Q3 2025: A Diverse and Dynamic Quarter for Global Content Production

Q3 2025 revealed a global content landscape in a period of transition, marked by underlying structural shifts and a profound rebalancing of value. In the Americas, the market settled into a new reality defined by cost-focused volume, with pure-play OTT platforms like Hulu and Disney+ entering the highest commissioning ranks. The EMEA region was defined by the structural dominance of Public Service Broadcasters (PSBs) and a focus on cost control. Meanwhile, the APAC region saw a fundamental market shift as the environment became more competitive, with local broadcasters and niche streamers populating the top ten.

Welcome to the latest edition of Vitrina’s global tracking of Film and TV production trends, providing insights across Movies and Feature Films, TV series, Animations, Documentaries, Scripted, and Unscripted projects.

Before we dive into Q3 2025 metrics, let’s recap the key Film and TV production trends driving the industry from last 33 months.

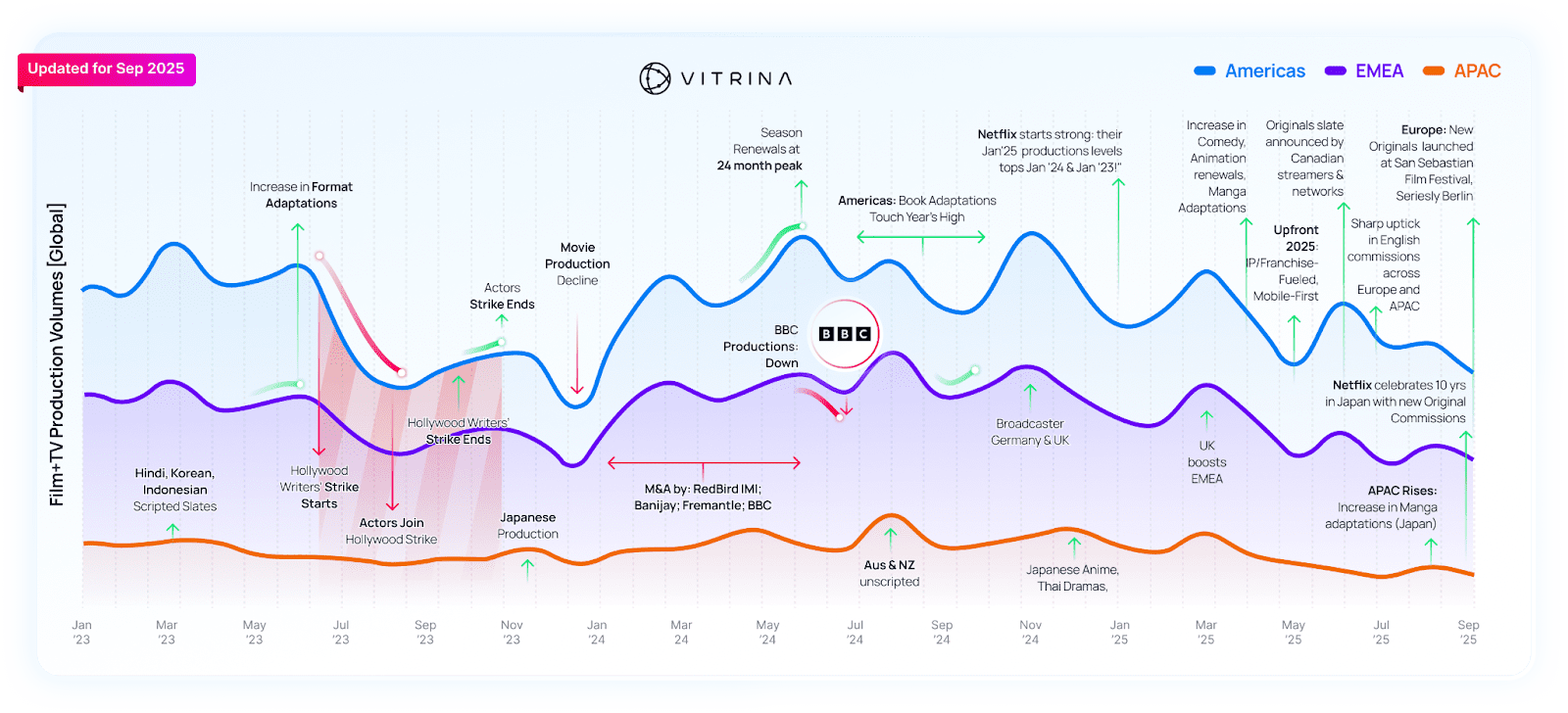

Global Film & TV Production: Updated for September-2025

Source: Vitrina Daily Production Tracker. [X-Axis : Months starting from Jan 2021. Y-Axis Production Volumes : Production Volumes are the total number of projects greenlit or financed or commissioned in that month. Please note that this is an area chart – meaning that the regions are stacked one above the other with the full height of the chart representing the global production volume.

While global content volumes declined by 17% in the first three quarters of 2025, this headline number conceals a more significant underlying trend: a profound rebalancing of the industry’s value spectrum.

This downturn is not a simple slowdown but an active market correction. The key dynamic is a pronounced slowdown in high-budget productions, occurring simultaneously with a rise in low-budget, high-efficiency content pipelines. This strategic pivot is squeezing the vital mid-to-high-tier segment, signaling a structural shift shaped by new economic pressures, capital constraints, and an evolving calculus of production risk.

2023: The Strike Effect:

- Hollywood Strikes: The dual writer and actor strikes froze the US and UK scripted ecosystems.

- Strategic Pivot: Studios were forced to shift focus to unscripted formats and international markets to keep pipelines active.

- Financial Impact: Financiers grew cautious, leading to greater scrutiny on entertainment-related risks.

2024: A Global Recalibration:

- Surface-Level Stability: While the global market appeared flat, significant volatility lay underneath.

- Regional Surges: Production spiked in key markets like Japan, Australia/New Zealand, Germany, and Brazil.

- Incentive Reset: A global overhaul of tax rebates and incentive schemes triggered a migration of projects from traditional hubs to more cost-efficient locations.

