Introduction

Why Hedge Funds Should Care About Disney’s Entertainment Supply Chain Strategy

If you’re managing a hedge fund or tracking media stocks, you’re probably watching Disney (NYSE: DIS) as it navigates one of the most pivotal transformations in its history.

Disney’s entertainment supply-chain strategy — spanning content production, distribution, and direct-to-consumer (DTC) platforms — has become the company’s biggest lever to rebuild profitability.

But here’s the kicker: Disney’s entertainment supply-chain network isn’t just operational infrastructure — it’s a real-time blueprint for how the company is aligning its business model with profitability.

For hedge funds looking for alpha in media stocks, analyzing Disney’s supply-chain decisions can offer critical insights into:

- Stock price momentum

- Cash flow projections

- Competitive positioning

Walt Disney Co

NASDAQ : DIS111.38 USD

0.89 (0.8055)52-week Low

110.15 USD52-week High

112.2 USDThe Disney Supply Chain: A Profitability Engine Hidden in Plain Sight

When most investors think about Disney, they see blockbuster movies and streaming platforms — not the 400+ companies in its supply chain powering those hits behind the scenes.

Disney’s media supply chain spans four critical components:

🎬 1. Production Houses: The Core Content Pipeline

Disney owns 75+ production houses across movies, TV, and animation — but the company’s biggest supply-chain move in 2024 is producing fewer, high-quality projects.

| Production House | Content Type | Top Partners |

|---|---|---|

| 20th Century Studios | Sci-Fi, Action | ILM, SpinVFX, GhostVFX |

| Marvel Studios | Superhero Films | Weta FX, Digital Domain |

| Walt Disney Pictures | Family Animation | Framestore, Atomic Cartoons |

| ABC Signature | TV Dramas | FuseFX, Ingenuity Studios |

| Lucasfilm | Sci-Fi & Fantasy | ILM, Atomic Cartoons |

🎯 Strategic Pivot: Quality Over Quantity

After a content volume boom in 2021-2022 — driven by streaming wars — Disney’s leadership under Bob Iger has reversed course:

| Year | Productions Commissioned | Key Strategy Shift |

|---|---|---|

| 2021 | 200+ | Volume over Quality (Disney+ Heavy) |

| 2023 | 110 | Cost Cuts + Restructuring |

| 2024 | 85 | Fewer, High-Quality Projects |

🌐 Distribution Network: Global Reach, Regional Power Plays

Disney’s 25+ distribution companies operate across USA, EMEA, APAC, and LATAM, giving the company one of the largest media distribution networks worldwide.

