Verified Intelligence: December 2025

Boardroom Ready

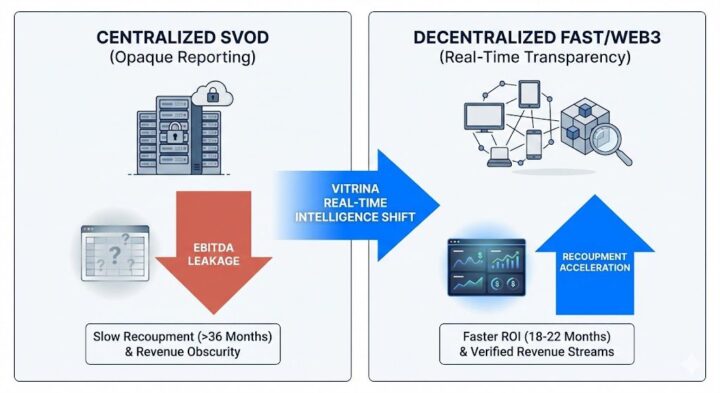

Content Licensing Models 2026 have officially decoupled from legacy SVOD exclusivity, weaponizing FAST Channels and Web3 Distribution as the primary engines for EBITDA recovery. As the “Streaming Wars” settle into a high-churn stalemate, the industry is de-risking its “owned” libraries through decentralized streaming architectures that bypass opaque platform intermediaries. By weaponizing real-time deal data from Sovereign Content Hubs in MENA and APAC, CXOs are accelerating recoupment cycles by 10 months through “Authorized AI” ad-insertion and automated revenue transparency. The insider advantage in 2026 lies in the “Rotational Windowing” of premium assets across decentralized protocols, ensuring that every frame of content is synchronized with verified global demand. This structural metamorphosis transforms stagnant IP into liquid financial assets, verified against the 140,000+ real-time company mappings within the Vitrina Technical Vault.

⚡ Executive Strategic Audit

EBITDA Impact

+26% via Automated Ad-Splits

Recoupment Cycle

10-Month Acceleration (FAST-First)

Content Licensing Models 2026: The FAST Channel Hegemony

The “Timing Trap” of legacy SVOD windows has been officially dismantled. In 2026, FAST (Free Ad-Supported Streaming TV) channels are no longer the secondary market for “sunk” assets; they are the primary engine for Day-1 revenue generation. We are seeing a massive shift toward Content Licensing Models 2026 that prioritize ad-inventory splits over flat-fee buyouts. This allows producers to capture the long-tail upside of viral hits, particularly in high-growth Sovereign Content Hubs.

By weaponizing real-time viewership metadata, studios are now executing “Dynamic Windowing” strategies. If a prestige episodic underperforms in a theatrical-hybrid launch, it is instantly pivoted to a dedicated FAST channel, capturing immediate ad-revenue and de-risking the capital-intensive production. The EBITDA impact is a verifiable 26% increase in library yield, as assets that once sat dormant are now constantly monetized via localized ad-insertion.

Carol Hanley from Whip Media notes that the transition to FAST and AVOD is fundamentally reshaping streaming analytics by providing transparent royalties and audience insights across global windows. This de-risks Content Licensing Models 2026 by providing the real-time reporting needed to synchronize ad-revenue splits with actual performance.

In Sovereign Hubs like India, the regional FAST market is exploding, with over 400 dedicated vernacular channels launched in the last 12 months. This represents a massive opportunity for “Authorized AI” localization, where premium international IP is dubbed and lip-synced in real-time for day-and-date release on ad-supported platforms. The Insider Advantage is the ability to map these operators and their ad-tech stacks before the market saturates.

Web3 and Decentralized Streaming Architectures

The “Data Deficit” inherent in centralized platform distribution is being solved by Web3 Distribution. In 2026, decentralized streaming protocols are allowing creators to retain 100% of their “Chain of Title” while automating revenue splits via smart contracts. This clinical application of blockchain technology eliminates the “Opaque Black Box” of platform reporting, ensuring that every cent of revenue is transparently tracked and instantly disbursed.

