The reason why the $5 million mark is our low threshold is because it becomes financially insolvent for a film to afford the finance insurance and the completion guarantee on a $500,000 film or a $2 million film, that’s not super sustainable.

Podcast Chapters

| Timestamp | Chapters |

| 00:00 | Introduction to Peachtree Media Partners |

| 01:31 | Understanding Film Financing and Unique Lending Models |

| 11:36 | Navigating Market Volatility in Film Financing |

| 21:19 | The Sweet Spot: Budget Ranges and Project Sourcing |

| 27:16 | Insurance and Collateral in Film Financing |

| 31:48 | Understanding Risk in Film Financing |

| 42:42 | Fundraising Insights and Investor Profiles |

| 48:03 | Looking Ahead: Genre Trends and Theatrical Releases |

| 53:47 | Lessons from Projects That Didn’t Make the Cut |

Key Takeaways:

-

On Market Opportunity: “That created an enormous gap in the marketplace… this enormous void of opportunity for private capital to stand up and raise their hand and say, ‘Hey, we know how to spend a dollar and we’re happy to invest it.’”

-

On Risk Mitigation: “We require at Peachtree, all of our films require a completion guarantee… that gives us great comfort that the biggest single risk in moviemaking, which is that we don’t finish the film, we are not taking that risk.”

-

On Business Model: “We’re not investing in film and TV. We lend in film and TV. So, we take a collateral position against the film IP, any pre-sales, distribution agreements, or tax incentives… and we loan against that piece of collateral.”

-

On Theatrical Strategy: “Most distributors now are looking for films that can play theatrically as well as then go to… streaming… we want to pull families back into the cinema.”

-

On Project Quality: “Our goal is to not get stuck in the Frankenstein mindset and have the monster never be made; our goal is to get the film made.”

There are the extremes, like the $80 million projects, the $100 million projects where we will go in and co-finance with a studio where they’ll put in some money and we’ll put in some money. So we do have access. We did a Guy Ritchie movie last year that’s coming out in 2026 called In the Gray with Henry Cavill and Jake Gyllenhaal... that was an 80 plus million dollar picture where we were just a nugget of money in that cap stack.

Sound Bites:

-

On the Market Gap: “Large commercial institutions are retracting… that has created this enormous void of opportunity for private capital.”

-

On Security: “We’re not investing in film and TV. We lend in film and TV.”

-

On Strategy: “We focus less on the big studio projects… and we focus more on the transactional independent film space.”

-

On the Primary Risk: “The biggest risk here. It’s not will we get repaid… it’s how long will it take to get repaid.”

-

On the Industry’s Future: “The entire base is really seeing the swing back to theatrical being the future of our business.”

Projects Mentioned in the Podcast

Wonka, In the Gray, We Bury the Dead, Mary, Wicked.

Why Partner With Peachtree Media Partners?

1. Retain Creative Control and Financial Upside

Unlike traditional equity investors who often demand significant ownership or creative say, Peachtree operates as a senior lender. By advancing funds against collateral rather than buying into the equity stack, they enable filmmakers to maintain creative autonomy and keep the majority of the project’s long-term financial upside.

2. Specialized Support for the “Bank Void”

Peachtree focuses on the $5M to $50M budget range—a specific segment often considered too small for large commercial banks but requiring more professional structure than individual investors can provide. They fill this critical gap by providing institutional-grade capital to mid-tier independent productions.

3. Institutional-Grade Risk Mitigation

Partners benefit from a “triple layer” of protection that safeguards the project’s financial health:

-

Completion Bonds: Every project requires a guarantee from a AAA-rated company to ensure it is finished on time and on budget.

-

Back Leverage: Loans are often co-underwritten by large commercial banks, providing a second set of professional eyes on every deal.

-

Asset-Backed Security: Loans are collateralized by “hard” assets like state tax incentives and executed distribution agreements from major players like Netflix or Sony.

4. Strategic Industry Connections

Peachtree is deeply embedded in the entertainment ecosystem, maintaining elite relationships with top-tier agencies like WME, CAA, and UTA. These connections help projects secure A-list talent and reputable sales agents, which are essential for driving international market value.

5. Proven “Real Estate” Lending Discipline

As a joint venture with the Peachtree Group, the media division applies a disciplined, conservative underwriting approach typically found in commercial real estate. This brings a level of financial rigor and transparency to film financing that is rare in Hollywood, treating film projects with the same structured accountability as a major construction development.

