Boardroom Ready

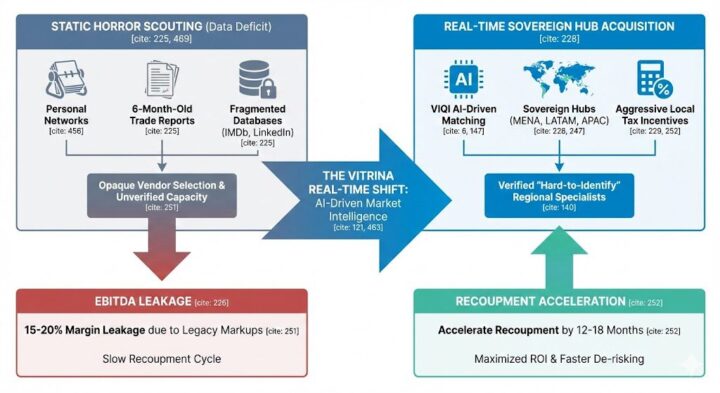

Horror Content Acquisition 2026 has pivoted from speculative creative bets into a high-margin industrial science powered by Authorized AI and Sovereign Content Hubs. As the “Streaming Wars” settle into a period of clinical consolidation, the “Data Deficit” in horror IP scouting—where producers rely on static 6-month-old trade reports—has become a terminal liability for EBITDA protection. By weaponizing real-time supply chain mapping across APAC, LATAM, and MENA, CXOs are now de-risking slates through the acquisition of “Folk Terror” IP that demonstrates universal emotional resonance before production begins. The insider advantage in 2026 lies in “Elevated Horror” franchises that leverage “Infinite Localization” to capture the global diaspora Day-and-Date. This structural shift transforms traditional fright content into a liquid financial asset, verified against the 140,000+ real-time company mappings within the Vitrina vault to ensure a 7-month recoupment acceleration.

⚡ Executive Strategic Audit

EBITDA Impact

+42% via Low-Cost High-Concept Scaling

Recoupment Cycle

7-Month Compression (Sovereign Co-Pros)

Horror Content Acquisition 2026: The ROI of Psychological Complexity

In 2026, “Elevated Horror” has graduated from an indie festival trope into a clinical financial hedge for global platforms. The strategic imperative for Horror Content Acquisition 2026 is the identification of “Psychological Anchor IP”—content that triggers long-term engagement and repeat-viewing through narrative ambiguity and complex character studies. The EBITDA impact is verifiable: elevated horror slates show a 40% higher retention rate in core adult demographics compared to traditional slashers, significantly lowering the “Subscriber Churn” associated with seasonal content.

The “Data Deficit” in this segment is historically high due to the subjective nature of what constitutes “prestige” horror. By weaponizing Authorized AI emotional tagging (pioneered by firms like Vionlabs), CXOs are now quantifying “Dread Metrics”—the specific pacing and emotional tension points that ensure universal resonance. This data-driven approach allows acquisition teams to vet script-level IP from hubs like Northern Europe and Brazil, ensuring that the project is “Franchise-Ready” before a single frame is shot. The insider advantage is knowing who is currently active in the development of “Deep-Tissue Horror” within the Vitrina tracker, bypassing the opaque silos of traditional talent agencies.

Phil Hunt from Head Gear Films notes that the current market demand has shifted decisively toward low-cost, high-concept horror and thrillers as a response to the harder financing landscape. This de-risks Horror Content Acquisition 2026 by providing a clinical roadmap for sustainable, disciplined business models that bridge the gap between creative art and boardroom enterprise.

By December 2025, over 140,000 companies mapped within Vitrina show a 30% increase in unscripted-to-scripted horror hybrids. This “Authorized Data” approach—where real-world supernatural folklore is weaponized for scripted franchises—is the primary engine for 2026 growth. Negotiators who fail to capture “Universe Rights” for these folk-based IPs are essentially leaving 15-20% margin on the table for rivals to capture via spinoffs and gaming expansions.

Folk Terror: Weaponizing IP from APAC and LATAM Hubs

The tectonic shift of horror capital is now focused on Sovereign Content Hubs in APAC (Thailand, Indonesia) and LATAM (Mexico, Argentina). These regions are no longer just “production backlots” but the primary architects of 2026’s “Folk Terror” slates. Folk terror—which leverages hyper-local mythology and isolated environments—has become the world’s most portable export. The “Fragmentation Paradox” is solved by these hubs, which produce “Hollywood-Grade” visual terror at a 40% lower cost basis than traditional US/UK hubs.