2025 (Jan-Sep): Regional Divergence:

- European Resilience: Europe showed steady growth through the first half of the year, with a production surge in May.

- APAC Momentum: The Asia-Pacific region saw a 30% rise in production volume in July, with a decisive shift toward English-language content from Australia and New Zealand.

- LATAM Contraction: In contrast, Latin America experienced a sharp decline in commissioning and financing activity.

The Takeaway:

Global production is not in decline—it is in a dynamic transition. The market now favors focus, efficiency, and smart decision-making that reflects the new realities of the entertainment economy.

Insights on Production Transaction Volumes

Q3’25 vs. H1’25

Methodology: Vitrina monitors unreleased or in-motion projects worldwide across all stages of the content lifecycle—development, production, post-production, and till release—on a daily basis. We track various transactions and deal activities related to content financing, commissioning, co-productions, green-lighting, as well as early stage (content development) and late stage (licensing) arrangements. These transactions between production houses, distributors, streamers, and broadcasters enable us to gain valuable insights into industry trends, key players, buyer behavior, and the specializations of production companies. Our monthly Film+TV productions chart serves as a bellwether of production financing and industry health.

Below are the key highlights for Q3 Film+TV Production Volumes:

- UCAN: A New, Disciplined Market Reality

The US/Canada market has stabilized into a cost-focused environment. Small-to-medium projects are the new anchor of the supply chain, while high-budget productions have not returned to pre-strike levels.- Commissioning Shake-Up: The biggest story is the rise of pure-play OTT platforms. Hulu, Disney+, and Paramount+ have surged into the top commissioning ranks, displacing established broadcasters like Fox Network and ABC.

- Studio Consolidation: Vertical integration is accelerating. Amazon MGM Studios remains the top studio, while Sony Pictures Television is the only independent studio left in the top tier.

- LATAM: Niche Players Stabilize the Market

The LATAM market is in a “maintenance mode,” with local broadcasters stepping up as major streamers have become quieter.- Who’s In, Who’s Out: While Netflix maintained its lead, major players like Vix and HBO Max were displaced from the top spots.

- The Rise of Niche: The gap was quickly filled by regional broadcasters like TV Azteca and TVN, proving the growing influence of local players.

- EMEA: The Resilience of Public BroadcastersThe European market is defined by cost control and the structural dominance of Public Service Broadcasters (PSBs). Their guaranteed public funding, deep IP control, and regulatory protection make them stable, essential partners.

