Deal Overview

Toho Co., Ltd. has established a European headquarters in London under its “Toho Global” banner and simultaneously acquired 100% of Glasgow-based distributor Anime Limited. The transaction folds Anime Limited’s theatrical, home video, and licensing operations in the UK and France into Toho’s direct control. Concurrently, Toho executed a strategic distribution alliance with Plaion Pictures to handle physical logistics and sales in Germany and Italy. This tripartite structure—direct ownership in English/French markets paired with a fulfillment partnership in DACH/Southern Europe—mirrors Toho’s recent North American maneuvers, significantly advancing the formation of a global direct-distribution network.

Parties & Dealmakers

Acquirer: Toho Co., Ltd. (via Toho Global), led by President/CEO Hiro Matsuoka and Toho Global President Koji Ueda. Target: Anime Limited, a boutique distributor known for high-end collector editions and theatrical eventizing. Founder Andrew Partridge retains leadership of the subsidiary. Strategic Partner: Plaion Pictures (formerly Koch Media), executing the pan-European physical logistics.

Direct-to-Consumer European Expansion

Strategic Rationale Toho is systematically dismantling its legacy “licensor” model to capture full margin on its IP. By acquiring Anime Limited, Toho secures immediate, boots-on-the-ground infrastructure in Europe’s two most critical anime markets (UK and France) without the lead time of greenfield hiring. The choice of Anime Limited is precise: the company specializes in “event” theatrical releases and premium physical formats—high-margin segments that align with Toho’s “Godzilla” and prestige anime slate. The alliance with Plaion acknowledges operational reality; avoiding the capital expense of building warehouses in Germany while retaining rights control.

