Sentiment Index: Gauging Confidence Across the Entertainment Supply Chain

As the global Film & TV industry emerges from a turbulent period marked by strikes and shifting economics, Sohonet and Vitrina surveyed media professionals across the supply chain to gauge current sentiment and near-term expectations. From production houses to post and VFX vendors, the findings reflect a sector in transition—still recalibrating, but showing early signs of revival. This report captures how different segments view their recovery trajectory heading into Q2 2025.

Executive Summary:

- ⅘ of our respondents state that they are less busy than prior to the strikes of 2023.

- Compared to both Q1 2025, and Q2 2024, over 50% of the respondents across our production and post-production focussed categories expect Q2 2025 to be busier.

- The most optimistic are the production-side element, with nearly ⅔ expecting next quarter to be busier than this one.

- The data points to continued gradual recovery in Q2, led by production-side elements.

Section 1: ‘Film+TV Industry Sentiment Survey’ Results

Introduction

As the global Film and Television industry navigates its way out of a prolonged period of disruption—marked by labor strikes, shifting distribution models, and evolving audience behaviors—understanding industry sentiment has never been more critical. To help decode the outlook from within the ecosystem, Sohonet and Vitrina conducted a targeted survey among producers and senior executives across key segments of the entertainment supply-chain.

The objective was to capture a real-time snapshot of how the industry perceives its current business environment relative to the pre-strike ‘normal’, and more importantly, how it forecasts activity levels over the coming quarters.

Through three core questions, we aimed to assess:

- How business today compares to the pre-strike era.

- Expectations for workload and activity in the upcoming quarter (Q2 2025) versus the current quarter (Q1 2025).

- A comparison of anticipated activity in Q2 2025 against the same period last year (Q2 2024).

The insights gathered provide a pulse-check on sentiment, confidence, and recovery trajectory—offering valuable directional signals for strategic planning, resource allocation, and partnership development.

Methodology for ‘Film+TV Industry Sentiment Survey’

This survey was conducted in March 2025 through an online poll distributed to the Vitrina community—an exclusive global network of media professionals within the film and television supply-chain. The survey reached hundreds of targeted respondents via Vitrina’s newsletters and industry digests.

The sample focused mainly on the following groups:

- Service Providers: Post-production, VFX, and Production services

- ProdCos/ Streamers/ Broadcasters: This includes production companies (ProdCos) as well as content platforms such as streamers and broadcasters

The data offers a representative snapshot of current sentiment from active contributors across both content creation and related services.

Please note: While responses were received from a broader range of sectors, this analysis excludes dedicated insights from distributors, localization vendors, sales agents, trade-show organizers, legal/talent service providers, and media technology companies.

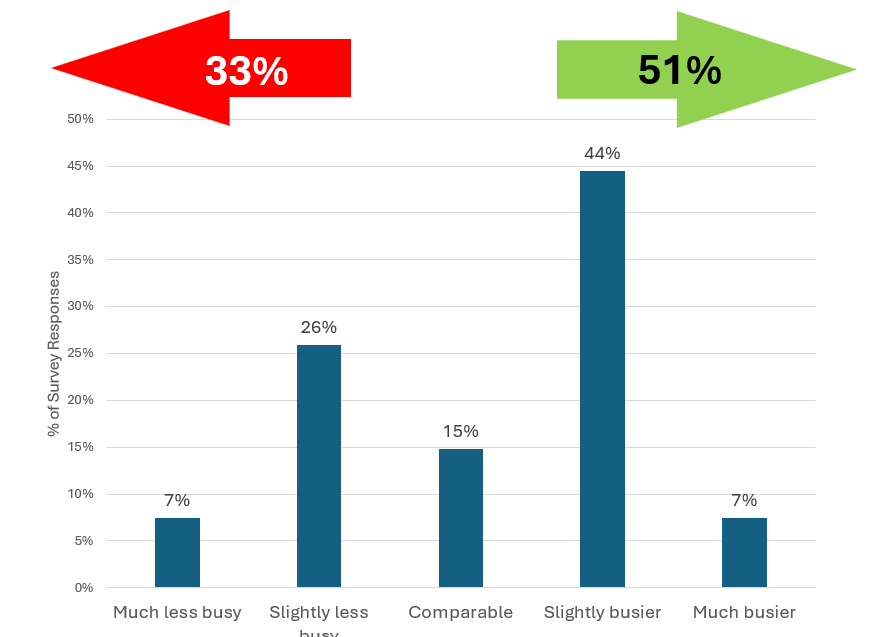

1.1: Post-Production & VFX/ Production Services

How would you describe business now compared to pre-strike ‘normality’?

Compared to this quarter (Q1 2025), how busy do you expect to be next quarter (Q2 2025)?

