| Executive Summary: Cyprus Production Intelligence | |

|---|---|

| The 45% Ceiling | Cyprus offers one of the highest rebates in the EU, capping at 45% of eligible local expenditure for qualified projects. |

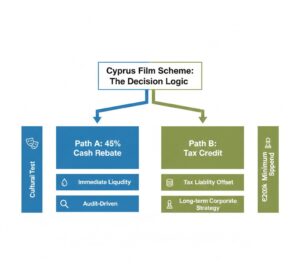

| Cash vs. Credit | The cash rebate provides immediate post-audit liquidity, while the tax credit serves as an offset for entities with local tax liability. |

| Spend Thresholds | Minimum local spend is set at €200k for features and €100k for documentaries/animation, with a €25M annual total fund cap. |

| Vitrina Relevance | Vitrina tracks the verified co-production credits of Cyprus-based service providers to ensure compliance with the Cultural Test. |

Strategic Roadmap

- The 45% Cash Rebate: Liquidity Mechanics and Timing

- The Tax Credit Alternative: When Does It Outperform the Rebate?

- Qualifying for Olivewood: The Cultural Test and Spend Audits

- Infrastructure & Post-Production: Capturing the Full Value Chain

- Market Discovery: Verified Cyprus Service Partners

- Operational Precision: How Vitrina Accelerates Market Entry

The 45% Cash Rebate: Liquidity Mechanics and Timing

The primary driver behind the recent surge in Cyprus-based production is the cash rebate, which was increased to 45% to position the island as a high-yield competitor to traditional hubs in Malta and Greece. Unlike tax credits, which can take years to realize, the Cyprus cash rebate is a direct reimbursement on eligible expenditure incurred within the Republic. For an executive, this translates to predictable cash flow that can be leveraged to secure production loans or to bridge the “last mile” of a financing gap. The ADFC (Invest Cyprus) manages the application process, ensuring that the funds are ring-fenced for projects that meet the €200,000 minimum spend for feature films.

Strategic timing is the critical variable here. The rebate is typically disbursed within 90 to 120 days after the final audit is approved by the Ministry of Finance. In a high-interest-rate environment, this turnaround time is a significant de-risking factor for completion bond companiesThis report de-risks the Mediterranean market entry by surfacing the technical nuances of the Cyprus “stack”, the cultural test requirements, and the verified vendor network.. Producers who align their shooting schedule with the Cyprus fiscal year can signal higher reliability to their investors, as the €25 million annual fund cap is allocated on a “first-come, first-served” basis. This necessitates an early application—ideally during the advanced pre-production phase—to lock in the rebate reservation.

The 45% rebate covers a broad spectrum of “Below the Line” (BTL) costs, including crew payroll for both local and non-resident talent (subject to specific caps), equipment rentals, and accommodation. Furthermore, the rebate applies to the purchase of specialized services from local firms, incentivizing the use of the island’s maturing post-production ecosystem. The bottom line is this: The cash rebate is designed for speed and liquidity, making it the preferred choice for independent features and episodic series that require immediate capital recovery.

The Tax Credit Alternative: When Does It Outperform the Rebate?

While the rebate garners the most attention, the Cyprus Film Scheme also offers a tax credit alternative that can be more beneficial for specific corporate structures. The tax credit functions as a reduction in the corporate income tax of a company subject to tax in Cyprus. This is particularly relevant for major studios or production conglomerates that intend to establish a long-term presence on the island or those involved in high-volume, multi-year slates. By offsetting tax liabilities, the credit can sometimes yield a higher net-present-value (NPV) than a cash grant, depending on the production’s broader fiscal strategy in the EU.

However, there is a catch: The tax credit cannot be combined with the cash rebate for the same project. This binary choice requires early-stage financial modeling. If a production company has significant local expenses that do not qualify for the rebate but can be leveraged for tax deduction purposes, the credit might signal a more efficient path forward. Most international producers, however, favor the rebate due to the immediate liquidity it provides in an industry where “cash is king” and bankability is the primary hurdle to greenlighting.

Qualifying for Olivewood: The Cultural Test and Spend Audits

Accessing the 45% rebate requires passing a rigorous “Cultural Test” designed by the Cyprus Ministry of Education and Culture. This test scores projects based on their contribution to the Cypriot and European cultural identity, the use of local talent, and the representation of the island’s unique topography. For an executive, this means the script and crewing strategy must be intentionally designed to trigger the necessary points. Strategic integration—such as hiring a Cyprus-based Director of Photography or utilizing the Troodos Mountains as a primary location—can unlock the higher tiers of the rebate.

The spend audit is the second major gatekeeper. The Ministry requires every invoice to be issued by a Cyprus-registered entity and paid through a local bank account. This “local nexus” rule ensures that the economic impact of the production is fully captured by the island’s economy. To de-risk this process, producers should partner with a local production service company (PSC) that has a verified track record of successful audit submissions. A PSC that understands the nuances of eligible vs. non-eligible spend can prevent “haircuts” on the final rebate check, which can otherwise destroy the project’s margin.

