October 2025: Scripted Content drives a Diverse and Dynamic Month for Global Content Production

The global production landscape in October 2025 revealed a pronounced contrast in regional activity. While the Americas (+28%) and EMEA (+24%) posted double-digit growth driven by active slates from commissioners like Netflix, Hulu, BBC, and ARD, the APAC region experienced a contraction in volume. Despite these volume shifts, the market remained united in its focus on premium storytelling, with Scripted content dominating globally—capturing 80% share in the Americas and 84% in APAC—while Drama reigned as the number one genre across all territories.

Welcome to the latest edition of Vitrina’s global tracking of Film and TV production trends, providing insights across Movies and Feature Films, TV series, Animations, Documentaries, Scripted, and Unscripted projects.

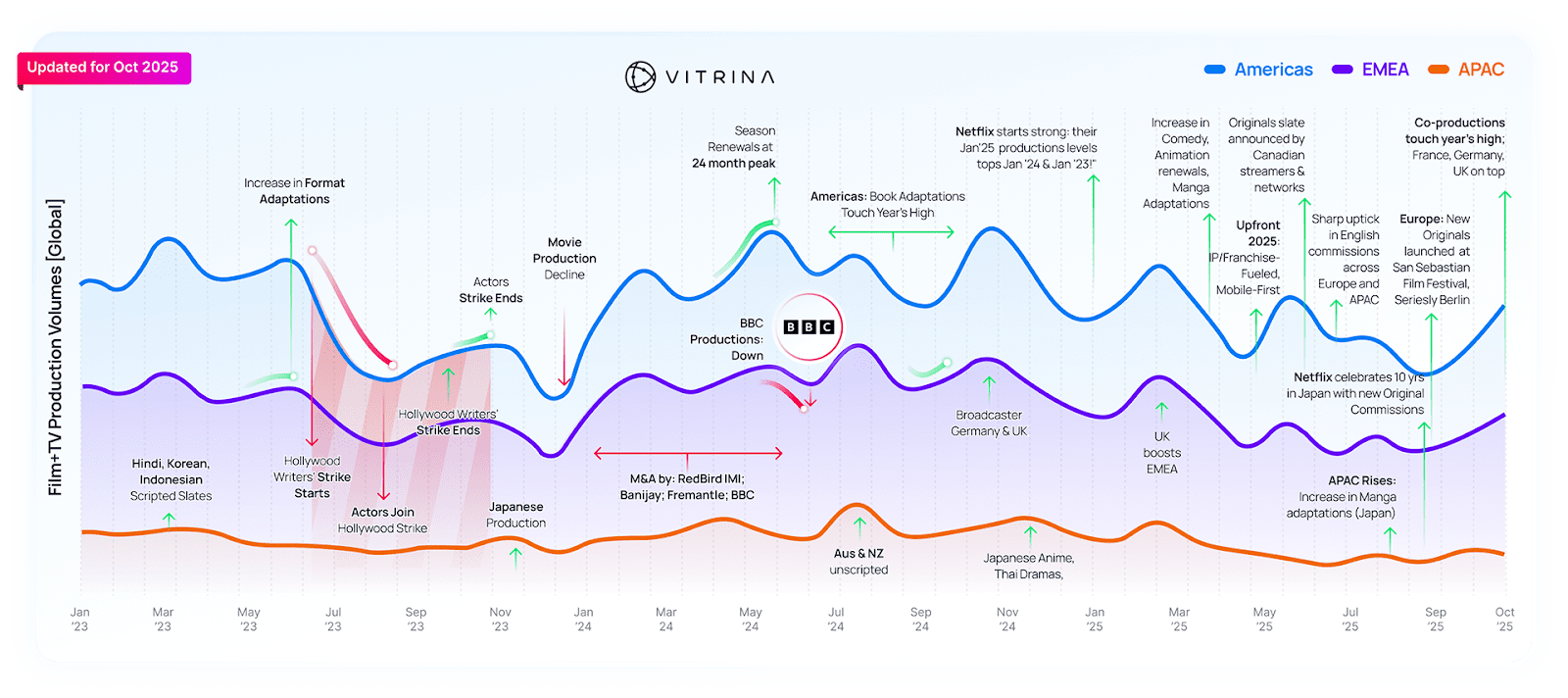

Before we dive into October 2025 metrics, let’s recap the key Film and TV production trends driving the industry over the last 2 years & 10 months.

