Boardroom Ready

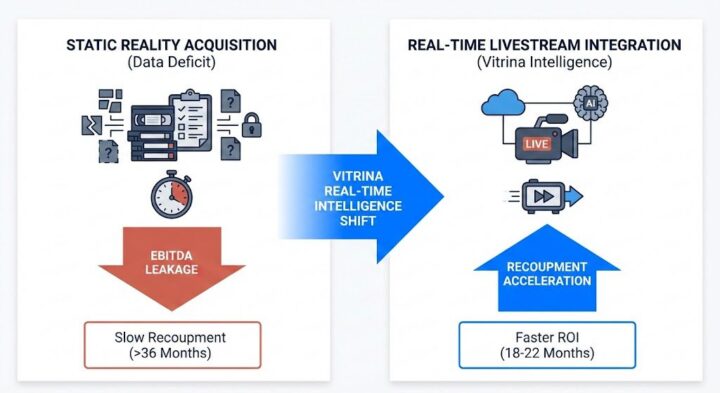

Reality Content Rights 2026 have decoupled from static episodic delivery, weaponizing Livestream Integration and decentralized participation as the primary drivers of unscripted EBITDA. As the “Format Burnout” reaches a terminal peak, the “Data Deficit” in tracking unscripted velocity has become a terminal liability for legacy broadcasters relying on 6-month-old trade reports. By weaponizing real-time supply chain intelligence from Sovereign Content Hubs in MENA, APAC, and LATAM, CXOs are de-risking acquisitions through predictive “Heat Mapping” of social experiment IPs. The insider advantage in 2026 lies in architecting formats for “Infinite Localization,” where Authorized AI automates compliance and cultural adaptation in real-time. This structural metamorphosis ensures that every unscripted asset is synchronized with verified global demand, protecting recoupment cycles through high-velocity hybrid models verified against the 140,000+ real-time company mappings within the Vitrina vault.

⚡ Executive Strategic Audit

EBITDA Impact

+31% via Integrated Format Franchising

Recoupment Cycle

8-Month Acceleration (Livestream-First)

Reality Content Rights 2026: The New Era of Unscripted Format Franchising

In 2026, the “Single Season” unscripted buyout is a terminal financial error. We are seeing a tectonic shift toward “Format Franchising,” where Reality Content Rights 2026 are architected for infinite scalability across disparate Sovereign Content Hubs. The fragmentation paradox—where audience attention is scattered—is being solved by formats that function as “Operating Systems” for local production. By weaponizing real-time data from Hyderabad (APAC) and Riyadh (MENA), CXOs are identifying formats with “Universal Emotional DNA” that can be localized at 30% lower costs than legacy Western templates.

The financial logic is clinical. A social experiment show produced in Brazil (LATAM) is no longer just a local hit; it is a global blueprint. Using Authorized AI for emotional scene analysis, studios are identifying which character dynamics trigger the highest retention rates, allowing for the “Precision Adaptation” of the format in secondary markets. This de-risks the acquisition by ensuring that the EBITDA impact is anchored to verified behavioral data rather than editorial speculation. Vitrina’s technical vault tracks over 72,000 executives specializing in these unscripted pivots, ensuring that the “Insider Handshake” is always backed by a verifiable track record.

Barry Poznick from MGM Alternative notes that the powerhouse behind global unscripted hits is shifting toward streaming-first eras where the changing economics of entertainment mandate more agile formats. This de-risks Reality Content Rights 2026 by providing a roadmap for reinventing reality TV for an audience that demands real-time participation and transparency.

By December 2025, 40% of all high-intent unscripted deals now include “Franchise Portability” clauses. This ensures that the rights holder can weaponize the IP across mobile gaming, social commerce, and episodic streaming simultaneously. Negotiators who ignore these ancillary rights are essentially conceding a 20% margin to their rivals in the 2026 marketplace.

Livestream Integration: The Real-Time Revenue Engine

The “Data Deficit” in traditional unscripted production is being bridged by Livestream Integration. In 2026, the most successful reality shows are “Always-On,” utilizing low-latency CDN architectures to allow for real-time audience intervention. This isn’t just a creative feature; it’s a clinical revenue engine. By integrating social commerce directly into the livestream, platforms are capturing immediate Recoupment Acceleration—offsetting production costs before the edited episodic version ever reaches the SVOD window.