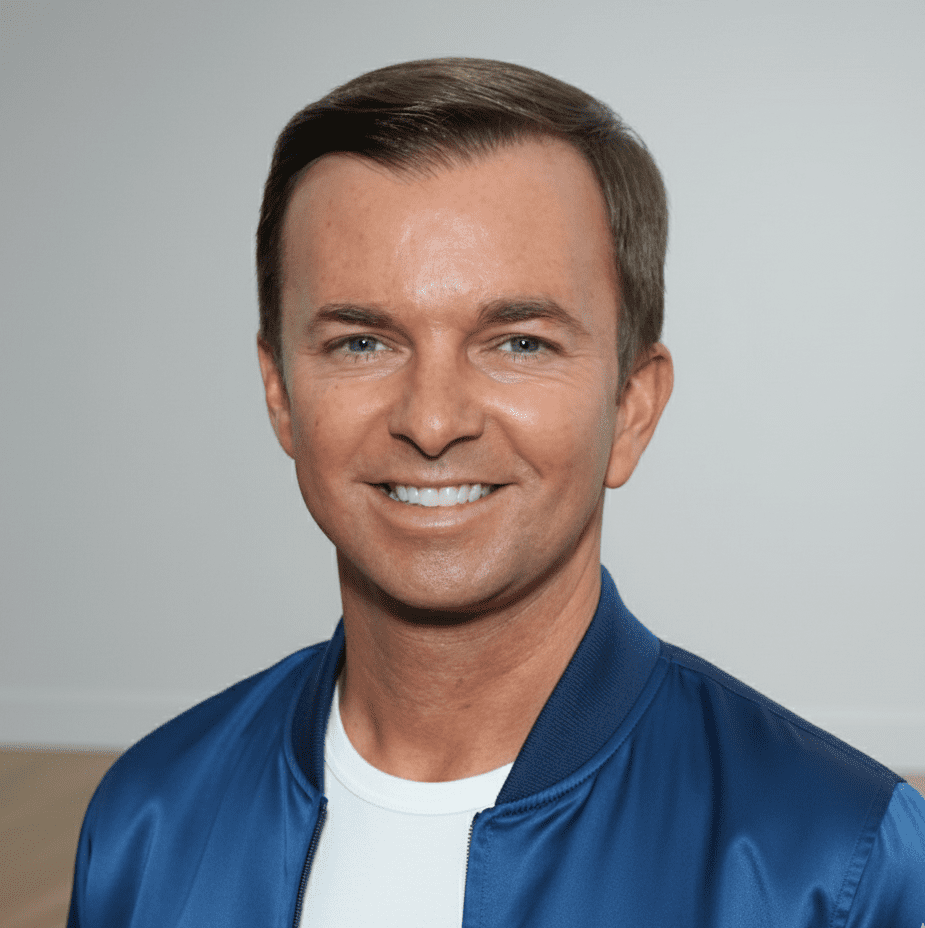

In Conversation with Joshua Harris, President and Managing Partner at Peachtree Media Partners

The below FAQ style format summarizes the deep-dive podcast discussion with Joshua Harris, President and Managing Partner of Peachtree Media Partners, regarding the evolving landscape of film finance.

1. Vitrina: To start, could you provide an “elevator pitch” for Peachtree Media Partners and clarify your specific role within the entertainment finance ecosystem?

Joshua Harris: Peachtree Media Partners is a film finance lender in film and entertainment. It is important to distinguish that we are not investing in film and TV; we lend. We take a collateral position against the film IP, pre-sales, distribution agreements, or tax incentives, and we loan against that piece of collateral. This enables filmmakers to maintain creative control and upside in the project while allowing us to put private capital to work at a much higher multiple.

“We take a collateral position against the film IP, any pre-sales, distribution agreements, or tax incentives that are offered for a film, and we loan against that piece of collateral.”

2. Vitrina: What led to the “entrepreneurial genesis” of Peachtree, and how did your background in traditional entertainment banking influence its creation?

Joshua Harris: I have been in financial services for about 26 years, with the majority focused on film and TV finance. I was previously an entertainment banker at City National Bank, but after their merger with Royal Bank of Canada, they became a more traditional commercial bank. This created an enormous gap in the marketplace. Peachtree Media Partners was born as a JV with the Peachtree Group to meet this supply and demand issue using private capital, specifically taking the least risky position in the capital stack—lending—rather than equity investing.

“We have a marketplace that’s never been as demanding for content… and we have large commercial institutions that are staying exactly the same or retracting a bit in the space. And so that has created this enormous void of opportunity for private capital.”

