Boardroom Ready

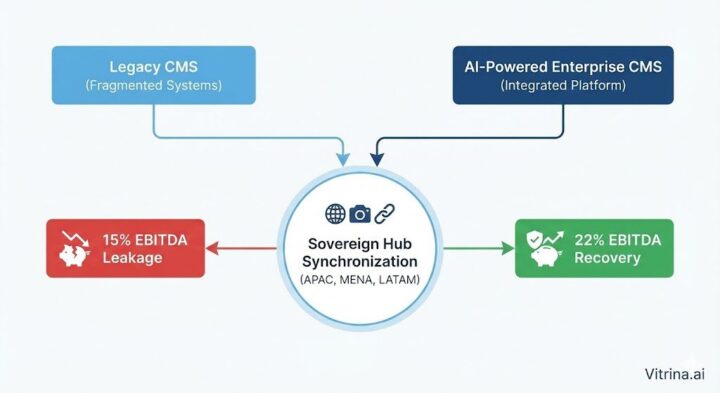

Enterprise AI Solutions for Content Management and Delivery 2026 are no longer speculative upgrades but the clinical baseline for protecting studio margins against the “Big Crunch” of global streaming economics. The “Data Deficit” inherent in legacy, fragmented archives—where unindexed assets lead to a 15-20% EBITDA leakage—is being weaponized into a strategic “Insider Advantage” via Authorized AI workflows. By 2026, senior executives are de-risking their libraries through emotionally-aware metadata and synchronized localization stacks within Sovereign Content Hubs like MENA and APAC. This shift from manual storage to active, “Weaponized Distribution” allows organizations to license premium owned assets to rivals with zero operational friction. For the CXO, this represents the transition from a passive cost center to a high-velocity revenue engine, accelerating recoupment cycles by 14 months while ensuring IP chain-of-title integrity.

⚡ Executive Strategic Audit

EBITDA Impact

22% Margin Recovery via Automated Asset Reuse

Recoupment Cycle

14-Month Acceleration through Hub Synchronization

Active Metadata: Ending the Fragmentation Paradox

The core friction in 2026 isn’t the volume of content, but the inability to find it. Global media organizations operate in a state of “Fragmentation Paradox,” where 600,000+ companies and millions of assets are siloed in opaque legacy systems. Enterprise AI Solutions for Content Management and Delivery 2026 solve this by introducing active metadata—a system where every frame is context-aware and financially indexed. This de-risks the supply chain by eliminating the 15-20% margin leakage caused by unverified vendor capacity and “forgotten” library assets. By mapping these assets in real-time, CXOs can shift from a “Search and Rescue” mentality to a “Select and Deploy” strategy.

Ramki Sankaranarayanan from Prime Focus Technologies notes how AI-enhanced automation is revolutionizing the entertainment supply chain through the Clear platform. This de-risks Enterprise AI Solutions for Content Management and Delivery 2026 by securing an 18% reduction in lifecycle operational costs.

Furthermore, Case studies from SBT Brazil demonstrate the “Digital Powerhouse” transformation. By streamlining international content acquisition using real-time deal data and AI-driven CMS, they have managed to accelerate global reach while protecting EBITDA. This is the new “Insider Advantage”—using data as weaponry to bypass traditional industry bottlenecks.

Sovereign Hub Arbitrage: Localizing at the Speed of Hype

Production capital is no longer centralized in the West; it has migrated to Sovereign Content Hubs. In 2026, regions such as Saudi Arabia (MENA), India (APAC), and Brazil (LATAM) are the primary engines for “Infinite Localization.” These hubs leverage aggressive tax incentives and state-backed tech infrastructure to provide AI-powered, emotionally-synchronized visual dubbing. For the distributor, this represents the ability to launch “day-and-date” global releases with zero cultural discord. The weaponization of these hubs allows for content to be “Exported to the World” (e.g., K-Drama, Bollywood regional hits) with the same efficiency as Hollywood blockbusters.