Compared to Q2 2024, how busy do you expect to be next quarter (Q2 2025)?

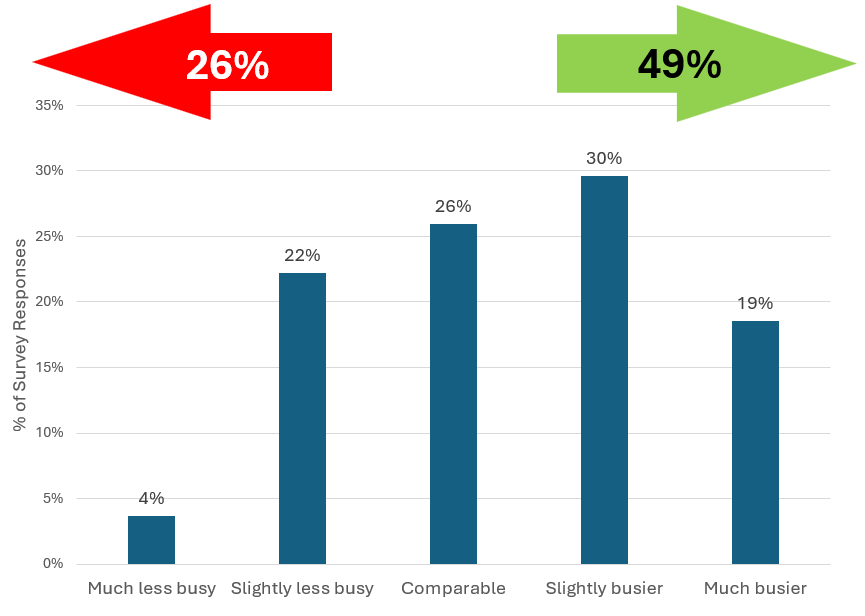

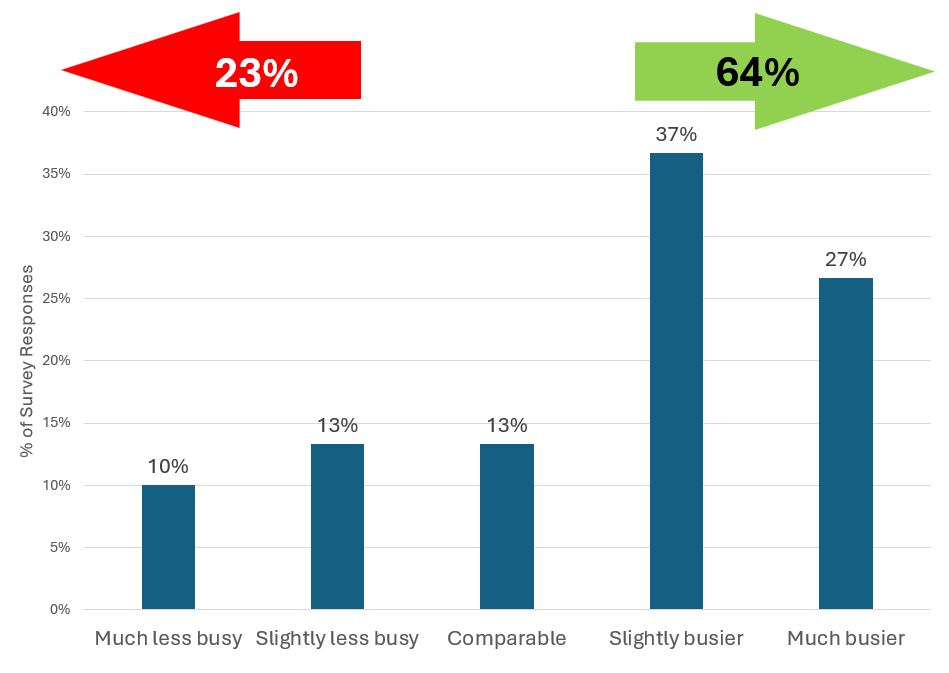

1.2: ProdCos / Streamers /Broadcasters

How would you describe business now compared to pre-strike ‘normality’?

Compared to this quarter (Q1 2025), how busy do you expect to be next quarter (Q2 2025)?

Compared to Q2 2024, how busy do you expect to be next quarter (Q2 2025)?

