| Executive Summary: Strategic Findings | |

|---|---|

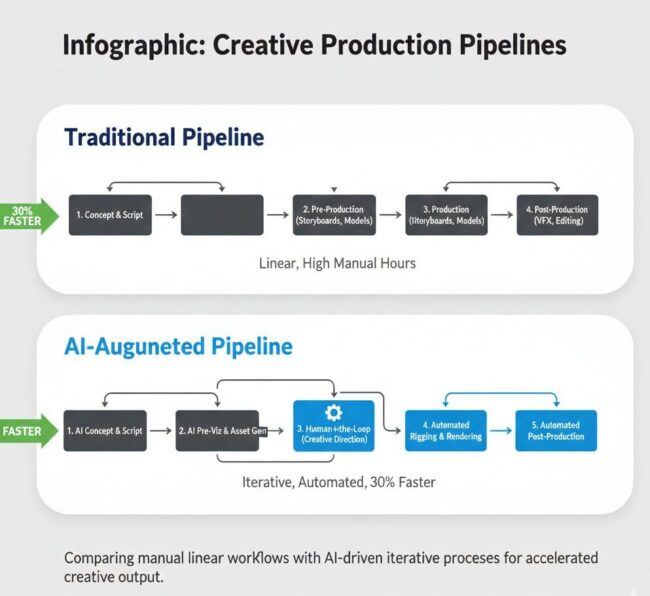

| Production Velocity | AI-integrated workflows for rendering and in-betweening have demonstrated up to a 10x throughput improvement, drastically shortening time-to-market. |

| Unit Cost Reduction | Studios are signaling potential savings of 20% to 35% across the pipeline by automating mechanical drudgery like cleanup and background generation. |

| IP Lifecycle Revenue | AI-driven localization (lip-syncing and dubbing) allows regional animation to scale globally with native-level immersion, increasing asset value. |

| Vitrina Relevance | Mapping the 150,000+ company ecosystem to identify the specific AI-enabled vendors capable of executing these high-fidelity transitions. |

Table of Contents

- The $23 Billion Signal: AI Market Economics

- From Pixels to Predictions: The Neural Rendering Shift

- The 2D/3D Bridge: Automating In-betweening and Rigging

- Strategic Verdicts: Studio Execution in 2024-2025

- How Vitrina Surfaces AI-Ready Production Partners

- The Human-AI Dividend: A Strategic Path Forward

The $23 Billion Signal: AI Market Economics

The economic gravity of the animation sector is shifting. According to data from Precedence Research, the generative AI in Animation market is projected to expand from $1.66 billion in 2024 to over $23 billion by 2032. This represents a compound annual growth rate (CAGR) of nearly 39%. For the executive persona, this is not merely a growth statistic; it is a signal of a mandatory technological pivot.

In the current high-interest-rate environment, the “unlimited budget” era of streaming has concluded. Studios are now tasked with maintaining the visual standards of a Frozen II or Spider-Verse on series-level budgets. AI serves as the primary deflationary force in this equation. By automating the mechanical tasks that consume 60-70% of a production schedule, studios can redirect capital toward IP development and market-entry strategies. The bottom line is clear: firms that fail to integrate AI-driven efficiencies will face a structural disadvantage in content throughput.

From Pixels to Predictions: The Neural Rendering Shift

Traditional 3D rendering is a brute-force computational process. Each frame requires calculating light paths, material properties, and particle physics—a task that historically necessitated massive server farms and weeks of compute time. Neural rendering is reshaping this landscape by using machine learning to “predict” final frame visuals rather than calculating them from scratch.

Systems powered by NVIDIA and Unity are now enabling real-time fidelity that previously belonged only to pre-rendered cinema. This allows for “Live Pre-viz,” where directors can adjust lighting and textures in real-time on set. The strategic benefit here is the reduction of “Post-Production Waste”—the expensive cycle of re-rendering scenes after creative changes. For a C-suite leader, this translates to “Production Elasticity,” allowing the studio to pivot creatively without triggering a budget crisis.

The 2D/3D Bridge: Automating In-betweening and Rigging

In the 2D animation supply chain, “in-betweening” (drawing the frames between key poses) has been the most significant labor expense. AI models can now ingest a studio’s “on-model” style and generate these frames automatically, maintaining character consistency without the need for massive offshore cleanup teams.

