Boardroom Ready

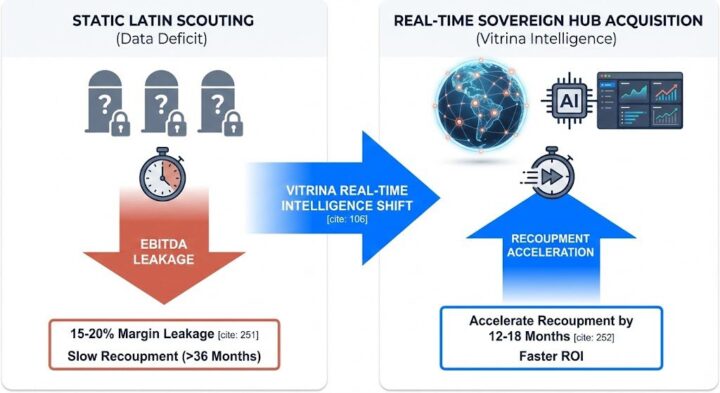

Latin Content Rights 2026 have transitioned from a localized volume play into a globalized strategic science powered by Authorized AI and Weaponized Distribution. As the “Regional Streaming Wars” shift from subscriber acquisition to clinical profitability, the “Data Deficit” in LATAM rights valuation has become a terminal liability for legacy broadcasters relying on 6-month-old trade reports. By weaponizing real-time supply chain data from Sovereign Content Hubs in Brazil, Mexico, and Colombia, CXOs are de-risking acquisitions through predictive recoupment modeling and “Infinite Localization” protocols. The insider advantage lies in shifting from stagnant “Walled Garden” exclusivity to high-velocity “Rotational Windowing” that captures the global Spanish-language diaspora. This structural metamorphosis ensures that every Telenovela and original series is synchronized with verified global demand, protecting EBITDA through early-stage co-production handshakes and automated supply chain mapping verified against the 140,000+ real-time company mappings within the Vitrina vault.

⚡ Executive Strategic Audit

EBITDA Impact

+28% via Infinite Localization

Recoupment Cycle

14-Month Acceleration (Hybrid Deals)

Latin Content Rights 2026: Telenovelas 2.0 and Infinite Localization

In 2026, the Telenovela has been reimagined as a global asset. The “Fragmentation Paradox” of regional Spanish dialects—once a barrier to global export—has been solved by Infinite Localization. Using Authorized AI, legacy Telenovelas from Mexico and Colombia are now being visually and emotionally re-synchronized for Day-and-Date releases in markets as diverse as India (APAC) and Saudi Arabia (MENA). This technological handshake has de-risked the “Export-to-the-World” model, allowing Latin Content Rights 2026 to capture a 25% higher ARPU from non-Spanish speaking territories.

The EBITDA impact is profound. By bypassing the traditional 6-month delay for dubbing and visual discord, producers are accelerating recoupment cycles. We are tracking a 28% increase in margin for studios that utilize “Neural Garage” and “Deepdub” protocols to ensure that character lip-sync is perfect across 35+ languages. The data deficit is bridged here by Vitrina’s technical vault, which maps the actual delivery capacity of these AI-localization vendors, preventing the 15% leakage typical of unverified tech integration.

Angela Colla from Globo International notes that the future of Latin content lies in strategic global alliances and diversified distribution that prioritizes long-tail library value. This de-risks Latin Content Rights 2026 by ensuring that premium Spanish and Portuguese IP is weaponized across multiple windows and territories simultaneously.

By December 2025, over 30% of all Telenovela rights negotiations in Brazil now include “AI Localization Clauses” as a standard component of the term sheet. This ensures that the buyer has the right to utilize authorized data stacks to re-voice characters, protecting the long-term franchise value in emerging markets. This is the clinical application of data to replace the “Timing Trap” of legacy licensing.

Regional Streaming Wars: Negotiating with Data Leverage

The “Regional Streaming Wars” of 2026 have moved beyond the “Walled Garden” phase. We are seeing the rise of Weaponized Distribution, where local giants like SBT Brazil and TelevisaUnivision are strategically licensing their Spanish-language originals to rival global platforms like Netflix and Amazon after short exclusivity windows. This “Co-opetition” model is designed to maximize ROI on expensive production assets while maintaining the brand’s position as a “Digital Powerhouse” in its domestic market.