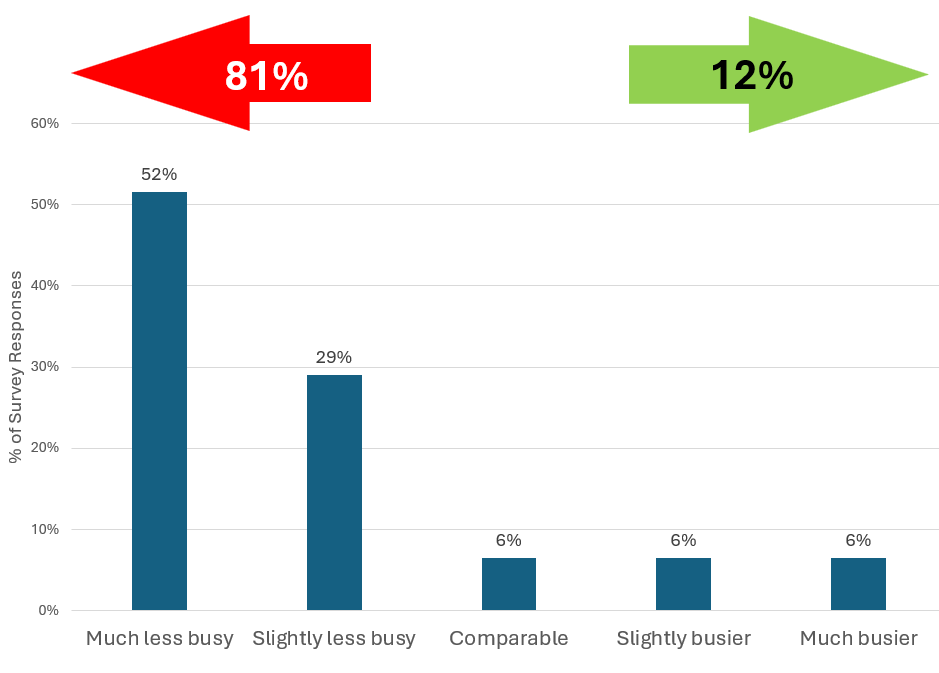

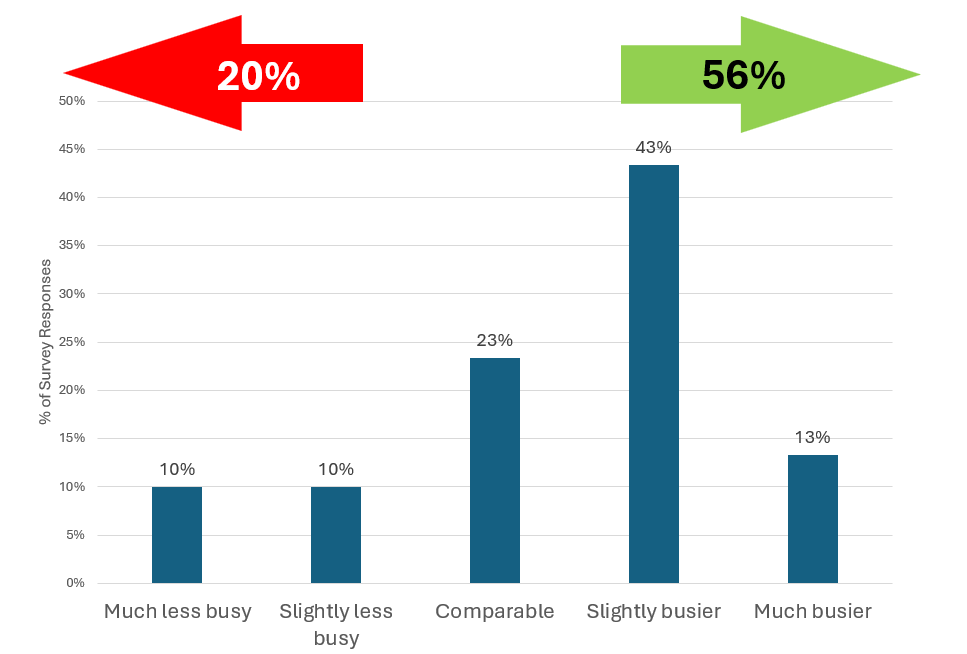

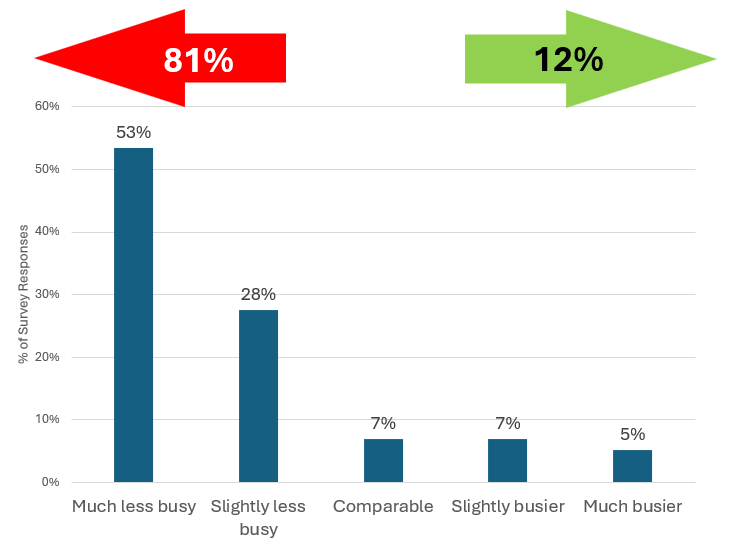

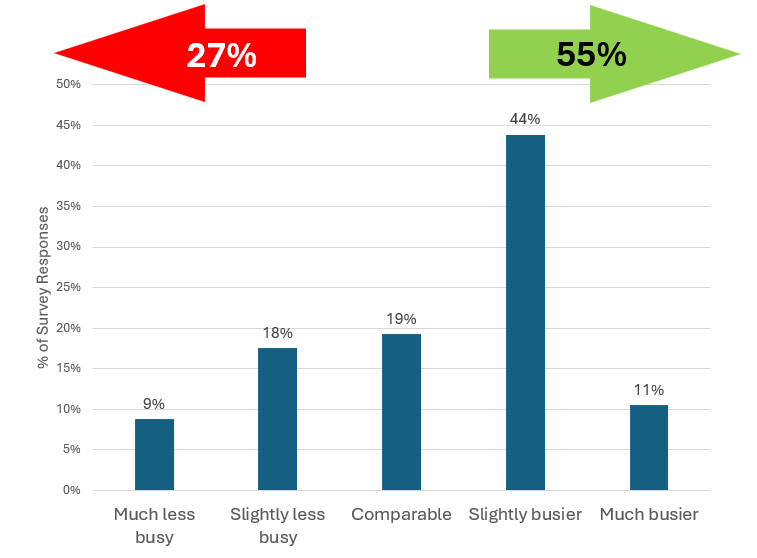

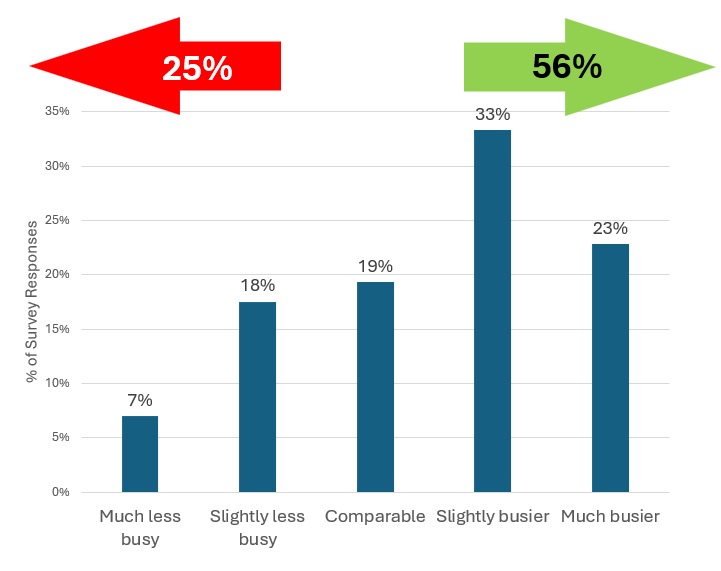

1.3: Overall Respondents

How would you describe business now compared to pre-strike ‘normality’?

Compared to this quarter (Q1 2025), how busy do you expect to be next quarter (Q2 2025)?

Compared to Q2 2024, how busy do you expect to be next quarter (Q2 2025)?

