreign producers get funding in India?

Moving Forward

About the Author

Key Insights

Independent producers typically secure funding through a “stack” of private equity, institutional loans, and pre-sales to streaming platforms. Using supply-chain intelligence to identify active financiers and co-production partners is the most effective way to compress the research phase.

The NFDC’s Incentive Scheme for foreign film production and various regional state subsidies are the best options. These offer significant reimbursements for production costs if the project meets specific cultural or co-production criteria.

Crowdfunding is best used as “bridge funding” or a proof-of-concept for niche projects. While it can successfully fund low-budget indies, its primary value lies in demonstrating audience demand to institutional distributors.

Platforms provide critical pre-licensing revenue that reduces production risk. By securing a streaming deal early, producers can leverage the contract to obtain bank loans or private equity more easily.

IPR securitization involves taking a loan against the projected future earnings of a film’s intellectual property rights. It allows producers to unlock capital without selling equity in their production company.

Yes, several scheduled commercial banks in India provide film loans, but they typically require a completion bond and pre-sales agreements with established distributors or platforms as security.

Vitrina AI provides verified data on 140,000+ companies and 5 million professionals, helping producers find active financiers, co-production partners, and buyers who are currently active in the Indian market.

Foreign producers can access the NFDC incentive scheme (reimbursing up to 30%) by partnering with an Indian production company under an official co-production treaty.

Who’s Using Vitrina — and How

From studios and streamers to distributors and vendors, see how the industry’s smartest teams use Vitrina to stay ahead.

Find Projects. Secure Partners. Pitch Smart.

- Track early-stage film & TV projects globally

- Identify co-producers, financiers, and distributors

- Use People Intel to outreach decision-makers