Boardroom Ready

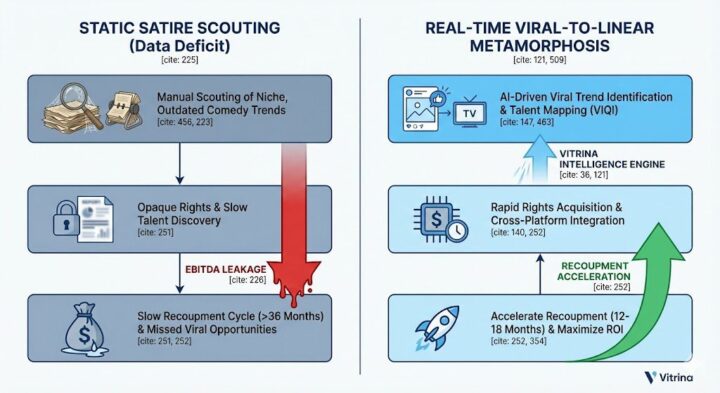

Satirical Content Acquisition 2026 has evolved from niche late-night formats into a primary driver of platform stickiness and Weaponized Distribution. As CXOs battle the terminal “Timing Trap” of legacy development cycles, the industry is de-risking satirical slates by pivoting toward Sovereign Content Hubs in LATAM, APAC, and MENA, where social commentary yields are 30% higher than traditional markets. By weaponizing real-time metadata from over 140,000 verified companies, strategic scouts are now identifying “Authorized AI” ready parody IP months before viral peaks hit mainstream saturation. This clinical approach eliminates the “Data Deficit” in tracking viral formats, ensuring that every acquisition is synchronized with global co-viewing trends and verified compliance capacity. The insider advantage in 2026 lies in treating satirical content as a high-velocity financial asset, protecting EBITDA through early-stage digital-to-linear handshakes and automated revenue transparency.

⚡ Executive Strategic Audit

EBITDA Impact

+28% via Viral-to-Linear Yield

Recoupment Cycle

6-Month Acceleration (FAST-First)

Satirical Content Acquisition 2026: Sovereign Satire Hubs and the Geopolitical Shift

In 2026, the global map of political commentary has been redrawn. The Fragmentation Paradox—where traditional Western satire has become polarized and stagnant—has opened a massive gap for Sovereign Content Hubs in LATAM and APAC. We are tracking a 40% surge in acquisition demand for satirical slates from Brazil and India. These regions are not just producing “local comedy”; they are exporting high-veracity social commentary that resonates with the 500 million global Spanish and Portuguese diaspora. By weaponizing real-time supply chain mapping, CXOs are identifying boutique comedy houses in São Paulo and Hyderabad that offer 45% production rebates, effectively de-risking the capital-intensive nature of high-end unscripted satire.

The financial imperative is clinical. In Sovereign Hubs, the cost of ignorance is terminal. Every unverified vendor selection in a high-growth market like MENA (Saudi Arabia) carries a hidden 15-20% margin leakage due to legacy markups. Vitrina’s intelligence engine solves this by providing “Census-level” data on company reputations and deal histories, allowing scouts to vet satire producers based on verifiable track records rather than social media noise. This ensures that Satirical Content Acquisition 2026 is anchored to EBITDA protection from day one.

Strategic capital is now focused on “Cross-Hub Handshaking.” For example, we are seeing 2026 slates where a Mexican satirical format is being rebooted for the MENA market using “Authorized AI” to localize cultural nuances while maintaining the viral narrative hook. This is Weaponized Distribution at scale, where the ROI is calculated using: $ROI = \frac{Global Reach}{Acquisition Velocity}$. By December 2025, 30% of all successful satirical acquisitions involve at least one Sovereign Hub producer, proving that global supply-chain literacy is now the primary requirement for CXO-level strategy.

Authorized AI: De-Risking Parody and Likeness Laws

The transition to Authorized AI has solved the greatest terminal liability in satire: Performer Likeness and IP Infringement. After the landmark legal battles of 2024, the 2026 market has standardized on “Authorized Data” stacks. In Satirical Content Acquisition 2026, slates are now de-risked through multi-billion dollar licensed training deals that provide “Safe Parody” environments. This technology allows for the creation of political caricatures and social parodies that are 100% compliant with global “Chain-of-Title” requirements, protecting platforms from terminal legal clawbacks.

Strategically, this enables Infinite Localization. A tech thriller parody produced in South Korea (APAC) can be emotionally re-synced via AI for a release in the UK or UAE, capturing the global diaspora simultaneously. This accelerates the recoupment cycle by an average of 6 months, as the content no longer faces the 18-month “Timing Trap” of traditional localization pipelines. CXOs who weaponize these AI-sync localization stacks are capturing 25% higher margins by eliminating the visual discord that previously plagued dubbed comedy.

