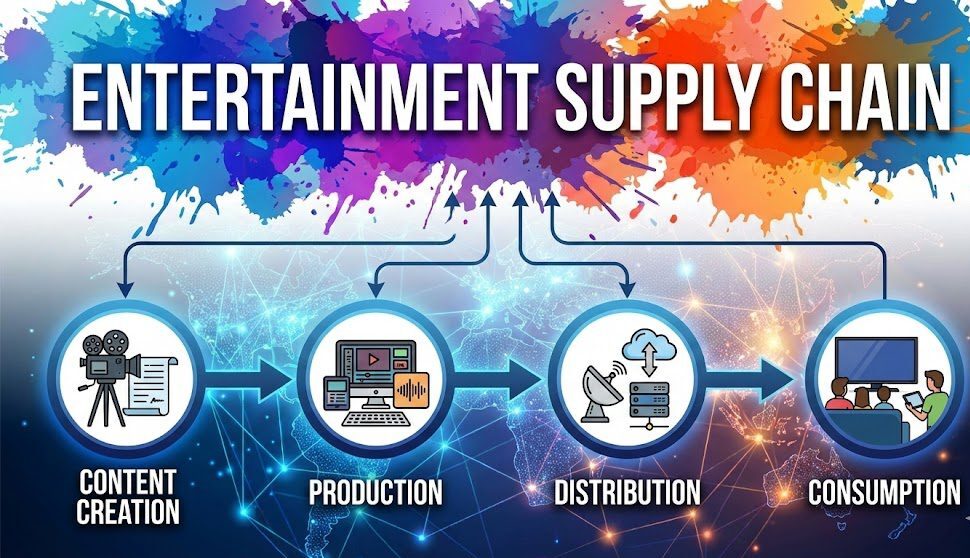

Content licensing platforms are centralized digital marketplaces and intelligence hubs that facilitate the legal transfer of rights between creators (licensors) and distributors (licensees).

These platforms function as the connective tissue of the global media supply chain, enabling buyers to discover, evaluate, and acquire rights for films, TV series, and digital assets.

According to recent industry data, the global content licensing market is projected to reach $800 billion by 2032 as platforms shift from “walled gardens” to strategic third-party licensing models.

In this guide, you will learn how to navigate emerging platform trends, mitigate legal risks during rights acquisition, and utilize supply chain intelligence to identify high-potential titles before they hit the open market.

Legacy sourcing methods—relying on manual spreadsheets and personal networks—are structurally incapable of handling the 600,000+ companies and 1.6M titles currently active in the global ecosystem.

This comprehensive analysis fills critical gaps by providing a step-by-step framework for platform selection and addressing the legal complexities of cross-border deals.

Table of Contents

Key Takeaways for Acquisition Leads

-

Data Prevents Dead-Ends: High-volume intelligence platforms eliminate the 4-6 week lag in verifying rights availability, allowing buyers to qualify leads in minutes.

-

Legal Chain Mastery: Transparent platforms provide verified “chain of title” data, reducing the risk of copyright disputes that can halt distribution indefinitely.

-

Precision Targeting: Successful teams use AI-powered answers to query specific genre appetites and territorial gaps, ensuring a 20%+ higher response rate from licensors.

What are Content Licensing Platforms and How Do They Function?

Content licensing platforms are the modern solution to the “fragmentation paradox” in entertainment. While global production is more connected than ever, the data required to navigate it remains siloed within personal networks and trade show catalogs.

These platforms function as dynamic databases that track unreleased projects, company spécialisations, and verified contact lists for 5 million industry professionals. By acting as a single source of truth, they replace anecdotal information with structured, real-time intelligence on which titles are entering development and which rights are available in specific territories.

Find which platforms are acquiring content in your key markets:

Why Do Acquisition Leads Use Data-Driven Platforms?

In today’s “austerity era,” major streamers like Netflix and Disney are moving away from total exclusivity toward a “Weaponized Distribution” model. This shift makes content licensing the industry’s new gold standard for financial flexibility.

Acquisition leads leverage these platforms to gain an “insider advantage” formerly held only by elite Hollywood agents. By tracking 140,000+ companies globally, teams can find regional hits—like Squid Game or Money Heist—long before they become international phenomena. This predictive capability allows for better allocation of acquisition budgets and ensures a steady pipeline of diverse content.

Industry Expert Perspective: Radial Entertainment: Forging a Content Distribution Giant

Garson Foos, CEO of Radial Entertainment, discusses how the merger of Shout! Studios and FilmRise creates a powerhouse in film and TV distribution, highlighting the strategic necessity of diverse content libraries in today’s multi-platform market.

Garson Foos discusses the merger, the diverse content libraries of both companies, and the vision for the new entity, illustrating how scaled distribution platforms combine the best of both worlds in film and TV to meet shifting consumer demands.

How to Choose the Right Content Licensing Platform for Your Needs

Selecting a partner is a high-stakes decision that impacts your catalog’s health and ROI. Beginners often fall into the trap of using generic databases that lack verified specialization data.

- Verify Catalog Strength: Look for platforms that categorize by sub-genre, budget range, and territorial history rather than just listing titles.

- Assess Adaptability: Ensure the platform tracks emerging distribution models like FAST (Free Ad-Supported TV) and niche regional streamers.

- Evaluate Deal Intelligence: The best platforms provide insights into “money movement”—which territories are seeing the most active funding and acquisition.

Mitigating Legal Risks: Copyright and Rights Management

The most common failure in content licensing is inadequate “due diligence” on the chain of title. Without a “single source of truth,” buyers are exposed to significant financial and reputational risks.

Advanced licensing platforms solve this by providing deep, verified profiles of 140,000+ companies. Users can qualify partners based on verifiable track records and reputation scores, ensuring that the licensor actually holds the rights they are selling. This systematic approach transforms partner vetting from a subjective art into an objective, data-backed science.

Case Study: SBT Brazil Accelerates Content Acquisition

SBT Brazil, one of the country’s most iconic television networks, faced the challenge of streamlining the acquisition of high-quality international content for its viewers. Traditional sourcing relied on slow manual outreach and limited regional networks.

By utilizing Vitrina’s custom intelligence solutions, SBT was able to curate a library of acclaimed films and series by identifying emerging distribution companies and tracking upcoming productions in real-time. This data-driven strategy allowed their acquisition team to qualify partners 70% faster, ensuring they remained competitive in Brazil’s rapidly digitizing market.

Moving Forward

The content licensing landscape has shifted from relationship-dependent networking to data-powered strategic intelligence. This evolution addresses the critical “data deficit” that has long left executives vulnerable to missed opportunities and financial risk.

Whether you are an acquisition lead looking to source trending regional content or an independent producer trying to maximize ROI through rotational windows, the principle remains: actionable intelligence drives deal velocity.

Outlook: Over the next 12-18 months, the rise of “Authorized AI” data markets and the continued proliferation of FAST channels will create a massive second window for library content, rewarding those with the best intelligence infrastructure.

Frequently Asked Questions

What is the difference between a licensing company and a distributor?

How do content licensing deals typically work?

What are the biggest legal risks in content licensing?

How can supply chain intelligence help independent filmmakers?

“The industry is transitioning from an opaque, relationship-driven ecosystem to a centralized, data-powered framework. For senior executives, having a ‘single source of truth’ isn’t just a convenience—it’s a structural necessity for mitigating financial risk in a hyper-competitive market.”

About the Author

Vitrina AI’s editorial team specializes in media supply chain transformation and data-driven content strategies. Our analysts track 30 million industry relationships to provide actionable intelligence for global M&E leaders. Connect on Vitrina.