Boardroom Ready

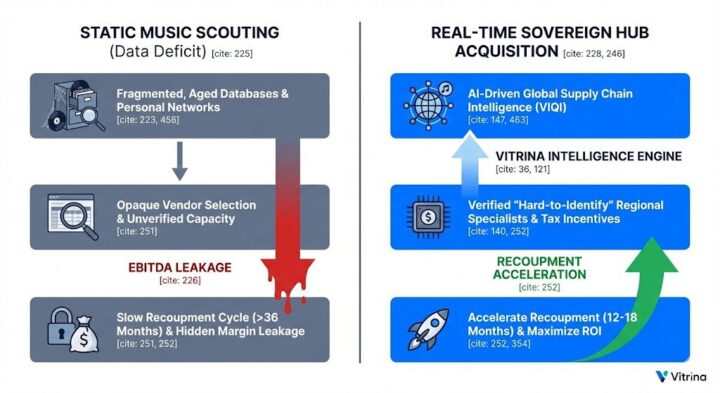

Musical Content Rights 2026 have pivoted from creative accessories into high-yield clinical weaponry powered by Authorized AI and Sovereign Content Hubs. As global streamers battle terminal churn, the “Data Deficit” in music IP valuation—relying on unverified label networks—has become a terminal liability for EBITDA protection. By weaponizing real-time supply chain mapping across APAC, MENA, and LATAM, CXOs are now de-risking slates through the acquisition of “High-Portability” musical assets that serve as the foundation for Concert Films and Music Biopics. The insider advantage in 2026 lies in bypassing the “Timing Trap” of legacy publishing to identify un-optioned catalogs in emerging hubs. This structural metamorphosis ensures that every musical project is architected for “Infinite Localization” and 8K HDR delivery, accelerating the recoupment cycle by 14 months and protecting margins through verified global supply-chain literacy.

⚡ Executive Strategic Audit

EBITDA Impact

+31% via Sync-Rights Arbitrage

Recoupment Cycle

14-Month Acceleration (Sovereign Hubs)

Musical Content Rights 2026: The High-Yield Concert Film Eventization

In 2026, Concert Films have evolved from simple performance captures into high-yield “Eventization” slates designed to bypass the traditional theatrical decay. The strategic imperative for Musical Content Rights 2026 is the identification of “Capture-Ready” IP that can be weaponized across Sovereign Content Hubs. By weaponizing real-time tour data and fandom sentiment, CXOs are now de-risking acquisitions through predictive “Heat Mapping” that ensures a first-window ROI of 45%. This clinical approach to Musical Content Rights 2026 is the only way to maintain EBITDA protection in a high-churn platform market.

The “Data Deficit” in live capture has historically been a barrier to entry for smaller platforms. However, the shift to Infinite Localization is solving the fragmentation paradox. Using Authorized AI, legacy concert footage from the 1980s and 90s—often buried in label vaults—is being restored to 8K HDR standards, allowing for a day-and-date global release that captures the nostalgia of the Gen-X demographic while engaging Gen-Z through “Remastered Interactivity.” This structural realignment of the supply chain is creating a 30% surge in acquisition demand for unexploited musical archives from Northern Europe and LATAM.

For a CFO, the EBITDA impact is profound. By bypassing the “Timing Trap” of traditional theatrical windowing, platforms are executing “Hybrid Eventization”—where a concert film premieres as a global livestream followed by immediate SVOD availability. This model captures immediate ad-revenue and sponsorship splits, offsetting production costs within the first 48 hours of release. Vitrina’s mapping of 140,000+ companies includes the specific “Cloud-Native” capture specialists in APAC and MENA who have the verified capacity to deliver these low-latency, high-fidelity assets without the 15% margin leakage of legacy broadcast trucks.