- The Leaderboard: Netflix and Prime Video are commissioning alongside key European PSBs like ZDF, ITV, and ARD.

- Strategic Partnerships: Distribution deals are directly impacting commissioning. France Télévisions, for example, dropped from the leaderboard, likely due to a major back-catalog deal with Amazon Prime Video that reduced its need for new high-cost originals.

- APAC: A Fundamental Power Shift

The APAC market is pivoting toward more strategic, high-value content, leading to a fundamental change in the competitive landscape.- A New Playing Field: The market is no longer dominated by a few OTT giants. Q3 saw a highly competitive environment where SonyLIV is now tied with Netflix for the commissioning lead.

- Local Powerhouses: The top ten is now heavily populated by local broadcasters and niche streamers like SBS (Australia), NHK (Japan), and TBS Television (Japan), signaling a major shift toward local influence.

Stay ahead of the competition by tracking the latest production trends and market moves.

Global Entertainment Leaders Speak

Decoding the MENA Content Market: Front Row’s Gianluca Chakra on Distribution, Production, and the Streaming Revolution

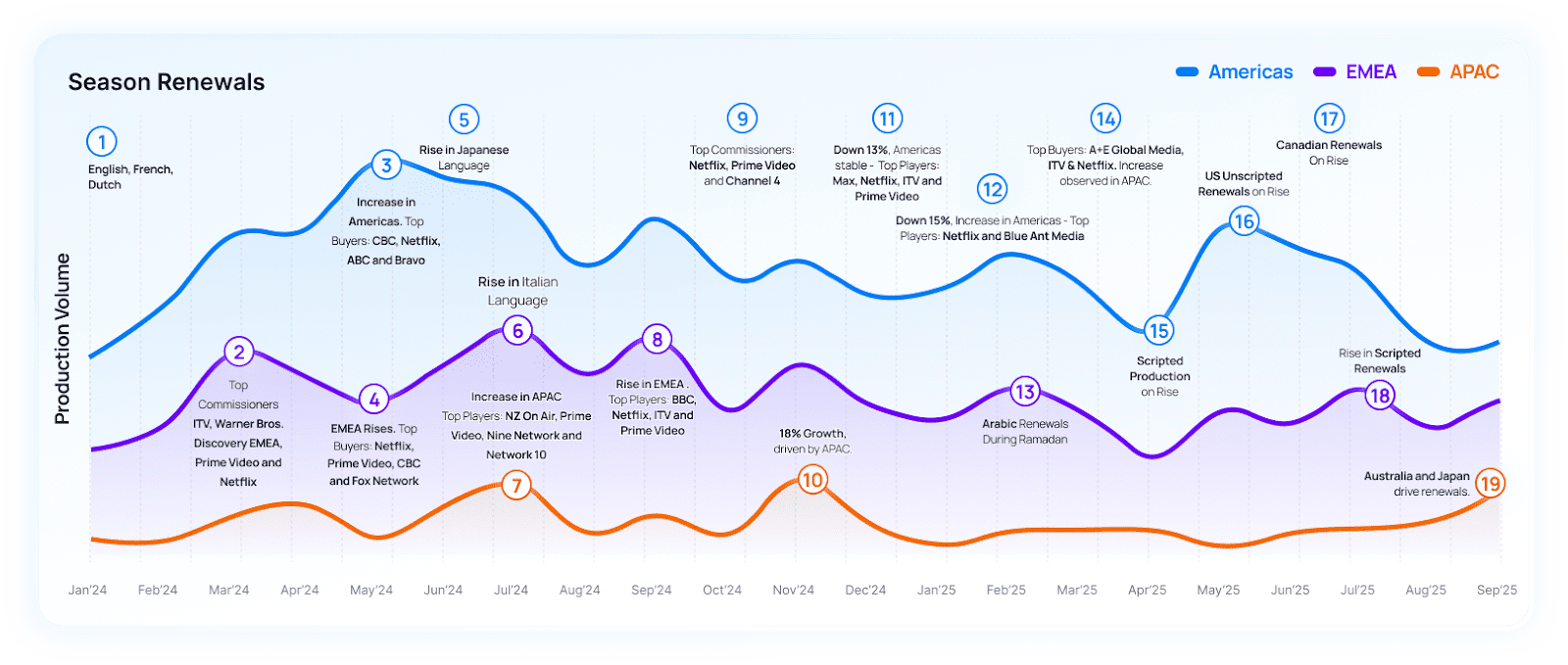

Trends in Season Renewals: Shifting Dynamics Across Regions

Season renewals remain a key strategy for streamers and broadcasters, ensuring continuity in content pipelines, sustaining viewer loyalty, and reducing the risks of launching new projects.