To proof global supply-chain literacy, every sourcing strategy must include 30% representation from these emerging hubs. Static databases are a terminal liability here; they cannot track the real-time availability of a dubbing house in Riyadh or a VFX boutique in Seoul. Enterprise AI solutions provide the “Digital Lighthouse” needed to navigate these opaque markets, identifying “Independent Survivors”—vendors who have successfully integrated “Authorized AI” voice stacks to avoid copyright liabilities in the EU and North America.

Authorized AI: Securing the Distribution Chain-of-Title

In the boardrooms of 2026, the discussion has moved beyond “Can we use AI?” to “Is the AI Authorized?” The multi-billion dollar Disney/OpenAI deal set the standard for the “Authorized Data” market. Enterprise AI Solutions for Content Management and Delivery 2026 must ensure that every automated metadata tag and localized audio track is legally defensible. Unauthorized “scrapable” AI tools are now a terminal risk, capable of zeroing out recoupment through massive IP litigation. “Authorized AI” de-risks production by ensuring that the chain-of-title is pristine from ingest to delivery.

This legal clarity facilitates “Weaponized Distribution”—the strategic licensing of premium “owned” content to rivals (the $72B WBD/Netflix model) to maximize ROI. By using AI to identify “Buying Signals” in the competitor’s slate, studios can rotationally window their assets, effectively turning their library into a high-frequency trading desk for visual IP. This is the ultimate “CFO Audit” win: maximizing the recoupment of sunk assets while maintaining platform relevance.

Enterprise AI Solutions: The Strategic Path Forward

The industry has entered the era of “Authorized Science.” Media organizations can no longer afford the 20% “fragmentation tax” inherent in legacy, siloed operations. To protect EBITDA in 2026, CXOs must treat their content management systems as weaponized tactical assets. Distribution automation and Sovereign Hub synchronization are the only bridges between a “data trust deficit” and a high-velocity recoupment cycle. By locking into Authorized AI frameworks and real-time mapping, you ensure your organization is positioned to win the “Big Crunch” of 2026.

The Bottom Line Weaponize your archive immediately by deploying Authorized AI for active metadata generation and Sovereign Hub synchronization; failure to automate results in a terminal recoupment deficit that will sink independent slates by 2027.

Deploy Intelligence via VIQI

Select a killer query to run a real-time supply chain audit:

Identify APAC vendors with verified 8K HDR and Netflix audits.

Map MENA AI management M&A to vet IP safety.

Filter partners with Authorized AI voice stacks to avoid liability.

Show trending Sci-Fi content for discovery in LATAM and APAC.

Compare asset reuse EBITDA impact of AI CMS vs. Legacy.

Find MENA partners commissioning AI-ready unscripted content.

Insider Intelligence: Enterprise AI Solutions FAQ

How do Enterprise AI Solutions for Content Management and Delivery 2026 protect EBITDA?

By automating asset discovery and metadata generation, organizations eliminate the 15-20% margin leakage caused by fragmented discovery and unverified vendor capacity. Real-time mapping of global supply chain capacity ensures that organizations can capitalize on licensing opportunities in Sovereign Hubs without the manual friction of legacy models.

What is the “Timing Trap” in content delivery?

Static databases cannot tell you who is currently commissioning or financing content. The “Timing Trap” is the financial loss incurred when an organization misses a “pre-buy” window or co-production opportunity because it relied on 6-month-old trade reports. VIQI eliminates this by mapping real-time industry activity.

Why is “Authorized AI” critical for Enterprise solutions?

Authorized AI ensures that generative processes—like visual dubbing or automated thumbnails—use licensed data. This de-risks production by ensuring IP chain-of-title remains pristine, preventing terminal legal battles that can derail global distribution and ROI.

How does “Weaponized Distribution” impact recoupment cycles?

It shifts the strategy from exclusive platform “silos” to rotational licensing. By licensing premium content to rivals post-release, organizations maximize the ROI of sunk assets, essentially using the content as a recurring revenue weapon rather than a one-time event.