August 2025: A Diverse and Dynamic Month for Global Content Production

August 2025 showcased a dynamic and diverse global content landscape, with distinct commissioning patterns emerging across key regions. The Americas saw scripted drama take the lead, supported by strong, long-term studio deals, while the EMEA region held steady with regional broadcasters like ITV gaining prominence. In the APAC region, English-language productions saw a boost driven by Australian and New Zealand (ANZ) broadcasters, and unscripted formats grew more prominent.

Welcome to the latest edition of Vitrina’s global tracking of Film and TV production trends, providing insights across Movies and Feature Films, TV series, Animations, Documentaries, Scripted, and Unscripted projects.

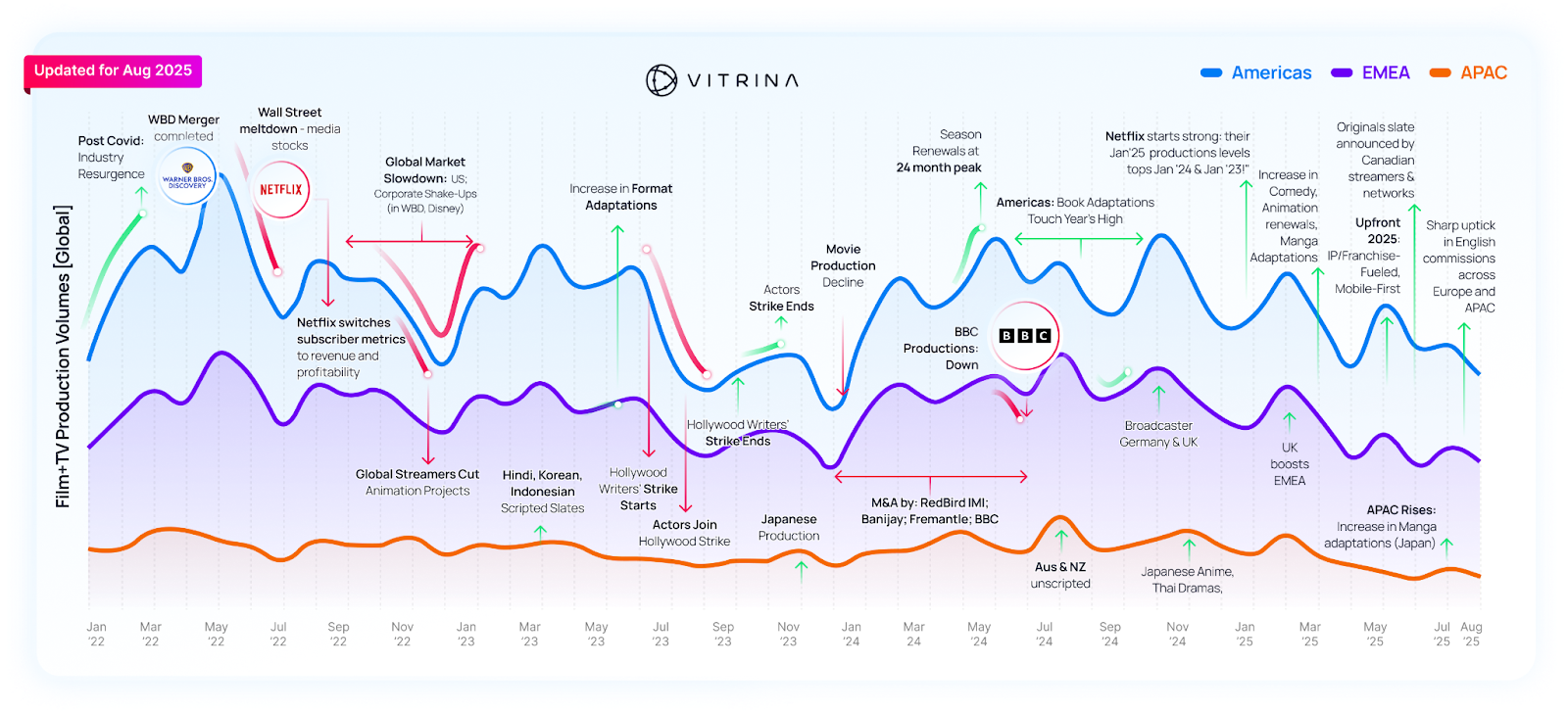

Before we dive into August 2025 metrics, let’s recap the key Film and TV production trends driving the industry over the last 3 years & 4 months.

