Verified Intelligence: December 2025

Boardroom Ready

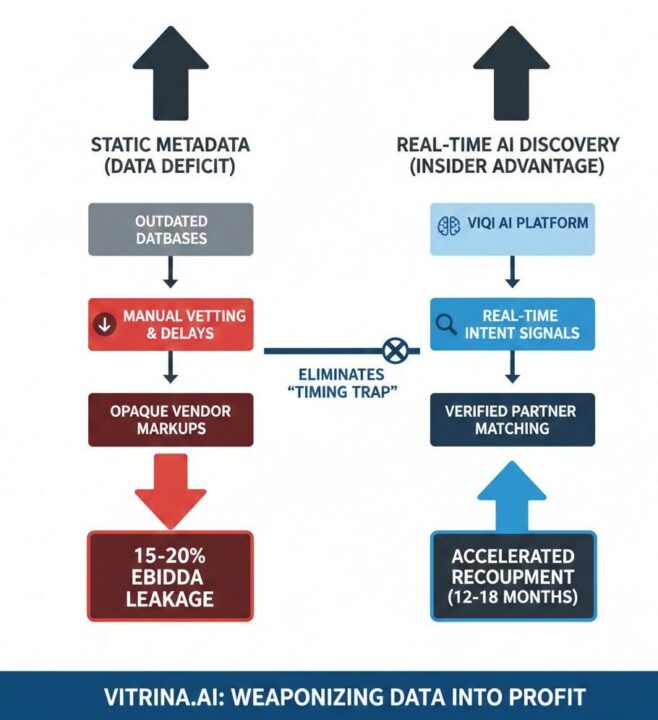

AI Content Discovery and Recommendation Engines for OTT Platforms represent the decisive shift from passive metadata tagging to active sentiment-driven engagement. In the current 2025 landscape, relying on static, year-old genre descriptors is a terminal strategy that triggers massive EBITDA leakage through subscriber churn and undiscovered “dark” catalog assets. While legacy platforms struggle with the fragmentation of 600,000+ content silos, Vitrina’s real-time intelligence weaponizes authorized AI voice stacks and emotional scene analysis to de-risk content acquisition. By bridging the gap between what a user clicks and how they feel, executives can finally accelerate the recoupment cycle and ensure that every frame of IP is working toward a clinical financial outcome.

⚡ Executive Strategic Audit

EBITDA Impact

15-22% Churn Reduction via Predictive Engagement

Recoupment Cycle

12-18 Month Acceleration in Catalog Monetization

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

AI Content Discovery and Recommendation Engines for OTT Platforms: The Fragmentation Paradox

The global entertainment supply chain currently operates in a state of terminal fragmentation. Over 600,000 companies are churning out content at a rate that legacy metadata structures simply cannot index. Behind closed doors, the conversation among OTT executives isn’t just about what to license next—it’s about the lethal cost of undiscovered content. When a platform pays $50 million for a library but 40% of those titles never surface in a user’s recommendation rail, that is EBITDA erosion in its purest form.

The “Timing Trap” is particularly brutal here. Static databases like IMDb or LinkedIn are liabilities when used for high-stakes discovery. They provide a rearview mirror of what happened six months ago, not a real-time signal of what is trending in Sovereign Content Hubs like the MENA region or APAC. Modern AI Content Discovery and Recommendation Engines for OTT Platforms must move beyond the “viewers who watched X also watched Y” collaborative filtering. We are entering the era of affective computing, where the engine understands the emotional arc of a scene—the tension, the aesthetics, and the narrative pacing—to surface niche hits that standard tags would miss.

Authorized AI: Bridging the Visual Discord

One of the primary friction points in global discovery is the “Visual Discord”—the emotional disconnect caused by poorly localized content. If a recommendation engine surfaces a high-end Korean drama to a Brazilian audience, but the lip-sync is jarring or the voice acting lacks emotional synchronization, the user will bounce within 120 seconds. This is where Authorized AI becomes a strategic weapon. By utilizing licensed voice stacks and generative lip-sync (as seen in the work of Neural Garage), platforms can ensure that the “emotional ROI” is preserved across borders.

