Understanding the Film Finance Waterfall Structure: A Complete Guide to Movie Revenue Distribution

Introduction

For any entertainment executive structuring a deal, the Film Finance Waterfall Structure is the single most critical document.

It is the contractual blueprint that dictates the flow of every dollar a film or television project generates, establishing the order of repayment for lenders, investors, distributors, and finally, talent and producers.

Ignoring the hierarchy defined within this recoupment schedule is the financial equivalent of flying blind—it guarantees a miscalculation of risk and potential return.

Table of content

- The Core Principle: Seniority and the Recoupment Waterfall

- Deconstructing the Traditional Film Finance Waterfall Structure

- The Streaming Shift: Simplification and IP Trade-Offs

- The Executive Imperative: Negotiating Your Waterfall Position

- How Vitrina Helps Finance and Strategy Executives

- Conclusion: The Strategic Imperative

- Frequently Asked Questions

Key Takeaways

| Core Challenge | The complex layering of the traditional recoupment schedule often conceals excessive distribution fees and high-interest debt, making “net profits” functionally non-existent for equity partners. |

| Strategic Solution | Move beyond legacy structures by strategically prioritizing non-recourse soft money and platform advances that simplify the capital stack and provide immediate de-risking. |

| Vitrina’s Role | Vitrina provides the essential deal intelligence to track how specific financiers and distributors have structured their past deals, ensuring you vet partners based on verifiable track records and realistic recoupment history. |

The Core Principle: Seniority and the Recoupment Waterfall

The essence of the Film Finance Waterfall Structure is the principle of seniority: first money in, first money out. Revenues flow sequentially from the top of the waterfall (the distribution revenue pool) to the bottom (the profit participants).

Each tier must be 100% satisfied before a single dollar can flow to the next tier down. This mechanism is primarily designed to mitigate risk for the senior lenders—those who provide the financing to get the project made in the first place.

This process is typically managed by a neutral third party, often a Collection Account Manager (CAMA), who receives all distribution revenues from all territories and allocates funds according to the pre-agreed-upon Collection Account Management Agreement.

The Top Tiers: The First Slice of Gross Revenue

Before any money touches the production’s internal capital stack, a significant portion of the gross receipts is extracted to cover the costs required to physically bring the film to market. These tiers hold the highest seniority:

- Collection Agent Fees: Fees paid to the CAMA for managing the account and administering the payment flow.

- Distribution Expenses: The distributor recoups the costs they incurred to market, advertise, and distribute the film (P&A—Prints and Advertising). This is often a massive, highly debated figure.

- Distribution Fees & Sales Agent Commissions: The distributor takes their commission (often 25-35% of net receipts in the traditional model) and the Sales Agent takes their commission (typically 10-20% of the Minimum Guarantee or license fee) for brokering the deals.

Only after these essential, third-party costs are covered do the remaining funds flow to repay the production’s debt and equity.

Deconstructing the Traditional Film Finance Waterfall Structure

The traditional model—built around pre-sales and territorial distribution—is the most complex and risk-heavy structure for the producer and the equity investors at the bottom. Understanding the order is essential for correctly assessing risk exposure:

- Tier 1: Senior Secured Debt (The Bank): This is the principal loan used to cover the majority of the production budget, typically secured by pre-sale contracts and potentially a completion bond. These lenders require repayment of principal plus interest (often 8-12%) before any other party is paid from the production’s account. Their low risk position is due entirely to this first-in-line priority.

- Tier 2: Gap/Mezzanine Financing: This high-interest loan (often 12-20% interest) covers the ‘gap’ between the Senior Debt and the total production budget. Because it is secured only against the estimated value of the unsold territories, it sits lower in the waterfall and demands a higher return to justify the increased risk.

- Tier 3: Tax Credit & Soft Money Recoupment: Funds derived from government rebates, grants, or tax credits are paid out. While these are often non-recourse (meaning they don’t have to be paid back if the film fails), they must be claimed and then distributed according to local rules.

- Tier 4: Equity Investors (The Risk Capital): The institutional or private money that took the highest risk. They receive their principal back, often with a “preferred return” or premium (e.g., 120-130% of their investment) before any profit split occurs.

- Tier 5: Deferred Payments: This includes payments owed to above-the-line talent (actors, directors) and key crew members who agreed to take a reduced, or deferred, fee during production in exchange for a position in the recoupment schedule.

- Tier 6: Net Profits: The final, and most elusive, tier. Only the revenues remaining after every single tier above it has been fully satisfied are considered “Net Profits.” This is the point where the producer and profit-sharing talent receive their contracted points. The high fees and costs taken at the top tiers mean that even successful films often never reach this tier, a phenomenon famously referred to as “Hollywood accounting.”

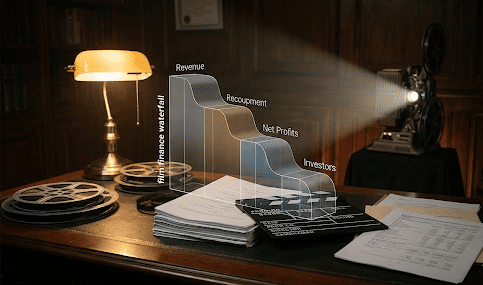

A visual representation of the traditional film finance waterfall, showing the cascading order of repayment from Gross Receipts down to Net Profits.