Global Film & TV Production: Updated for August-2025

Source: Vitrina Daily Production Tracker. [X-Axis : Months starting from Jan 2021. Y-Axis Production Volumes : Production Volumes are the total number of projects greenlit or financed or commissioned in that month. Please note that this is an area chart – meaning that the regions are stacked one above the other with the full height of the chart representing the global production volume.

As is evident from the monthly trends monitored by Vitrina globally for Film+TV Productions that were commissioned, greenlit or financed – the last 3 years have been turbulent and eventful – to say the least! A quick summarized view would be:

2022: A year of extremes—an early-year “revenge production financing” surge fueled by post-COVID recoveries, followed by a sharp market correction on Wall Street’s market-cap reset for entertainment companies, leading to widespread budget tightening.

2023: Marked by Hollywood strikes, which froze scripted productions in the US & UK, forcing many studios to pivot toward unscripted content and international markets to keep productions moving.

2024: A year of stabilization with no major peaks, but regional surprises—Japan, ANZ, Germany, and Brazil saw production spikes, while broadcasters continued scaling back commissioning amid shifting business models.

Jan–Aug 2025: Highlighted clear regional contrasts in production momentum. Europe remained resilient with steady growth across three quarters, peaking in February on the back of UK screenings and Upfronts. May marked a global high point, as EMEA and the Americas recorded nearly 40% more new productions than April, alongside record renewals—almost doubling in EMEA and up 45% in the Americas. APAC, though smaller in volume, showed upward traction with a 30%+ rise in July and, by August, a shift toward English-language output driven by ANZ broadcasters.

Insights on Production Transaction Volumes

August’ 25 vs. July’ 25

Methodology: Vitrina monitors unreleased or in-motion projects worldwide across all stages of the content lifecycle—development, production, post-production, and till release—on a daily basis. We track various transactions and deal activities related to content financing, commissioning, co-productions, green-lighting, as well as early stage (content development) and late stage (licensing) arrangements. These transactions between production houses, distributors, streamers, and broadcasters enable us to gain valuable insights into industry trends, key players, buyer behavior, and the specializations of production companies. Our monthly Film+TV productions chart serves as a bellwether of production financing and industry health.

Below are the key highlights for August Film+TV Production Volumes:

- Global Production Trends: August production activities highlighted a more balanced market where regional players were increasingly visible alongside major streamers.

- Language Trends: English rose to 57% (from 49%), while Russian output also grew modestly, expanding their overall share.

- Genre Trends: The mix was stable, with Drama inching up to 29% in Aug’25 (from 26%in Jul ’25), while Comedy, Documentary, Reality, and Animation remained nearly unchanged.

- Scripted vs. Unscripted: The balance held steady at 75% Scripted vs. 25% Unscripted, showing little month-on-month change.

Top Players Overall (Aug’25 vs. Jul’25):

In Aug’25, Netflix and Prime Video retained the top two spots. ITV entered the Top 5, where it joined consistent performers like Channel 4, ZDF, Hulu, and NTV Mir, all of which maintained their slots in Top 10 of leaderboard from the previous month. Disney+, Channel 5, Apple TV+, and UKTV dropped out of the leaderboard, making room for new entrants including BBC Northern Ireland, HGTV, and Paramount+,

Within AMERICAS: Scripted output rose to 84% in Aug’25, up from 79% in July, led by Drama at 35% of activity. New entrants to the leaderboard included Paramount+, HGTV, and Tubi, widening the field beyond the big streamers. Key commissions were tied to studio partnerships: Hulu’s Foster Dade (WBTV, Berlanti Productions) and Murray Hill (WBTV, Kaling International); Netflix’s Dad Camp (21 Laps Entertainment, Happy Madison Productions); Prime Video’s Dish It Out (Tastemade Studios); and Paramount’s The Island (Day Zero Productions).