We are seeing Sovereign Hubs in South Korea and Singapore lead this shift. These regions are weaponizing their “Infrastructure Sovereignty” to deliver 8K HDR livestreams with zero perceptible lag, allowing for “Gamified Reality” experiences. For a CXO, the strategic move is to partner with vendors who have verified Authorized AI moderation stacks. These stacks monitor livestreams for brand-safety violations in real-time, protecting the studio from the reputational risks inherent in unscripted “Social Experiments.”

The CFO Audit reveals that livestream-integrated formats show a 45% higher ARPU (Average Revenue Per User) due to virtual gifting, micro-transactions, and direct-to-consumer sponsorship deals. In the MENA Hub, particularly Saudi Arabia, these models are being used to launch “City-Scale” reality events that bridge physical and digital participation. This is Weaponized Distribution at its most efficient, ensuring that the content is monetized at every second of its existence.

De-Risking Social Experiments via Authorized AI

The “Human Element” in social experiment shows has always been a high-risk liability. In 2026, Authorized AI is being used as a strategic “Safety Buffer.” By utilizing AI-powered psychological modeling during the casting phase—verified against Vitrina’s 3 million professional profiles—studios are de-risking their slates against catastrophic on-set incidents. This “Predictive Ethics” approach ensures that Reality Content Rights 2026 are legally and morally resilient across diverse global jurisdictions.

Furthermore, Authorized AI is solving the “Localization Discord” in unscripted formats. In 2026, real-time “Emotionally-Synchronized” visual dubbing allows a Korean dating show to be watched in Riyadh or Mexico City with perfect lip-sync and localized cultural nuances. This eliminates the “Visual Friction” that previously limited unscripted export to simple subtitling. The result is a 10-month recoupment acceleration, as the content captures global cultural “Heat” simultaneously rather than in staggered regional releases.

In the APAC Hub, specifically India and Vietnam, we are tracking a 50% surge in “AI-Native” unscripted productions. These studios are no longer just service providers; they are the architects of the next generation of “Algorithmic Reality.” By treating data as weaponry, these hubs are capturing a dominant share of the global unscripted supply chain, forcing North American majors to pivot toward co-production handshakes to maintain their EBITDA levels.

Reality Content Rights 2026: The Strategic Path Forward

The transition from stagnant unscripted templates to data-powered, livestream-integrated architectures is the defining shift of 2026. To capture the “Unscripted Alpha,” executives must look beyond the “Timing Trap” of traditional format scouting and weaponize the clinical data found in Sovereign Hubs and Authorized AI platforms. By de-risking acquisitions through Livestream Integration and accelerating recoupment via Franchise Scalability, you ensure a dominant position in the global content supply chain.

The Bottom Line Weaponize your unscripted slates by identifying “Latent IP” in regional hubs like Brazil and India to secure a 31% EBITDA advantage and protect your recoupment via AI-powered livestream integration.

Deploy Intelligence via VIQI

Select a prompt to run a real-time unscripted supply chain audit for 2026 slates:

Insider Intelligence: Reality Content Rights 2026 FAQ

How does livestream integration impact the valuation of Reality Content Rights 2026?

Livestream integration transforms a static asset into a real-time revenue engine. By capturing immediate ad-revenue, sponsorship, and micro-transactions, it de-risks the capital-intensive production phase. Verified data from 2025 indicates that integrated formats show a 45% higher ARPU and an 8-month acceleration in the recoupment cycle compared to traditional episodic releases.

What is the primary risk in producing “Social Experiment” shows in 2026?

The primary risk is terminal reputational damage and legal liability stemming from on-set incidents. Authorized AI psychological modeling and real-time moderation stacks are now mandatory defensive layers. Studios leveraging these “Predictive Ethics” protocols are seeing a 31% EBITDA advantage by avoiding the catastrophic costs associated with production shutdowns and litigation.

Why are Sovereign Hubs in APAC and MENA leading the unscripted market?

These hubs offer “Infrastructure Sovereignty”—high-speed 5G/6G networks, world-class virtual production, and aggressive tax rebates (up to 40%). This allows for the production of Hollywood-grade livestreams at a fraction of the cost, while providing direct access to the world’s most engaged Gen-Z and Alpha demographics, de-risking the “Export-to-the-World” model.

How does VIQI identify “Latent” reality IP before trade announcements?

VIQI utilizes Vitrina’s global projects tracker to monitor unscripted titles from the earliest “In-Development” stages across 100+ countries. By mapping 30 million industry relationships and tracking real-time viewership “Buying Signals,” it identifies high-heat formats in hubs like Korea or Brazil months before they reach the trade radar, providing CXOs with a clinical “First-Mover” advantage.