July 2025: APAC & EMEA Growth Fuels Uptick in Global Productions

July ’25 recorded an uplift in production activity across both EMEA and APAC, helping balance a quieter month in the Americas. In EMEA, the leaderboard welcomed new entrants and saw German-language content gain momentum, alongside steady dominance of drama and growth in reality formats. APAC’s rise was fueled by expanding language diversity, with Hindi and Malayalam making strong inroads, while animation and action increased their share. In both regions, scripted productions maintained a commanding lead, reinforcing the global appetite for narrative-driven content even as language and genre profiles continue to diversify.

Welcome to the latest edition of Vitrina’s global tracking of Film and TV production trends, providing insights across Movies and Feature Films, TV series, Animations, Documentaries, Scripted, and Unscripted projects.

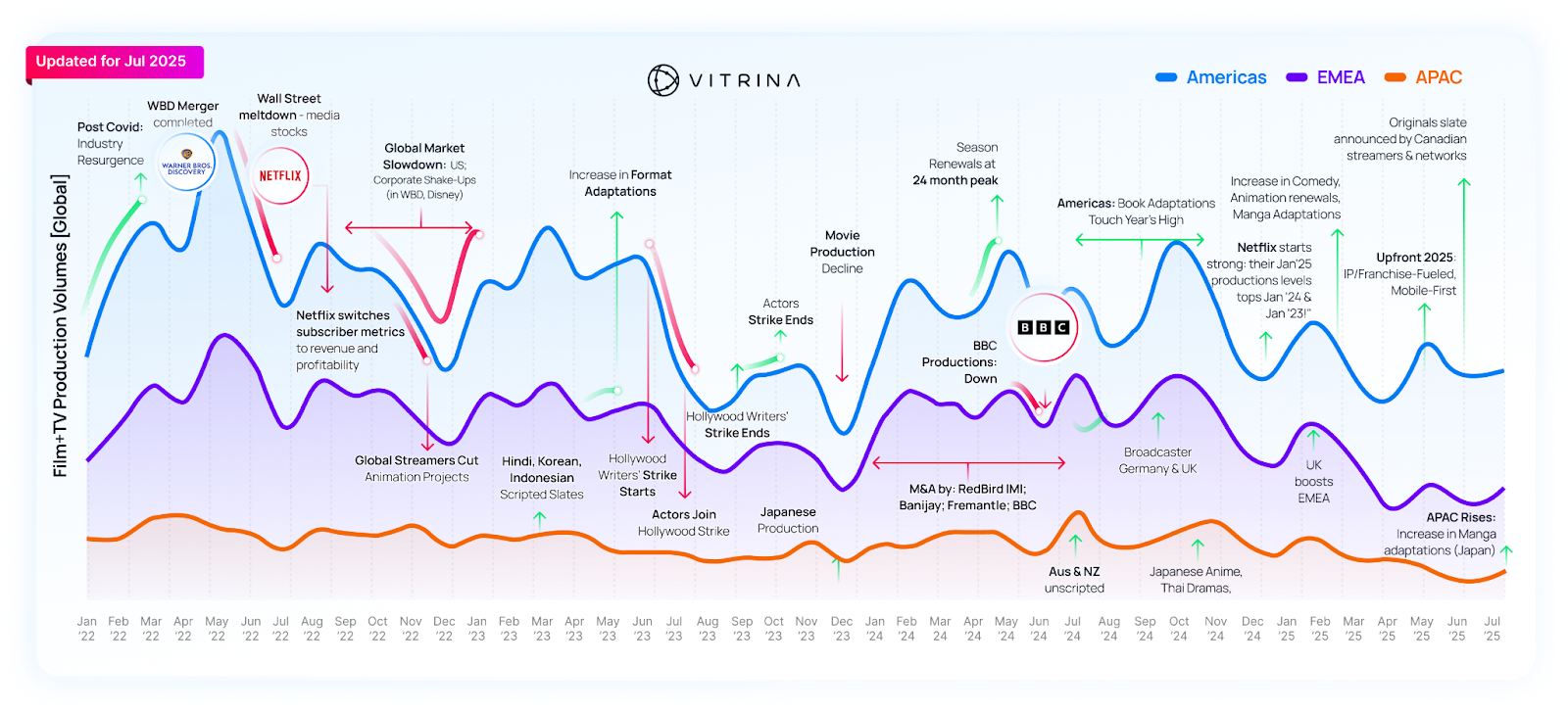

Before we dive into July 2025 metrics, let’s recap the key Film and TV production trends driving the industry over the last 3 years & 4 months.

Global Film & TV Production: Updated for July-2025

Source: Vitrina Daily Production Tracker. [X-Axis : Months starting from Jan 2021. Y-Axis Production Volumes : Production Volumes are the total number of projects greenlit or financed or commissioned in that month.