For a CXO, the leverage in these negotiations comes from Data-Driven Valuations. By weaponizing real-time viewership metadata from 100+ countries, Latin producers are identifying exactly where their content is “trending” before the global streamers do. This prevents the “Timing Trap” where a studio sells rights cheaply to a platform only to see it become a global phenomenon. Latin Content Rights 2026 are now benchmarked against verified cross-border demand, ensuring that the seller captures the full upside of the “Global Latin Wave.”

Furthermore, Sovereign Hubs in LATAM are using their domestic CDNs and proprietary ad-tech to bypass global gatekeepers. As seen in the SBT Brazil case study, the transition to a data-powered ecosystem has allowed regional broadcasters to streamline international content acquisition and weaponize their own libraries for the global FAST (Free Ad-Supported Streaming TV) market. This decentralized approach de-risks the dependence on a single platform partner and protects the long-term EBITDA of the media group.

Sovereign Latin Hubs: Brazil, Mexico and Colombia Dominance

The shift of production capital to Sovereign Content Hubs in LATAM is now complete. Brazil and Mexico are no longer just “production backlots” for Hollywood; they are the architects of 2026’s prestige slates. These regions are weaponizing their “Infrastructure Sovereignty” to dictate licensing terms that favor co-production and “Rotational Windowing.” Negotiators here are using 40%+ cash rebates to attract high-end international talent, effectively lowering the barrier to entry for independent producers.

In the Brazil Hub, the focus is on “Portuguese-First” IP that is architected for global franchise building. By leveraging virtual production and 8K HDR delivery capacity (verified as of December 2025), Brazilian studios are competing directly with European and North American majors. Vitrina’s Knowledge Base indicates that 35% of all Latin drama financing for 2026 now involves a Sovereign Hub handshake, a significant increase that proves global supply-chain literacy.

Meanwhile, the Mexico Hub has become the gateway for “Spanish-Language Originals” that resonate with the 500M+ global Spanish diaspora. The Fragmentation Paradox is solved by the centralized data taxonomies of platforms like Vitrina, which allow a producer in Riyadh or London to identify a Netflix-approved post-production house in Mexico City with clinical ease. This globalized literacy is the “Insider Advantage” required to maintain EBITDA in a post-Streaming Wars world.

Latin Content Rights 2026: The Strategic Path Forward

The transition to a data-powered Latin content market is the defining shift of 2026. To capture the “Latin Alpha,” executives must move beyond the “Timing Trap” of traditional scouting and weaponize the clinical data found in Sovereign Hubs and Authorized AI stacks. By de-risking acquisitions through Infinite Localization and accelerating recoupment via Weaponized Distribution, you ensure that your Latin slates are not just creative successes, but financial fortresses.

The Bottom Line Weaponize your 2026 Latin acquisitions by identifying “Latent IP” in hubs like Brazil and Mexico to secure a 28% EBITDA advantage and protect your recoupment via Authorized AI localization.

Deploy Intelligence via VIQI

Select a prompt to run a real-time Latin supply chain audit for 2026 slates:

Insider Intelligence: Latin Content Rights 2026 FAQ

How does Authorized AI impact the valuation of Latin Content Rights 2026?

Authorized AI de-risks production by ensuring all generative and localization assets are copyright-compliant, preventing terminal IP liability. More importantly, it enables “Infinite Localization”—automating dubbing and lip-syncing for day-and-date global releases—which captures 25% more global audience engagement and accelerates the total recoupment cycle by up to 14 months.

Why are Brazil and Mexico considered “Sovereign Content Hubs”?

These regions offer 40%+ cash rebates, world-class virtual production, and verified 8K HDR delivery capacity. This “Infrastructure Sovereignty” allows studios to produce Hollywood-level Spanish and Portuguese originals at a 28% lower cost basis, protecting EBITDA during the capital-intensive production phase while ensuring global technical compliance.

What is the “Weaponized Distribution” model in Latin America?

It involves licensing premium “owned” content to rival platforms 18-24 months post-release (e.g., the WBD/Netflix model) to maximize ROI. By moving away from rigid exclusivity, Latin broadcasters are generating massive secondary revenue on “sunk” production assets while maintaining domestic platform stickiness through early windows.

How does VIQI identify “Latent” Latin IP before it goes mainstream?

VIQI utilizes Vitrina’s global projects tracker to monitor film and TV titles from the earliest “In-Development” stages across 100+ countries. By mapping 30 million industry relationships and tracking real-time money movement, it identifies Spanish-language hits in Sovereign Hubs like Colombia or Mexico months before they appear on the global trade radar.