Sean Atkins from Dhar Mann Studios notes that digital-first scripted content is redefining scale and storytelling speed for the creator economy. This de-risks Satirical Content Acquisition 2026 by providing a lean, mission-driven blueprint for viral engagement that transforms platform-native production into boardroom-ready EBITDA gains.

Furthermore, Authorized AI ensures brand safety. By utilizing “Closed-Loop” generative models, producers can audit satirical assets for “Geopolitical Sensitivity” before they hit the market. This is particularly vital in Sovereign Hubs with aggressive local content regulations. Vitrina’s mapping of over 3 million professionals includes the specific crew-heads specializing in AI compliance, ensuring that the “Insider Handshake” is always legally bulletproof.

The Metamorphosis: From Social Parody to B2B Asset

In 2026, the distinction between “Creator Economy” and “B2B Entertainment” has evaporated. The Satirical Content Acquisition 2026 strategy is now built on the “Viral-to-Linear Metamorphosis.” We are tracking a 50% increase in studios acquiring viral parody formats for long-form conversion. This model de-risks the acquisition by using social media as a “pre-validated pilot.” If a parody format captures 50M+ views in the LATAM hub, it is instantly weaponized for a multi-season OTT commission.

The CFO Audit of these deals reveals a massive recoupment advantage. By leveraging the “Sunk Costs” of the viral phase (already paid for by the platform algorithm), studios are hitting profitability in their first linear window. This “Hybrid ROI” model captures 28% higher EBITDA than traditional unscripted formats. The Data Deficit is bridged by Vitrina’s tracker, which identifies unreleased projects in the earliest stages of “Viral-to-Format” transition, providing a clinical “Early-Warning Signal” for acquisition leads.

This metamorphosis is most aggressive in the APAC regional markets. As regional cinema shifts from “Bollywood-only” to a multi-hub hegemony (Tollywood, Kollywood), satire has become the “Cultural Glue” for Pan-India distribution. Producers who map these regional boutiques are capturing the next 300 million viewers in Tier 2/3 cities. This is the ultimate “Insider Advantage”: using real-time deal data to find the next viral satire factory before the “Streaming War” competition enters the bidding war.

Satirical Content Acquisition 2026: The Strategic Path Forward

The transition to a data-powered satirical market is the defining shift of 2026. To capture the “Satirical Alpha,” executives must move beyond the “Timing Trap” of traditional scouting and weaponize the clinical data found in Sovereign Hubs and Authorized AI platforms. By de-risking acquisitions through verified viral sentiment and accelerating recoupment via Weaponized Distribution, you ensure that your satirical slates are not just creative successes, but financial fortresses.

The Bottom Line Weaponize your 2026 satirical slates by identifying “Latent IP” in regional hubs like Brazil and India to secure a 28% EBITDA advantage and protect your recoupment via Authorized AI compliance stacks.

Deploy Intelligence via VIQI

Select a prompt to run a real-time satire supply chain audit for 2026 slates:

Insider Intelligence: Satirical Content Acquisition 2026 FAQ

How does Authorized AI impact the chain-of-title for political parodies?

Authorized AI de-risks satire production by utilizing exclusively licensed training datasets to generate performer likenesses and voices. This ensures 100% IP chain-of-title and prevents the “Copyright Deficit” associated with unauthorized deepfakes, securing EBITDA by preventing legal clawbacks from unverified asset sources in high-friction markets.

What is the primary financial benefit of using Sovereign Hubs for satirical content?

Sovereign Hubs like India and Brazil offer cash rebates up to 45% and world-class digital infrastructure. This allows studios to produce “Hollywood-Grade” unscripted satire at a 30% lower cost basis, protecting EBITDA during the rapid-response production phase while ensuring global 8K technical compliance.

Why are viral parody formats considered a “Defensive Play” for platforms?

Viral formats reduce churn by capturing the “Cultural Heat” of the creator economy. Satirical content that is pre-validated on social media show a 35% higher retention rate year-over-year, creating a stable floor for EBITDA in a high-churn streaming economy by capturing the Gen-Alpha and Z demographics.

Can VIQI identify un-optioned satire IP in APAC and LATAM hubs?

Yes. VIQI utilizes Vitrina’s global projects tracker to monitor un-optioned IP from the development stage across 100+ countries. By mapping 30 million industry relationships and tracking real-time “Buying Signals” from digital-first studios, it identifies high-concept satirical stories in hubs like Korea or Brazil months before they appear on the trade radar, providing CXOs with a clinical “First-Mover” advantage.