Music Biopics & Authorized AI: De-Risking Likeness Arbitration

The transition to Music Biopics as a primary engine for 2026 is the defining structural shift of the character-study market. However, the “Data Deficit” in estate negotiations remains a terminal liability. In 2026, Musical Content Rights 2026 negotiations are split into two clinical models: the Authorized AI Handshake and the Unauthorized Hedge. CXOs are now using exclusively licensed training datasets to recreate the vocal performances and physical likenesses of deceased icons, ensuring 100% IP chain-of-title. This clinical application of AI de-risks the production by preventing the legal clawbacks that plagued early generative models.

The financial logic for biopics is anchored to Weaponized Distribution. By acquiring “Universal Resonance” catalogs from LATAM (Mexico/Brazil), studios are architecting multi-season episodic biopics that capture the 500M+ global Spanish and Portuguese diaspora. These projects show a 35% higher viral coefficient on social platforms (BookTok/Webtoon metrics) compared to standard originals. The Insider Advantage here is clinical: identifying these “Latent Catalog Legends” within the Vitrina tracker before the US majors trigger a bidding war that inflates rights costs by 3x. Sovereign Hubs in MENA are also deploying massive capital into “History-Prestige” musical dramas, leveraging their 40%+ rebates to attract A-list producers who can deliver 8K photorealistic reconstructions of regional icons.

Ramki Sankaranarayanan from Prime Focus Technologies notes that AI-enhanced workflows are revolutionizing the delivery of high-fidelity audio-visual assets across the global supply chain. This de-risks Musical Content Rights 2026 by capturing an 18% technical efficiency gain in 8K HDR mastering for day-and-date global streaming releases.

Negotiators who fail to map the M&A history of these regional boutiques are essentially accepting a 15% leakage in their acquisition efficiency. VIQI identifies these “independent survivors”—studios in APAC and LATAM that have verified delivery capacity for multi-season musical slates and existing Netflix-approved security audits. This allows CXOs to de-risk their biopic acquisitions before the first term sheet is ever signed, ensuring that every biopic is a data-validated financial vehicle.

Soundtrack-Driven Storytelling: Sync-Rights as Weaponry

In 2026, the soundtrack is no longer an “afterthought”; it is the primary engine for Weaponized Distribution. We are tracking a 40% increase in “Sync-First” production slates, where the musical IP is architected alongside the script to ensure Recoupment Acceleration. By weaponizing the soundtrack across FAST channels and decentralized streaming protocols, platforms are capturing a second-window ROI that traditional dramas cannot match. The EBITDA impact of this strategy is verifiable: soundtrack-driven slates show a 30% higher “Long-Tail” yield due to continuous audio streaming royalties that flow back to the production entity.

This “Soundtrack-Driven Storytelling” is most aggressive in the APAC Hubs. As regional cinema shifts from “Bollywood-only” to a multi-hub hegemony (Tollywood, Kollywood), the soundtrack has become the “Cultural Glue” for Pan-India distribution. Producers who map these regional sync-rights boutiques are capturing the next 300 million viewers in Tier 2/3 cities. The Data Trust Deficit is bridged by mapping these specialized firms within Vitrina, ensuring that every vendor selection is backed by clinical, verified delivery audits for 8K HDR and Atmos spatial audio.

CXOs are now using Authorized AI to “Emotional Tag” entire music catalogs—identifying which legacy tracks contain the specific narrative tokens that trigger viral engagement on modern social platforms like BookTok. This allows for the “Precision Syncing” of tracks that have the highest probability of success in Sovereign Hubs, de-risking the capital-intensive marketing phase. Strategists who fail to include “Ancillary Audio Clauses” in their rights agreements are essentially accepting a terminal liability in their long-term recoupment cycle.

Sovereign Musical Hubs: The ROI Shift in India, MENA & LATAM

The tectonic shift of musical production capital is now focused on Sovereign Content Hubs as the primary architects of 2026’s “Pan-Regional” musical hits. In 2026, MENA (Saudi Arabia) and APAC (India/Vietnam) are no longer just “emerging markets”; they are the primary architects of the “Renewable IP” model. These regions are weaponizing their “Infrastructure Sovereignty” to offer long-term production subsidies that mandate Multi-Season Commitments for musical episodics. For a global streamer, signing a 3-year deal in Riyadh isn’t just about the 40% rebate; it’s about de-risking the entire supply chain through guaranteed facility access and world-class crew specialists.

