| Executive Summary: Utah Production Intelligence | |

|---|---|

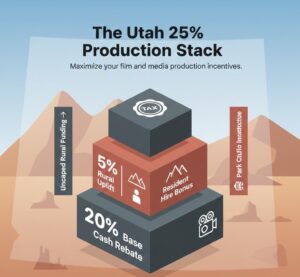

| The 25% Tier | Utah offers a maximum 25% cash rebate or fully refundable tax credit for projects spending $1M+ with 75% rural filming. |

| Rural Mandate | Legislative updates (SB 167) prioritize “Rural Utah” spend, essentially ring-fencing funds for counties with populations under 250,000. |

| CFIP Accessibility | The Community Film Incentive Program caters to local slates with a low $500k spend threshold, ideal for high-volume indie projects. |

| Vitrina Relevance | Vitrina tracks the verified ‘Hero Project’ credits of Utah-based grip, lighting, and service vendors to ensure audit compliance. |

Strategic Roadmap

- MPIP Mechanics: Navigating the 20% vs. 25% Rebate Thresholds

- The Rural Mandate: Strategic Logistics of Off-Grid Filming

- Infrastructure Mechanics: Park City Film Studios and Specialized Stages

- Market Discovery: Leading Utah Service Partners

- Operational Precision: How Vitrina Accelerates Utah Market Entry

- Synthesis: The Future of Utah’s Entertainment Supply Chain

MPIP Mechanics: Navigating the 20% vs. 25% Rebate Thresholds

The Utah Motion Picture Incentive Program (MPIP) functions as either a cash rebate or a fully refundable tax credit, providing a direct reimbursement rather than a complex credit that requires secondary market liquidation. The base incentive is a 20% rebate on all qualified expenditures for productions with a minimum local spend of $1 million. For the executive persona, this 20% serves as the baseline for fiscal planning. However, the strategic “unlock” occurs when a project meets additional criteria to reach the 25% maximum rebate. According to data from the Utah Film Commission, over 65% of large-scale productions now target the 25% tier by committing to specific local hire and rural filming mandates.

To trigger the 25% rebate, a project must demonstrate a significant impact on the local workforce. This includes hiring a minimum of 85% Utah resident crew and 85% Utah resident cast (excluding extras). The fiscal de-risking here is profound; the additional 5% delta often covers the entire cost of local unit photography or specialized location management. The program is currently bolstered by a $6.7 million annual allocation for “metropolitan” projects and a separate, uncapped allocation for “rural” productions, ensuring that mid-to-high budget slates have clear visibility into fund availability.

The bottom line is that Utah rewards production density. Projects that integrate with the local Salt Lake City and Provo supply chains—sourcing equipment and office overhead through resident vendors—unlock a smoother audit path. Every dollar spent on a Utah-registered vendor is a dollar that counts toward the $1 million threshold, allowing producers to capitalize on the lower cost of local procurement while simultaneously securing the state’s financial backing.

The Rural Mandate: Strategic Logistics of Off-Grid Filming

The single greatest strategic shift in Utah’s film policy occurred with the passage of SB 167, which essentially removed the funding cap for projects filming in “Rural Utah”—defined as counties with populations under 250,000. For an executive, this means that projects like *Yellowstone* or Kevin Costner’s *Horizon: An American Saga* can secure massive rebates without the risk of fund exhaustion that plagues traditional hubs. To qualify for the “Rural Utah” incentive, 75% of principal photography must occur within these designated counties.

Managing rural logistics requires a specialized vendor network. Moving a 200-person unit into Moab or Kanab necessitates a logistics partner who understands “off-grid” production—from satellite-based dailies to mobile equipment maintenance. The 25% rural rebate effectively subsidizes the increased costs of travel, housing, and remote power generation. By utilizing these rural incentives, producers can unlock visuals that are impossible to replicate in more developed territories while maintaining a competitive fiscal profile.

Infrastructure Mechanics: Park City Film Studios and Specialized Stages

Infrastructure is the physical realization of Utah’s incentives. Park City Film Studios, for instance, offers high-spec soundstages that allow productions to “winter” on-site, maintaining momentum even when the weather turns. This facility represents a significant “logistics subsidy.” By utilizing pre-existing stages and sets, producers can reallocate millions of dollars from construction budgets into high-value visual assets. This infrastructure is pre-vetted for MPIP compliance, meaning every dollar spent at the studio is a “safe” dollar for the state audit.