Infrastructure & Post-Production: Capturing the Full Value Chain

Cyprus is rapidly expanding its infrastructure to support the “Island as a Studio” concept. Beyond its 300+ days of sunshine, the island offers advanced post-production facilities and soundstages that are fully eligible for the 45% rebate. By keeping the post-production on-island, producers can capture the rebate on a larger portion of the total budget. This includes color grading, VFX, and sound finishing—services that were previously shipped back to London or Berlin but are now increasingly being executed in Limassol and Nicosia.

The strategic advantage of “bundling” production and post-production in Cyprus is the simplification of the audit trail. When a single local ecosystem handles the entire lifecycle of a project, the documentation is more cohesive, and the Ministry’s review process is often accelerated. This “all-in” approach signals a mature production strategy, allowing executives to reallocate the saved costs toward higher-end talent or aggressive marketing campaigns upon release.

Market Discovery: Verified Cyprus Service Partners

Navigating the Cyprus Film Scheme requires local partners who possess both creative excellence and fiscal precision. The following entities represent the peak of the Olivewood supply chain in 2024–2025.

Green Olive Films

A premier production service house with operations across the Mediterranean, Green Olive Films specializes in high-budget episodic and feature film logistics, offering end-to-end support for ADFC compliance.

Verdict: Green Olive Films demonstrated elite capacity on the The Family (2024), managing complex location shoots and crew integration while ensuring every dollar met the 45% rebate criteria.

AB Seahorse Film Productions

Known for their deep roots in the Cyprus creative community, AB Seahorse provides co-production services that bridge the gap between local cultural mandates and international commercial requirements.

Verdict: Their involvement in the Verified Documentary Slates (2024) confirms their status as a reliable partner for projects seeking to navigate the €100k lower-spend threshold.

Southeastern Film Services

Specializing in technical production and equipment rentals, Southeastern provides the BTL infrastructure that anchors most “Olivewood” slates, ensuring that equipment costs are fully rebated through local invoicing.

Verdict: Their long-standing support of European Co-Productions showcases their expertise in managing the cross-border audits required by the Cyprus Ministry of Finance.

Operational Precision: How Vitrina Accelerates Market Entry

The challenge of filming in Cyprus isn’t the availability of the 45% rebate; it is the precision of the execution. To capture the full value, every vendor must be a verified resident, and every contract must be structured to meet the ADFC’s audit criteria. Vitrina de-risks this process by providing a “census-level” view of the Cyprus supply chain, allowing executives to pre-vet partners based on their historical involvement in incentivized projects. Through VIQI, our AI-powered business development agent, producers can instantly surface the right decision-makers at Limassol-based studios and post-houses.

Whether you are looking for a co-production partner to satisfy the Cultural Test or a service provider to manage a high-stakes desert shoot, Vitrina provides the verified contacts and deal-analysis required to ensure your Mediterranean entry is not just cost-effective, but operationally seamless. In an industry where “unseen” audit gaps can destroy margins, Vitrina surfaces the hidden signals of the global supply chain.

Optimize Your Cyprus Strategy with VIQI

Accelerate your Mediterranean market entry with verified partner data and real-time incentive intelligence.

Strategic Conclusion

The Cyprus Film Scheme represents a pivotal opportunity for producers to maximize their ROI within a stable EU jurisdiction. By choosing the 45% cash rebate, executives can unlock significant post-audit liquidity that de-risks the entire project lifecycle. However, the path to a 100% successful disbursement lies in early-stage strategic planning—ensuring that the script meets the Cultural Test and that all local vendors are vetted for audit compliance. The dual-track model of rebate vs. credit provides the flexibility needed for both independent slates and major studio investments, provided the financial modeling is executed with precision during the pre-production phase.

Moving forward, the success of “Olivewood” will depend on the continued expansion of its infrastructure and the quality of its local partnerships. As the island matures into a Tier-1 production hub, speed and data-backed partner selection will be the primary differentiators for successful slates. Utilizing the Vitrina platform and the VIQI assistant ensures that your Cyprus strategy is backed by the industry’s most robust data engine. The opportunity in the Mediterranean is clear; the next step is to activate the local supply chain with surgical precision.

Strategic FAQ

What is the primary difference between the Cyprus cash rebate and the tax credit?

The cash rebate is a direct reimbursement of up to 45% of eligible local spend, ideal for immediate liquidity. The tax credit functions as an offset against Cyprus-based corporate tax liability, better suited for entities with long-term local tax obligations.

What are the minimum spend requirements to qualify for the scheme?

Feature films and TV series must spend a minimum of €200,000 in Cyprus. For documentaries and animation, the threshold is lower, starting at €100,000. These thresholds apply only to qualifying local expenditures.

How does the Cyprus Cultural Test impact the production rebate?

The Cultural Test is a mandatory scoring system. Projects must achieve a minimum point threshold by utilizing local locations, talent, and themes to qualify for the 45% rebate. It ensures the incentive supports the local and European cultural identity.

Are non-resident crew costs eligible for the 45% rebate?

Yes, non-resident crew costs are eligible, but they are often subject to specific caps (typically 25% of the total eligible expenditure) and must be processed through local payroll services to ensure they are captured in the final audit.