Observations

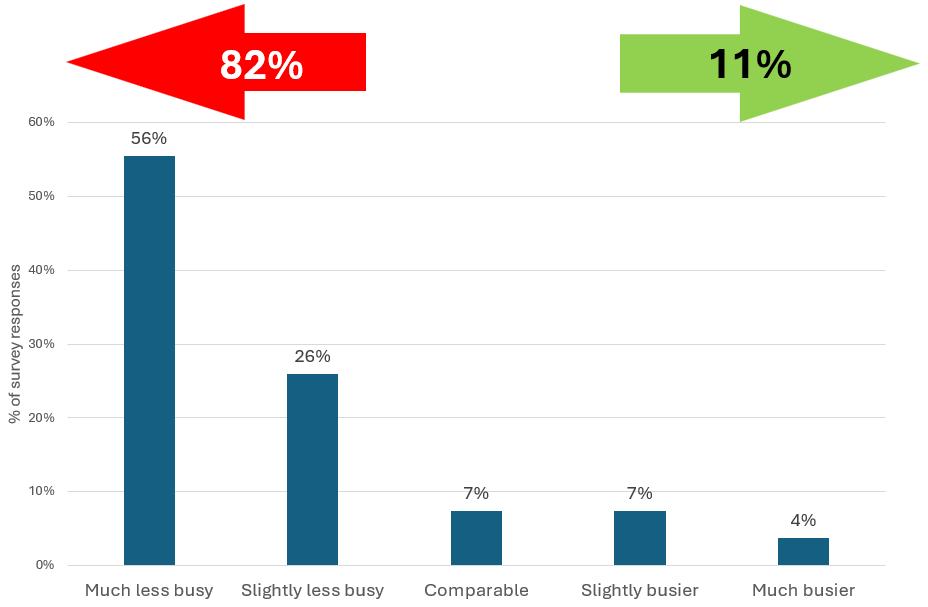

1. Business Today vs. Pre-Strike ‘Normality’

Post-Production / VFX / Production Services:

- 82% report reduced workloads (56% much less busy), confirming ongoing headwinds in the segment.

ProdCos / Streamers / Broadcasters:

- 81% also report reduced activity but show early signs of recovery via restarts and greenlights.

Overall:

- 81% report being less busy than pre-strike (53% much less, 28% slightly less).

Just 12% report increased activity.

2. Near-Term Outlook: Q2 2025 vs. Q1 2025

Post-Production / VFX / Production Services:

- 51% are cautiously optimistic, projecting increased activity—but 33% still anticipate softness.

ProdCos / Streamers / Broadcasters:

- 56% forecast a busier Q2, reflecting increasing commissioning and development activity.

Overall:

55% expect to be busier in Q2 2025, compared to 27% who expect a slowdown.

3. Year-over-Year Outlook: Q2 2025 vs. Q2 2024

Post-Production / VFX / Production Services:

- 49% expect growth year-on-year, though 26% remain uncertain or pessimistic.

ProdCos / Streamers / Broadcasters:

- 64% anticipate a busier Q2 YoY, highlighting renewed confidence in the production cycle.

Overall:

56% expect to be busier than Q2 last year, while 25% expect a decrease.

Summary & Conclusion:

What’s Driving the Sentiment Shift?

The data reveals not just a recovering industry, but one that’s strategically shifting gears in response to the challenges and disruptions of the past year:

- Strike Disruptions Still Echoing: The prolonged labor strikes disrupted development pipelines, halted productions, and pushed out release timelines. Many projects remain behind schedule, and teams are still catching up.

- Cost-Conscious Commissioning: Studios and streamers are adopting a more cautious and ROI-driven approach—greenlighting fewer projects, with sharper focus on pre-buys, co-productions, and regionally strategic formats that lower risk while expanding global appeal.

- Cautious Optimism Among Vendors: While service providers are not yet seeing full project pipelines, they are beginning to prepare for a delayed surge as the upstream development and production activities pick up.

- Content Demand Rebounds: Platforms are reloading slates and preparing for late 2025 and early 2026 releases, driving production companies and broadcasters into more active development and filming cycles.

‘Film+TV Industry Sentiment Survey’ Conclusion: The global entertainment supply chain is progressing toward recovery—but not uniformly.

- Production companies, streamers, and broadcasters are showing increased confidence and activity, as slates reactivate, new budgets are deployed, and international partnerships are pursued. The sharp uptick in Q2 expectations—especially when compared to the same period last year—signals a pivot to proactive content rebuilding.

- In contrast, service vendors—especially in post-production, VFX, and production services—are in a more guarded position. Despite signs of improvement, they continue to face multiple structural and market headwinds:

- A decline in high-budget scripted productions has reduced demand for complex post-production and high-end VFX.

- The rise of automation and AI tools is rapidly transforming traditional workflows, compressing margins, and displacing human-driven tasks such as clean-up, rotoscoping, and localization.

- The shift toward unscripted and fast-turnaround formats, initially driven by strike-related constraints, has lowered the technical sophistication of many projects—further impacting demand for post-intensive services.

Together, these dynamics have led to a more muted and cautious sentiment among vendors compared to production-side stakeholders. They are watching the rebound closely, but understand that their recovery will trail behind the initial wave of greenlights and development activity.

As Q2 2025 unfolds, the industry appears to be transitioning from reactive adaptation to proactive rebuilding. There is no universal pace of recovery—but clear signs that the market is rebalancing and redefining what the next era of global content production will look like.

Section 2: Sohonet Quarterly Budget and Principal Photography Analysis

Sohonet Methodology

- Sohonet conducts ongoing data aggregation from a number of industry and public sources to understand the number and size of productions in the market. In particular, we look at the date of principal photography as the marker for a production beginning in earnest, and assign budget values to each production to estimate size.This analysis is limited to the US/UK/Canada and scripted, live-action productions only. Only productions that can be associated with a studio or an established production company are included.A shorthand of XS-XL production budget sizes has been used. These represent the following buckets: (XL > $100m, L > $35m, M > $10m, S > $1m, XS < $1m)Where publicly available, listed production budgets are used. Otherwise, a peer-reviewed algorithmic approach is taken assigning budgets based on known productions with similar features.

