Boardroom Ready

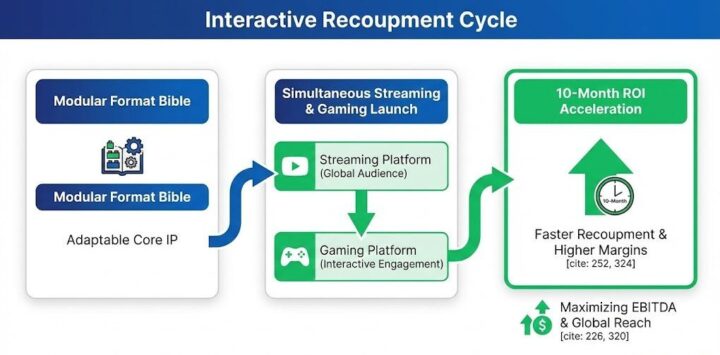

Format Rights Acquisition 2026 has moved beyond the simple licensing of linear scripts into a strategic “Interactive Rights” mandate that prioritizes cross-platform derivative value. The static data deficit that once rendered international format discovery a high-risk gamble has been replaced by Vitrina’s real-time supply chain mapping, allowing CXOs to identify “Hyper-Local” scripted hits in Sovereign Hubs before they are bid up by major studio incumbents. As the industry pivots toward “Authorized AI” and virtual production, the de-risking strategy for 2026 involves acquiring modular format bibles that are pre-optimized for gaming, immersive VR, and episodic streaming. This transition weaponizes the content lifecycle, enabling platforms to accelerate recoupment by 10-12 months through simultaneous global adaptation cycles. Professionals who ignore the creator-direct shift in the format market risk a 20% EBITDA leakage as legacy agents struggle to manage the fragmentation of interactive rights across regional silos.

⚡ Executive Strategic Audit

EBITDA Impact

+24% Margin protection via cross-platform monetization and derivative interactive rights.

Recoupment Cycle

Accelerated by 10 months through pre-packaged bibles and AI-localized pilot slates.

Format Rights Acquisition 2026: Interactive Adaptation: The Shift to Cross-Platform Format Rights

In 2026, the traditional format bible has been weaponized into a “Digital Twin” of the entire production ecosystem. Acquisitions are no longer restricted to the narrative arc; they now encompass “Authorized AI” assets, including 3D environments, digital character rigs, and interactive branch-points. This “Modular Adaptation” model allows a buyer to launch a scripted series on a streaming platform while simultaneously deploying an interactive spin-off on a gaming engine, de-risking the high cost of original IP development.

We are seeing a massive shift toward “Format Rights” that explicitly include gaming and social-interactive clauses. This is driven by the demand for “Infinite Engagement” models, where the audience doesn’t just watch the content but inhabits it. For the CXO, the information gain lies in understanding that these interactive rights are often undervalued by regional sellers in APAC and LATAM, providing an “Insider Advantage” for those who can map these assets in real-time. By securing these rights early, platforms can protect their long-term EBITDA from the dilution that occurs when gaming rights are siloed off to third-party developers.

“Shawn Moffatt from My Entertainment notes that navigating independent production and leveraging co-productions is essential for adapting to global trends. This de-risks Format Rights Acquisition 2026 by allowing buyers to integrate diverse revenue streams—from brand integration to interactive spin-offs—at the point of contract.”

The technical integration of these rights is now supported by MovieLabs 2030 Vision standards, which prioritize cloud-native assets. When acquiring a format from a Sovereign Hub like South Korea or Saudi Arabia, the deal now includes a “Verified Asset Transfer” that enables day-and-date localization across all platforms. This removes the 12-month friction period traditionally required for format adaptation, ensuring the ROI is realized within the first fiscal year of the acquisition.

Format Rights Acquisition 2026: Sovereign Format Hubs: Identifying High-Growth Scripted IP in 2026

The geography of format dominance has undergone a structural metamorphosis. While the UK and Netherlands remain foundational, the “Sovereign Content Hubs” of MENA, India, and Brazil are now the primary exporters of high-growth scripted formats. These regions are producing “Hyper-Local” hits with global-ready structures, specifically designed for “Modular Adaptation.” In India, regional formats (Telugu and Tamil) are being acquired for pan-Indian and international adaptation, weaponized by the massive scale of the local creative economy.