3. Vitrina: How has Peachtree navigated the recent volatility in Hollywood, such as the COVID-19 pandemic and the SAG-AFTRA strikes?

Joshua Harris: Volatility mostly impacts larger studio projects that are box office dependent. At Peachtree, we support independent film and remove the need for a film to overperform at the box office by hedging risk through foreign pre-sales and tax incentives. Interestingly, the strikes actually benefited the independent model; we were able to get A-list talent for non-studio films at favorable rates because they wanted to keep working while studio projects were struck.

“The independent film though, which is run by the producers and the filmmakers and not by a studio… that was the heyday… Because all the talent wanted to keep a paycheck coming in.”

4. Vitrina: You mentioned a unique “hybrid” lending model that helps filmmakers unlock more value. Can you explain how you use the “real estate” analogy for film production?

Joshua Harris: We allow filmmakers to “hold back” certain territories, like the valuable domestic market, rather than pre-selling everything. Like a real estate developer selling a condo tower, you pre-sell the lower-floor units to get the money to start building, but you save the penthouse for when the tower is finished and its value has reached its pinnacle. We advance capital against the “lower units”—tax incentives and foreign sales—to build the “tower” (the film), so the filmmaker can sell the “penthouse” (domestic rights) for a much higher price once the product is complete.

“A completed film is always worth… more than a project that’s just conceptual… We go out and we enable the filmmakers to take that risk on themselves and say, we think we’re gonna be able to sell this for X times two once we’ve made it.”

5. Vitrina: What are the specific budget ranges you support, and what is the “sweet spot” for a project to approach Peachtree?

Joshua Harris: Our sweet spot is the $5 million to $50 million budget range, which usually results in a transaction size between $3 million and $35 million. We require a completion guarantee from a AAA-rated bond company to ensure the film is finished on time and on budget. We typically source our pipeline through deep-rooted relationships with major agencies like WME, UTA, and CAA, rather than taking unsolicited projects from the outside.

“We will only lend when there is a completion guarantee on a project… That gives us great comfort that the biggest single risk in moviemaking, which is that we don’t finish the film, we are not taking that risk.”

6. Vitrina: How do you structure your risk mitigation, and what role do commercial banks play in your private fund?

Joshua Harris: We have a triple layer of protection. First, we have the completion bond. Second, we have a relationship with a large commercial bank that provides “back leverage”—they borrow about 80 cents for every 20 cents the fund puts in. This means a $100 million fund can support half a billion dollars worth of pictures. Because the bank underwrites every agreement we do, our investors benefit from a second set of expert eyes.

“If they [the commercial bank] don’t provide back leverage against it, we don’t either. So it really is a risk mitigation mechanism… we are getting sort of a triple layer of protection for the films that we are lending against.”

7. Vitrina: If the “loss given default” rate is so low, what is the primary risk your investors face?

Joshua Harris: The primary risk is a timing issue. The likelihood of being repaid is very high—the loss given default rate is less than half a percent—but the risk is how long it takes to get repaid. For instance, foreign partners often cannot release a film until the domestic release occurs. To mitigate this, we build in 15 to 18 months of interest reserves. As senior lenders, we also reserve the right to “fire sell” a project to a streamer if the timeline exceeds our cushion.

Our likelihood of getting repaid from this industry is very high… we often are only calculating a default on the basis of time.”

8. Vitrina: Looking toward 2026, what trends are you seeing in terms of genre and the “theatrical vs. streaming” debate?

Joshua Harris: We are genre-agnostic but lean into commercial products like action, horror, and thrillers. For 2026, the big news is the pendulum swinging back to theatrical releases. Distributors are now looking for films that can play in theaters before moving to at-home streaming to diversify revenue. We want more theatrical movies that pull families back into the cinema for a collective experience.

“The entire base is really seeing the swing back to theatrical being the future of our business… We want movies that can play theatrical… pull families back into the cinema.”

——————————————————————————————————————————–

Bridging the Void: Institutional Discipline in Independent Film Financing

Peachtree Media Partners is a specialized film finance lender providing institutional-grade capital to the independent entertainment sector. Operating as a joint venture with the real-estate-focused Peachtree Group, the firm applies disciplined, collateral-based underwriting to projects with budgets between $5 million and $50 million. Unlike traditional equity investors, Peachtree functions as a senior lender, securing positions against tax incentives, pre-sales, and intellectual property. By leveraging deep agency relationships and requiring AAA-rated completion guarantees, Peachtree offers a “triple layer” of protection for private capital while empowering filmmakers to retain creative control and financial upside.