The Streaming Shift: Simplification and IP Trade-Offs

The emergence of major streaming platforms has introduced a simpler, but fundamentally different, financial model that circumvents much of the traditional Film Finance Waterfall Structure. This modern approach is less about managing sequential debt and more about structuring a single commission.

When a platform fully commissions a project, the capital stack is simplified dramatically:

- Platform Advance/Fee: The streamer pays the full or majority cost of production, plus a producer fee, in exchange for exclusive global distribution rights. This payment structure eliminates the need for Senior Debt, Gap Financing, and international pre-sales.

- Soft Money: Applicable tax incentives or soft money are recouped by the platform or the production company, depending on the structuring agreement.

- Profit Participation (The Exception): The producer or key talent may negotiate a nominal “buy-out” or a small percentage of a highly defined “Net Revenue,” but this is rare.

The Trade-Off: While this offers reduced financial risk and immediate funding certainty, the producer nearly always forfeits all intellectual property (IP) and loses control of the project’s long-term value. This is a critical strategic decision that must be weighed against the potential back-end revenue offered by a riskier, but IP-retaining, traditional structure.

Executives must continuously track which major streamers and distributors are active in commissioning deals versus licensing completed films to maintain a competitive advantage in deal-making. For deeper distribution insight, you can explore current market trends in distribution and licensing.

The Executive Imperative: Negotiating Your Waterfall Position

The difference between a successful investment and a phantom profit is often determined by the negotiated position within the waterfall. For M&E strategy and finance leaders, success relies on three actions:

- Negotiate Against the Distributor’s P&A Cap: The biggest drain on early revenue is the distributor’s recoupment of Prints and Advertising (P&A) costs. Savvy producers negotiate a hard cap or a collaborative approval process on P&A to ensure these expenses don’t endlessly postpone investor recoupment.

- Map All Financial Track Records: Before signing with a financier or distributor, you must assess their history of paying out to lower tiers. The only way to do this effectively is to map their track record across multiple projects and jurisdictions. Do they consistently cross-collateralize? Do their films reliably hit the project tracker with high-value international deals? A strong track record in production intelligence is a prerequisite for a trustworthy partner.

- Prioritize “Above-the-Line” Deferments Strategically: If a deferment is critical (e.g., A-list talent), giving that participant a senior position above equity investors can be the essential lubricant to close the deal, even if it slightly increases the risk profile for the remaining capital.

How Vitrina Helps Finance and Strategy Executives

Navigating the intricacies of the Film Finance Waterfall Structure requires deal-specific and partner-specific intelligence. Vitrina is purpose-built to provide the transparency needed to de-risk these multi-layered capital stacks.

- Partner Vetting via Deal History: We allow executives to instantly search and analyze the complete deal history of over 3 million executives and companies. This lets you verify if a distributor’s reported fees are in line with industry standards or if an equity partner has a history of transparent pay-outs.

- Mapping Co-Production Structures: For projects leveraging soft money and international co-production treaties, Vitrina maps all financial and creative partners, allowing you to understand the complete, integrated revenue structure before committing to a financing model.

- Real-Time Market Benchmarking: By tracking content from development through distribution, Vitrina gives you the market data to benchmark your film’s financial terms against comparable projects in real-time, strengthening your negotiating position at every tier of the waterfall.

Conclusion: The Strategic Imperative

The Film Finance Waterfall Structure is not merely an accounting ledger; it is the ultimate strategic document that defines a project’s financial destiny.

In the current hybrid market, the most successful executives are those who move beyond the constraints of the complex, low-profit traditional waterfall.

They strategically blend de-risked soft money and platform equity, leveraging granular intelligence to vet partners and negotiate favorable positions, thus ensuring that profit is a reality for their investors, not a hypothetical entry at the bottom of the column.

Frequently Asked Questions

A Minimum Guarantee is a cash advance paid by a distributor to a production company in exchange for exclusive rights to distribute the film in a specific territory. The distributor recoups the MG, sometimes with interest, from the gross receipts before paying any overages to the producer.

Net Profits are only paid out after all prior tiers—including distribution fees (which can be 25-35%), P&A expenses, Senior Debt, Gap Financing, and Equity Premiums—have been fully recouped. The high cost and complexity of these deductions often mean the balance never reaches the Net Profit tier.

The CAMA is a neutral third party, usually a bank or specialty firm, that receives all revenues generated by the film from distributors worldwide. Their role is to administer and distribute these revenues strictly according to the contractually defined Recoupment Waterfall.

Soft Money refers to financing provided in the form of government subsidies, tax credits, grants, and rebates that do not typically require a profit-dependent repayment. It is often used as collateral for Senior Debt but is recouped early in the waterfall, sometimes before equity, as per the rules of the local government incentive program.