Global Film & TV Production: Updated for October-2025

Source: Vitrina Daily Production Tracker. [X-Axis : Months starting from Jan 2023. Y-Axis Production Volumes : Production Volumes are the total number of projects greenlit or financed or commissioned in that month. Please note that this is an area chart – meaning that the regions are stacked one above the other with the full height of the chart representing the global production volume.

As is evident from the monthly trends monitored by Vitrina globally for Film+TV Productions that were commissioned, greenlit or financed – the last 3 years have been turbulent and eventful – to say the least! A quick summarized view would be:

2023: Marked by Hollywood strikes, which froze scripted productions in the US & UK, forcing many studios to pivot toward unscripted content and international markets to keep productions moving.

2024: A year of stabilization with no major peaks, but regional surprises—Japan, ANZ, Germany, and Brazil saw production spikes, while broadcasters continued scaling back commissioning amid shifting business models.

Jan–Oct 2025: The global production market saw distinct regional shifts from January to October 2025. After reaching a yearly high in May with a 40% rise in activity, trends diverged in the second half of the year. While Latin America slowed in Q2 and APAC saw a 60% drop in October, Western markets grew, with the Americas up 28% and EMEA up 24%. These production output shifts show the industry is adjusting its strategies, with financing now prioritizing efficiency and global appeal over volume growth

Insights on Production Transaction Volumes

October’ 25 vs. September’ 25

Methodology: Vitrina monitors unreleased or in-motion projects worldwide across all stages of the content lifecycle—development, production, post-production, and till release—on a daily basis. We track various transactions and deal activities related to content financing, commissioning, co-productions, green-lighting, as well as early stage (content development) and late stage (licensing) arrangements. These transactions between production houses, distributors, streamers, and broadcasters enable us to gain valuable insights into industry trends, key players, buyer behavior, and the specializations of production companies. Our monthly Film+TV productions chart serves as a bellwether of production financing and industry health.

Below are the key highlights for October 2025 Film+TV Production Volumes:

-

Americas — October 2025

-

Production activity increased by 28%

-

Scripted accounted for 80% of the slate

– Drama: 25%

– Comedy: 9% -

Language mix: English (78%), Portuguese (7%), Spanish (6%)

-

Most active commissioners: Netflix, Prime Video, Hulu, Globoplay, HGTV, Lifetime, Disney+, Apple TV+

-

Key studios involved: Amazon MGM Studios, Fox Entertainment, 3 Arts Entertainment, Apple Studios, 20th Television, Vertigo Entertainment

-

Primary growth driver: Surge in literary and graphic novel adaptations, especially in Horror and Fantasy

– Examples: Something is Killing the Children, The School for Wicked Witches, Calabasas, If You Lived Here You’d Be Famous By Now -

Major international partnerships:

– TV Globo × Fox Entertainment → English-language holiday films

– TV Globo × Gaumont → Deluxe (Documentary)

– TV Globo × BBC Studios → Amazon Rainforest docuseries

– Netflix × TF1 → The Count of Monte Cristo

– Netflix × Zola Filmes → Fúria

– Warner Bros. Discovery × CJ ENM

– El Reino Infantil × Mediawan Kids & Family

-

-

EMEA — October 2025

-

Production activity increased by 24%

-

Scripted vs. Unscripted: 63% Scripted | 37% Unscripted

-

Top genres: Drama (21%), Documentary (16%)

-

Top languages: English (44%), German (14%)

-

Most active commissioners: Channel 4, Netflix, BBC, ARD, Prime Video, ZDF, BBC Children’s & Education, ITV

-

Key studios: ARD Degeto, Amazon MGM Studios, BBC Studios, STV Studios, Banijay

-

Unscripted trend: Strong momentum in format adaptations, led by German and English-language versions

