Hottest Anime Titles Acquired Worldwide

This edition showcases our latest features in Film & TV commissions globally. Additionally, we also cast a special light on Anime. We look at the latest trends in international Anime productions and acquisitions.

Acquiring Anime Content WEBINAR

Missed our webinar? During the webinar we reviewed the most successful Anime titles internationally as well as ways to acquire hot, trending and high-demand Japanese Animations. Watch the recording now!

The increasing global recognition of Japanese pop culture and the emergence of robust digital distribution platforms are driving the expansion of the anime industry in Japan. Moreover, the burgeoning demand for innovative narrative techniques and distinctive animation styles is propelling the expansion of the anime industry. Likewise, the advancement of animation technologies, which necessitates more intricate storytelling and animation techniques, is fostering the desire for varied anime content, which in turn plays a role in the growth of the market.

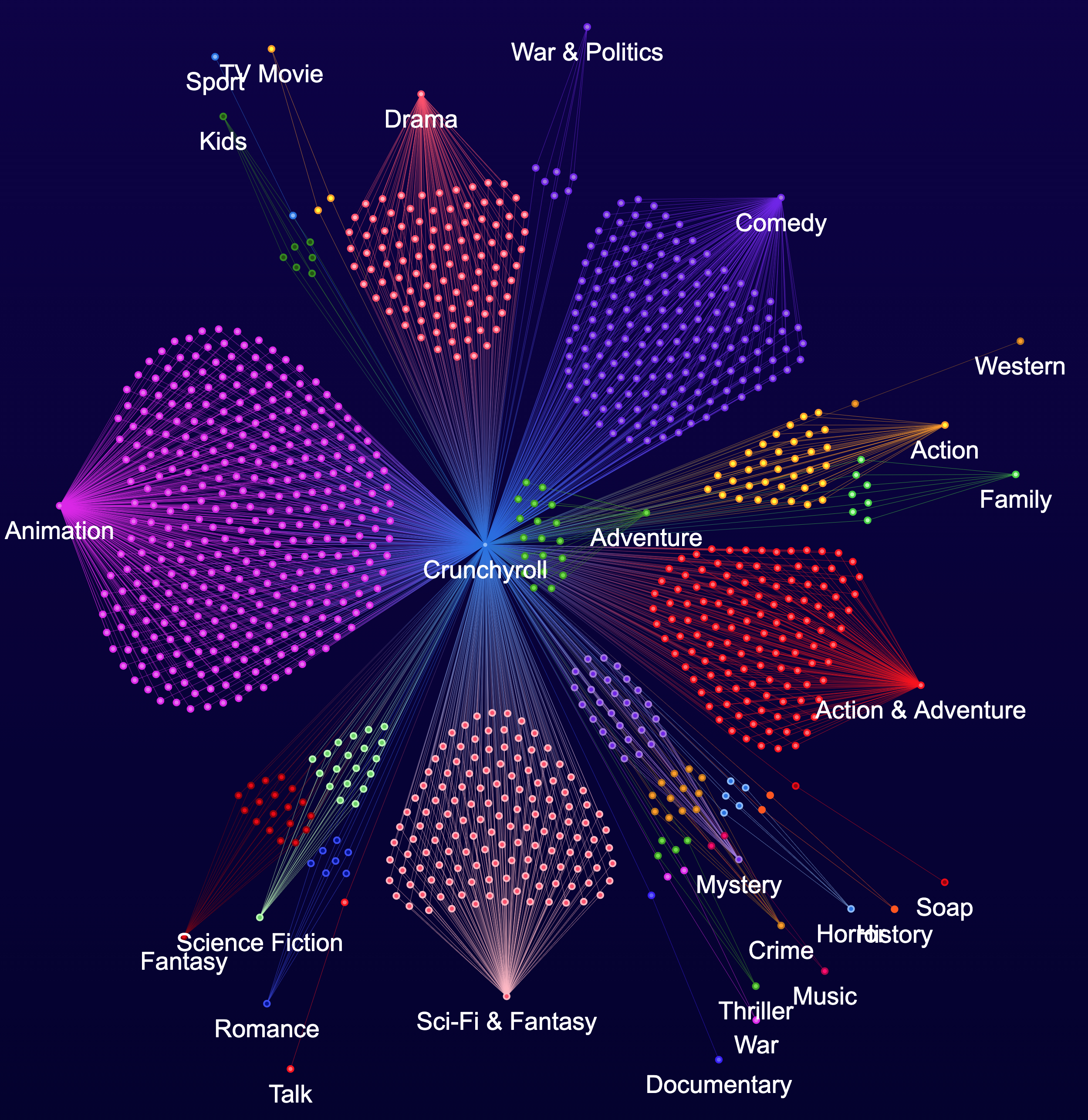

Crunchyroll (owned by Sony Group Co.), a leading American OTT provider and a key hub for streaming Anime in the US, is actively expanding its library by securing numerous titles. This strategic move aims to attract new subscriptions in response to the slowdown in new content creation.

So what’s hot and high-demand for Anime and has already shown to be successful in other markets and streaming services?

Which Anime titles have been chosen by the most number of platforms globally? This is one of the powerful indicators tracked by Vitrina to determine high demand content. We found more than 4,000 titles that have been acquired by multiple platform.

