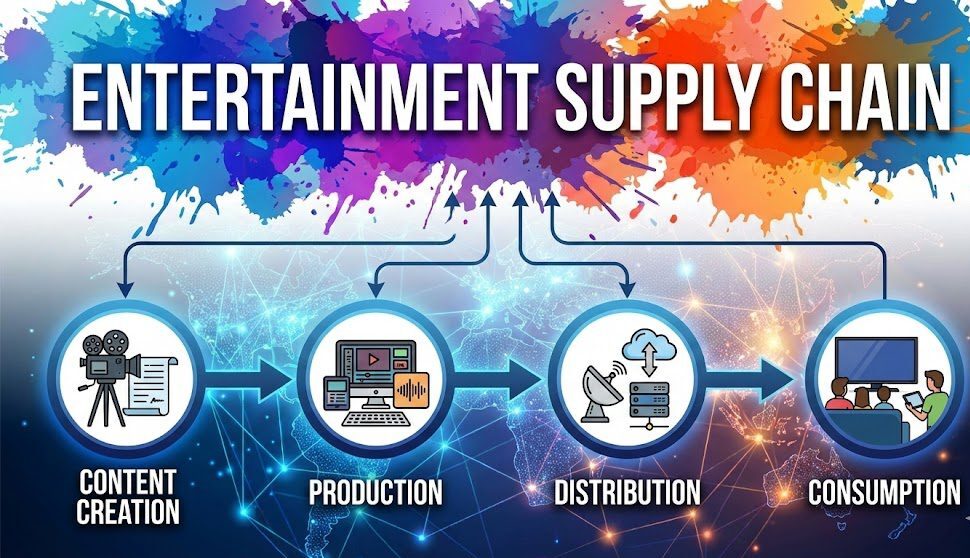

Top animation companies are the strategic creative engines driving the global entertainment supply chain through specialized 2D, 3D, and CGI production services.

Securing the right partnership involves evaluating technical pipelines, historical deal data, and regional specialization to ensure project scalability.

According to industry reports, the global animation market is projected to reach new heights in 2025, fueled by $17 billion in annual content spend from major streamers.

In this guide, you’ll learn how to navigate the global studio landscape, segment partners by technical specialty, and use supply chain intelligence to compress sourcing cycles.

While many industry resources often conflate animation with general VFX, this overlap creates a strategic data deficit for acquisition leads and producers seeking specialized animation talent.

This analysis fills that gap by providing a targeted framework for evaluating global animation leaders, from Hollywood giants to emerging regional powerhouses.

Table of Contents

Key Takeaways for Service Providers

-

Intelligence Over Lap: Moving beyond generic VFX databases allows studios to identify specialized animation partners with a 60% higher vetting accuracy.

-

Global Tracking Advantage: Monitoring the worldwide production pipeline in real-time reveals co-production opportunities in emerging hubs like the Middle East and SE Asia.

-

Technical Specialization: Segmenting partners by 2D/3D/Stop-motion capabilities ensures that project pipelines are optimized for specific creative outcomes from day one.

What is the Difference Between Top Animation Companies and VFX Studios?

The primary keyword “Top Animation Companies” is often underserved in current digital landscapes because search results frequently default to VFX (Visual Effects) firms. While both use high-end technical pipelines, animation studios specialize in the creation of character-driven movement and world-building from a blank slate, whereas VFX studios primarily enhance live-action footage. This distinction is critical for acquisition leads who need partners with narrative character expertise rather than integration specialists.

Traditional databases often fail to provide this granular differentiation, leading to inefficient sourcing cycles. According to Vitrina AI’s supply chain analysis, companies like Toonz Media Group and WBD Animation Group represent the true “Animation First” model, focusing on long-form IP development and preschool demographics. By leveraging vertical AI intelligence, professionals can now filter for these specific specializations, bypassing the “VFX noise” that often clutters B2B discovery.

Identify specialized animation studios for your next character-driven project:

Who are the Top 10 Global Animation Companies in 2025?

The 2025 animation landscape is dominated by a mix of legacy titans and disruptive regional studios. While Pixar and Disney Animation remain the gold standard for theatrical features, companies like Studio Ghibli and Aardman continue to lead in artistic innovation through hand-drawn and stop-motion excellence. Understanding these leaders requires looking at their production volume, technical IP, and historical deal flow—metrics that Vitrina AI tracks across 140,000+ global companies.