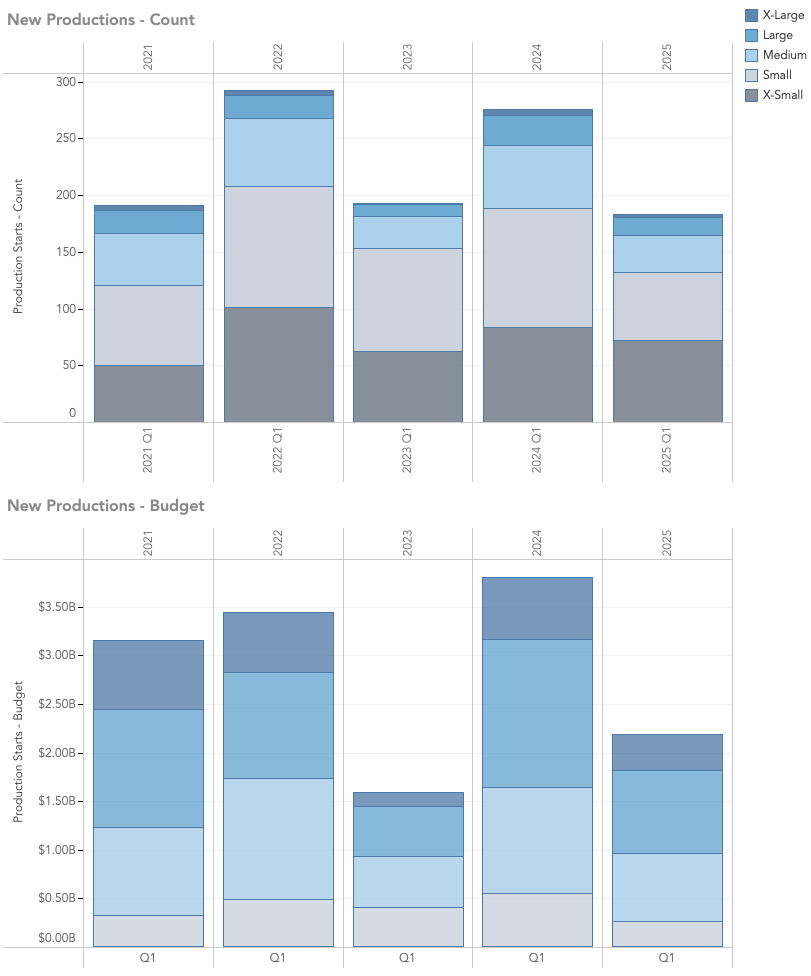

Q1 2025 – Productions By Budget Size

The charts below show productions entering principal photography in Q1 from 2021 through to 2025. The data is shown by count and by aggregate budget, with productions of different sizes segmented by colour.

- Production starts in Q1 2025 were level with those in Q1s 2021 and 2024. They were roughly ⅓ down on starts in 2024.

- Measured in terms of the aggregate budget of productions, Q1 2025 starts were down 42% against Q1 2024, and up 38% against Q1 2023.

- Q1 is conventionally a relatively quiet quarter, as production slowly ramps back up after the holiday season.

- In 2023, the industry was bracing for a potential writers’ strike amid a glut of content resulting from the ‘peak TV’ years of 2021 and 2022. This engendered some caution in commissioning, evident in the low aggregate budget.

- By contrast in 2024, a swathe of projects went into production that had been greenlit over the previous months but were waiting for the end of strike disruption and a production schedule undisturbed by the end of year holiday season. This was followed by a marked slowdown in subsequent quarters.

- In 2025, we see a more cautious approach. Production budgets are down (although not by as much as in the ultra-cautious 2023) as studios slowly ramp up their schedules. There is steady month-on-month growth from January to March, implying a more traditional pattern of seasonal production growth than the atypical years of 2023 and 2024.