Within EMEA: Production patterns in Aug’25 remained broadly consistent with July, Top languages (English, German, Russian, Spanish) and genres (Drama, Documentary, Comedy, Reality) remained consistent. The Scripted share rose to 69% in Aug’25 (from 67%). On the commissioning front, ITV rose to the top of the leaderboard, while Channel 4 held second place. Channel 5, ZDF, NTV Mir, and BBC remained steady, with ARD joining as a new entrant.

Within APAC: English language productions surged to 41% (from 18%), driven by ANZ-based players, while Japanese and Hindi production shares declined. The genre mix (Drama, Animation, and Comedy) remained consistent; but the Scripted–Unscripted split in Aug’25 shifted to 74% (from 88% in Jun’26) vs. 26%. Three (TV3) in New Zealand led the leaderboard, followed by Australian Broadcasting Corporation, as Prime Video scaled back regional commissioning.

Stay ahead of the competition by tracking the latest production trends and market moves.

Global Entertainment Leaders Speak

Radial Entertainment: Forging a Content Distribution Giant

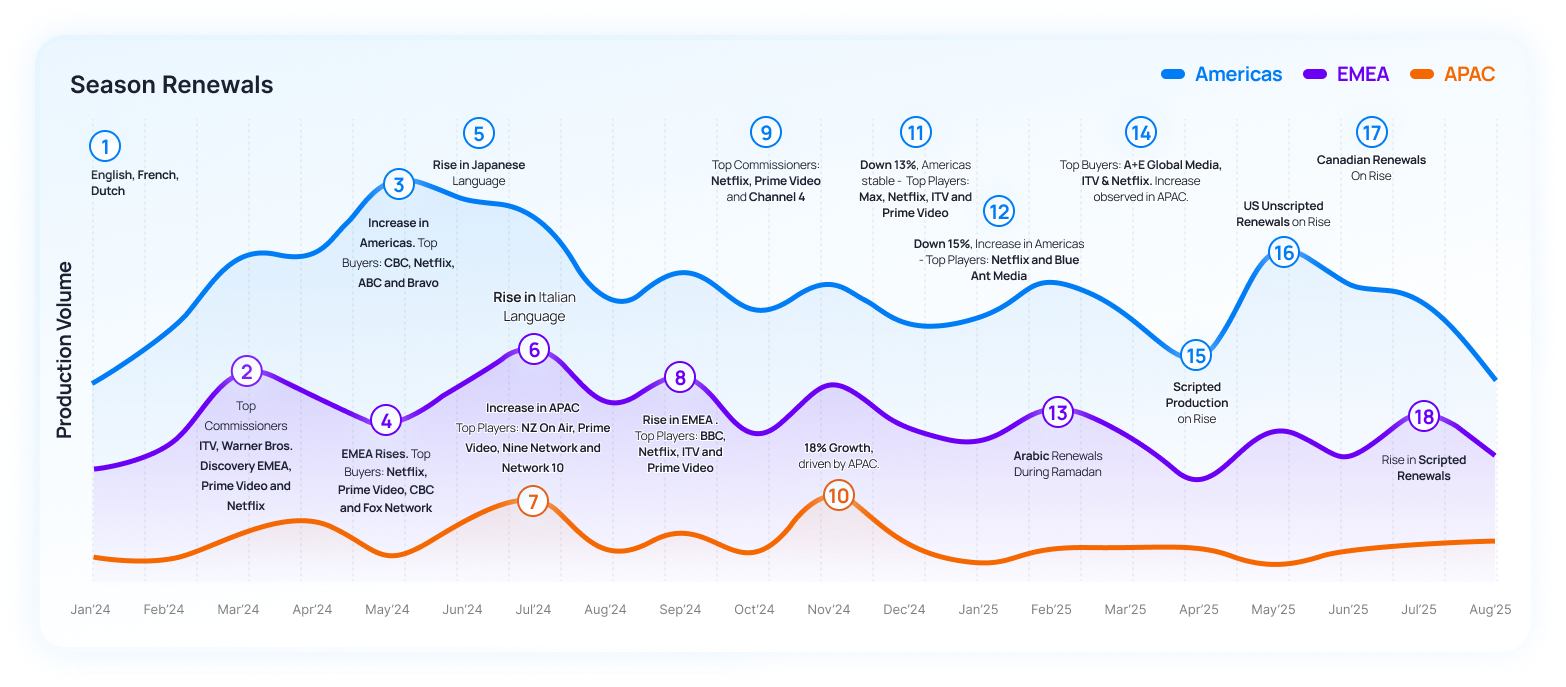

August 2025 Season Renewals: Shifting Dynamics Across Regions

Season renewals remain a key strategy for streamers and broadcasters, ensuring continuity in content pipelines, sustaining viewer loyalty, and reducing the risks of launching new projects.

Source: Vitrina Daily Production Tracker. Please note that this is an area chart – meaning that the regions are stacked one above the other with the full height of the chart representing the global production volume….

Regional Insights – Aug 2025

Americas:

-

Netflix retained its lead, with Paramount+ rejoining the leaderboard alongside Hulu, while Prime Video scaled back. Reality, Drama, and Comedy continued to dominate renewals, in line with July trends.

EMEA:

-

Renewals were led by English, Russian, and German, with Spanish replacing French in fourth place. The Scripted–Unscripted split shifted to 55% vs. 45% (from 61% vs. 39%) as Reality increased from 16% to 30%, becoming the top genre. NTV Mir and Okko led renewals, while UKTV dropped out and Netflix, Prime Video, and BBC eased back.

APAC:

-