As is evident from the monthly trends monitored by Vitrina globally for Film+TV Productions that were commissioned, greenlit or financed – the last 3 years have been turbulent and eventful – to say the least! A quick summarized view would be:

2022: A year of extremes—an early-year “revenge production financing” surge fueled by post-COVID recoveries, followed by a sharp market correction on Wall Street’s market-cap reset for entertainment companies, leading to widespread budget tightening.

2023: Marked by Hollywood strikes, which froze scripted productions in the US & UK, forcing many studios to pivot toward unscripted content and international markets to keep productions moving.

2024: A year of stabilization with no major peaks, but regional surprises—Japan, ANZ, Germany, and Brazil saw production spikes, while broadcasters continued scaling back commissioning amid shifting business models.

Jan–July 2025: Early 2025 shows signs of divergence in regional momentum. Europe is proving more resilient, with production activity heating up and a clear surge sustained over the last three quarters—highlighted by a February spike in the UK driven by screenings and Upfronts that boosted announced slates. The gap between Americas and Europe has narrowed, as US production remains comparatively subdued. However, Canada emerged as an exception in this period, with significant activity in June—driven in part by companies converging for Upfront events and bolstering their originals slate. Compared to Jun’25, Netflix emerged as the leader in Jul’25 commissioning new projects

Insights on Production Transaction Volumes

July’ 25 vs. June’ 25

Methodology: Vitrina monitors projects worldwide across all stages of the content lifecycle—development, production, post-production, and release—on a daily basis. We track various transactions and deal activities related to content financing, commissioning, co-productions, green-lighting, as well as early stage (content development) and late stage (licensing). These transactions between production houses, distributors, streamers, and broadcasters enable us to gain valuable insights into industry trends, key players, buyer behavior, and the specializations of production companies. Our monthly Film+TV productions chart serves as a bellwether of production financing and industry health.

Below are the key highlights for July Film+TV Production Volumes:

- Global Production Trends:Production activity saw a modest lift from last month, with APAC and EMEA driving the momentum. Graphic novel adaptations emerged as a growing category, adding creative variety to global slates.

- Scripted content edged up from 77% to 78% share of all tracked productions.

- Regional Highlights (comparing Jun ’25 vs. Jul ’25):

-

- EMEA: +7% growth, reflecting strong commissioning activity across multiple markets.

- APAC: +33% increase, powered by both emerging and established production hubs.

- Americas: Slight decline, influenced by slower greenlights in certain key markets.

- Gains in APAC and EMEA more than offset the softness in the Americas, keeping global output on a modest upward trajectory.

- Genre and Language Trends: Between Jun ’25 and Jul ’25, English-language productions dropped from 58% to 49% of total output, while German and Spanish titles both rose to 7%, reflecting an uptick in non-English commissioning. Scripted content inched up from 77% to 78%, while Unscripted declined from 23% to 22%, indicating a continued preference for narrative-led formats.

- Top Players Overall: In July ’25, Netflix moved to the top position, overtaking Prime Video, which slipped to second place. Channel 4 rose sharply into the top three, while several Canadian players from the previous month, including Crave, CBC, and Bell Media, dropped out entirely from the Top-5. The month also saw a wave of new entrants not present in June’s leaderboard —ZDF, Channel 5, Hulu, Lifetime, NTV Mir

Within AMERICAS: July saw Netflix move into the top position, pushing Prime Video to second place, while Disney+ secured a spot in the top three. Hulu and Apple TV+ entered the leaderboard alongside Hallmark Channel, replacing Canadian companies like Crave, CBC, and Bell Media.

Language trends shifted toward greater diversity, with English declining slightly while Spanish and Portuguese gained share. Comedy grew in prominence, edging ahead of documentary, while thriller made an appearance in the genre mix. Scripted content strengthened its lead, increasing its share by two points, reinforcing the region’s preference for narrative-driven productions despite a softer overall output.

Within EMEA: Productions increased in July’25 by 7%. July saw Netflix climb to the top position, with Prime Video moving down to third (was leader in Jun’25) and Channel 4 securing the second place. UKTV and Channel 5 joined the leaderboard, replacing Warner Bros. Discovery EMEA and RTVE from the previous month.

Language share shifted notably toward German, which made strong gains, while English saw a slight decline. Drama remained the dominant genre, with incremental growth, while Reality rose to overtake Comedy and Documentary. The Scripted-to-Unscripted split held steady, underscoring the region’s consistent preference for scripted formats.

Within APAC: Productions increased in July’25 by 33% vs. Jun ’25. July’s activity in APAC reflected a shift in both language and genre dynamics. Japanese maintained its lead, while English saw a noticeable drop in share as Hindi gained ground. Drama’s share declined, with Animation and Action gaining prominence. Scripted formats remained overwhelmingly dominant, though with a slight dip compared to June.