– Includes new versions of Taskmaster (Netherlands, Iceland), The Traitors (Turkey), and Come Dine With Me (France/Africa)

– Regional format examples: The Other Side of the Table (Spain), Shaolin Heroes (Switzerland) -

Co-production activity: Notable rise driven by Drama (33%) and Documentary (23%)

– Large multi-broadcaster coalition (NTR, Channel 4, Arte, WDR) → David Bowie: The Final Act

– Natural History highlights:

• BBC Studios NHU × PBS + WNET → Tiger Island

• BBC Studios NHU × Passion Pictures → Wild London

-

-

APAC — October 2025

-

Overall production volume declined during the month

-

Scripted accounted for 84% of total activity

– Drama: 23%

– Documentary: 10% -

Top languages: English (24%), Japanese (17%)

-

Active commissioners: Channel 9, Netflix, Kadokawa, Stan, Prime Video

-

Category showing resilience: Manga and Graphic Novel adaptations

– Japanese productions dominated with 71% share

– Korean titles followed with 14%

– Focus genres: Fantasy, Isekai, Animation

– Sample titles: Hell Mode, The Easygoing Lord’s Fun Territory, Kujo no Taizai

– Kadokawa led the segment alongside commissions from NBCUniversal Entertainment Japan and TBS Television -

Cross-regional collaboration: South Korean studios (Hive Media, DR Movie) worked with Australian counterparts (Glitch Productions)

-

Stay ahead of the competition by tracking the latest production trends and market moves.

Global Entertainment Leaders Speak

Blink49 Studios: The Future of Branded Entertainment

The October Commissioning Slates of Top Players: Franchise Focus vs. Factual Content

Netflix — October 2025 Commissioning Strategy

Strategic Focus: “Brand-defining IP” supported by elite creative partnerships.

• Prioritized high-value, high-recognition properties

– Literary adaptations: The Great Gatsby, The Count of Monte Cristo

– Gaming adaptations: CATAN, Crash Bandicoot

• Approach anchored in IP-first commissioning to drive global brand equity

• Partnerships aligned with top-tier suppliers

– A24, Plan B, Media Res, Sony Pictures Television

• Parallel investment in original content to maintain global relevance

– US originals: The In-Claus (Lord Miller)

– South Korea: The Dealer, Made in Korea

– Europe: Paria, Furia

Outcome: A slate balancing prestige franchises with broad-appeal originals across key markets.

Prime Video — October 2025 Slate

Strategic Focus: Franchise expansion, renewals, and international unscripted formats.

• Major franchise-driven greenlights

– Spaceballs 2

– Pacific Rim (prequel)

• Priority renewal

– Fallout Season 2 (global tentpole)

• Consolidation of creative pipelines via Amazon MGM Studios and production partners

– Notably Legendary and Gaumont

• Unscripted strategy built around proven formats for local acquisition and retention

– The Traitors Türkiye

– I Kissed a Boy (Norway adaptation)

Outcome: A mix of high-budget global franchises and targeted local unscripted to drive both scale and retention.

Channel 4 — October 2025 Slate

Strategic Focus: Talent-fronted factual formats, specialist factual, and refreshed legacy brands.

• Celebrity-led factual anchors

– Ben Fogle, Lorraine Kelly

• Specialist factual with high editorial stakes

– Hitler’s DNA (Blink Films)

• Commissioning aligned with commercial appetite for wealth & consumer themes

– Dual commissions to Crackit Productions

• Revitalizing legacy IP for younger demos

– Come Dine With Me: Teens (Multistory Media)

• Continued support for international hit formats

– SAS Australia

Outcome: Personality-driven factual, commercial factual, and refreshed hits to reinforce broad primetime appeal.

BBC — October 2025 Slate

Strategic Focus: Stability, event television, and trusted returning formats.

