| Executive Summary: Dallas Production Intelligence | |

|---|---|

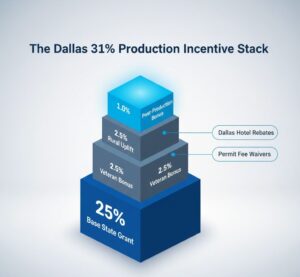

| The 31% Ceiling | Texas offers a 25% base rebate for projects over $1.5M, with stackable uplifts for rural filming, veteran hiring, and post-production. |

| The Dallas Advantage | Local hotel rebates and fee waivers in Dallas supplement state grants, specifically de-risking the “Above the Line” housing costs. |

| Operational Mandate | Successful stacking requires a 60% in-state filming threshold and 35% Texas residency for both cast and crew. |

| Vitrina Relevance | Vitrina tracks the verified supply chain of Dallas-based vendors and historical project data to validate production credit worthiness. |

Strategic Roadmap

- State Incentive Mechanics: The TMIIIP Framework

- The Dallas Municipal Stack: Grants and Hotel Rebates

- The Residency Mandate: Managing the 35% Talent Threshold

- Strategic Post-Production: Unlocking the 1% Bonus

- Market Discovery: Leading Dallas Service Partners

- Operational Precision: How Vitrina Accelerates Market Entry

State Incentive Mechanics: The TMIIIP Framework

The Texas Moving Image Industry Incentive Program (TMIIIP) remains one of the most stable cash-grant programs in the United States, recently bolstered by a significant legislative allocation for the 2024–2025 cycle. Unlike tax credits that require a secondary market for liquidation, Texas issues direct cash grants, ensuring that liquidity returns to the production’s balance sheet shortly after the final audit. For projects with a qualified spend of $1.5 million or more, the base incentive sits at 25%. This tiered approach allows the state to attract both high-budget episodic content and feature-length indies, with smaller slates qualifying for 5% to 10% rebates depending on the spend bracket.

The strategic shift in 2024 is the introduction of stackable uplifts designed to decentralize production. Producers can now target a 31% maximum rebate by integrating specific operational choices. For instance, the “Rural Filming Grant”—which replaces the previous “Underutilized Area” bonus—provides a 2.5% uplift if at least 25% of filming days occur in counties with populations under 300,000. For a Dallas-anchored production, this means utilizing the outskirts of the DFW metroplex to trigger the uplift while maintaining proximity to the city’s primary equipment houses and studio infrastructure.

According to current market intelligence, over 60% of a production’s total filming days must occur within state lines to unlock these primary tiers. Furthermore, a 35% residency requirement for cast and crew is strictly enforced. This “residency floor” ensures that the economic impact remains local, shielding the state’s investment and justifying the high-cap payroll eligibility—where the first $1 million of each Texas resident’s compensation qualifies for the incentive. This structure signals a move toward sustainable long-term crewing rather than fly-in talent models.

The Dallas Municipal Stack: Grants and Hotel Rebates

While the state handles the macro-funding, the Dallas Film & Creative Industries Office (DFCIO) manages the micro-logistics that often determine a project’s local viability. The Dallas Creative Industries Incentive Program provides a crucial layer for “Above the Line” (ATL) expenses, particularly in travel and housing. The Dallas Hotel Rebate is a standout feature; productions requiring at least 15 hotel rooms within the city can access significant rebates on state occupancy taxes, effectively lowering the cost of non-resident talent and key department heads who are brought in from out of state.

Beyond rebates, Dallas offers aggressive permit fee waivers for public property. In a city where locations range from the Art Deco splendor of Fair Park to the sleek high-modernism of the Downtown business district, these waivers signal a “Film Friendly” posture that reduces the administrative friction typically found in coastal hubs. These local incentives do not compete with TMIIIP; they are designed to be stacked, allowing a Dallas-based production to offset the “non-qualifying” costs that the state program traditionally excludes. The bottom line is this: The Dallas stack is not just about the money—it is about the infrastructure.

The presence of the 100,000-square-foot Netflix House at Galleria Dallas further validates the city’s readiness for large-scale investment. This facility represents more than a retail footprint; it is a signal to the industry that Dallas can support permanent, high-volume entertainment operations. Producers entering this market can leverage the city’s existing fiber-optic capabilities and its status as a major logistics hub to streamline both physical production and cloud-based post-production workflows.

The Residency Mandate: Managing the 35% Talent Threshold

For the C-suite, the 35% residency requirement is the most sensitive variable in the Dallas incentive equation. Failure to meet this threshold disqualifies the entire project from the TMIIIP grant. However, the DFW area boasts a robust talent pool that has been nurtured by decades of commercial, industrial, and episodic work. To ensure compliance, producers must shift their hiring strategy early in pre-production, focusing on local department heads (DPs, Line Managers, Art Directors) who bring their own vetted, resident crews.

Managing this threshold requires precise data. Every resident hired must provide a valid Texas Driver’s License or state ID to be included in the final audit. Vitrina’s project tracker and vendor verification tools allow producers to signal their needs to the local community months in advance, ensuring that the necessary 35% of the workforce is locked in before the first day of principal photography. This proactive approach de-risks the final grant disbursement, which typically occurs 120 days after the project’s completion.

