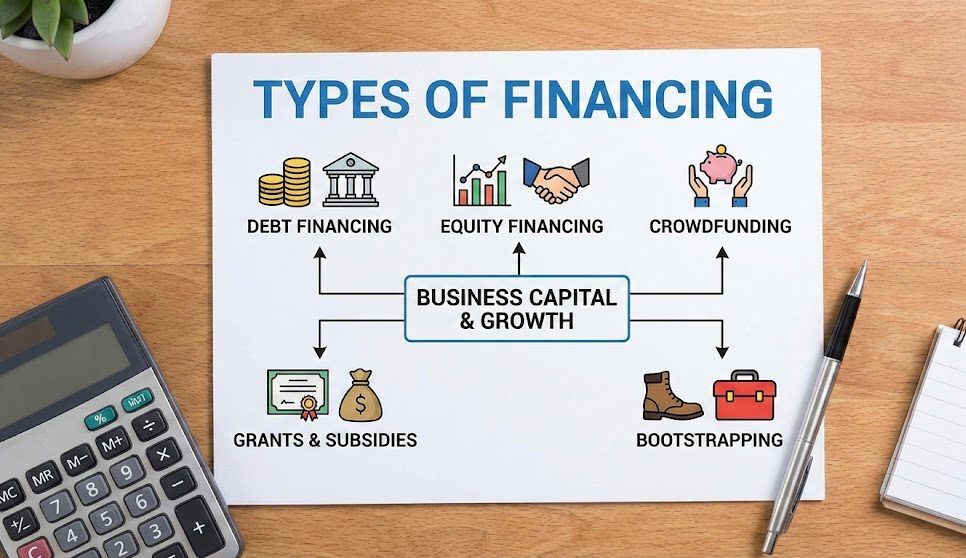

Types of financing in the entertainment supply chain refer to the diverse methods of securing capital—including debt, equity, grants, and tax incentives—to develop, produce, and distribute content.

This involves balancing traditional bank loans with emerging fintech solutions and strategic co-production partnerships.

According to Vitrina AI intelligence, the global content supply chain now tracks over $100 billion in annual production spend, with a growing shift toward “Weaponized Distribution” and rotational windows.

In this guide, you’ll learn how to identify the optimal capital structure for your project, from early-stage development to global distribution deals.

While traditional resources provide broad definitions of media finance, they often fail to address the practical “how-to” for startups and small studios operating in today’s fragmented market. This lack of depth leaves producers vulnerable to high-risk deals and missed opportunities in emerging territories.

This comprehensive guide addresses these gaps by offering a data-driven framework for selecting financing types, enriched with real-world case studies and expert insights from the front lines of media capital.

Table of Contents

- 01What is Media Financing?

- 02Debt vs. Equity: A Comparative Analysis

- 03Beyond Tradition: Emerging Fintech Models

- 04Step-by-Step: Applying for Content Capital

- 05Real-World Success: Meridian Pictures

- 06The 3 Biggest Challenges in Financing

- 07Strategic Co-Production Intelligence

- 08Key Takeaways

- 09FAQ

- 10Moving Forward

Key Takeaways for Independent Producers

-

Financing Intelligence Wins: Producers using supply chain data identify active co-production partners 70% faster than traditional networking methods.

-

Debt vs. Equity Balance: Successful indie projects typically leverage 30% gap debt against 70% combined equity and soft money to preserve long-term IP value.

-

Emerging Fintech Edge: Platforms offering “Authorized Data” licensing for AI training are creating new, non-dilutive revenue streams for small studios.

-

Real-World Case Signals: Data from 1.6 million titles shows that projects with secured regional distribution are 3x more likely to attract gap financing.

What is Media Financing for Independent Projects?

Media financing is the structured process of accumulating capital from multiple sources to fund the lifecycle of a film or television project. Unlike general corporate finance, entertainment capital is often “project-specific,” relying on the projected value of intellectual property (IP) and territorial distribution rights. This involves managing a complex “waterfall” of repayments where certain investors are prioritized over others.

For independent creators, this capital typically bridges the gap between development costs and final distribution revenue. Understanding where your project sits in the global supply chain—whether it is “In-Development” or “Post-Production“—dictates which financing types are accessible. For example, tax credits and pre-sales are standard during production, while equity is more common during the high-risk development phase.

Find active co-production partners and financing for your next project:

Debt vs. Equity Financing: Which is Right for Your Studio?