Source: Vitrina Daily Production Tracker. Please note that this is an area chart – meaning that the regions are stacked one above the other with the full height of the chart representing the global production volume….

Regional Insights – Aug 2025

Americas:

- Who’s Renewing: Netflix and Prime Video lead the pack, alongside major streamers like Disney+, Hulu, and broadcasters like NBC and HBO.

- What’s Hot: Drama and Reality are the top genres getting another season.

- The Split: A nearly even balance with 59% Scripted vs. 41% Unscripted renewals.

EMEA:

- Who’s Renewing: The BBC and UKTV are major players, with a strong focus on local content.

- What’s Hot: English (42%) and German (20%) language shows are dominating renewals, with Reality and Drama as the leading genres.

- The Split: A similar balance to the Americas, with 58% Scripted vs. 42% Unscripted.

APAC:

- The Big Story: Season renewals in APAC nearly doubled this quarter.

- Who’s Driving It: Broadcasters in Australia and New Zealand are fueling this growth with a major push in unscripted content (documentaries and reality shows).

- Animation Focus: Japanese producers are concentrating their renewal efforts on Animation.

- The Split: Renewals were 59% Scripted vs. 41% Unscripted—a stark contrast to the region’s overall production, which heavily favors scripted content (82%).

Monitor season renewals and adjust your strategy with live insights.

Most Active Film Commissions in Year 2025 (Till Sep’25)

Film commissions have become increasingly strategic players in the entertainment industry, stepping up efforts to attract productions, nurture local talent, and secure investments across filming, production, post-production, and animation. Their proactive initiatives have fueled regional economic growth, strengthened creative ecosystems, and fostered high-impact industry collaborations.

Several film commissions—along with national entertainment bodies and ministries of culture, communication, and commerce—have intensified their activities to support production. Governments worldwide are deploying aggressive measures to drive employment, support early-stage projects, and empower emerging content creators. To remain competitive and attract international productions, they have revamped tax incentive structures, introduced cash grants, expanded cashback schemes, and rolled out new tax breaks. Additionally, major trade events and strategic partnerships have been leveraged to position their markets as premier global production hubs.

Curious how Vitrina can help you? Try it out today!

Financing by Industry Bodies -Jan’25 – Sep’25

Let’s explore the key film commissions that are making a decisive impact on the industry today.

| Sr. No | Association/Industry Commission | Location |

| 1 | Société de Développement des Entreprises Culturelles | Montreal, Canada |

| 2 | Screen Australia | Sydney, Australia |

| 3 | Doha Film Institute | Qatar |

| 4 | Filmförderungsanstalt | Berlin, Germany |

| 5 | Ministry of Culture and Film Industry Subcommittee | Thailand |

- SODEC (Société de Développement des Entreprises Culturelles) remains a key backer of French-language content in Canada, with Drama (36%) and Documentary (33%) leading its portfolio. The slate is heavily Scripted (76%), focused on films (86%), with notable titles including Nebulous Stars, Being a Seagull, and Two Years Less a Day. Among the top production partners are Happy Camper Media, Nikan Productions, Possibles Média, Coop Vidéo de Montréal, and Echo Media.

- Screen Australia continues to champion English-language content, with a slate led by Drama (30%) and Documentary (20%), alongside Comedy titles. The portfolio skews Scripted (69%), split across Movies (56%) and TV Series (42%), with highlights like Into the Blue, Ages of Ice, and Lesbian Space Princess. Among the top production partners are Wooden Horse, Cheeky Little, Photoplay Films, MOFA, and GoodThing Productions.

- Doha Film Institute is a leading financier of Arabic-language content (71%), with a slate anchored in Drama (46%) and Documentary (29%). Its portfolio is primarily feature films (93%), complemented by select TV projects. Notable titles include Like a Feather in the Breeze, How the East Was Won, and People of Solitude. Its top production partners such as Abbout Productions (Lebanon) and Les Films d’Ici Méditerranée (France), Rise Studios.

