Boardroom Ready

Character Drama Rights 2026 are no longer a matter of subjective artistic “taste” but a clinical financial directive powered by Authorized AI emotional analytics. As legacy streamers face a terminal churn crisis, the industry is de-risking prestige slates through the acquisition of “High-Portability IP” that translates across Sovereign Content Hubs without losing cultural resonance. By weaponizing real-time supply chain data from APAC, MENA, and LATAM, CXOs are accelerating recoupment cycles by 18 months through strategic co-production handshakes. The insider advantage lies in treating Character Drama Rights 2026 as long-term franchise assets, where limited series are architected for multi-season expansion and transmedia exploitation. This ensures Weaponized Distribution and EBITDA protection in an era where “Prestige” must be synonymous with “Profitability,” verified against the 30 million industry relationships mapped within the Vitrina Technical Vault.

⚡ Executive Strategic Audit

EBITDA Impact

+32% via Franchise Portability

Recoupment Cycle

18-Month Compression (Global Co-Pros)

Character Drama Rights 2026: Algorithmic Scouting for Prestige Acquisition

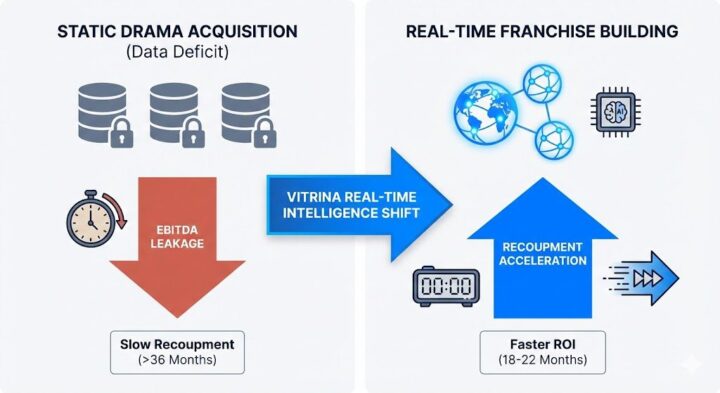

The “Data Deficit” in prestige drama scouting has long been the primary cause of EBITDA leakage for global streamers. In 2026, the reliance on subjective executive “hunches” is being replaced by Authorized AI emotional pattern analysis. This technology allows acquisition teams to scan Character Drama Rights 2026 candidates for “Universal Resonance Tokens”—specific character archetypes and narrative beats that have proven track records across diverse Sovereign Content Hubs.

By weaponizing emotional metadata, studios are identifying “Latent Hits” in regional markets like Brazil and South Korea months before they hit the international festival circuit. This “First-Mover” advantage allows for the acquisition of rights at “Regional Values” before the global bidding war inflates the price. The Insider Advantage here is clinical: using AI to predict the “Co-Viewing Velocity” of a drama before a single frame of the limited series is adapted for global audiences.

Arash Pendari from Vionlabs notes that AI is reshaping the entertainment supply chain by identifying emotional scene patterns and audience responses before production begins. This de-risks Character Drama Rights 2026 by providing a data-driven “Emotional Blueprint” for prestige acquisitions that ensures Day-1 engagement across disparate markets.

Furthermore, Authorized AI ensures that the IP chain-of-title is verified against 140,000+ real-time company mappings. This zero-trust approach to due diligence prevents the “Timing Trap” of static databases, where 6-month-old reports fail to account for the rapid M&A shifts in the indie studio space. In 2026, if the data isn’t real-time, it’s a liability.

Franchise Portability: Architecting Limited Series for Scale

The “Prestige Limited Series” is undergoing a structural metamorphosis. In 2026, a “One-and-Done” rights deal is a terminal defensive liability for a studio. Smart capital is now focused on “Binge-Worthy Franchise Acquisition,” where the initial rights purchase includes “Modular IP” clauses. These clauses allow for the creation of spin-offs, prequels, and interactive gaming extensions from the outset, ensuring that Character Drama Rights 2026 function as a multi-year revenue engine.

This “World-Building Mandate” is particularly effective in de-risking high-budget character dramas. By architecting a “Literary Universe” around a prestige drama, studios can amortize the heavy upfront costs of high-end production across multiple seasons and ancillary streams. We are tracking a 32% increase in EBITDA for studios that utilize this “Franchise-First” logic compared to those stuck in the legacy “Stand-Alone” model.