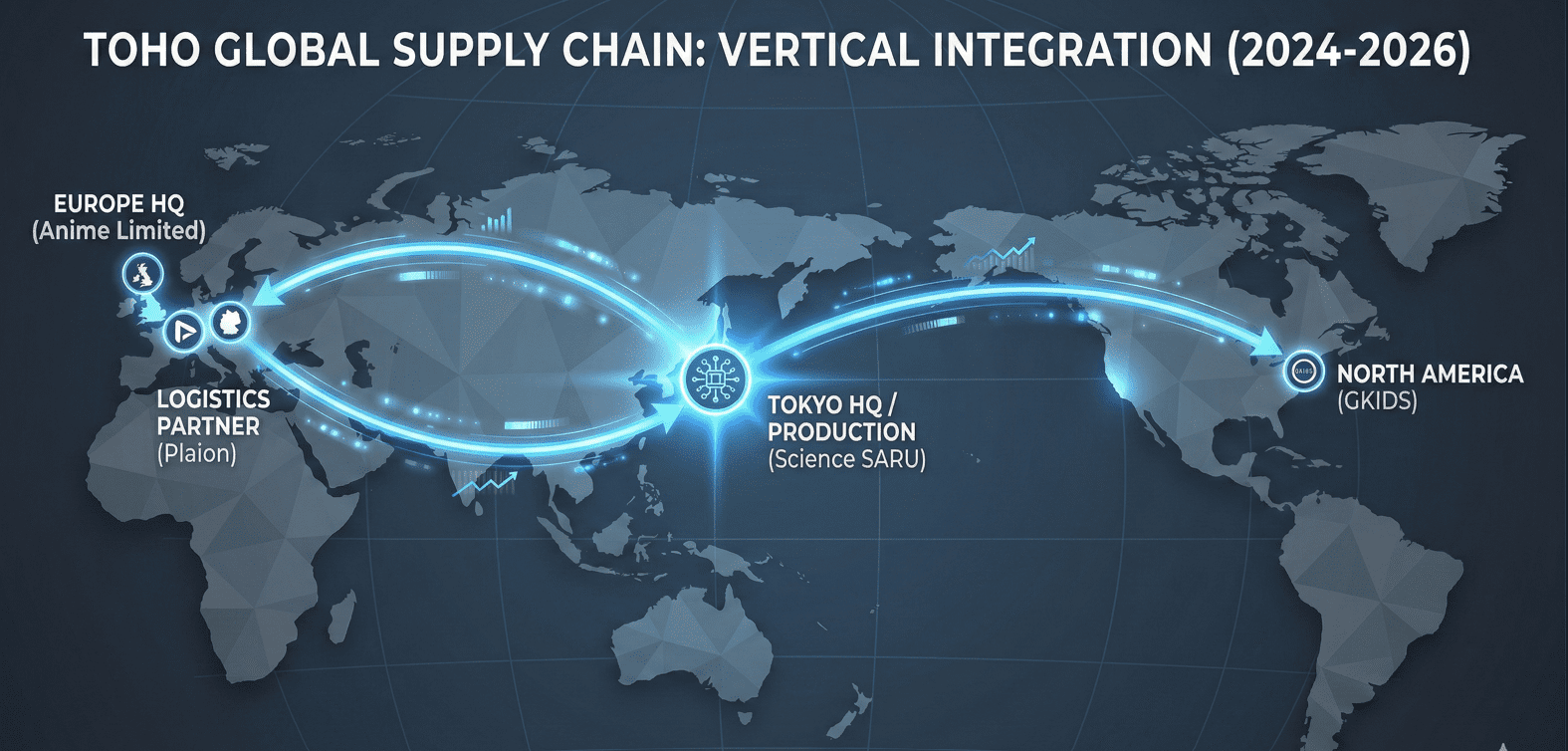

The M&A Roadmap This European expansion is not an isolated event but a continuation of a precise 24-month restructure designed to verticalize the supply chain. The roadmap began in December 2023 with a $225M stake in Fifth Season, securing a foothold in US live-action production. Toho then moved upstream in May 2024 by acquiring Science SARU, locking in high-end production capacity amidst a Japanese labor shortage. The distribution network began to solidify in October 2024 with the acquisition of GKIDS in North America, effectively replacing licensing with direct operations. The current Anime Limited deal (Dec 2025) replicates the GKIDS model in Europe, extending the chain from production (Science SARU) to global delivery (GKIDS/Anime Limited).

Operational Reality Integration carries friction. Anime Limited operates with a boutique, curator mindset that contrasts with Toho’s corporate scale. The challenge lies in scaling Anime Limited’s operations to handle volume without diluting the brand equity that makes them valuable to collectors. Furthermore, Toho must now manage complex localization workflows across French, German, and English simultaneously, a task previously offloaded to local licensees.

Momentum This deal consolidates regional rights and accelerates Toho’s ability to coordinate global day-and-date releases. It signals to legacy partners (like Crunchyroll or local independents) that high-value IP will increasingly be withheld for internal distribution.

Market Context This transaction is the European corollary to Toho’s acquisition of GKIDS (October 2024), effectively replicating that structure across the Atlantic. It also parallels Bandai Namco’s recent aggressive consolidation of its own IP supply chain (e.g., the Eightbit acquisition). Unlike Sony/Crunchyroll, which aggregates third-party content, Toho is building a vertical silo for its owned IP, challenging the platform-centric model.

Supply-Chain Impact

Vendors in the UK and France should anticipate a shift in localization procurement. Toho will likely centralize subtitling and dubbing decisions in Tokyo or London, potentially bypassing smaller regional vendors previously used by sub-licensees. Physical manufacturing for the collector market may see increased volume as Toho leverages Anime Limited’s packaging expertise globally.

Vitrina Perspective

By late 2026, expect Toho to test strict windowing strategies in Europe that favor theatrical and physical holdbacks over immediate streaming availability. This “windowing discipline” is designed to retrain audiences to pay premium prices before content hits SVOD. As Toho reclaims rights, regional licensing fees for platforms like Crunchyroll or Netflix will likely rise, or specific tier-1 titles (e.g., Jujutsu Kaisen or Godzilla spinoffs) will be withheld entirely from blanket output deals in favor of transactional models. The industry often overestimates the “Netflix effect” (reach) and underestimates the “Otaku effect” (ARPU). Toho is betting that 100,000 fans buying a £60 collector’s box is better business than millions of passive streams. They are likely right.

Tokyo, Japan

Tokyo, Japan