- Medienboard Berlin-Brandenburg is Germany’s key film financing body, with 50% of its slate led by Drama. Over 90% of funded projects are for Scripted; out of which 60% is Movies and 40% TV Series. Few of the featured titles include The Good Sister, Das Manko, Das Manko. Top partners are One Two Films, Razor Film Produktion GmbH, FilmFernsehFonds Bayern.

- Filmförderungsanstalt (FFA) is Germany’s key film financing body, with a slate led by Drama (43%) and Documentary (19%), alongside Family and Kids projects. The portfolio is predominantly German-language scripted films (97%), with featured titles such as Johanna und die Maske der…, Coming Out – The Documentary, and On Thin Ice. Leading partners include Wüste Film, Film Five, CALA Film, Lupa Film, and Lieblingsfilm.

Impact Deals – September 2025

High-Impact Deals are a spotlight on significant deals and partnerships shaping the global entertainment ecosystem. This section focuses on a range of unique signals Vitrina has picked up in the last month, including innovative financing, new distribution models, and cross-industry collaborations that offer a glimpse into the evolving business of content.

- PBS KIDS Commissions Full Series of 39 half-hour episodes of Super Why’s Comic Book Adventures from 9 Story Media Group

PBS KIDS has commissioned a full, 39-episode series of Super Why’s Comic Book Adventures from 9 Story Media Group, with animation by Brown Bag Films, for an exclusive Fall 2026 U.S. premiere. This greenlight is a low-risk strategic move, justified by the original short-form content’s massive success (over 159 million streams), which helps de-risk the large investment in this proven literacy franchise. For PBS KIDS, the deal secures vital content for its digital platform strategy. For 9 Story, it provides a stable production pipeline for its studio while allowing them to keep global rights for distribution and merchandise, ensuring long-term revenue. This deal highlights a growing industry trend where platforms use the performance of short digital content as a required test before approving expensive, full-series commissions.

2. ReelShort Commissions First Canadian Microdrama, Adapting 1980s Bollywood Film

ReelShort is making a strategic investment by commissioning “The Billionaire’s Fake Wife,” a microdrama adapted from the 1980s Bollywood film Kissi Se Na Kehna. This move establishes a new production base in Vancouver with Service Street Pictures to achieve three goals: diversify its content supply by leveraging Canada’s incentives, reduce creative risk by adapting proven, well-known Bollywood content for romance viewers, and guarantee the continuous high-volume output needed for its mobile-first, freemium model. This deal validates the growing professionalism of the vertical drama sector, mirroring investments by competitors like Caracol Televisión and setting a clear precedent for traditional studios such as Lionsgate.

3. ITV Studios’ Zoo 55 Licenses Celebrity Talk and Docuseries Video Content to Spotify

The video licensing deal between ITV Studios’ Zoo 55 and Spotify is a strategic move that confirms the “vodcast” format is a profitable way to distribute premium, unscripted library content, such as The Graham Norton Show. This partnership allows ITV Studios to earn extra revenue and gain global reach by licensing specific video compilations to Spotify’s unique, non-traditional TV audience. This is a key example of how companies are now selling digital rights separately from standard TV or streaming deals. For Spotify, getting this well-known content is a cheap way to attract and keep subscribers by adding appealing video to its main audio platform. For the content owners, this deal shows that library assets are a reliable way to maintain digital engagement.

4. Sony Pictures Partners with Little Dot Studios to Launch Six German-Language YouTube Channels

Sony Pictures Entertainment Germany and Little Dot Studios have partnered for a Content Licensing and Channel Management deal to monetize the over 3,000 hours of library content (like Dawson’s Creek) in the DACH region. They are launching six genre-specific, ad-supported (AVOD) channels on YouTube. This move gives Sony a new revenue stream and hands over operations to a third party, while Little Dot gets access to valuable, premium digital ad space. This model is a reliable way to maintain audience engagement using stable library content. The deal shows a larger market trend where studios now rely on specialist vendors to quickly launch many local AVOD/FAST channels, forcing competitors to organize their catalogs and rapidly fill content gaps internationally.