• Multi-season renewals of heritage properties

– The Graham Norton Show (So Television)

– Fake or Fortune? (BBC Studios)

• Expanded commitment to celebrity-centered entertainment

– The Apprentice specials

– Celebrity Bridge of Lies (STV Studios)

• Strengthening daytime and family programming

– Returning titles: Shakespeare & Hathaway

– Major event content: Doctor Who Christmas Special and Pablo: Next Level

Outcome: Commissioning centered around predictability, audience loyalty, and high-visibility tentpole moments.

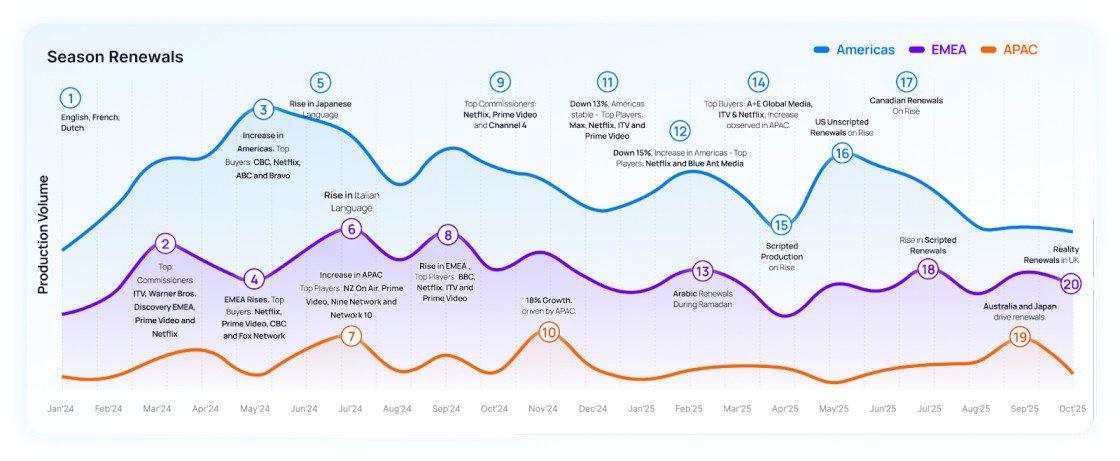

October 2025 Season Renewals Trends:

Season renewals remain a key strategy for streamers and broadcasters, ensuring continuity in content pipelines, sustaining viewer loyalty, and reducing the risks of launching new projects.

Source: Vitrina Daily Production Tracker. Please note that this is an area chart – meaning that the regions are stacked one above the other with the full height of the chart representing the global production volume….

Global Markets — October 2025 Commissioning Trend

Returning Franchises Outperform Originals Across Major Markets

- Global commissioning leaned toward renewals and franchise continuity, rather than new IP launches.

- The trend was most pronounced in Americas and EMEA:

– Renewals up 33% in EMEA

– Renewals up 21% in the Americas - APAC moved in the opposite direction, recording a 60% contraction in renewal activity.

Content Strategy Breakdown:

- Scripted titles remained foundational, accounting for 53% of total commissioning.

- Unscripted formats rose sharply to 47%, signaling demand for efficient, retention-focused programming.– Top genres for the month:

– Reality: 21%

– Comedy: 14% - English-language productions held 66% share of the global slate, reinforcing demand for widely exportable content.

Commissioner & Partnership Focus:

- Major global streamers and broadcasters aligned behind a proven IP strategy, favoring familiarity over experimentation.

– Includes Netflix, Prime Video, and Warner Bros. Discovery

– Supported by public broadcasters such as BBC and ITV - Key studios and suppliers advancing renewal-led commissioning pipelines included:

– STV Studios

– EndemolShine Australia

Monitor season renewals and adjust your strategy with live insights.

IP Adaptations Trends in October 2025:

This section provides a review of IP Adaptation deals announced in October, and = specifically covers Book Adaptations and Game Adaptations.

Book Adaptations — Market Overview

- October reflected strong demand for established literary IP, with clear polarization across two clusters:

– Children’s Fantasy Series (e.g., Dragon Girls, The School for Wicked Witches)

– High-concept Horror and Thriller (e.g., Black Hole, A Head Full of Ghosts) - Publishers and rights holders benefited from a global acquisition strategy, as buyers sourced non-English titles from Brazil, France, and Germany in addition to traditional US/UK markets.