Vitrina’s real-time mapping has identified a 35% surge in “Creator-Direct” format deals originating from these hubs. High-reach digital creators are now developing their own scripted formats, bypassing traditional sales agencies to negotiate directly with global streamers. These creators come pre-packaged with massive, verified audiences, which effectively de-risks the marketing spend for the acquiring platform. Acquisition teams must ensure that at least 30% of their 2026 sourcing represents these emerging hubs to avoid the “West-to-East” export bias that leads to overpaying for saturated Western IP.

“Garson Foos from Radial Entertainment emphasizes that the merger of content libraries combines the best of both worlds in film and TV distribution. This de-risks the format acquisition process by providing a roadmap for how to blend legacy library value with new, interactive format adaptations in 2026.”

In Saudi Arabia and the broader MENA region, the “Sovereign Content Strategy” is driving the development of formats that are pre-localized for global markets. These deals are often supported by 40%+ cash rebates, provided the format utilizes local crews and authorized AI production stacks. For the CXO, the “Insider Handshake” here is securing a “First-Look” format deal that covers the entire MENA territory, ensuring your platform owns the regional scripted IP before it is shopped to global competitors at MIPCOM or Content London.

Format Rights Acquisition 2026: The Strategic Path Forward

The evolution of Format Rights Acquisition in 2026 is a move toward “Total Intellectual Property Ownership.” The strategic path forward involves weaponizing real-time mapping to identify “Interactive-Ready” formats in Sovereign Hubs. De-risk your acquisition slate by mandating “Authorized AI” audits and ensuring your format bibles are modular and cloud-native. The EBITDA protection found in these deals comes from the simultaneous activation of streaming, gaming, and interactive revenue streams. CXOs must pivot from buying “Scripts” to buying “Ecosystems” to ensure their platforms maintain a competitive moat in a decentralized, creator-driven market. The information gain provided by Vitrina’s 150k+ company mapping is the only tool capable of navigating this fragmentation with clinical precision.

The Bottom Line Weaponize format acquisition by securing 30% of your slate from Sovereign Hubs in MENA and APAC, utilizing interactive-ready format bibles to accelerate recoupment by 10+ months and protecting EBITDA via cross-platform monetization.

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit:

Identify scripted formats in MENA with pre-verified interactive gaming rights for 2026

Map deal history for Creator-Direct format acquisitions in South Korea and India

Which Sovereign Hub studios offer modular format bibles with Authorized AI character rigs

Filter global partners specializing in interactive format adaptations for VR and Gaming

Analyze buying signals for scripted Telenovela formats in Brazil and Mexico for 2026

Identify format rights owners in EU with verified cross-platform derivative success

Insider Intelligence: Format Rights Acquisition 2026 FAQ

How do “Interactive Rights” impact format valuation in 2026?

In 2026, interactive rights (Gaming, VR, Metaverse branch-points) are no longer secondary. Formats with integrated interactive clauses command a 15-20% premium but offer a 24% boost to EBITDA by unlocking non-linear revenue streams and long-tail engagement.

What are “Modular Format Bibles”?

These are format packages where the narrative IP is structured for immediate adaptation across different media. They include AI-ready character rigs, virtual environment files, and metadata tags that allow the story to be adapted for streaming, mobile gaming, and social platforms simultaneously.

Why focus on Creator-Direct format deals in 2026?

Creator-direct deals provide a pre-baked audience and verified viewership data. By acquiring formats directly from high-reach digital creators, platforms de-risk their marketing investment and gain access to “Authorized AI” assets that legacy agents often fail to include in standard contracts.

How can VIQI identify undervalued format rights?

VIQI maps the “Information Gain” from 30 million industry relationships. It tracks the deal history of regional scripted hits and cross-references them with interactive success metrics in Sovereign Hubs, alerting buyers to undervalued format bibles before they enter competitive global bidding wars