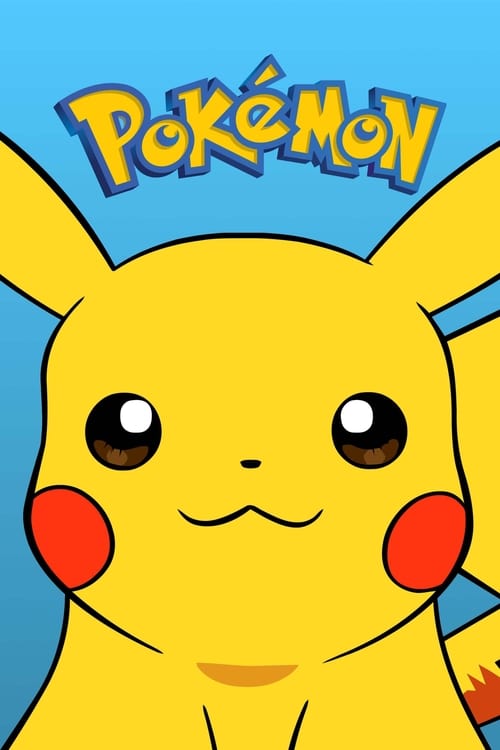

TV Series | 1997 | 25 Seasons | TV-Y7 – Japanese

Animation · Action & Adventure · Sci-Fi & Fantasy

Country of origin: Japan

Worldwide Reach – 81 Platforms

Platforms including Netflix, Hulu, Prime Video

Movie | 2012 | 1h 40m | R – English

Animation · Horror · Action

Country of origin: Japan

Worldwide Reach – 59 Platforms

Platforms including Netflix, Hulu, Prime Video, Tubi, Max

TV Series | 2015 | 1 Season | TV-14 – Japanese

Animation · Action & Adventure · Sci-Fi & Fantasy

Country of origin: Japan

Worldwide Reach – 55 Platforms

Platforms including Prime Video, ABC, Hulu, Crunchyroll

Who are the most influential dealmakers in the industry for Anime? Vitrina tracks deals, transactions and catalogs across Content IP, Development, Production, Acquisitions and Collaborations. On the basis of this tracking, we are able to create lists of powerful and influential dealmakers per genre, country and company. For Anime, three most influential dealmakers picked up by our system are:

Asa Suehira

David Jesteadt

Belinda Menendez

Who are the largest acquirers for Anime content? From our daily monitoring of content acquisition deals as well as streamer catalogs, we are able to create lists of the largest buyers for every genre, language and country. For Anime, the three largest buyers are:

Latest deal transactions seen in the Anime category

Shima Shima Tora no Shimajirou TV Series | 8 Seasons – Japanese

Returning Series

Country of origin: Japan

Mentari TV

signed an acquisition deal with Bomanbridge Media for Shima Shima Tora no Shimajirou for Indonesia

My Hero Academia

TV Series | 2016 | 7 Seasons | TV-14 – Japanese

Action & Adventure · Animation

Returning Series

Country of origin: Japan

Cartoon Network

signed an acquisition deal with Bones for My Hero Academia for India

The Boy and the Heron

Movie | 2023 | 2h 4m – Japanese

Animation · Adventure · Drama

Country of origin: Japan

Wild Bunch Distribution

signed a distribution deal with Goodfellas for The Boy and the Heron for France

Lucky Red

signed a distribution deal with Goodfellas for The Boy and the Heron for Italy

Bleecker Street Media ,

Anonymous Content and Elysian Film Group signed a distribution deal with Goodfellas and Studio Ghibli Co Ltd for The Boy and the Heron for United Kingdom

Acquiring Anime Content

Missed our webinar? During the webinar we reviewed the most successful Anime titles internationally as well as ways to acquire hot, trending and high-demand Japanese Animations. Watch the recording now!

Our weekly global scan of new Productions getting greenlit/ financed as well as high-demand content and IP being acquired from around the world.

Our “High-Demand Content” lists are based on following dealmakers – thousands of leaders in Content Acquisition for every major and minor streamer, broadcaster and distributor. We follow their actions individually as well as cumulatively to understand global demand. We call this approach “Collective Wisdom of Content Curators“. Read more about our methodology.

Hulu signed an acquisition deal with Nicely Entertainment for A Christmas Frequency and Reporting for Christmas

Lionsgate Play

signed an acquisition deal with A24 for Past Lives

Prime Video

signed an acquisition deal with Columbia Pictures for The Equalizer 3

National Geographic International signed an

acquisition deal with Autentic GMBH

for Soul of the Ocean and

for Worldwide

Canal+ Polska

signed an acquisition deal with Autentic GMBH for In the Grip of Gazprom, Undressed—The History of Nudity and Hormones Have No Gender for Poland

Norsk Rikskringkasting

signed a IP & Development deal with

Banijay Nordic for Portrait Artist of the Year for Norway

Eureka Productions

signed a IP & Development deal with

Talpa Network for Quiz with Balls for United States of America

TV Globo

signed a IP & Development deal with CJ ENM Co for MY BOYFRIEND IS BETTER for Brazil

Acquiring Anime Content

Missed our webinar? During the webinar we reviewed the most successful Anime titles internationally as well as ways to acquire hot, trending and high-demand Japanese Animations. Watch the recording now!