- Netflix was the most active buyer, prioritizing high-prestige and globally recognizable properties:

– Major literary classics: The Great Gatsby, The Count of Monte Cristo

– Graphic novel acquisitions to anchor future franchise development - Takeaway: Premium streamers continue to treat book-based IP as a shortcut to built-in audiences and long-form franchise potential.

Game Adaptations — Market Overview

- The October slate featured a diverse mix of IP categories migrating to screen, including video games, board games, and viral puzzle platforms.

- Netflix led commissioning activity, building a multi-format and multi-genre pipeline:

– Catan → Film + Series franchise

– Crash Bandicoot → Animated series

– Clue → Animated series - Secondary trend: nostalgic and niche IP gaining traction

– Immaculate Grid adaptation (Religion of Sports)

– Backyard Baseball (Playground Production) - On the theatrical side, horror continues to leverage indie gaming communities:

– Finding Frankie (13 Films) in development - Warner Bros. sustained long-term franchise world-building

– Expansion of the Mortal Kombat universe - Takeaway: Game-based IP is evolving beyond single-title adaptations into multi-format, cross-platform franchise ecosystems, with nostalgia now joining AAA titles as a driver of commissioning.

Curious how Vitrina can help you? Try it out today!

Most Active Film Commissions in October 2025

Financing by Industry Bodies -October’25 was mainly driven by Associations / Industry commissions from Germany

| Sr. No | Association/Industry Commission | Location |

| 1 | Mitteldeutsche Medienförderung (MDM) | Germany |

| 2 | Filmförderungsanstalt | Germany |

| 3 | Film- und Medienstiftung NRW GmbH | Germany |

| 4 | Netherlands Film Production Incentive | Netherlands |

| 5 | HessenFilm und Medien | Germany |

- Mitteldeutsche Medienförderung (MDM) deployed significant capital across the content lifecycle, balancing early-stage IP incubation with major production financing. The body awarded high-value production grants to premium projects like the drama About People (Lucky Bird Pictures, €750k) and the documentary Die Tiedge Files (Avanga Filmproduktion, €290k). Simultaneously, MDM fueled the development pipeline with numerous targeted grants (€25k–€60k) for companies such as Black Mary Films, Neue Bioskop Film, and Tellux Film, supporting a diverse genre mix spanning Comedy, Animation, Horror, and Political Documentary.

- Filmförderungsanstalt (FFA) executed a robust dual-track funding strategy in October 2025, combining substantial capital injections for high-end production with widespread support for early-stage IP. The body heavily favored Animation, awarding its largest grants to family-focused projects like Mimi & Harold – Out of Frame (Ulysses Filmproduktion, €780k) and No One Stops Don Carlo (Zeitgeist Filmproduktion, €750k). On the live-action front, FFA backed major dramas and biographies, including a €500k grant for ROLAND (Hellinger / Doll) and Don’t Be A Stranger (Kundschafter Filmproduktion). Simultaneously, the agency nurtured a diverse development pipeline, issuing numerous €40k grants to emerging voices like Fabian & Fred and Seera Films across drama, documentary, and fantasy genres.

- Film- und Medienstiftung NRW GmbH prioritized the incubation of diverse, genre-bending IP, deploying capital across a wide spectrum of development stages. The fund backed substantial narrative projects, awarding its largest grants to the drama About Mrs. Schmidt’s Neighbors (Eitel Sonnenschein, €100k) and the mystery-thriller The Last Tears of the Deceased (Die Gesellschaft DGS, €80k). Simultaneously, NRW demonstrated a strong commitment to experimental formats, funding multiple Animation/Documentary hybrids like Space and Vogelfrei, alongside fantasy titles such as The House on the Moon (Weydemann Bros, €60k).