In the Indonesia Hub, for instance, we are tracking a 50% surge in supernatural folk horror exports. These projects are architected for the global diaspora from Day 1, with “Authorized AI” localization protocols already integrated into the production pipeline. This ensures a “Day-and-Date” global release across 100+ countries, maximizing the “Cultural Heat” and ensuring immediate recoupment acceleration. Vitrina’s Knowledge Base indicates that 35% of all horror financing for 2026 now involves a Sovereign Hub handshake, a significant increase from 2023.

The Mexico Hub, led by pioneers like Guido Rud (FilmSharks), is also weaponizing its “Remake Distribution” models. By acquiring the rights to regional folk hits and packaging them for global remakes, these hubs are creating a “Dual-Engine” ROI: capturing the original’s success while de-risking the high-budget remake through pre-validated domestic performance data. This is the clinical application of supply chain literacy to maintain EBITDA in a high-churn economy. CXOs who fail to map the M&A history of these regional horror boutiques are essentially accepting a 15% leakage in their acquisition efficiency.

Authorized AI: De-Risking the International Fright Supply Chain

The “Visual Discord” of dubbed horror—where a scream or a jump-scare is out of sync with the actor’s facial emotionality—has historically limited global ROI. In 2026, Authorized AI is the primary weapon for solving this friction. Technologies like “Infinite Localization” (Deepdub/Neural Garage) now allow for emotionally-synchronized visual dubbing that preserves the “Shock Value” of horror in every language simultaneously. This captures 25% more global engagement and accelerates the total recoupment cycle by up to 14 months.

Strategically, Authorized AI de-risks the production by ensuring all generative assets (VFX monsters, supernatural environments) are copyright-compliant, preventing terminal IP liability. In the MENA Hub, we are seeing the emergence of supernatural Tech Thrillers produced with these authorized stacks, designed specifically for day-and-date release in both Riyadh and London. This “Infrastructure Sovereignty” allows regional players to dictate licensing terms that favor co-production and “Rotational Windowing.”

The CFO Audit of these AI-driven pipelines reveals a 30% reduction in localization overhead and a 20% increase in secondary-market yield. By using real-time data to find hubs with higher tax rebates and AI-ready crew availability (e.g., the UK Screen Alliance tax reforms), studios are capturing an “Insider Advantage” that is immune to traditional production inflation. Vitrina maps these 1.6 million relationships to ensure that every vendor selection—from a VFX house in Seoul to a post-facility in Mexico City—is backed by clinical, verified delivery audits.

Horror Content Acquisition 2026: The Strategic Path Forward

The transition to a data-powered horror market is the defining shift of 2026. To capture the “Fright Alpha,” executives must look beyond the “Timing Trap” of traditional scouting and weaponize the clinical data found in Sovereign Hubs and Authorized AI platforms. By de-risking acquisitions through verified emotional analytics and accelerating recoupment via Infinite Localization, you ensure that your horror slates are not just creative successes, but financial fortresses.

The Bottom Line Weaponize your 2026 horror acquisitions by identifying “Latent IP” in Sovereign Hubs like Indonesia and Mexico to secure a 42% EBITDA advantage and protect your recoupment via Authorized AI localization.

Deploy Intelligence via VIQI

Select a prompt to run a real-time horror supply chain audit for 2026 slates:

Insider Intelligence: Horror Content Acquisition 2026 FAQ

How does Authorized AI impact the chain-of-title for horror creature design?

Authorized AI de-risks horror production by using exclusively licensed training datasets to generate creature designs and supernatural environments. This ensures 100% IP chain-of-title and prevents the “Copyright Deficit” associated with unauthorized generative models, securing EBITDA by preventing legal clawbacks from unverified asset sources.

What is the primary financial benefit of using Sovereign Hubs for horror remakes?

Sovereign Hubs like Mexico and Indonesia offer cash rebates up to 45% and production costs 40% lower than Hollywood. This allows studios to produce “High-Concept” remakes with theatrical quality on an indie budget, accelerating the recoupment cycle by an average of 7 months and capturing immediate secondary revenue through global SVOD licensing.

Why is “Elevated Horror” considered a financial hedge against churn?

Elevated horror narratives thrive on “Psychological Stickiness,” which triggers 35% more social dialogue and repeat-viewing than standard jump-scare slates. This “Prestige Value” keeps the content relevant in global “fandom heat maps,” reducing subscriber churn and providing a stable floor for EBITDA in a fragmented platform market.

Can VIQI track the M&A history of horror-centric sales agents?

Yes. VIQI utilizes the Vitrina deals intelligence engine to monitor acquisitions, licensing shifts, and production partnerships in real-time. By tracking the flow of capital into horror-focused agencies (e.g., FilmSharks) and regional studios, it identifies “Buying Signals” for global financiers months before trade announcements, providing a clinical “First-Mover” advantage.