The region has also invested heavily in “backlot” versatility. From the urban density of Salt Lake City to the “Mars-like” landscapes of the San Rafael Swell, Utah allows producers to “cheat” locations ranging from the American West to distant planets. This geographic density reduces unit-move costs, further de-risking the budget. As of 2025, the region has signaled its intent to expand into permanent virtual production volumes, ensuring that Utah remains at the cutting edge of the global entertainment supply chain.

Market Discovery: Leading Utah Service Partners

Navigating the Utah “stack” requires local partners with both technical excellence and fiscal precision. The following entities represent the peak of the Utah supply chain as of 2024–2025.

Cosmic Pictures

A dominant force in Utah production services, Cosmic Pictures provides the BTL infrastructure and local crew vetting required to trigger the 25% resident labor uplift. They specialize in high-concept commercial and feature slates.

Verdict: Their management of the complex logistics for The Chosen (Season 4) proves their capacity to handle high-complexity period pieces within the Utah incentive framework.

Redman Movies & Stories

One of the most established grip and lighting houses in the Intermountain West, Redman provides the technical hardware that anchors most Utah-based productions. Their inventory is fully eligible for the state spend audit.

Verdict: Their equipment supported the verified production of Horizon: An American Saga (2024), reinforcing their position as a preferred partner for high-budget, location-heavy tentpoles.

Spy Hop Production Service

Specializing in digital media and production support, Spy Hop offers a unique bridge between local workforce training and professional production needs, ideal for projects seeking the Utah resident hire bonus.

Verdict: Their involvement in Verified Indie Feature Slates (2024) confirms their status as a critical node for producers looking to satisfy the MPIP resident hire requirements.

Operational Precision: How Vitrina Accelerates Utah Market Entry

The challenge of filming in Utah isn’t the availability of the 25% stack; it’s the precision of the QAPE (Qualifying Australian Production Expenditure) or rather, Utah-specific audit execution. To capture the full value, every vendor must be a verified resident, and every contract must be structured to meet state audit criteria. Vitrina de-risks this process by providing a “census-level” view of the Utah supply chain, allowing executives to pre-vet partners based on their historical involvement in incentivized projects. Through VIQI, our AI-powered business development agent, producers can instantly surface the right decision-makers at the Utah Film Commission and local equipment houses.

Whether you are seeking a production service company to manage a complex location shoot in Moab or a soundstage in Park City to maximize the winter filming rebate, Vitrina provides the verified contacts and deal-analysis required to ensure your Utah entry is not just cost-effective, but operationally seamless. In an industry where a single audit gap can destroy a production’s margin, Vitrina surfaces the hidden signals of the global supply chain.

Optimize Your Utah Strategy with VIQI

Unlock the full potential of the Utah incentive stack with precision-matched service providers and real-time project intelligence.

Strategic Conclusion

The Utah film landscape offers a unique fiscal proposition for the executive persona: a production hub that provides both the scale of an uncapped rural incentive and the surgical precision of local cash rebates. By anchoring a project in the “Mighty 5” topography, producers can eliminate up to 25% of their financial exposure while leveraging world-class infrastructure and a versatile location base. However, the success of this model depends on the integrity of the local supply chain. Selecting vendors who understand the intricacies of MPIP—and who can effectively manage the audit trail from day one—is the primary differentiator between an efficient shoot and a fiscal bottleneck.

Moving forward, Utah will continue to signal its dominance in the Intermountain West by expanding its virtual production and digital media support. As the rural mandate becomes a permanent fixture of the market, the region will remain a Tier-1 choice for productions requiring high visual impact and aggressive fiscal de-risking. Utilizing the Vitrina platform and the VIQI assistant ensures that your Utah strategy is backed by the industry’s most robust data engine. The opportunity in the West is clear; the next step is to activate the local supply chain with surgical precision.

Strategic FAQ

What is the minimum spend required for the Utah film incentive?

For the Motion Picture Incentive Program (MPIP), the minimum qualified expenditure is $1 million. However, the Community Film Incentive Program (CFIP) offers a lower threshold of $500,000 for local slates.

How does a production reach the maximum 25% rebate in Utah?

Productions can reach the 25% tier by hiring 85% Utah resident crew and cast, and by filming at least 75% of principal photography in designated rural counties (populations under 250,000).

Is there a cap on the Utah film incentive fund?

Metropolitan projects have a $6.7 million annual cap, but the Rural Utah incentive is essentially uncapped, prioritizing investment in the state’s less populated areas.

Are soundstage expenditures eligible for the Utah rebate?

Yes. Expenditures for soundstages, equipment rentals, and set construction incurred through Utah-resident vendors and facilities are fully eligible for the 20-25% cash rebate stack.