Renewals rose slightly, with English jumping from 20% to 66%, driven by NZ broadcasters Three (TV3), TVNZ 2, and TVNZ. Reality and Documentary led renewals, Japanese and Hindi renewals declined, while the Scripted–Unscripted split shifted to 46% vs. 54% (from 64% vs. 36%), showing stronger momentum for unscripted formats.

Monitor season renewals and adjust your strategy with live insights.

Most Active Film Commissions in Year 2025 (Till Aug’25)

Film commissions have become increasingly strategic players in the entertainment industry, stepping up efforts to attract productions, nurture local talent, and secure investments across filming, production, post-production, and animation. Their proactive initiatives have fueled regional economic growth, strengthened creative ecosystems, and fostered high-impact industry collaborations.

Several film commissions—along with national entertainment bodies and ministries of culture, communication, and commerce—have intensified their activities to support production. Governments worldwide are deploying aggressive measures to drive employment, support early-stage projects, and empower emerging content creators. To remain competitive and attract international productions, they have revamped tax incentive structures, introduced cash grants, expanded cashback schemes, and rolled out new tax breaks. Additionally, major trade events and strategic partnerships have been leveraged to position their markets as premier global production hubs.

Curious how Vitrina can help you? Try it out today!

Financing by Industry Bodies -Jan’25 – Aug’25

Let’s explore the key film commissions that are making a decisive impact on the industry today.

| Sr. No | Association/Industry Commission | Location |

| 1 | Société de Développement des Entreprises Culturelles | Montreal, Canada |

| 2 | Screen Australia | Sydney, Australia |

| 3 | Doha Film Institute | Qatar |

| 4 | Filmförderungsanstalt | Berlin, Germany |

| 5 | Ministry of Culture and Film Industry Subcommittee | Thailand |

- SODEC (Société de Développement des Entreprises Culturelles) remains a key backer of French-language content in Canada, with Drama (36%) and Documentary (33%) leading its portfolio. The slate is heavily Scripted (76%), focused on films (86%), with notable titles including Nebulous Stars, Being a Seagull, and Two Years Less a Day. Among the top production partners are Happy Camper Media, Nikan Productions, Possibles Média, Coop Vidéo de Montréal, and Echo Media.