- Netherlands Film Production Incentive directed significant capital toward high-budget co-productions and diverse genre features. The fund awarded its top tier grants to the action film Scrumple (Stellar Film / Lemming Film, €878k) and the drama Late Bloomer (Hazazah Pictures, €668k). The slate balanced commercial ambition—supporting the thriller Patsers for Life (Fiction Valley, €470k)—with a steady commitment to documentary storytelling through projects like Case Nathalie and Baseball Island. Notably, Family Affair Films demonstrated strong momentum, securing dual grants for the family drama Kimchi & Potatoes and the comedy Heartbreak for Beginners.

- HessenFilm und Medien focused its funding on a mix of narrative depth and regional storytelling, deploying capital across diverse genres. The fund awarded a significant €120k production grant to Port au Prince and Tatami Films for the drama Blackbird, underscoring its commitment to high-quality scripted features. Simultaneously, the body supported documentary and niche projects, granting €90k to Grandfilm and Socavón Cine for Lost Songs and backing Raumkapsel with €40k for the animation Caterpillars and Ruins. The slate also included targeted development support for historical and political themes, evidenced by the grant for Chronicle in Stone (Enkelejd Lluca).

Impact Deals – October 2025

High-Impact Deals are a spotlight on significant deals and partnerships shaping the global entertainment ecosystem. This section focuses on a range of unique signals Vitrina has picked up in the last month, including innovative financing, new distribution models, and cross-industry collaborations that offer a glimpse into the evolving business of content.

M&A Spotlight: Disney & Fubo Create a vMVPD Giant

In a major consolidation move, Disney (70%) and Fubo (30%) have formed a strategic Joint Venture to combine Hulu + Live TV with Fubo’s platform. This deal creates a powerful new entity with approximately 6 million subscribers, instantly securing the position of the #2 vMVPD in North America. The explicit goal of this combination is to achieve the scale necessary to compete head-to-head with YouTube TV, challenging its dominance in the live streaming TV market.

This transaction impacts the distribution supply chain by ending the fragmentation of the vMVPD market and establishing a clear Google vs. Disney duopoly. By creating a second “must-have” distributor, Disney significantly increases its leverage to reduce programming costs and dictate terms with upstream content suppliers. Furthermore, the consolidated scale creates a unified advertising platform capable of competing directly with Google for high-value live sports and linear ad revenue.

Strategic Partnership: Bell Media & Tubi Unite on Ads & Content

In a comprehensive strategic pact, Bell Media becomes the sole ad sales representative for Tubi in Canada, gaining access to a high-growth, younger audience -skewing inventory. In return, Bell will license its extensive Canadian library and FAST channels (e.g., CTV News, Corner Gas) to Tubi’s platform, effectively reaching “cord-never” audiences. Beyond distribution, the deal establishes a Global Co-Pro Pipeline, where both parties will co-fund original content, ensuring Bell’s productions have a built-in global partner from day one.

This partnership centralizes the Canadian advertising supply chain by consolidating premium video inventory, allowing advertisers to buy Tubi placements directly through their existing Bell Media accounts. On the production side, it creates a streamlined “New Content Pipeline” that solves a critical financing challenge: Canadian projects can now be funded and distributed simultaneously, securing a clear domestic window via Bell and an immediate global platform via Tubi.

Strategic Pivot: Inter Medya Enters the MicroDrama Market

Turkish company, Inter Medya is the new entrant in the vertical drama sector, and has adopted a hybrid content strategy that combines original production with third-party acquisitions to build a mobile-first catalog. This move is a calculated response to a high-growth market—forecast to reach $26 billion by 2030—positioning the company to compete with vertical-first disruptors like COL Group’s ReelShort.

This transforms Inter Medya from a pure distributor into a hybrid producer-distributor, adding a high-volume, “factory-like” production layer for mobile content. By adopting a B2B “Premium Supplier” model (avoiding D2C risk), the company establishes a dual-track sales pipeline: supplying continuous content to vertical apps while simultaneously upselling these short-form series to traditional broadcast and SVOD clients as tools to engage younger audiences on digital platforms.