| Region | Platforms | Distribution Focus |

|---|---|---|

| USA | 70+ | Blockbusters + Streaming (Disney+, Hulu) |

| EMEA | 140+ | Localized TV + Arthouse Films |

| LATAM | 70+ | Telenovelas + Family Content |

| APAC | 75+ | Disney+ Hotstar + Local Broadcasters |

🎯 Direct-to-Consumer (DTC): The Profitability Pivot

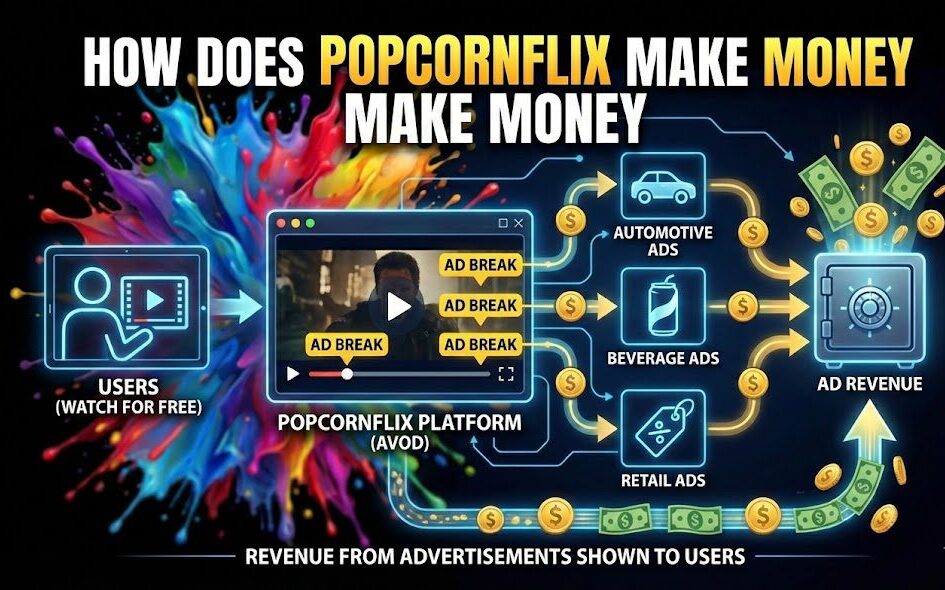

Disney’s DTC segment (Disney+, Hulu, ESPN+) went from bleeding cash to becoming the company’s biggest profitability engine in 2024.

| Metric | 2023 | 2024 (Projected) |

|---|---|---|

| DTC Revenue | $5.3B | $6.8B |

| Operating Income | -$400M | +$875M |

| Streaming Subscribers | 220M | 225M |

What’s Driving DTC Profitability?

✅ Ad-supported streaming tiers

✅ Higher subscription prices

✅ Content rationalization (fewer, better shows)

✅ Bundled offerings (Disney+, Hulu, ESPN+)

Supply Chain Partners Powering Disney’s Content Pipeline

One under-the-radar edge Disney holds over competitors like Netflix? Deep partnerships across the entire content supply chain.

| Function | Top Partners | Contribution |

|---|---|---|

| VFX | ILM, Weta FX | Blockbuster CGI (Star Wars, MCU) |

| Audio | Skywalker Sound | Immersive soundscapes |

| Post-Production | Deluxe, Harbor Picture | Global localization + dubbing |

| Filming Equipment | Panavision, Keslow Camera | High-end camera systems |

📊 Financial Tailwinds vs. Headwinds

| Factor | Tailwind 🌬️ | Headwind ⛈️ |

|---|---|---|

| DTC Profitability | ✅ +95% Growth | ❌ Subscriber Churn |

| Box Office Hits | ✅ Moana 2, Deadpool & Wolverine | ❌ Underperforming Originals (The Marvels, Haunted Mansion) |

| Localization Expansion | ✅ LATAM & APAC | ❌ Star India Exit (37% Stake Sold) |

| Sports Streaming | ✅ ESPN Digital Strategy | ❌ Rising NBA & NFL Rights Costs |

Investment Outlook: Is Disney a Buy for Hedge Funds?

Disney’s supply-chain recalibration is the most underappreciated catalyst for its stock price rebound.

If the company sustains:

- Lower content volumes

- Higher DTC margins

- Localization expansions

… Disney could outperform the S&P 500 Media Index by 2025.

How Vitrina Helps Hedge Funds Track Disney’s Supply Chain Moves

At Vitrina, we help hedge funds track the global media supply chain — from early-stage content development to distribution partnerships.

With Vitrina’s Global Film+TV Projects Tracker, investors can:

- Track Disney’s active productions before public announcements

- Map regional partnerships in emerging markets

- Monitor outsourcing trends and vendor relationships

- Identify upcoming co-production opportunities

Final Verdict: BUY Disney Stock (Long-Term Position)

Disney’s supply chain overhaul under Bob Iger is a multi-year turnaround story — and hedge funds that track the right supply-chain signals will have an edge over the broader market.

🔥 Start Tracking Disney’s Supply Chain Moves Today

Get exclusive access to Vitrina’s Global Film+TV Projects Tracker — the #1 media supply chain intelligence platform for hedge funds.