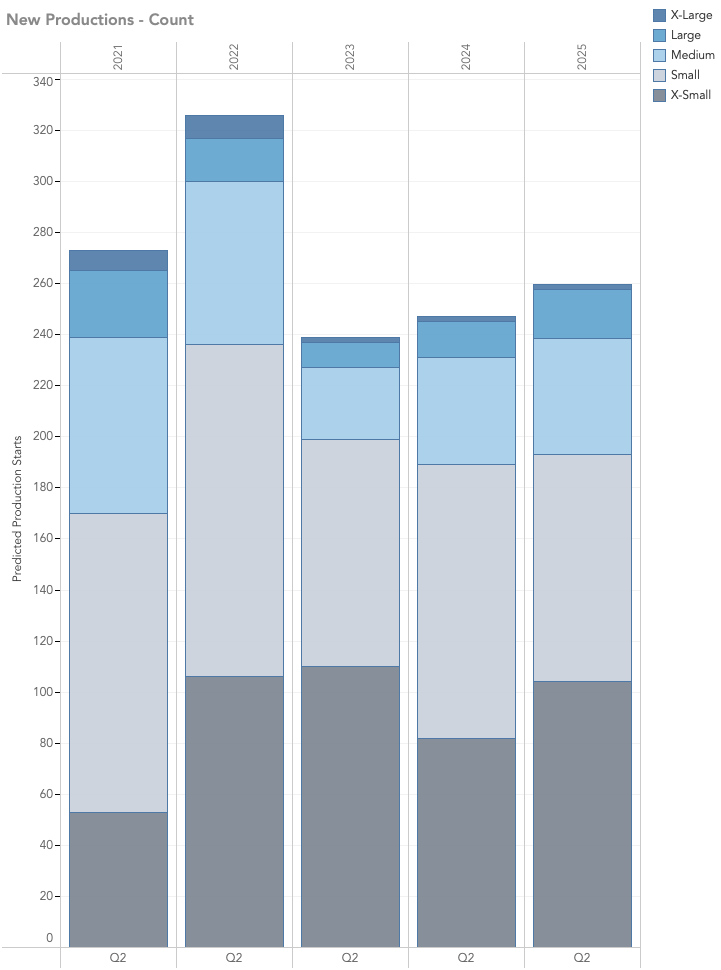

Q2 2025 – Productions By Count

The charts below show productions entering principal photography in Q1 from 2021 through to 2025. The data is shown by count and by aggregate budget, with productions of different sizes segmented by colour.

- Q2 2025 production starts are forecasted to be 8% higher than those of Q2 of 2023, and 5% higher than those of Q2 of 2024.

- Q2 2025 production starts are forecasted to be 20% lower than those of Q2 2022.

- To arrive at this prediction, we have combined data on announced dates of future production starts, historic data on patterns of growth over a calendar year, and historic data on rates of completeness for production start data at different points in time.

- It is likely that production starts will grow month-on-month through to the end of Q2 2025, although by the end of Q2 they will not be much higher than in March.

- This reflects the continued cautiousness of studios in the current market.

- In terms of mix, we have seen an increase in announcements for high-budget features that points to an advantageous mix of budgets compared to 2023 and the latter half of 2024, but not close to the peak levels of 2022.

- We would anticipate a peak in production activity this year in July-October, before a ramp-down into the holiday season. Overall we are currently forecasting this year to be 20%-25% down on production starts compared to 2022.

Section 3: Forward Looking Statements

Beyond gauging growth sentiment through our industry poll (Section 1) followed by our projections on Original Production Volumes (Section 2), and our Quarterly Budget and Principal Photography Analysis (Section 3), this last section zooms in on the words of leadership — the forward-looking statements made by key executives across major entertainment groups.We’ve curated select remarks that offer more than optimism — these are strategic signals. Whether it’s investment in IP, a shift from TV to theatrical, or global partnership plays, these quotes reveal the next moves from some of the most powerful corporations shaping our industry’s future.

Netflix: Ambitious Slate; Investments in Hit Titles, Regional Focus

- “Our 2025 slate is another ambitious step, showcasing scale and ambition, reflecting our steady cadence of programming.” — Ted Sarandos, Co-CEO

- “A steady drumbeat of hit titles from around the world reflects our decade-plus investment in creative communities.” — Greg Peters, Co-CEO

- “We’re pleased that we’ve reaccelerated our growth… by improving our core series and film offering while investing in new growth initiatives like ads and gaming.” – Ted Sarandos, Co-CEO.

- “Our revenue growth rate in APAC (+19% year over year) led all regions, driven by strong local content slates in Japan, Korea, Thailand, and India.”

- “Latam memberships are growing nicely… Incredible slate upcoming — Senna from Brazil, A Hundred Years of Solitude from Colombia, and Pedro Páramo from Mexico.” — Ted Sarandos, Co-CEO

Paramount Global: Strategic Bets: Content, Sports, Ads

- “We will continue to invest in the growth levers that are the key to the future, including content, streaming, and advertising.”

- “Sports, including the return of the NFL and UEFA, originals like Tulsa King, and post-theatrical releases such as A Quiet Place: Day One and IF, all drove acquisition in the quarter.”

Comcast (NBCUniversal/Peacock): Growth Drivers: Peacock, Studios, Olympics

- “We are focused on driving our growth businesses, including the investment in Peacock and our studios.”