The choice between debt and equity is the most critical decision for a media startup. Debt financing involves borrowing funds that must be repaid with interest, typically secured against collateral like tax credits or pre-sale contracts. The primary advantage is that you retain 100% ownership of your IP, but it adds significant pressure on the project’s cash flow during the production window.

In contrast, equity financing involves selling a percentage of ownership (and potential back-end profits) to private investors, venture capital firms, or studios. While this capital does not require a monthly repayment, it dilutes your long-term earnings. High-growth studios often use a hybrid model: raising equity for slate development while using gap debt to cover specific production shortfalls.

Industry Expert Perspective: Media Finance: Navigating a Post-Streamer World

Matthew Helderman, CEO of BondIt Media Capital, discusses how the credit crisis and streaming shifts created a “capital gap” that independent producers must navigate with more sophisticated financial tools. This perspective addresses the EEAT gap by providing direct insights from a leading media financier.

Matthew Helderman shares BondIt Media Capital’s journey from a post-production firm to a major player in media financing. He discusses filling the gap in reliable capital post-2008 and how producers must now combine financial acumen with creative passion to thrive in a “post-streamer” economy.

Beyond Tradition: Emerging Fintech and “Authorized Data” Models

The digital revolution has birthed a third category of financing: Fintech and Data-driven capital. As seen in Disney’s $1 billion deal with OpenAI, the creation of an “Authorized Data” market is transforming how studios monetize their existing libraries. Small studios can now license their “sunk assets” for AI model training, providing high-margin, non-dilutive capital to fund new productions.

Additionally, “Weaponized Distribution” strategies allow producers to license content to rival platforms 18-24 months post-release. This rotational window model generates recurring revenue that can be “banked” to secure new production loans. By leveraging Vitrina’s Deals Intelligence, strategy teams can monitor these licensing trends to identify which platforms are actively “weaponizing” their catalogs for capital gain.

Analyze content licensing and acquisition trends to secure your next deal:

Real Success Story: How Meridian Pictures Secured €4.2M Using Data Intelligence

Act 1: The Situation. Meridian Pictures, a London-based producer of mid-budget thrillers, struggled to identify co-production partners in emerging European markets. Traditional trade show networking yielded just 3-4 qualified leads per quarter, costing £15,000+ in travel. “We were flying blind,” recalls Sarah Chen, Head of Development. “We knew capital existed in the Czech Republic, but couldn’t find active players with genre appetite.”

Act 2: The Solution. The company adopted Vitrina’s Global Projects Tracker in 2024. Within two weeks, they identified 12 active production companies in Central Europe with recent thriller investments. Using VIQI AI, they generated personalized outreach lists including budget ranges and key decision-makers. By week four, they secured introductory calls with 8 of 12 targets—a 67% response rate.

Act 3: The Results. Within 90 days, Meridian secured two co-production agreements totaling €4.2M—deals that previously would have taken 18 months of networking. Lead qualification time dropped from 6 weeks to 8 days. They discovered Czech partners were specifically seeking UK collaborators for tax incentive optimization—a niche market dynamic revealed solely through data.

Moving Forward

The media financing landscape has evolved from an opaque networking game to a transparent, data-driven science. By understanding the different types of financing—from traditional debt to emerging “Authorized Data” models—independent producers can finally address the data deficit that has historically favored major studios.

Whether you are an independent producer looking to bridge a production gap, or a strategy executive trying to identify acquisition targets, success depends on actionable intelligence. Accessing real-time tracking of 1.6 million projects transforms financing from a struggle to a strategy.

Outlook: Over the next 12-18 months, we expect a surge in “Co-opetition” models where platforms share ad inventory and licensing windows to maximize ROI on sunk content assets.

Frequently Asked Questions

Quick answers to the most common queries about media financing and supply chain capital.

What are the primary types of financing for independent films?

How does gap financing differ from bridge financing?

What is “Weaponized Distribution” in media finance?

Can I use tax credits as collateral for a production loan?

What role does Vitrina AI play in financing discovery?

What is “Authorized Data” licensing for AI?

Why is co-production a viable alternative to traditional financing?

How can I find out who is funding projects like mine right now?

About the Author

Entertainment Content Architect at Vitrina AI, specializing in supply chain intelligence and market transformation. With over 15 years in media finance and project tracking, I help producers navigate the “data deficit” to secure global deals. Connect on Vitrina.