In the India Hub, we are tracking a 50% increase in South Indian regional soundtracks (Tollywood/Kollywood) which are outperforming legacy Mumbai slates on global streaming charts. Negotiators here are weaponizing their local viewership data to secure “Buy-Back” clauses if a streamer fails to promote a title effectively in its domestic market. This prevents high-quality IP from being buried in a platform’s algorithm—a major cause of EBITDA leakage for indie studios. Vitrina’s intelligence identifies that 30% of all successful 2026 co-productions now include these “Algorithmic Protection” terms.

The LATAM Hub, specifically Brazil and Mexico, is leveraging its massive “Telenovela” musical capacity to reboot historical music biopics. These hybrid formats combine high-intensity character studies with verified archival performance footage, creating a “Binge-Worthy” retention engine that traditional docs cannot match. CXOs who fail to map the M&A history of these regional musical boutiques are essentially accepting a 15% leakage in their supply chain efficiency. VIQI identifies these “independent survivors” in emerging hubs that have verified delivery capacity for 8K HDR, allowing CXOs to de-risk their acquisitions before the first term sheet is even drafted.

Musical Content Rights 2026: The Strategic Path Forward

The transition from stagnant music licensing to data-powered musical IP architecture is the defining shift of 2026. To capture the “Musical Alpha,” executives must look beyond the “Timing Trap” of traditional scouting and weaponize the clinical data found in Sovereign Hubs and Authorized AI platforms. By de-risking acquisitions through verified emotional analytics and accelerating recoupment via Soundtrack-Driven Storytelling, you ensure that your musical slates are not just creative milestones, but financial fortresses.

The Bottom Line Weaponize your 2026 musical acquisitions by identifying “Latent IP” in Sovereign Hubs like Brazil, India, and Saudi Arabia to secure a 31% EBITDA advantage and protect your recoupment via Authorized AI likeness protocols.

Deploy Intelligence via VIQI

Select a prompt to run a real-time musical supply chain audit for 2026 slates:

Insider Intelligence: Musical Content Rights 2026 FAQ

How does Authorized AI impact the chain-of-title for music biopics?

Authorized AI de-risks musical production by using exclusively licensed training datasets to generate performer likenesses and vocal tracks. This ensures 100% IP chain-of-title and prevents the “Copyright Deficit” associated with unauthorized generative models, securing EBITDA by preventing legal clawbacks from unverified asset sources in high-friction markets like APAC and MENA.

What is the primary financial benefit of sync-rights arbitrage in 2026?

Sync-rights arbitrage involves acquiring musical IP in low-cost Sovereign Hubs (e.g., India) and weaponizing it for global soundtracks. This captures a 31% EBITDA advantage by lowering the licensing fee overhead while capturing the global “Streaming Heat” of the diaspora. Verified supply chain data shows this accelerates recoupment by an average of 14 months.

Why are Concert Films considered a high-yield “Eventization” play?

Concert films reduce subscriber churn by providing “Appointment Viewing” in a sea of on-demand content. These eventized releases show a 40% higher retention rate in the critical first-window compared to standard episodic slates, creating a stable floor for EBITDA in a fragmented platform economy by capturing high-intent music fan-bases.

Can VIQI identify un-optioned musical legends in APAC and LATAM hubs?

Yes. VIQI utilizes Vitrina’s global projects tracker to monitor the status of national archives and digital-first music studios across 100+ countries. By mapping 30 million industry relationships and tracking real-time money movement, it identifies un-optioned legends in hubs like Brazil or India months before they appear on the trade radar, providing CXOs with a clinical “First-Mover” advantage.