In 3D, the bottleneck has always been “Character Rigging”—the process of building a digital skeleton. AI-driven auto-rigging tools can now analyze character geometry and apply skeletal structures in seconds. This allows studios to prototype hundreds of character movements before committing to final production. This “Rapid Iteration” is the new moat for creative studios; the faster you can see a character move, the faster you can find the emotional heart of the story.

Strategic Verdicts: Studio Execution in 2024-2025

The following verdicts surface the specific “Hero Projects” where AI was successfully deployed to solve production-scale challenges. These case studies provide the blueprint for the executive path forward.

Disney: Physics-Aware AI in “Frozen II”

Disney utilized proprietary AI tools like Swoop and Hyperion to manage complex environmental physics—snow, wind, and water. By using machine learning to simulate particle behavior, Disney reduced the manual calculation hours for lighting and effects by over 40%.

Verdict: Disney’s application of AI in Frozen II proved that high-fidelity environmental immersion can be scaled without a linear increase in the VFX budget.

Netflix: VFX Throughput in “El Eternauta”

Netflix leveraged AI-assisted rendering and background generation to scale a feature-film visual aesthetic to a series format. By automating the destruction sequences, they achieved a 10x speed improvement compared to traditional CGI pipelines.

Verdict: Netflix’s execution of El Eternauta signals a new era where regional content can achieve “Global Blockbuster” visuals on a optimized TV budget.

DreamWorks: Asset Retargeting for “Kung Fu Panda 4”

DreamWorks utilized AI for massive crowd simulations and character retargeting. This allowed them to reuse complex movement data from previous films and apply it to thousands of background characters with high visual diversity.

Verdict: DreamWorks’ strategy for Kung Fu Panda 4 demonstrates how AI can unlock “Asset Lifecycle Value,” allowing legacy animation data to drive modern visual scale.

How Vitrina Surfaces AI-Ready Production Partners

The risk for any C-suite leader in the AI era is “Vendor Hallucination”—partnering with firms that claim AI capabilities but lack the technical depth to deliver on-model results. Vitrina de-risks this by providing verified data on the global animation supply chain. We track the specific AI tech stacks and production credits of over 150,000 companies, allowing you to filter for studios that have actually delivered AI-driven results for major platforms.

The Human-AI Dividend: A Strategic Path Forward

The integration of AI in animation is not a replacement for human creativity; it is a mechanism for its liberation. By reallocating the mechanical labor of the production pipeline to intelligent agents, studios are unlocking a “Human-AI Dividend.” This dividend manifests as higher creative ambition, faster release cycles, and more resilient production economics. The winners of the next decade will be the leaders who can distinguish between the noise of AI hype and the signal of structural production transformation.

As you look to modernize your content slate and de-risk your production partnerships, the path forward requires “Census-level” intelligence. Vitrina provides the visibility you need to identify emerging AI leaders, monitor competitive slates, and secure the right partners for the right project. The era of manual animation is closing; the era of intelligent production is here. Leverage VIQI and the Vitrina Project Tracker to stay inside the room where the future of content is being built.

Strategic FAQ

What is the primary cost-saving driver for AI in animation?

The primary driver is the automation of labor-intensive “mechanical” tasks such as in-betweening, frame cleanup, and asset rigging. By offloading these tasks to AI, studios can reduce the required headcount for technical roles and shorten the production timeline by 30-50%.

How does AI improve global content distribution?

AI enables automated lip-syncing and dubbing that adapts character mouth shapes to the phonemes of target languages. This creates a native-level viewing experience for global audiences, significantly increasing the lifecycle revenue and marketability of regional animation assets.

What is neural rendering and why is it a macro shift?

Neural rendering uses machine learning to predict the final visual output of a frame, rather than calculating physics and light paths manually. This reduces the need for massive on-site render farms and enables real-time high-fidelity visuals, allowing for faster creative iterations during production.

How should executives verify an AI-enabled production partner?

Executives should look for partners with verifiable “Hero Project” credits where AI was utilized in the pipeline. Platforms like Vitrina provide the cross-referenced data to confirm if a vendor’s claims of AI capability are backed by successful delivery for major studios or streamers.