Global Micro-Drama Momentum Drives Vertical Co-Production Deal

The global appetite for narrative-driven, ultra-short-form video content has created a multi-billion dollar economy, validating the format worldwide. Originating as a phenomenon in China, where the segment’s revenue surpassed the domestic box office in 2024, the micro-drama market is forecast to grow globally to an estimated $26 billion by 2030.

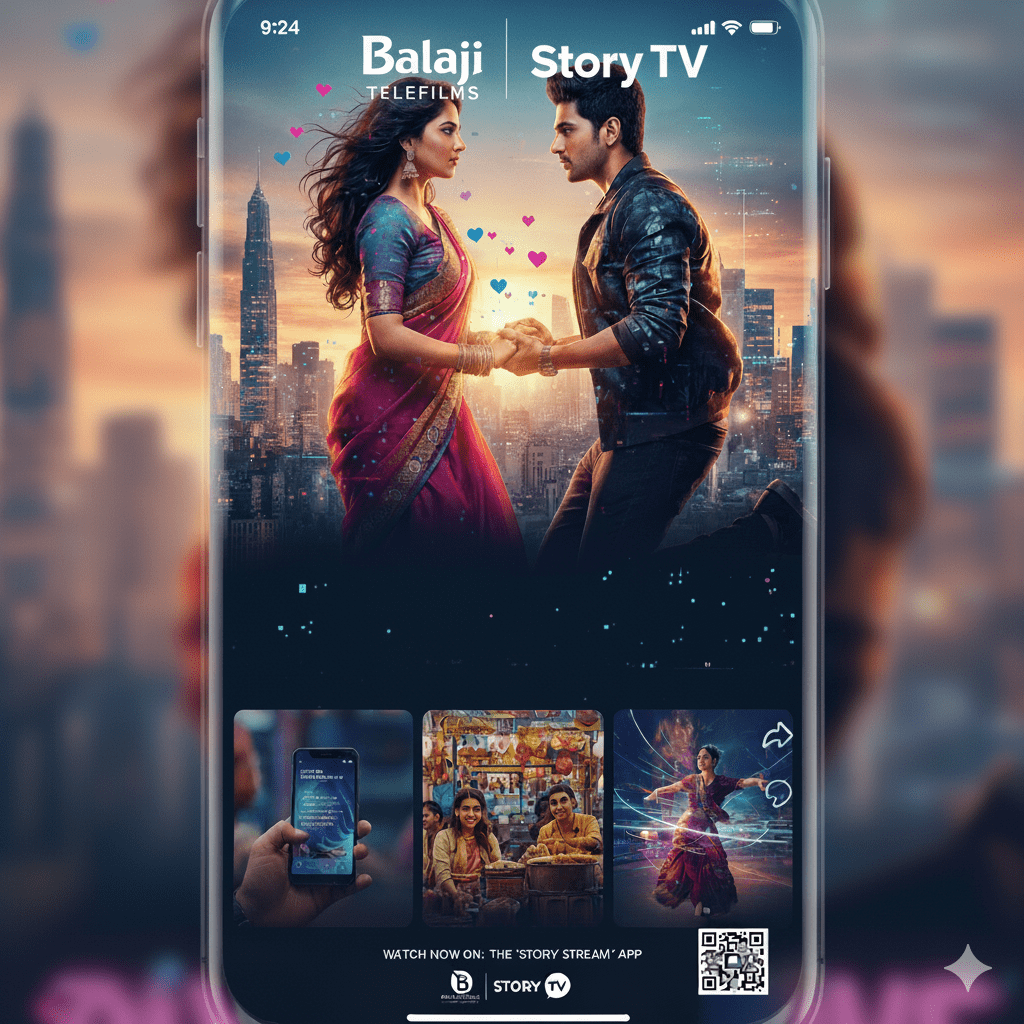

This momentum is being seen in India too with an exclusive partnership and content development alliance between India’s established content powerhouse, Balaji Telefilms, and the pioneering micro-drama platform, Story TV. Story TV, launched by the homegrown social gaming and live entertainment firm Eloelo Group, offers a dedicated vertical viewing ecosystem.

The agreement focuses on the co-creation of an entire slate of new, original, mobile-first micro-dramas specifically formatted for vertical video consumption, with episodes designed to be approximately one minute in length. The content, rooted in rich Indian narratives across various genres and languages, will be distributed exclusively on the Story TV platform across India to capture the rapidly growing mobile-first audience of 10 million+ users.

Legacy Expertise Merges with Platform Reach: The Key Dealmakers

The partnership involves content producer Balaji Telefilms, distributor/platform Story TV, and its parent organization, Eloelo Group. The deal was spearheaded by Balaji Telefilms Joint Managing Director Ekta Kapoor, Group Chief Revenue Officer Nitin Burman, and Story TV Founder and CEO Saurabh Pandey. This alliance represents Balaji’s move to leverage its production scale for a segment experiencing a 113% year-on-year surge in app downloads in India, signaling a formal commitment to the vertical video format.

Gaining Scale: Strategic Rationale and Competitive Positioning

The operational advantages are clear: Story TV gains immediate access to Balaji’s decades of creative expertise, production scale, and trusted storytelling legacy, which is critical for legitimizing and scaling the nascent Indian format. Balaji, conversely, secures a high-growth distribution channel and a mechanism to extend its intellectual property into the hyper-short-form segment.

While the format is precedented by the global success of players like ReelShort and DramaBox, and actively pursued locally by funded start-ups and other players—such as Dashverse ($13M funding in 2025), Flick TV ($2.3M funding in 2025), and integrated initiatives by ShareChat/Moj—this is considered unique because it is an exclusive co-production alliance between a publicly listed, traditional content major and a vertical-specialist platform. The competitive implication is that rival content companies who previously overlooked vertical video as UGC must now recognize it as a serious, industrialized, high-volume production format. A likely response will be for platforms such as Kuku TV to secure their own high-profile content development deals with established regional production houses to maintain competitive parity.

Optimizing the Value Chain: Content Pipeline and Monetization

The primary supply-chain impact is the explicit establishment of a dedicated, high-speed content supply chain optimized for a 60-second vertical window. This collaboration allows Balaji to use its existing content creation infrastructure to create professionally produced, serialized content, optimized specifically for the high-volume demand of mobile-first micro-dramas. Furthermore, Indian studios, particularly Balaji, are well-positioned to meet the demands of this industrialized volume, given the nation’s traditional ‘soap’ culture, which has long optimized content creation for rapid, close-to-air production cycles. For Story TV, the deal provides a volatility hedge by securing a stable supply of culturally rooted content from a reliable source, ensuring schedule density and user retention in a segment where content churn is high.

Outlook: Specialization and the Next Phase of Regional Content Convergence

Looking forward, this alliance signals increased investment convergence between legacy content producers and dedicated vertical-video platforms, validating the financial viability of the micro-drama format as a standalone business rather than merely a marketing tool. By partnering with Story TV, Balaji also gains immediate access to a tailored distribution funnel and a distinct, rapid-monetization model.

Mumbai, India

Mumbai, India