5. ProSiebenSat.1/Disney+ Licensing Deal: Die Cooking Academy

The partnership for the 120-episode German daily series, Die Cooking Academy, is a Licensing/Cooperation agreement between ProSiebenSat.1 (Seller) and Disney+ (Buyer). The deal disrupts traditional release rules by giving Disney+ a co-exclusive premium streaming window that begins four days before the series airs for free on ProSieben. This approach allows ProSiebenSat.1 to monetize the most valuable window first to secure its investment, while Disney+ gains fresh, high-volume local content to boost subscriptions and ad-tier growth in the DACH region.

6. Delta Air Lines / YouTube In-Flight Entertainment Partnership

The deal between Delta and YouTube is a strategic partnership that turns in-flight entertainment (IFE) into a tool for customer loyalty. Delta licenses a specially curated, ad-free selection of YouTube creator content to meet the demand for contemporary short-form media. A crucial part of the deal is offering U.S. SkyMiles members a 14-day free trial of YouTube Premium. This directly links watching content with collecting valuable customer data and boosting loyalty program sign-ups. The move positions the Creator Economy as a core premium content option for airlines, changing IFE spending from a passive cost to an active strategy for acquiring high-value subscriber data.

7. Amazon Prime Video Solidifies 2026 French Slate with New Local Originals Commissions

Amazon Prime Video is accelerating its production of French original content for its 2026 slate, a move that goes beyond simply meeting local quotas. The core strategy is to secure market leadership through exclusive content. This aggressive, preemptive investment gives Prime Video a crucial competitive advantage, especially with the rival Netflix-TF1 content partnership set to begin in 2026. By building its own content pipeline, Prime Video creates a strong defense against market volatility and ensures it has the exclusive shows needed for both attracting and keeping subscribers in France’s highly competitive streaming market.

🎯 Vitrina Concierge — Your Virtual Agent for Industry Outreach

Finding the right financing, co-production, or commissioning partners can be harder than making the show itself. That’s where Vitrina Concierge steps in!

✨ Right companies. Right decision-makers. Right messaging.

👉 [ Explore Vitrina Concierge → ]

(Already trusted by Sony Pictures, Disney, Warner Bros. Discovery, Netflix, Globo, and more.)

Get In Touch with Vitrina Today:

-

- Feature your company and content announcements: Email us at updates@vitrina.ai

- Request production trends or competitive intel reports: Contact us at sales@vitrina.ai

Frequently Ask Questions

Yes, Vitrina provides buyers with direct access to the contact information of vendors. Our platform includes verified leadership and key decision-makers within vendor companies, along with their mapped departments, specializations, and accessible contact details.

The Vendor Reputation Rating on Vitrina is a comprehensive metric that incorporates various factors critical to buyers’ assessments of vendors, service providers, and suppliers. This rating is used by buyers to evaluate vendors’ qualifications and capabilities in the M&E supply chain. Vitrina’s Reputation Rating system provides buyers with valuable insights into vendors’ size, parentage, past work, quality of projects/clients, recency, specializations, strengths, and other factors that may affect the vendor’s suitability for the buyer’s project.

Yes, Vitrina can assist you in finding and shortlisting the ideal partners for your project. Our Partner-Finder team is experienced in running vendor recruitment and screening mandates that are specific to your needs. We can help you find the best vendors for your business by identifying niche and specialist companies in new markets. We stay up-to-date with the latest developments in the M&E supply chain, allowing us to continually identify and qualify the most innovative vendors. Additionally, our extensive network of storefront owners updates their latest projects, capabilities, and certifications on our platform. These sellers are highly engaged and active on our platform, allowing us to connect buyers with vendors who are best suited to meet their requirements. By working with Vitrina, you can access the latest solutions and expertise in Animation, Localization, VFX, Stages, Virtual Production, and gaming engines. Contact us today to learn more about how Vitrina can help you find the right vendors and partners for your business.

Vitrina is a private and exclusive business network designed for dealmakers in the Media and Entertainment (M&E) industry. Members are carefully screened to ensure they meet the network’s high standards for professionalism and integrity, and the platform is not open to the public or to search engines. This ensures that all information shared is kept confidential and private. Vitrina takes the privacy and confidentiality of its members very seriously and provides a secure platform for members to share valuable information and insights with a select group of vetted and verified buyers and sellers.