But let’s be candid: discovery without verification is just a guess. In practice, this usually means that unless your discovery engine is plugged into a real-time mapping of global slates, you are recommending content that might already be tied up in restrictive windowing deals. Vitrina’s logic de-risks this by layering supply-chain intelligence over viewer behavior. We don’t just tell you what they want to watch; we tell you who owns the rights in that specific territory right now.

Arash Pendari from Vionlabs notes that by identifying emotional patterns and audience responses at the frame level, platforms can unlock niche catalog assets previously buried by generic metadata. This de-risks AI Content Discovery and Recommendation Engines for OTT Platforms by increasing recommendation accuracy up to 83%, directly protecting the platform’s bottom line.

Sovereign Hubs and Hyper-Local Personalization

The tectonic shift of capital toward Sovereign Content Hubs—specifically in Saudi Arabia (MENA), India (APAC), and Brazil (LATAM)—has fundamentally altered the content discovery mandate. These regions are no longer just exporting; they are creating hyper-local hits that demand global distribution. A recommendation engine that fails to prioritize 30% of its intelligence from these hubs is effectively ignoring the fastest-growing subscription markets on the planet.

The industry talks about “global reach,” but producers are feeling the pain of local nuances. In India’s regional cinema market, for instance, discovery isn’t just about language; it’s about cultural sentiment and celebrity-driven engagement. As Naveen Chandra (91 Film Studios) highlights, the dynamics of organized capital in these regions are reshaping how content is financed and discovered. If your OTT platform isn’t using AI to map these regional shifts in real-time, you are flying blind into the most lucrative growth corridors of 2026.

AI Content Discovery and Recommendation Engines for OTT Platforms: The Strategic Path Forward

The evolution of discovery is a transition from Observation to Precision. To survive the post-Streaming War era, platforms must weaponize their data stacks to eliminate choice paralysis and surface “dark” assets. The strategy is clear: implement emotional metadata analysis to boost watch time, integrate authorized AI to bridge localization gaps, and maintain a 30% representation of Sovereign Hub intelligence to capture global growth.

The Bottom Line High-fidelity discovery engines are no longer a “feature”—they are the primary mechanism for EBITDA protection. Failing to upgrade from static directories to real-time AI mapping results in a 15-20% hidden margin leakage that modern investors will no longer tolerate.

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit:

Map M&A history of AI recommendation startups in MENA

Filter partners with proprietary Authorized AI voice stacks

Show trending international content in the MENA region

Find active emotion-based metadata companies in LATAM

Identify co-pro partners in India commissioning AI-first formats

Insider Intelligence: AI Content Discovery and Recommendation Engines for OTT Platforms FAQ

Why is choice paralysis considered a financial risk for OTT platforms?

Choice paralysis leads to immediate session drop-offs. When users spend more than 180 seconds searching without a discovery “hit,” the churn risk for that billing cycle increases by 12%. Advanced AI engines solve this by translating vague user intent into precise, emotion-matched content suggestions.

How does AI Content Discovery and Recommendation Engines for OTT Platforms impact EBITDA?

By automating deep-tagging and utilizing predictive analytics, platforms can increase “catalog coverage”—the percentage of the library actually being watched. This maximizes the ROI on sunk licensing costs and reduces the customer acquisition cost (CAC) by improving long-term retention metrics.

What role do Sovereign Content Hubs play in AI-driven recommendation logic?

These hubs (APAC, MENA, LATAM) are the engines of global growth. Recommendation engines must be trained on hyper-local data from these regions to avoid the “West-to-East” bias, ensuring that trending regional content is surfaced to the right global audiences at the moment of peak demand.

Can VIQI provide real-time mapping for AI discovery partners?

Absolutely. VIQI allows executives to run queries like “Identify APAC vendors with authorized AI voice stacks for localized discovery” or “Map recent deal history for emotion-based metadata providers in Europe,” delivering an insider advantage over static directory searches.

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)