- “NBC’s #1 ranking for the 2023-2024 season was fueled by the Paris Olympics, which generated a record-high $1.9 billion of incremental media revenue.”

- “Paris Olympics… generated a record-high $1.9 billion of incremental media revenue.”

Vivendi: Expanding Footprint with Originals & Investments

- “Canal+ remains committed to investing in premium content to sustain its leadership in the pay-TV and streaming markets.”

- “Studiocanal will expand its original production portfolio to cater to both local and international markets.”

- “Canal+ increased its stakes in Viaplay and Viu, thereby strengthening its international positions.”

- “Revenues from international operations increased by 5.8% year-on-year… due to continued growth in the subscriber base, particularly in Africa.”

Banijay: Targeted Expansion via New Labels & Acquisitions

- “We continue to see strong momentum with streamers, particularly as demand remains strong for scripted quality shows and increases for non-scripted content.”

- “In Q3 2024 we launched two new labels BD4 and Navybee to meet the growing demand for talent-led premium documentaries.”

- “In September 2024, the Group acquired Procidis to expand its kids and family offering… This acquisition marks its first move in edutainment.”

- “Acquired 51% of GloNation… focused on scripted content that highlights Latin American heritage.”

BBC: Championing UK Stories

- “We will invest in an unparalleled range of storytelling from every part of the UK.”

- “Today, the BBC invests far more in original British content than anyone else. No one does more to champion new talent from every corner of the country.”

- “More than 60% of our TV production will be outside London by 2026.”

- “BBC Studios took full ownership of BritBox International and achieved sales of £1.8 billion…”

- “We launched The Whoniverse… letting fans watch over 800 episodes of Doctor Who content all in one place.”

CJ ENM: Scaling Up: Tentpoles, Co-Productions, Global Reach

-

- “Establish JV with Major Cineplex Group… building up know-hows and experience on local content production.”

- “Fortify original & exclusive content across all genres: drama series, variety, music show, film, documentary.”

- “Expand including co-production such as Grandpas over Flowers and production support satellite TV such as happy invitation in China.”

- “To develop a strong presence in the global media market… tvN + Global OTT prebuys, Global OTT original series.”

- “Scaling up a worldwide production and distribution capability… including drama series Severance S2, Queen of Tears, Golden Boy, and Tokyo Vice S2.”

- “4Q24: Aim to enhance viewership with titles such as Jeongnyeon and refine the 2025 lineup portfolio.”

- Studio Dragon:”Tentpoles targeting W2bn+ per episode for premium productions.”

Afterword

As we navigate forward into Q2 2025, the sentiment across the film and TV production ecosystem suggests cautious optimism blended with strategic recalibration. Productions are leading the charge in recovery, demonstrating renewed confidence and a willingness to proactively rebuild content slates. This resurgence signals confidence, but it also comes with a clear message: adaptability and strategic intent are now core to how we move forward.

Vendors and service providers, meanwhile, are experiencing a slower rebound. Structural shifts and evolving buyer behaviors continue to pose challenges. And by the nature of the ecosystem, services often follow the lead of production—with opportunities typically emerging a quarter or more later.

The industry’s trajectory is no longer defined solely by recovery but by thoughtful transformation—embracing streamlined operations, strategic partnerships, and innovative content strategies. At Sohonet and Vitrina, we remain committed to providing clarity and actionable insights, helping our industry peers effectively chart the course through these dynamic and transformative times.

Chuck Parker, CEO, Sohonet

Atul Phadnis, CEO, Vitrina AI

Sohonet: Connecting Storytellers

Sohonet is a leading global provider of remote collaboration, asset management, network connectivity and production services, tailored specifically for the media and entertainment industry.

With decades of experience, Sohonet has built a reputation for delivering reliable, high-performance solutions with world-class managed service, connecting storytellers with cutting-edge technologies to enable exceptional collaboration and user experiences.

Vitrina AI: Intelligence for the Global Entertainment Supply Chain

Vitrina AI is the intelligence layer powering smarter decisions across the global Film and TV ecosystem. From identifying emerging production hubs and tracking global projects in real time, to surfacing the right partners, vendors, and content opportunities—Vitrina connects the dots across 100+ countries and every stage of the supply chain. With daily updated data, verified decision-maker insights, and powerful discovery tools, Vitrina AI helps leaders stay ahead of market shifts, de-risk their choices, and unlock high-value collaborations with unmatched precision.

At the heart of Vitrina’s solution is its flagship Global Film+TV Projects Tracker—the industry’s most comprehensive system for monitoring every film and series in development, production, post, or release worldwide. Mapped to collaborators, financiers, commissioners, production partners, and key decision-makers, this daily tracker delivers real-time visibility, competitive intelligence, and lead generation across content, service, and distribution landscapes.