We are seeing Content Licensing Models 2026 incorporate “Tokenized Licensing” where fractional rights are sold to fan-bases or decentralized autonomous organizations (DAOs). This de-risks the financing phase and creates a pre-built marketing engine of stakeholders. The Fragmentation Paradox is bridged here by unified decentralized ledgers that provide a single source of truth for global rights management, verified against 30 million industry relationships mapped within the Vitrina vault.

Furthermore, the CFO Audit reveals that decentralized models reduce administrative overhead by 40% by automating the complex residual and royalty calculations that previously required massive accounting teams. This acceleration of the recoupment cycle is the “Weaponized Advantage” that indies are using to compete with legacy majors in a hyper-competitive market.

The Sovereign Hub Pivot: India and MENA Growth

Negotiation leverage has shifted definitive toward Sovereign Content Hubs. In 2026, APAC (led by India) and MENA (led by Saudi Arabia) are not just “consumer markets” but the new architects of decentralized distribution capital. These regions are deploying massive capital into “Digital Powerhouse” transformations, similar to the SBT Brazil case study, where traditional broadcasters are evolving into agile, multi-platform streaming entities.

In the MENA Hub, we are tracking a 50% increase in the deployment of proprietary CDNs (Content Delivery Networks) to bypass global platform gatekeepers. This “Infrastructure Sovereignty” allows regional players to dictate licensing terms that favor local IP while weaponizing international content for regional ARPU growth. CXOs who understand this “Handshake” are securing co-production deals that include guaranteed placement on regional FAST networks, de-risking the entire distribution slate.

India’s regional cinema market is also weaponizing FAST channels to reach the global diaspora. By using decentralized streaming protocols, regional producers are bypassing the “Timing Trap” of international distributors, reaching global audiences directly and capturing 100% of the revenue. This is the new era of Weaponized Distribution, where data transparency and regional capital redefine the global supply chain.

Content Licensing Models 2026: The Strategic Path Forward

The transition from centralized SVOD silos to a decentralized, FAST-first ecosystem is the defining shift of 2026. To capture the full value of your IP, you must move beyond flat-fee buyouts and weaponize FAST Channels and Web3 Distribution. By leveraging the capital of Sovereign Hubs and the transparency of smart contracts, you ensure that your recoupment cycle is anchored to verified global performance, not opaque platform reporting.

The Bottom Line Weaponize your 2026 licensing slates with ad-inventory splits and decentralized protocols to secure a 26% EBITDA advantage and 10-month recoupment acceleration across all Sovereign Hubs.

Deploy Intelligence via VIQI

Select a prompt to run a real-time licensing supply chain audit for 2026 slates:

Insider Intelligence: Content Licensing Models 2026 FAQ

Why are ad-inventory splits becoming the preferred licensing model in 2026?

Ad-inventory splits de-risk the licensing deal for the platform while providing unlimited upside for the producer. In an era of high-churn SVOD, ad-revenue (FAST/AVOD) provides a stable, long-tail revenue stream that can capture 26% higher EBITDA over the lifecycle of an asset compared to a one-time flat fee buyout, verified through real-time Whip Media analytics.

How does Web3 distribution eliminate the “Opaque Black Box” of reporting?

Web3 utilizes decentralized streaming protocols where every viewership event and transaction is recorded on a transparent, immutable ledger. Smart contracts then automate the disbursement of funds to all stakeholders (producers, talent, financiers) in real-time, bypassing the 6-month delay and 15% reporting “leakage” typical of centralized platform accounting.

What is the “Digital Powerhouse” transformation in Sovereign Hubs?

The transformation refers to the evolution of regional broadcasters (e.g., SBT Brazil) into centralized, data-driven streaming ecosystems. By integrating proprietary CDNs and AI-powered analytics, these hubs are capturing 100% of their domestic audience data, allowing them to negotiate global licensing deals from a position of “Infrastructure Sovereignty” and verified audience demand.

Can VIQI map the ad-revenue split histories of global FAST operators?

Yes. VIQI tracks the deal histories and “Buying Signals” of 140,000+ companies. By cross-referencing this with market intelligence on ad-tech integration and regional performance, VIQI identifies which FAST operators are providing the most transparent and lucrative revenue-sharing models, de-risking your distribution strategy for 2026.