- Screen Australia continues to champion English-language content, with a slate led by Drama (30%) and Documentary (20%), alongside Comedy titles. The portfolio skews Scripted (69%), split across Movies (56%) and TV Series (42%), with highlights like Into the Blue, Ages of Ice, and Lesbian Space Princess. Among the top production partners are Wooden Horse, Cheeky Little, Photoplay Films, MOFA, and GoodThing Productions.

- Doha Film Institute is a leading financier of Arabic-language content (71%), with a slate anchored in Drama (46%) and Documentary (29%). Its portfolio is primarily feature films (93%), complemented by select TV projects. Notable titles include Like a Feather in the Breeze, How the East Was Won, and People of Solitude. Its top production partners such as Abbout Productions (Lebanon) and Les Films d’Ici Méditerranée (France).

- Filmförderungsanstalt (FFA) is Germany’s key film financing body, with a slate led by Drama (43%) and Documentary (19%), alongside Family and Kids projects. The portfolio is predominantly German-language scripted films (97%), with featured titles such as Johanna und die Maske der…, Coming Out – The Documentary, and On Thin Ice. Leading partners include Wüste Film, Film Five, CALA Film, Lupa Film, and Lieblingsfilm.

- Thailand’s Ministry of Culture and Film Industry Subcommittee supports a slate dominated by Thai-language films, with a strong focus on Drama (57%) and Documentary (29%), alongside Horror titles. The portfolio is largely scripted features (100%), with highlights including Tharae The Exorcist and A Girl Who Wasn’t There. Key production partners include Doc Club Original and 185 Films.

Impact Deals – August 2025

High-Impact Deals are a spotlight on significant deals and partnerships shaping the global entertainment ecosystem. This section focuses on a range of unique signals Vitrina has picked up in the last month, including innovative financing, new distribution models, and cross-industry collaborations that offer a glimpse into the evolving business of content.

Samsung has entered the original content space with Tudo Sob Controle, a romantic mini-series produced in Brazil and streamed on Globoplay. This marks the company’s first K-drama and represents a bold step in fusing branded content with mainstream entertainment. By embedding Samsung’s smart devices organically into the storyline, the project moves beyond traditional advertising to a strategic branded entertainment model. The partnership with Globoplay not only ensures wide visibility in Brazil but also positions Samsung at the intersection of technology, culture, and storytelling. With this partnership with Globoplay, Samsung leverages the global appeal of the K-drama format to reinforce its brand identity while capitalising on the platform’s wide distribution network to reach a key audience in Brazil.

Canela.TV has partnered with Pitaya Entertainment to bring some of its most popular Spanish-language podcasts to the screen in video format, marking the streamer’s first move into video podcasts. The collaboration adds shows like Me lo dijo Adela and Casi 40 to Canela.TV’s catalog, blending influential podcast voices with on-demand and linear video distribution. For Pitaya, the deal extends its reach by translating its audio hits into video experiences, while for Canela.TV, it strengthens the platform’s Spanish-language offering, diversifies formats, and broadens audience engagement across podcast and video ecosystems.

Screen Australia and YouTube Australia have committed $480,000 to fund four new digital-first projects, including Garn: The Series, BUG (W/T), Re:Plastic, and The Vegetable Plot. The initiative combines financing with mentorship and training, enabling online creators to transition from short-form content into more ambitious, narrative-driven productions. Acting as a talent incubator, the program builds on the success of alumni like RackaRacka (Talk to Me) and Aunty Donna (Aunty Donna’s Big Ol’ House of Fun), showing a pathway from YouTube to mainstream film and television. Beyond industry development, the collaboration also supports diverse Australian storytelling for a global audience, amplifying cultural reach while strengthening YouTube’s pipeline of high-quality, creator-led content.

Phreesia has entered a five-year partnership with Sesame Workshop to deliver health education content through its digital patient engagement platform. The collaboration will feature campaigns using beloved Sesame Street characters like Elmo and Cookie Monster to make complex health topics more engaging and accessible for parents and children. For Sesame Workshop, the deal provides a powerful new distribution channel to reach millions of families in healthcare settings, while Phreesia enhances its service with purpose-driven, trusted educational content that bridges entertainment and public health.