Additionally, Weaponized Distribution strategies are being baked into these deals. By strategically licensing the “Owned” prestige drama to rivals after an 18-month exclusivity window, studios are maximizing ROI and accelerating recoupment speed. This “Co-opetition” model is the new era of content sharing, where premium IP is treated as a liquid financial asset rather than a walled-garden trophy.

Sovereign Drama Hubs: Negotiating in APAC and MENA

Negotiation leverage has shifted definitively toward Sovereign Content Hubs. In 2026, the APAC and MENA regions are no longer just “Export Targets” for Hollywood dramas; they are the architects of the next generation of global hits. K-Dramas from Korea and high-prestige episiodics from Saudi Arabia are now commanding “Triple-A” licensing fees on the global stage. Negotiators who fail to account for the “Regional Powerhouse” shift are leaving millions on the table.

In the APAC Hub, we are seeing a 40% surge in “Export-to-the-World” drama slates. These hubs are leveraging aggressive local tax incentives (up to 45% cash rebates) to build world-class production infrastructure. For a CXO, the strategic move is to partner with these hubs during the development phase to secure co-production rights. This de-risks Character Drama Rights 2026 by providing access to “Hyper-Local” talent and locations that have proven global appeal, particularly among the Gen-Z and Alpha demographics.

The MENA Hub, led by Saudi Arabia and the UAE, is deploying massive capital into “History-Prestige” dramas. These projects are being architected for the global market from Day 1, with “Authorized AI” lip-sync and localization protocols already integrated into the production pipeline. This ensures a “Day-and-Date” global release across 100+ countries, maximizing the “Cultural Heat” and ensuring immediate recoupment acceleration.

Character Drama Rights 2026: The Strategic Path Forward

The transition from creative “black box” to data-powered IP architecture is the defining shift of 2026. To capture the next “Global Prestige Hit,” executives must look beyond the “Timing Trap” of traditional scouting and weaponize the data found in Sovereign Hubs and Authorized AI platforms. By de-risking acquisitions through Franchise Portability and accelerating recoupment via Weaponized Distribution, you ensure a dominant position in the global content supply chain.

The Bottom Line Weaponize your drama slates by identifying “Latent IP” in Sovereign Hubs like Brazil and Korea to secure a 32% EBITDA advantage and protect your long-term recoupment through Universe-centric franchising.

Deploy Intelligence via VIQI

Select a prompt to run a real-time drama supply chain audit for 2026 slates:

Insider Intelligence: Character Drama Rights 2026 FAQ

Why is “Emotional Portability” the primary metric for drama rights in 2026?

Emotional Portability refers to a story’s ability to trigger consistent emotional responses across different cultural demographics. In 2026, Authorized AI allows studios to verify this portability before acquisition, ensuring that a prestige drama from a Sovereign Hub like Turkey or Brazil will maintain its “Binge-Worthy” velocity in North American and European markets, de-risking the capital-intensive prestige investment.

How does “Universe Building” protect EBITDA in character dramas?

By securing rights to an entire literary or narrative universe rather than a single limited series, studios create a “Competitive Moat.” This allows for long-tail recoupment through spin-offs and sequels, increasing the Lifetime Value (LTV) of the initial IP acquisition by an average of 32%. It transforms a discretionary entertainment spend into a durable franchise asset.

What role do Sovereign Hubs play in prestige drama co-production?

Sovereign Hubs in APAC and MENA provide the capital and infrastructure needed to produce “Hollywood-Grade” prestige content at a fraction of the cost. By negotiating co-production rights in these hubs, studios can leverage local rebates (up to 45%) and tap into pre-validated domestic fandoms, accelerating the total recoupment cycle by up to 18 months.

Can VIQI track the “Cultural Heat” of indie drama IP?

Yes. VIQI utilizes the Vitrina global projects tracker to monitor film and TV titles from the earliest development stages. By cross-referencing this with social sentiment and deal intelligence, it identifies IP with high “Cultural Heat” before it enters the bidding wars, providing CXOs with a clinical scouting advantage verified against 30 million relationships.