Stay ahead of the competition by tracking the latest production trends and market moves.

Global Entertainment Leaders Speak

Inside Zixi: Marc Aldrich on Redefining Live Video Delivery

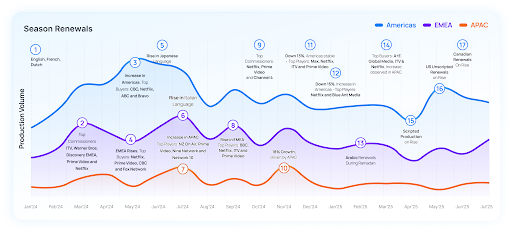

July 2025 Season Renewals: Shifting Dynamics Across Regions

Season renewals (TV Series, Formats, Animation Series, Docuseries) have been a cornerstone for both streamers and broadcasters, offering a reliable strategy for sustaining viewer engagement and ensuring operational stability across production and post-production. By securing ongoing content pipelines, renewals help streamline workflows, optimize resource allocation, and minimize the risks associated with launching entirely new projects. This continuity not only strengthens audience loyalty but also enhances efficiency across the entire content supply chain.

Source: Vitrina Daily Production Tracker. Please note that this is an area chart – meaning that the regions are stacked one above the other with the full height of the chart representing the global production volume….

Regional Insights – July 2025

Americas:

-

Season renewals in the Americas were led by Netflix, Prime Video, and Apple TV+. Genres spanned a wide range, with Drama remaining central while Reality kept unscripted formats firmly in play. Activity reflected a focus on sustaining established hits while balancing narrative-led and format-based programming.

Notable season renewals in July ’25 included:

-

Fake Profile (Season 3), Eva Lasting (Season 4), Selling Sunset (Season 9), and The Ultimatum: Marry or Move On (Season 4) – Netflix

-

The Legend of Vox Machina (Season 5) and Mr. & Mrs. Smith (Season 2) – Prime Video

-

Pluribus (Season 2) – Apple TV+

-

EMEA:

-

Season renewals in EMEA rose by more than 40% versus June, with English-language titles leading at 47%, followed by Russian (17%) and German (14%). French and other languages accounted for the remainder. Drama held the top genre share (21%), with Reality overtaking Comedy. Scripted formats continued to dominate over Unscripted at 62% to 38%.

-

On the commissioner side, UKTV (part of BBC) led renewals, with Prime Video, Channel 4, Netflix, and BBC also active.

Key renewals in July ’25 included:

-

Made in Chelsea (Season 30) and I Am… (Season 4) – Channel 4

-

Freddie Flintoff’s Field of Dreams (Season 3) and SOS: Extreme Rescues (Season 2) – BBC

-

Stranger Sins (Season 3) – RTL+

-

APAC:

-

Language share in APAC was split evenly between Hindi and Japanese (29% each), followed by English (20%) and Korean (8%). Drama, Reality, and Animation remained strong, while Comedy and Action & Adventure added further genre depth. Scripted formats represented two-thirds of renewals, with Unscripted maintaining a substantial one-third share.

-

Prime Video and Netflix drove most renewals in the region.

Highlighted renewals in July ’25 included:

-

Khauf, Gram Chikitsalay, Panchayat, Inspector Rishi, Four More Shots Please! – Prime Video

-

Kian’s Bizarre B&B and Cyberpunk: Edgerunners – Netflix

-

The Chase Australia (Season 15) – Seven Network

-

Black Clover (Season 2) – Crunchyroll

-

Monitor season renewals and adjust your strategy with live insights.

Most Active Film Commissions in Year 2025 (Till July’25)

Film commissions have become increasingly strategic players in the entertainment industry, stepping up efforts to attract productions, nurture local talent, and secure investments across filming, production, post-production, and animation. Their proactive initiatives have fueled regional economic growth, strengthened creative ecosystems, and fostered high-impact industry collaborations.

Several film commissions—along with national entertainment bodies and ministries of culture, communication, and commerce—have intensified their activities to support production. Governments worldwide are deploying aggressive measures to drive employment, support early-stage projects, and empower emerging content creators. To remain competitive and attract international productions, they have revamped tax incentive structures, introduced cash grants, expanded cashback schemes, and rolled out new tax breaks. Additionally, major trade events and strategic partnerships have been leveraged to position their markets as premier global production hubs.

Curious how Vitrina can help you? Try it out today!

