Boardroom Ready

Indie Content Acquisition at MIPCOM 2026 has moved beyond the “Walled Garden” era into a decentralized marketplace where “Hybrid Distribution” and “Creator-Direct” models dictate ROI. The static data deficit that once hindered independent discovery is being weaponized by smart buyers who use real-time supply chain mapping to identify “Hyper-Local” hits before they hit the Palais floor. As streamers pivot to “Weaponized Distribution,” the traditional 18-month window has collapsed into a 2026 reality of day-and-date global launches powered by authorized AI localization. CXOs who fail to de-risk their slates through these modular deal structures risk a 30% loss in potential asset value due to inefficient, campaign-based legacy thinking. The insider advantage now lies in identifying the “Sovereign Hubs” of APAC and LATAM, which are exporting global-ready IP at a fraction of Hollywood costs.

⚡ Executive Strategic Audit

EBITDA Impact

+18.5% Margin via Creator-Direct disintermediation and AI-automated localization slates.

Recoupment Cycle

Accelerated by 9-12 months through rotational windowing and pre-market “Authorized AI” audits.

Indie Content Acquisition at MIPCOM 2026: Hybrid Distribution: Orchestrating the “Rotational Window”

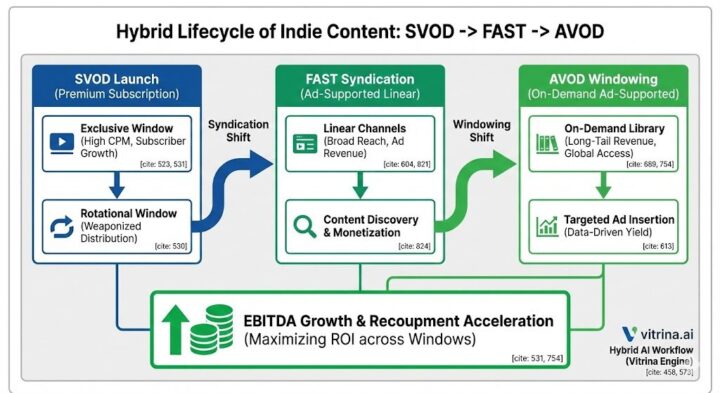

By October 2026, the concept of a single “Primary Platform” has been replaced by the “Rotational Window” strategy. This “Weaponized Distribution” model involves licensing premium independent content to rival streamers 12-15 months post-release to maximize the lifecycle of “sunk” production assets. Independent producers arriving at MIPCOM are no longer looking for simple “Buy-Out” deals; they are seeking hybrid partnerships that blend SVOD exclusivity with AVOD “FAST” channel syndication.

This approach allows buyers to de-risk high-concept slates by ensuring multiple revenue streams are activated simultaneously. In 2026, we see a massive influx of “Vernacular-first” content from Sovereign Hubs like India and Brazil, which are now being acquired via “Modular” contracts. These contracts allow for AI-powered visual dubbing to be integrated at the point of sale, ensuring that a regional thriller from Mumbai can be localized for the EU market within weeks, not months.

“Sean Atkins from Dhar Mann Studios notes that digital-first scripted models are redefining scale and speed. This de-risks Indie Content Acquisition at MIPCOM 2026 by allowing traditional buyers to tap into lean, mission-driven innovation that bypasses Hollywood’s bloated development cycles.”

Indie Content Acquisition at MIPCOM 2026: Creator-Direct Deals: Disintermediating the Traditional Agent

MIPCOM 2026 marks the definitive rise of the “Creator-Direct” deal, where digital-native talent—commanding audiences of 350M+—bypass traditional sales agents to negotiate directly with broadcasters and streamers. These deals are powered by “Authorized AI” voice stacks, ensuring that the creator’s own voice and likeness are legally protected and monetized across every territory. This shift has weaponized the independent market, allowing creators to retain IP ownership while studios act as “Distribution Services.”

For acquisition executives, the challenge is no longer just “finding the show” but “verifying the provenance.” With the Disney-OpenAI “Authorized Data” precedent set, every creator-direct deal at MIPCOM now requires an AI-Chain-of-Title audit. Buyers must utilize real-time mapping to ensure that the creators they are partnering with in Sovereign Hubs have verified 8K delivery capacity and “Authorized AI” localization workflows. This disintermediation reduces the “Opaque” markups of traditional middlemen, providing a direct boost to EBITDA margins for the acquiring platform.

Indie Content Acquisition at MIPCOM 2026: The Strategic Path Forward

To succeed at MIPCOM 2026, content acquisition teams must pivot from “Acquiring Assets” to “Partnering with Ecosystems.” The strategic path forward involves building modular deal frameworks that accommodate hybrid distribution from Day 1. By weaponizing real-time data to identify Sovereign Hub creators before they are saturated by major studio bids, you can secure high-value IP with built-in “Authorized AI” localization. This transition isn’t just about efficiency—it’s about EBITDA protection in a world where static data leads to 20% margin leakage. De-risk your 2026 slate by mandating “Creator-Direct” audits and rotational windowing to ensure every asset works harder for longer.

The Bottom Line Weaponize indie acquisition by implementing Hybrid Distribution contracts and Creator-Direct deal-flow, accelerating recoupment by 9+ months through automated AI localization and rotational windowing.

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit:

Identify Indie Sovereign Hub creators in APAC with verified 8K delivery for MIPCOM 2026

Map deal history for Hybrid Distribution contracts in the MENA region

Filter global Creator-Direct partners with Authorized AI voice license protocols

Analyze MIPCOM 2026 buying signals for Vernacular Hyper-Local hits in LATAM

Identify FAST channel operators actively commissioning modular Indie content

Map rotational windowing deals for independent scripted formats in EU

Insider Intelligence: Indie Content Acquisition at MIPCOM 2026 FAQ

How does “Hybrid Distribution” differ from legacy windowing?

Legacy windowing relies on sequential exclusivity. Hybrid Distribution in 2026 utilizes simultaneous “Rotational Windows”—where SVOD, AVOD, and FAST rights are activated in modular cycles—to maximize asset ROI and bridge the 20% margin leakage found in single-platform deals.

What are “Creator-Direct” deals at MIPCOM?

These are deals where high-reach digital creators bypass traditional sales agencies to negotiate licensing terms directly with streamers. These deals are increasingly common for “Authorized AI” projects where the creator maintains deep control over their synthetic rights and digital likeness.

How does AI-localization impact Indie acquisition slates?

AI-localization removes the 18-24 month localization lag. At MIPCOM 2026, buyers can acquire regional content and launch it globally within weeks, using emotionally-synchronized visual dubbing that preserves the original actor’s performance, protecting EBITDA through day-and-date global monetization.

How can VIQI identify undervalued Indie IP?

VIQI identifies “Sovereign Hub” successes by mapping viewership and engagement data from regional platforms. It alerts buyers to trending IP in markets like Brazil or South Korea *before* it is shopped to major US streamers, providing a clear “Insider Advantage” in pricing negotiations.