| Strategic Pillar | Executive Insight |

|---|---|

| The 35% Maximum Rebate | A discretionary cash rebate that covers up to 35% of qualified expenditures, including local goods, services, and resident labor. |

| The $250k Qualification Floor | Productions must demonstrate a minimum of $250,000 in direct taxable spend within the District to activate the fund. |

| Residency & Labor Tiers | The rebate is tiered: 35% for DC resident labor, 21% for qualified goods/services, and 10% for certain infrastructure spends. |

| Vitrina Relevance | Identify the verified DC-based service companies that maintain a high percentage of local residents to maximize the 35% tier. |

Table of Content

The Rebate Architecture: Understanding the 35% Tiered Structure

The Washington DC Production Rebates program is not a flat subsidy. It is a strategically tiered cash rebate designed to stimulate the local economy rather than just subsidizing visiting crews. According to data from OCTFME, the program is divided into three distinct buckets of eligibility.

The 35% Tier is reserved exclusively for the taxable wages of District residents. This is the “gold standard” of the fund, intended to grow the local craft base. For productions that heavily utilize DC-based department heads and technical crews, the ROI on labor is unmatched in the Northeast corridor.

The 21% Tier applies to qualified goods and services purchased from District-based vendors. This includes equipment rentals, catering, transportation, and hotel stays, provided the vendor has a physical “brick and mortar” presence within DC. The 10% Tier is reserved for qualified infrastructure investments, which are often utilized by long-term episodic productions that require permanent studio space or localized post-production facilities.

Qualification Mandates: The $250,000 Spend Threshold

The barrier to entry for the DC fund is a $250,000 minimum spend. While this floor is lower than the millions required in states like New York or Georgia, it must be “Direct Spend” within the District’s borders. For productions shooting a “split” schedule between Virginia, Maryland, and DC, the accounting must be meticulously siloed.

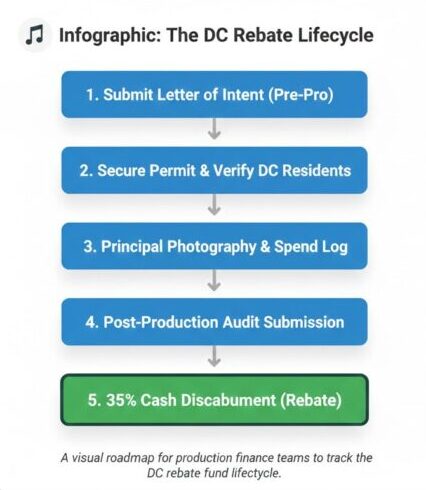

According to industry reports from KFTV, the DC rebate is “First-Come, First-Served” based on the fiscal year’s allocation. This means that timing the application is as critical as the shoot itself. A production must submit a formal “Letter of Intent” before principal photography begins. If the budget is not finalized or if the spend is speculative, the OCTFME may deny the initial application, as the fund requires a high degree of capital certainty.

The Qualified Production Expenditure (QPE) excludes any payments to individuals who are not District residents if those payments are for services performed outside of DC. This reinforces the need for a local production service partner who can verify the residency status of every BTL (Below-The-Line) hire before the audit phase.

Residency Logic: Maximizing the Resident Labor Multiplier

The 35% rebate on resident labor is the District’s most powerful tool for workforce development. However, proving residency in a city where the metropolitan area spans three different jurisdictions (DC, Maryland, Virginia) is a significant administrative hurdle.

To qualify a crew member for the 35% tier, they must provide a valid DC driver’s license or a certified voter registration card. In the 2024–2025 production cycle, the OCTFME has intensified its scrutiny of “dual-residency” claims. If a crew member maintains a residence in Virginia but uses a DC address for tax purposes, the 35% rebate may be clawed back during the final audit.

The strategic play for executives is to prioritize SIRECINE-equivalent (local registry) vendors who have a pre-vetted list of DC residents. By front-loading the crew with residents, a project can effectively lower its net labor cost by over one-third, allowing for the reallocation of funds into “Above-The-Line” talent or higher-end post-production.

Beyond the Monuments: DC Permitting and Logistical Strategy

Permitting in Washington, DC, is notoriously complex due to the jurisdictional overlap between the Metropolitan Police Department (MPD), the National Park Service (NPS), and the Secret Service. The Washington DC Production Rebates are only one part of the equation; the “Permit Strategy” is the other.

While filming on the National Mall is managed by the NPS and is generally not eligible for the DC rebate (as it is federal land), shooting in the city’s vibrant neighborhoods like Adams Morgan, Capitol Hill (the residential side), and the Wharf is fully eligible. The OCTFME operates as a “Single-Window” for city-owned properties, but projects requiring street closures in high-security zones must begin the permitting process at least 15–20 business days in advance.

According to the DC Film Commission, the city is aggressively promoting its “Film-Friendly” status in non-traditional zones to reduce the congestion on the Mall. Productions that diversify their locations across the eight wards often find more administrative flexibility and faster permit approvals, which directly impacts the “Burn Rate” of the production budget.

Vitrina Execution: Sourcing Vetted DC Partners

Qualifying for the 35% fund is a data-driven exercise. Vitrina de-risks the DC greenlight by providing the intelligence layer required to find partners who understand the District’s fiscal landscape. Whether you need a local production service company with a high DC-resident crew ratio or a tax accountant who specializes in OCTFME audits, Vitrina’s platform surfaces the verified collaborators you need.

Accelerate with VIQI Intelligence

Strategic Conclusion

The Washington DC Production Rebates have transformed the District from a tactical backdrop into a strategic production hub. The ability to stack a 35% labor rebate with a 21% vendor rebate allows studios to achieve a high degree of capital efficiency in a premium metropolitan market. However, the path to the 35% fund is paved with administrative rigor; failing to verify residency or missing the $250,000 floor can result in a total loss of the incentive.

For production finance leaders, the mandate is clear: move beyond speculative scouting and engage with the District’s local supply chain. By leveraging Vitrina’s real-time project tracking and verified collaborator database, you can ensure that every dollar spent in the District contributes toward a clean, high-yield fiscal exit. The DC greenlight is a play for both creative authenticity and financial ROI.

Strategic FAQ

What is the minimum spend for the Washington DC production rebate?

To qualify for any tier of the rebate fund, a production must spend at least $250,000 in direct, taxable expenditures within the District of Columbia. This spend must be audited and verified before any funds are disbursed.

Does the 35% rebate apply to all cast and crew?

No, the 35% rebate applies exclusively to the taxable wages of documented District of Columbia residents. Non-resident labor typically does not qualify for the rebate, though certain exceptions may apply for long-term infrastructure-based projects.

Can I film on federal land and still get the DC rebate?

Generally, no. Spending on federal land (like the National Mall or the Smithsonian) is not considered spending within the District for the purposes of the rebate, as those areas are under federal jurisdiction. Rebate spend must occur on District-owned or private land.

Is the DC rebate fund a tax credit or a cash rebate?

The Washington DC Production Rebates program is a cash rebate. Unlike a tax credit, which requires tax liability in the District, a cash rebate is a direct payment from the District government to the production entity following a successful audit.