Strategic Post-Production: Unlocking the 1% Bonus

For executives, the “Post-Production Bonus” is an often-overlooked lever for margin expansion. If a project allocates at least 25% of its total eligible in-state spend toward qualifying post-production—including visual effects (VFX), color grading, and sound—it unlocks an additional 1% bonus across the entire spend. In the context of a $10 million Texas spend, this single strategic allocation represents a $100,000 delta in the final grant. This incentivizes a “cradle-to-grave” production model within Dallas, rather than the traditional method of shooting in Texas and shipping the drives to Los Angeles.

Dallas is uniquely positioned to fulfill this requirement due to its concentration of high-end editorial and design firms. Companies like Republic, which handled the 2024 AICP Southwest Sponsor Reel, demonstrate the city’s ability to execute at a national standard. By keeping the post-production within the Dallas cluster, producers simplify the audit trail, as vendors like Republic are already vetted within the TMIIIP framework, ensuring that every dollar spent on VFX or sound testing is documented to the commission’s specifications.

Market Discovery: Leading Dallas Service Partners

To capture the full 31% stack, producers must partner with verified local vendors who have a track record of incentive-eligible performance. The following companies represent the core of the Dallas supply chain as of 2024–2025.

Republic

A powerhouse in production, editorial, and design, Republic provides the full-spectrum service required to trigger the 1% Post-Production bonus. They are a primary node in the Dallas creative ecosystem.

Verdict: Republic demonstrated high-level execution on the AICP SW Sponsor Reel (2024), reinforcing their position as a preferred partner for high-budget commercial and episodic slates.

7 Wonders Cinema

With a 100% communication rating on industry trackers, 7 Wonders Cinema excels in multimedia production and corporate-to-commercial crossovers, essential for projects seeking high-efficiency post-production.

Verdict: Their expansive portfolio of over 19 verified projects in 2024 confirms their status as a high-volume, reliable Dallas service provider capable of meeting rigorous audit standards.

Think Branded Media

Specializing in cinematography and post-production, this firm is known for its collaborative approach and high-quality output for logistics and tech-heavy projects.

Verdict: Think Branded Media’s work on the Freight Movement Tech Video (2024) showcases their ability to handle complex, specialized cinematography with a focus on local DFW locations.

Operational Precision: How Vitrina Accelerates Market Entry

The complexity of the Dallas-Texas stack is its protection; it rewards producers who deeply integrate with the local supply chain. Vitrina de-risks this process by providing a census-level view of the Dallas supply chain, allowing executives to pre-vet partners based on their historical involvement in incentivized projects. By using VIQI, Vitrina’s AI-powered business development agent, producers can instantly surface the right decision-makers at Dallas studios and post-houses.

Whether you are looking for a co-production partner to meet the 35% residency floor or a VFX house to secure the post-production uplift, Vitrina provides the connectivity required to transform a spreadsheet of incentives into a realized production budget. The intelligence is here; the next step is the connection to the verified vendors who can execute.

Optimize Your Dallas Strategy with VIQI

Unlock the full potential of the Texas incentive stack with precision-matched service providers and real-time project intelligence.

Strategic Conclusion

The “Filming in Dallas” strategy is fundamentally a game of stacking. By anchoring a production in the DFW metroplex, executives can capture the 25% base grant of the Texas state incentive while strategically deploying second units into rural counties to trigger the 2.5% uplift. When the Dallas-specific hotel rebates and the 1% post-production bonus are factored in, the financial landscape of Dallas becomes one of the most competitive in North America. The success of this model depends on the integrity of the local supply chain—choosing partners who understand the audit trail as well as they understand the creative.

Moving forward, the path to a high-yield Dallas production lies in early-stage vendor verification. As the 2024–2025 $300M fund is allocated, speed and data-backed partner selection will be the primary differentiators for successful slates. Utilizing the Vitrina platform and the VIQI assistant ensures that your Dallas entry is not just cost-effective, but operationally seamless. The intelligence is here; the next step is to activate the local connections.

Strategic FAQ

What is the maximum combined rebate for filming in Dallas?

Producers can achieve a maximum combined rebate of 31% on qualified Texas spending. This is reached by stacking the 25% base grant for projects over $1.5M with uplifts for rural filming (2.5%), veteran hiring (2.5%), and post-production (1%).

How does the Dallas Hotel Rebate impact production budgets?

The Dallas Hotel Rebate allows productions requiring 15 or more rooms to recover state and local occupancy taxes. This de-risks the housing costs for non-resident “Above the Line” talent, which are traditionally excluded from the state’s TMIIIP cash grant.

What are the residency requirements for the Texas Film Incentive?

To qualify for state grants, 60% of total filming days must occur in Texas, and 35% of the combined paid crew and cast (including extras) must be Texas residents. This residency threshold is a critical gatekeeper for the high-tier 25% rebate.

Can post-production alone trigger a Texas incentive?

Yes, stand-alone post-production, VFX, and animation projects are eligible for rebates starting at 5% for spends over $100,000, scaling to 25% for spends over $1.5M. Utilizing Dallas-based post-houses ensures these costs are captured effectively.