Strategic Consolidation: Banijay Asia Secures Exclusive Talpa Rights

In a major consolidation play for the Asian unscripted market, Banijay Asia has entered an exclusive two-year strategic agreement with Talpa Studios, securing sole rights to represent, license, and produce Talpa’s entire format catalogue across India and Thailand. The deal covers all distribution windows—linear, SVOD, and AVOD—and grants Banijay control over global heavyweights like The Voice alongside rapidly growing new IPs such as The Floor and The Quiz with Balls.

This agreement establishes a Centralized Hub for unscripted formats in the region, effectively creating an “exclusive funnel” where all broadcasters and streamers must route through Banijay Asia to access Talpa’s IP. By folding Talpa’s assets into its existing portfolio (which already houses Endemol Shine), Banijay significantly strengthens its market leverage, offering platforms a simplified, single-vendor buying process while cementing its dominance in the high-value reality and game show sector.

How the Industry Uses Vitrina

Vitrina For VFX and Post Companies:

Vitrina is helping VFX companies like PhantomFX, Crafty Apes, and Light Iron discover and secure new Film & TV projects by tracking unreleased productions across development, production, and post. With deep intel on production companies, crew-heads, and decision-makers—plus direct contact details—VFX teams can reconnect with past collaborators, pitch at the right time, and expand their network of high-potential leads. It’s smart, targeted business development made easy.

Vitrina For Production Companies & Indies:

Vitrina empowers production companies and indie creators to find the right financing and commissioning partners—globally. From early-stage tracking of co-production-friendly projects to surfacing the latest deals and investment themes, Vitrina helps match projects with relevant financiers, commissioners, and collaborators. With up-to-date preferences and verified contacts, creators can focus on pitching to the right people—saving time and increasing chances of success.

Vitrina For Streamers:

Streamers use Vitrina to navigate the global content supply-chain with clarity. By tracking unreleased slates, mapping competitive activity, and identifying trending genres, formats, and territories, Vitrina equips content and strategy teams with the intel to make proactive moves—whether it’s preemptive pre-buys, co-production deals, or vendor discovery. With insights drawn from markets like LATAM, APAC, and Europe, Vitrina helps streamers stay ahead of content trends and competitors alike.

Get In Touch with Vitrina Today:

-

- Feature your company and content announcements: Email us at updates@vitrina.ai

- Request production trends or competitive intel reports: Contact us at sales@vitrina.ai

Frequently Ask Questions

Yes, Vitrina provides buyers with direct access to the contact information of vendors. Our platform includes verified leadership and key decision-makers within vendor companies, along with their mapped departments, specializations, and accessible contact details.

The Vendor Reputation Rating on Vitrina is a comprehensive metric that incorporates various factors critical to buyers’ assessments of vendors, service providers, and suppliers. This rating is used by buyers to evaluate vendors’ qualifications and capabilities in the M&E supply chain. Vitrina’s Reputation Rating system provides buyers with valuable insights into vendors’ size, parentage, past work, quality of projects/clients, recency, specializations, strengths, and other factors that may affect the vendor’s suitability for the buyer’s project.

Yes, Vitrina can assist you in finding and shortlisting the ideal partners for your project. Our Partner-Finder team is experienced in running vendor recruitment and screening mandates that are specific to your needs. We can help you find the best vendors for your business by identifying niche and specialist companies in new markets. We stay up-to-date with the latest developments in the M&E supply chain, allowing us to continually identify and qualify the most innovative vendors. Additionally, our extensive network of storefront owners updates their latest projects, capabilities, and certifications on our platform. These sellers are highly engaged and active on our platform, allowing us to connect buyers with vendors who are best suited to meet their requirements. By working with Vitrina, you can access the latest solutions and expertise in Animation, Localization, VFX, Stages, Virtual Production, and gaming engines. Contact us today to learn more about how Vitrina can help you find the right vendors and partners for your business.

Vitrina is a private and exclusive business network designed for dealmakers in the Media and Entertainment (M&E) industry. Members are carefully screened to ensure they meet the network’s high standards for professionalism and integrity, and the platform is not open to the public or to search engines. This ensures that all information shared is kept confidential and private. Vitrina takes the privacy and confidentiality of its members very seriously and provides a secure platform for members to share valuable information and insights with a select group of vetted and verified buyers and sellers.