Google has partnered with Range Media Partners, Doug Liman, and 30 Ninjas to launch Asteroid, an immersive XR thriller premiering at Venice Immersive. As part of a multi-year initiative, the collaboration connects Google’s AI and XR technologies with Hollywood creators through programs like AI on Screen and 100 Zeros. By funding experimental projects that merge cutting-edge tech with cinematic storytelling, the deal provides Google with direct access to Hollywood’s creative community while showcasing the real-world applications of its tools. For the film industry, the partnership signals a bold step in content innovation, blending technology, marketing, and narrative to pioneer new forms of audience engagement.

How the Industry Uses Vitrina

Vitrina For VFX and Post Companies:

Vitrina is helping VFX companies like PhantomFX, Crafty Apes, and Light Iron discover and secure new Film & TV projects by tracking unreleased productions across development, production, and post. With deep intel on production companies, crew-heads, and decision-makers—plus direct contact details—VFX teams can reconnect with past collaborators, pitch at the right time, and expand their network of high-potential leads. It’s smart, targeted business development made easy.

Vitrina For Production Companies & Indies:

Vitrina empowers production companies and indie creators to find the right financing and commissioning partners—globally. From early-stage tracking of co-production-friendly projects to surfacing the latest deals and investment themes, Vitrina helps match projects with relevant financiers, commissioners, and collaborators. With up-to-date preferences and verified contacts, creators can focus on pitching to the right people—saving time and increasing chances of success.

Vitrina For Streamers:

Streamers use Vitrina to navigate the global content supply-chain with clarity. By tracking unreleased slates, mapping competitive activity, and identifying trending genres, formats, and territories, Vitrina equips content and strategy teams with the intel to make proactive moves—whether it’s preemptive pre-buys, co-production deals, or vendor discovery. With insights drawn from markets like LATAM, APAC, and Europe, Vitrina helps streamers stay ahead of content trends and competitors alike.

Get In Touch with Vitrina Today:

-

- Feature your company and content announcements: Email us at updates@vitrina.ai

- Request production trends or competitive intel reports: Contact us at sales@vitrina.ai

Frequently Ask Questions

Yes, Vitrina provides buyers with direct access to the contact information of vendors. Our platform includes verified leadership and key decision-makers within vendor companies, along with their mapped departments, specializations, and accessible contact details.

The Vendor Reputation Rating on Vitrina is a comprehensive metric that incorporates various factors critical to buyers’ assessments of vendors, service providers, and suppliers. This rating is used by buyers to evaluate vendors’ qualifications and capabilities in the M&E supply chain. Vitrina’s Reputation Rating system provides buyers with valuable insights into vendors’ size, parentage, past work, quality of projects/clients, recency, specializations, strengths, and other factors that may affect the vendor’s suitability for the buyer’s project.

Yes, Vitrina can assist you in finding and shortlisting the ideal partners for your project. Our Partner-Finder team is experienced in running vendor recruitment and screening mandates that are specific to your needs. We can help you find the best vendors for your business by identifying niche and specialist companies in new markets. We stay up-to-date with the latest developments in the M&E supply chain, allowing us to continually identify and qualify the most innovative vendors. Additionally, our extensive network of storefront owners updates their latest projects, capabilities, and certifications on our platform. These sellers are highly engaged and active on our platform, allowing us to connect buyers with vendors who are best suited to meet their requirements. By working with Vitrina, you can access the latest solutions and expertise in Animation, Localization, VFX, Stages, Virtual Production, and gaming engines. Contact us today to learn more about how Vitrina can help you find the right vendors and partners for your business.

Vitrina is a private and exclusive business network designed for dealmakers in the Media and Entertainment (M&E) industry. Members are carefully screened to ensure they meet the network’s high standards for professionalism and integrity, and the platform is not open to the public or to search engines. This ensures that all information shared is kept confidential and private. Vitrina takes the privacy and confidentiality of its members very seriously and provides a secure platform for members to share valuable information and insights with a select group of vetted and verified buyers and sellers.