Financing by Industry Bodies – Jan’25 – July’25

Let’s explore the key film commissions that are making a decisive impact on the industry today.

| Sr. No | Association/Industry Commission | Location |

| 1 | Société de Développement des Entreprises Culturelles | Montreal, Canada |

| 2 | Medienboard Berlin-Brandenburg | Germany |

| 3 | Doha Film Institute | Qatar |

| 4 | Screen Australia | Sydney, Australia |

| 5 | Filmförderungsanstalt | Berlin, Germany |

| 6 | Ministry of Culture and Film Industry Subcommittee | Thailand |

| 7 | Thailand Creative Culture Agency | Thailand |

| 8 | CNC | France |

| 9 | Canada Media Fund | Canada |

| 10 | FilmFernsehFonds Bayern | Munich, Germany |

Vitrina Spotlight: Film+TV Projects in Production / Planned Stage

152 New Projects

Announced Last Week! – across production financing, greenlit and season renewals.

Quick Market Snapshot:

20+ Production Financing and 15+ Season Renewals are announced overall. Major players – NZ On Air (New Zealand) , Warner Bros. (UK), Three (TV3) and Disney Branded Television (USA)

Americas: 40+ new productions including 9 season renewals, Top players – Disney Branded Television and Netflix. Top languages – English, followed by Spanish. Drama, Comedy and Animation top the genre mix. 84% were scripted projects and 16% UnScripted

Explore More Projects [Americas]..

EMEA: 35+ Production deals announced including 7 projects – Production financing. Top Players – ITV and Warner Bros. International Television Production. 61% Scripted, 39% UnScripted. 26% Drama and 17% Reality projects.

APAC: 30+ new productions. NZ On Air announced 14 production financing deals. 10 new season renewals. Documentary, Reality, Drama and Comedy tops the chart with 32% Scripted and 68% UnScripted

How the Industry Uses Vitrina

Vitrina For VFX and Post Companies:

Vitrina is helping VFX companies like PhantomFX, Crafty Apes, and Light Iron discover and secure new Film & TV projects by tracking unreleased productions across development, production, and post. With deep intel on production companies, crew-heads, and decision-makers—plus direct contact details—VFX teams can reconnect with past collaborators, pitch at the right time, and expand their network of high-potential leads. It’s smart, targeted business development made easy.

Vitrina For Production Companies & Indies:

Vitrina empowers production companies and indie creators to find the right financing and commissioning partners—globally. From early-stage tracking of co-production-friendly projects to surfacing the latest deals and investment themes, Vitrina helps match projects with relevant financiers, commissioners, and collaborators. With up-to-date preferences and verified contacts, creators can focus on pitching to the right people—saving time and increasing chances of success.

Vitrina For Streamers:

Streamers use Vitrina to navigate the global content supply-chain with clarity. By tracking unreleased slates, mapping competitive activity, and identifying trending genres, formats, and territories, Vitrina equips content and strategy teams with the intel to make proactive moves—whether it’s preemptive pre-buys, co-production deals, or vendor discovery. With insights drawn from markets like LATAM, APAC, and Europe, Vitrina helps streamers stay ahead of content trends and competitors alike.

Get In Touch with Vitrina Today:

-

- Feature your company and content announcements: Email us at updates@vitrina.ai

- Request production trends or competitive intel reports: Contact us at sales@vitrina.ai

Frequently Ask Questions

Yes, Vitrina provides buyers with direct access to the contact information of vendors. Our platform includes verified leadership and key decision-makers within vendor companies, along with their mapped departments, specializations, and accessible contact details.

The Vendor Reputation Rating on Vitrina is a comprehensive metric that incorporates various factors critical to buyers’ assessments of vendors, service providers, and suppliers. This rating is used by buyers to evaluate vendors’ qualifications and capabilities in the M&E supply chain. Vitrina’s Reputation Rating system provides buyers with valuable insights into vendors’ size, parentage, past work, quality of projects/clients, recency, specializations, strengths, and other factors that may affect the vendor’s suitability for the buyer’s project.

Yes, Vitrina can assist you in finding and shortlisting the ideal partners for your project. Our Partner-Finder team is experienced in running vendor recruitment and screening mandates that are specific to your needs. We can help you find the best vendors for your business by identifying niche and specialist companies in new markets. We stay up-to-date with the latest developments in the M&E supply chain, allowing us to continually identify and qualify the most innovative vendors. Additionally, our extensive network of storefront owners updates their latest projects, capabilities, and certifications on our platform. These sellers are highly engaged and active on our platform, allowing us to connect buyers with vendors who are best suited to meet their requirements. By working with Vitrina, you can access the latest solutions and expertise in Animation, Localization, VFX, Stages, Virtual Production, and gaming engines. Contact us today to learn more about how Vitrina can help you find the right vendors and partners for your business.

Vitrina is a private and exclusive business network designed for dealmakers in the Media and Entertainment (M&E) industry. Members are carefully screened to ensure they meet the network’s high standards for professionalism and integrity, and the platform is not open to the public or to search engines. This ensures that all information shared is kept confidential and private. Vitrina takes the privacy and confidentiality of its members very seriously and provides a secure platform for members to share valuable information and insights with a select group of vetted and verified buyers and sellers.