The 2025 Definitive List

- Pixar Animation Studios: The pioneer of 3D CGI, now leveraging real-time rendering for episodic expansion.

- Walt Disney Animation Studios: Bridging the gap between legacy hand-drawn aesthetics and cutting-edge digital worlds.

- Studio Ghibli: The global authority on high-concept hand-drawn narrative and world-building.

- Illumination Entertainment: Masters of high-ROI franchise management and global audience appeal.

- Sony Pictures Animation: Leading the “stylized animation” revolution (e.g., Spider-Verse).

- Aardman Animations: The undisputed leader in stop-motion and claymation supply chains.

- DreamWorks Animation: Diversifying into massive episodic slates for global streamers.

- Toei Animation: Driving the massive global anime export market from Japan.

- Toonz Media Group: A key global production partner with massive infrastructure in SE Asia and Europe.

- WBD Animation: Strategically expanding into global production hubs as part of the WBD-Netflix consolidation.

Industry Expert Perspective: Animating the Future: Toonz Media Group’s Evolution

Discover how Jayakumar P, CEO of Toonz Media Group, is navigating market expansion and the integration of AI tools to scale animation production for a global preschool audience.

Key Insights

The conversation focuses on market adaptation and the exploring diverse applications of animation beyond traditional media, highlighting the critical shift in the preschool audience demographic.

How to Segment Top Animation Companies by Technical Specialty?

Effective B2B sourcing requires segmenting studios by their technical “moats.” A 2D studio specializing in “tradigital” animation (like Studio Ghibli or Cartoon Saloon) has a fundamentally different pipeline than a 3D CGI powerhouse like Pixar. In 2025, we see the rise of hybrid studios that utilize real-time rendering tools like Unreal Engine to bridge the gap between high-end feature quality and rapid episodic delivery.

Service providers monitoring these shifts can better qualify leads. For instance, the demand for stop-motion is concentrated in niche but high-value projects, whereas 3D CGI accounts for over 70% of the streaming mandate. Vitrina AI’s Global Projects Tracker allows users to monitor these projects by stage—In-Development to Post-Production—ensuring you target studios during their active bidding windows.

Target active projects using real-time rendering and Unreal Engine:

What Are the Hiring and Salary Trends for Animators in 2025?

The “Talent War” in the animation supply chain has shifted toward technical fluency in AI-assisted workflows. As Disney and other majors formalize “Authorized Data” deals (e.g., Disney’s $1B OpenAI partnership), the role of the animator is evolving from manual frame-by-frame creation to senior artistic direction over AI-generated outputs. This shift is particularly visible in high-growth markets like the Middle East and SE Asia, where Getty Images has engaged in video supply-chain mapping to boost productivity.

Salaries for senior technical directors in 3D animation have seen a 12% year-over-year increase, reflecting the demand for professionals who can manage complex Unreal Engine pipelines. For job seekers and studios alike, monitoring these personnel movements is vital. Vitrina AI tracks 5 million industry professionals, providing a clear view of executive shifts and hiring trends across 100+ countries, transforming talent management from word-of-mouth into a data-driven strategy.

“The animation model that worked five years ago—manual character rigging followed by traditional rendering—no longer serves global streamers in a real-time era. Studios that leverage data intelligence to identify and engage the right technical partners at the right moment are securing deals 60-90 days faster than peers.”

Frequently Asked Questions

Quick answers to the most common queries about the top animation companies.

Who is the #1 animation company in the world?

Are VFX and animation companies the same?

What are the top animation studios in India?

What is the average salary for an animator in 2025?

How can I find animation co-production partners?

What is real-time animation?

Moving Forward

The global animation supply chain has transitioned from a manual art form to a high-speed, data-driven science. By addressing the intelligence gaps between generic VFX and specialized animation, industry professionals can now identify partners with surgical precision.

Whether you are an acquisition lead looking to source trending IP, or a service provider trying to target active productions, supply chain intelligence transforms your strategy from speculation to certainty.

Outlook: Over the next 18 months, real-time rendering and ethical AI integration will become the baseline requirement for all top animation companies globally.

About the Author

Entertainment supply chain analyst specializing in B2B intelligence and global production trends. Leveraging Vitrina AI’s proprietary dataset to help professionals navigate the complex animation landscape. Connect on Vitrina.